Looking to download your IDFC First Bank Loan Statement? This crucial document provides a detailed overview of your home loan, including the principal amount borrowed, interest charged, outstanding balance, and payment history. Follow this guide to learn how to download your home loan statement easily!

How to Download IDFC First Bank Home Loan Statement/Certificate Online

Viewing Your IDFC First Bank Loan Statement online is simple and quick. Follow these steps to download or view your statement:

Time needed: 2 minutes

Here’s how you can download the Loan Statement

- Visit Website

Visit the official IDFC First Bank website.

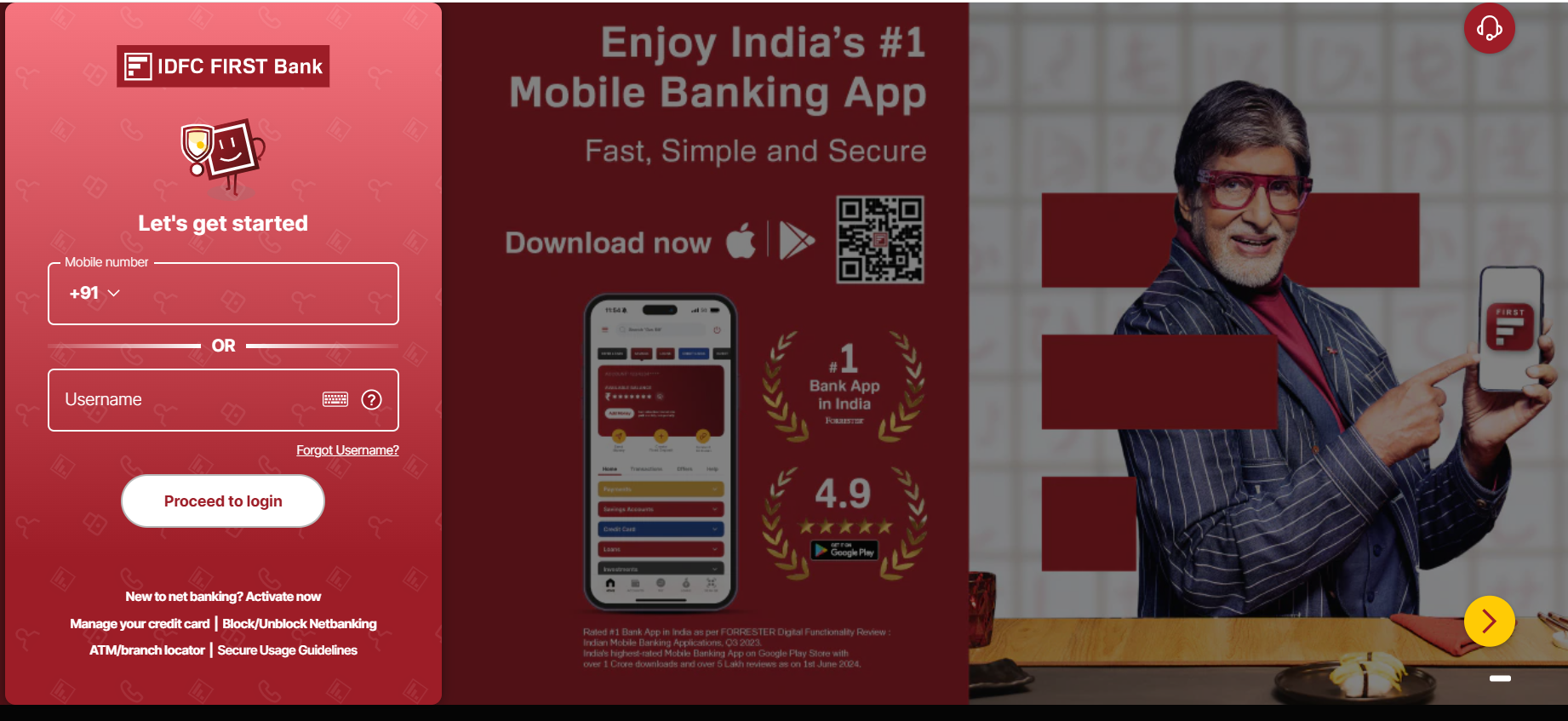

- Log in to Net Banking/Mobile Banking

– Visit the IDFC First Bank Login Page.

– Enter your registered User ID and Password to log in.

- Navigate to the Loan Section

– On the dashboard, scroll to the “Loans” section.

– Select the “Enquiries” tab. - Choose the Statement Option

Click on “Home Loan Provisional Certificate” or “Statement of Account.”

- Enter Loan Details

Provide the necessary details related to your existing home loan.

- Download or View Statement

Once verified, you can view, download, or print your loan statement instantly.

Check Out: IDFC First Bank Home Loan Interest Rates 2025

Steps to Obtain an IDFC First Bank Loan Statement Offline

To obtain the physical copy of your Loan Statement, you can follow a simple process at your nearest IDFC Bank branch. Follow these steps to receive your statement offline:

- Locate and visit the nearest IDFC First Bank Branch that handles home loans.

- Enquire about the Loan statement by speaking to a bank representative and requesting your ongoing home loan statement.

- You will need to fill out a form with essential details, including the Applicant’s Full Name, PAN Number, Residential Address, Date of Birth, Email ID, Contact Number, and Loan Account Details.

- After filling up the Form, Submit the same along with the necessary supporting documents, as directed by the bank staff.

Once the form and documents are processed, the branch will provide you with your IDFC First Bank Loan Statement in a printed format or through your preferred communication method.

Some branches may charge a small fee for issuing physical statements, particularly for older records. It’s recommended to contact your branch in advance to verify any charges and the processing time.

Why do you need an IDFC First Bank Loan Statement?

| Benefits of Tracking Loan Statements | Details |

|---|---|

| Track Repayments | Regularly reviewing your loan statement keeps you informed about the total amount paid towards your loan. |

| Monitor Outstanding Balance | Stay updated on the remaining loan amount, which helps in planning future finances. |

| Plan Future Repayments | Use the statement to strategize your IDFC First Bank repayment schedule and ensure timely payments. |

| Strategic Prepayments | Identify opportunities to make prepayments and reduce your overall debt burden. |

| Efficient Financial Management | Regular monitoring of your loan statement supports better financial planning and management. |

| Accessibility | You can access your loan statement anytime during the year, either online or by visiting a physical IDFC First Bank branch. |

Conclusion

Managing your IDFC First Bank Loan Statement online is simple and highly convenient. By following the easy steps provided, you can quickly access detailed financial information, helping you make informed decisions about your home loan.

Take full advantage of the IDFC First Bank online platform to manage your loan accounts efficiently. If you need further assistance with your loan payments, account details, or tracking your loan, our team of experts is here to guide you every step of the way. Trust Credit Dharma as your reliable partner for loans, credit management, and financial planning.

Frequently Asked Questions [FAQs]

Log in to IDFC First Bank’s net banking or mobile app, navigate to the “Loans” section, and select your loan account to view details like balance, EMIs, and interest rates.

Log in to the IDFC First Bank net banking portal or app, go to the “Loans” section, select “Download Statement,” and choose your loan account to download the statement instantly.

Access your IDFC First Bank net banking or mobile app, navigate to “Loans,” select “Loan Statement,” enter the required details, and download or view the statement online.

Loan details refer to specific information about your loan, such as the principal amount, interest rate, tenure, EMIs, outstanding balance, and repayment schedule.

You can contact IDFC loans customer service by calling the 24/7 Toll-Free Number 1800 10 888 or emailing customer.care@idfcfirstbank.com for assistance.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan