Foreclosure allows you to pay off your IDFC FIRST Bank home loan early, saving on future interest. Using the foreclosure calculator, you can estimate your payoff amount and savings.

What is Foreclosure?

Foreclosure refers to prepaying the total outstanding amount of a home loan before the agreed loan tenure. By doing so, borrowers save on future interest payments and eliminate the monthly EMI burden.

Also Read: Home Loan Foreclosure Charges 2025

How to Foreclose Your IDFC FIRST Bank Home Loan

You can foreclose your IDFC home loan through the following methods:

- Online foreclosure via the IDFC official website or mobile banking app

- Calling IDFC’s toll-free number for assistance

- Visiting the nearest IDFC FIRST Bank branch in person

1. Closing the Loan via IDFC’s Official Website

Follow these steps to foreclose your loan through the IDFC website:

- Website

Visit the IDFC official website.

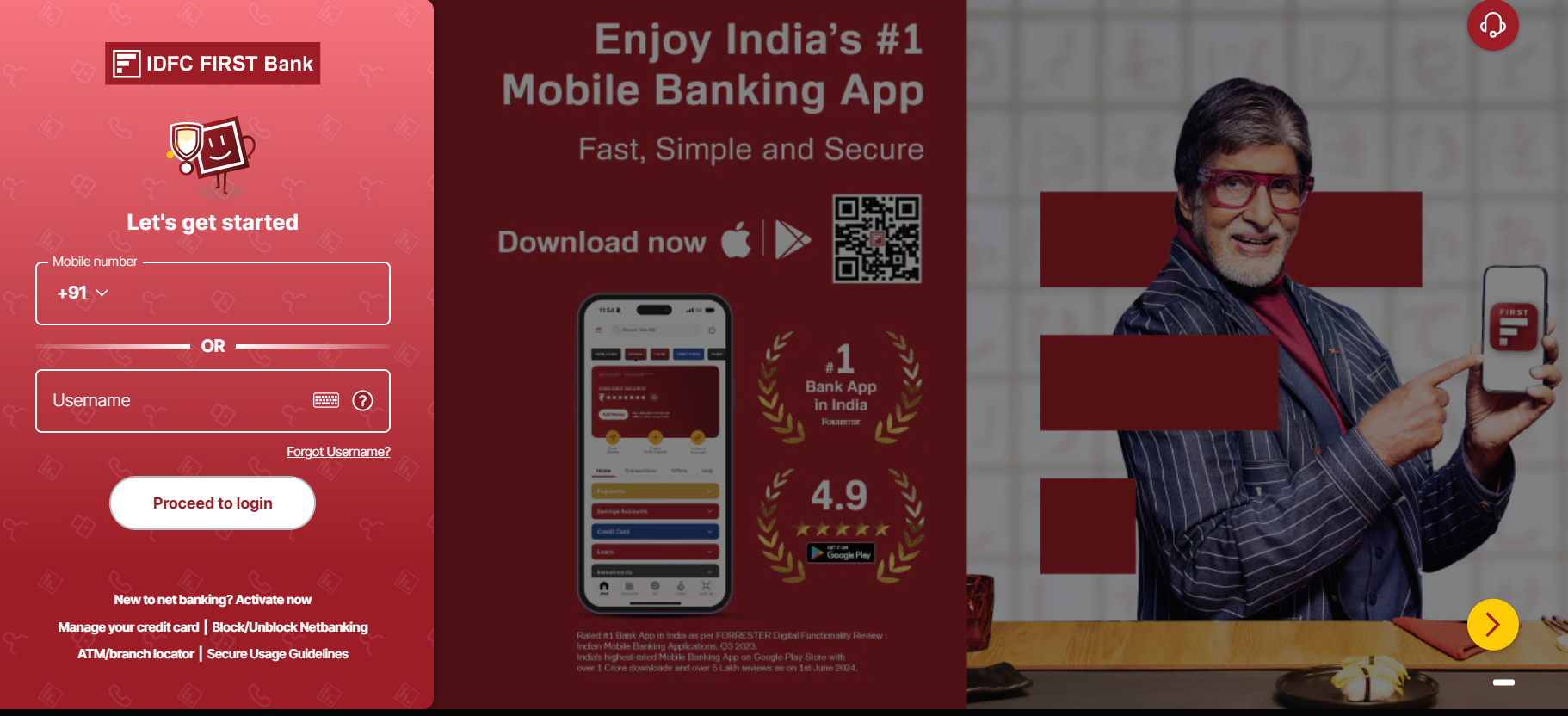

- Log In

Log in with your loan credentials.

- Navigating to Loan Section

Navigate to the loan section and select “Foreclosure.”

- Payment

Pay the outstanding loan amount.

- Download Receipt

Download the foreclosure receipt and the No Objection Certificate (NOC).

2. Closing the Loan via Mobile Banking

Here’s how to foreclose your loan using the IDFC Mobile Banking platform:

- Open the IDFC FIRST Bank mobile app.

- Log in to your account.

- Select the Loan option from the menu.

- Tap on Pay EMI or use the foreclosure option.

- Pay the remaining loan amount.

- Your loan will be closed, and the NOC will be generated.

3. Additional Options for Loan Closure

If you prefer, you can also:

- Call IDFC’s toll-free number: 1800 10 888 for assistance.

- Visit the nearest IDFC FIRST Bank branch to foreclose your loan in person.

These methods ensure a smooth and convenient loan foreclosure process, tailored to your preferred mode of interaction with the bank.

Also Read: How to Download IDFC Home Loan Statement.

Documents Required for IDFC Foreclosure

Ensure all the mentioned documents are up-to-date and properly submitted to avoid any delays in the foreclosure process:

| Document | Purpose |

|---|---|

| Loan Account Number | To identify and verify your loan details. |

| Request for Foreclosure | A formal letter or application stating your intention to foreclose the loan. |

| Outstanding Balance Statement | Issued by the bank, it confirms the remaining amount to be paid for foreclosure. |

| Proof of Payment | Evidence of the lump sum payment made (e.g., receipt, transaction ID). |

| Identity Proof | A government-issued ID such as Aadhaar, Passport, PAN Card, or Driving License. |

Read More: Required Legal Documents for Property Loans.

Charges and Penalties for IDFC Home Loan Foreclosure

IDFC FIRST Bank offers favourable terms for home loan foreclosure:

- Zero foreclosure charges on floating interest rate home loans.

- For fixed-rate home loans, a 5% foreclosure charge (plus taxes) may apply to the principal outstanding amount.

To minimize foreclosure charges:

- Wait until after any lock-in period ends.

- Consider making partial prepayments instead of full foreclosure.

- Inquire about promotional offers that might temporarily reduce or waive foreclosure fees.

Also Read: IDFC Home Loan Interest Rates 2025.

Online vs Offline Foreclosure with IDFC

| Feature | Online | Offline |

|---|---|---|

| Convenience | High – Done from anywhere | Requires branch visit |

| Time Required | Minimal | Moderate |

| Document Submission | Digital upload | Physical submission |

| Support Availability | Limited to online chat/call | Direct interaction with staff |

Source: IDFC Home Loan EMI Calculator

Benefits and Drawbacks of IDFC Foreclosure

Below mentioned are the benefits and drawbacks of IDFC Foreclosures:

Benefits:

- Significant interest savings over the loan tenure.

- Improved credit score from early loan closure.

- Zero foreclosure charges on floating-rate loans.

Drawbacks:

- Large one-time payments may impact liquidity.

- Potential loss of tax benefits on home loan interest.

Also Read: Home Loan Tax Benefits 2025

How to Avoid Common Challenges in IDFC Foreclosure

To avoid the challenges in IDFC Foreclosure submission, follow these simple steps:

- Verify the exact outstanding amount with the bank.

- Understand all terms and conditions before proceeding.

- Plan your finances to maintain an emergency fund.

- Keep all receipts and No Dues Certificates (NDCs) for future reference.

Conclusion

Foreclosing your IDFC FIRST Bank home loan can be a financially sound decision if planned correctly. With zero foreclosure charges on floating-rate loans, borrowers can save significantly while enjoying flexibility in repayment options.

Always review terms carefully and consult bank representatives for clarity on your specific loan agreement.

Frequently Asked Questions

Yes, IDFC FIRST Bank allows partial prepayment with certain conditions and charges.

Yes, when done through official bank channels with proper security protocols.

No, floating-rate home loans for individual borrowers typically have no foreclosure charges.

You may incur additional charges and potential legal consequences.

After completing the payment, IDFC FIRST Bank will issue a No Objection Certificate (NOC) confirming the loan closure.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan