IMC property tax is a tax imposed on property owners by the Indore Municipal Corporation (IMC). This tax is essential for funding local infrastructure and public services such as roads, water supply, and sanitation. Paying this tax helps maintain and improve the city for everyone. It is important for residents of Indore to pay their property tax on time to support these services and avoid penalties. By doing so, property owners contribute to the development and upkeep of their community.

How to Pay IMC Property Tax?

Paying your IMC property tax is easy and can be done both online and offline.

Online Payment via IMC Portal

The simplest way to pay your IMC property tax is through the official IMC portal. Here’s a quick step-by-step guide:

- Visit the IMC website.

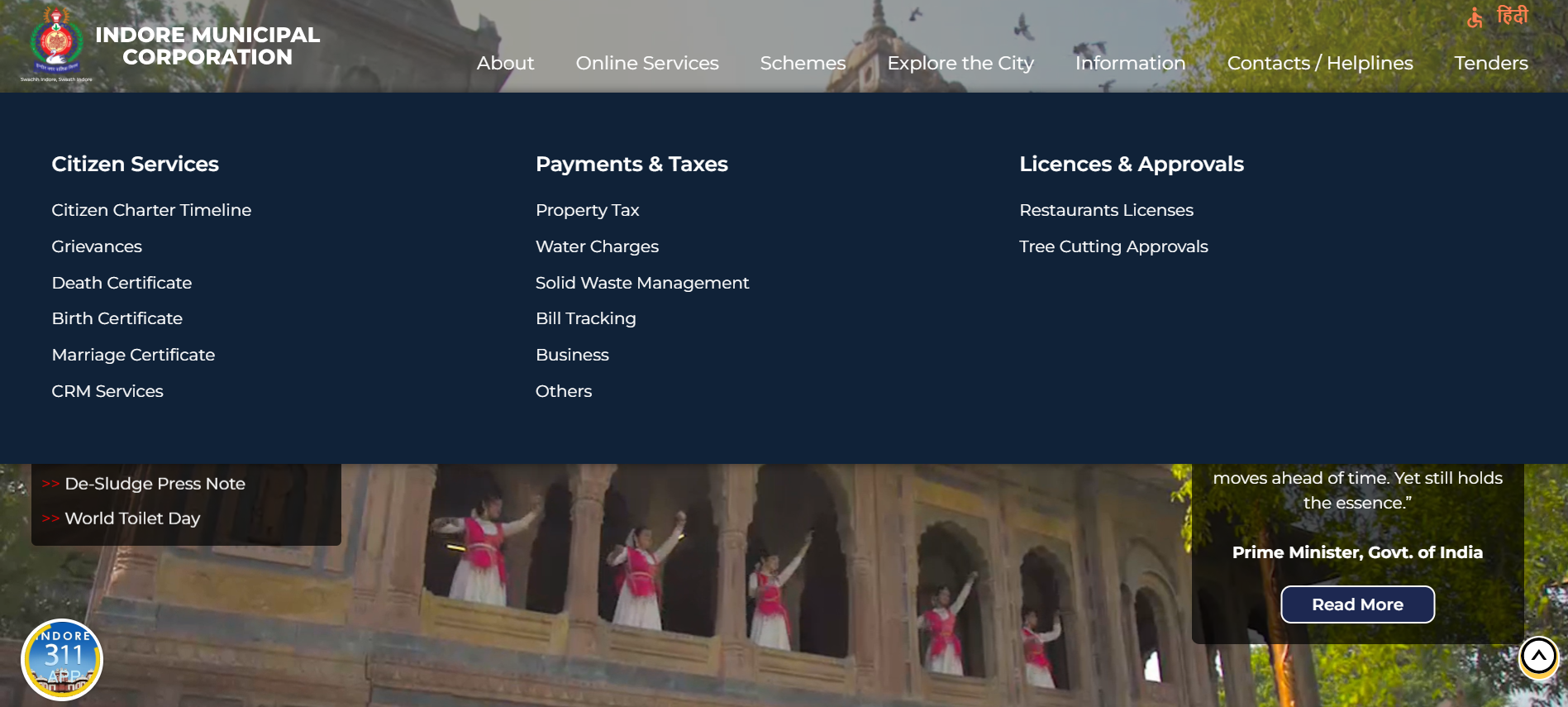

- Look for the “Property Tax” section on the homepage.

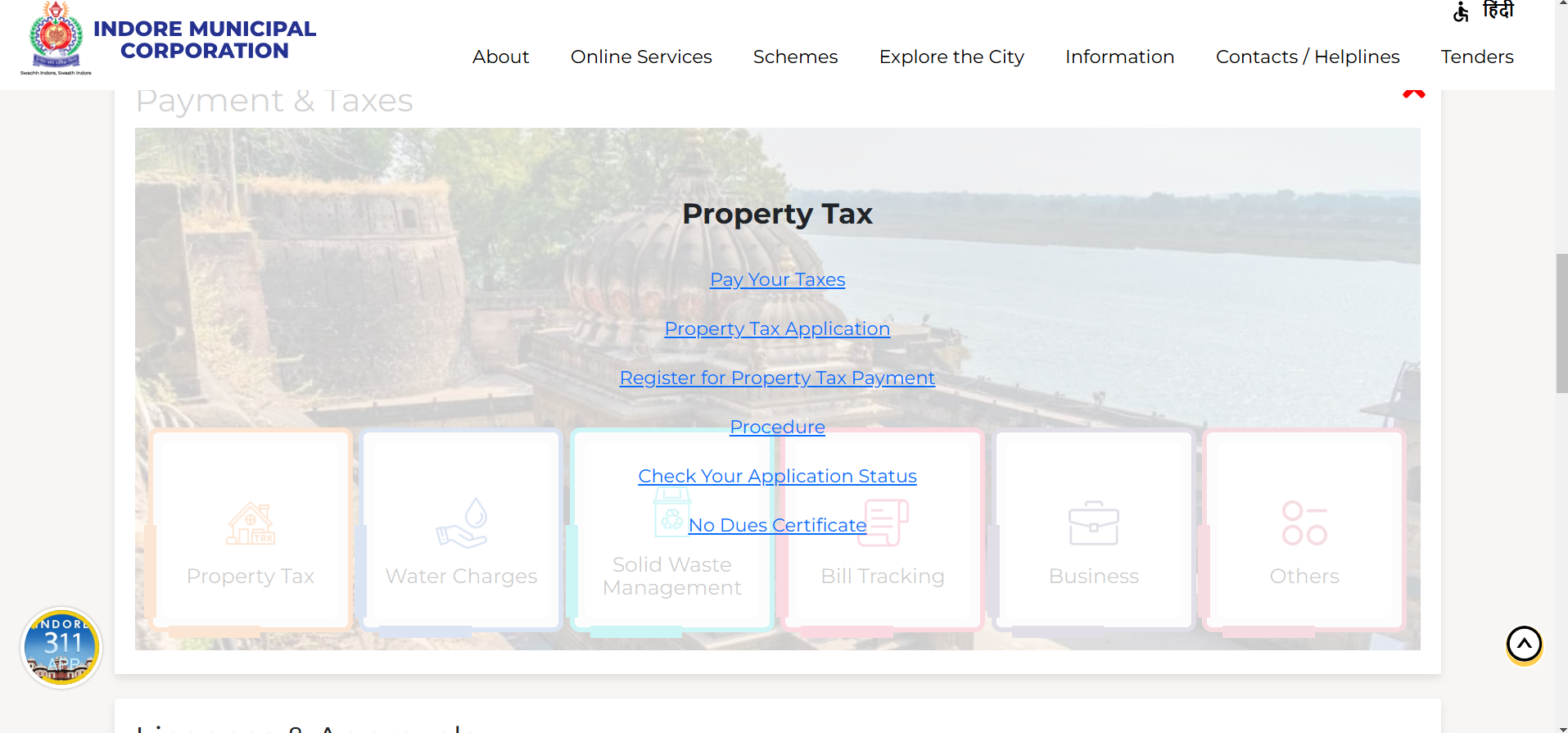

- Click on the “Pay Property Tax Online” option.

- Enter your service number and click “Search.”

- The website will show you the amount you owe.

- Choose your payment method (like debit/credit card, net banking, etc.).

- Confirm the payment and download your receipt once the transaction is complete.

This method allows you to pay anytime, anywhere, and avoid waiting in long lines.

Offline Payment Methods

If you prefer to pay in person, you can visit the Indore Municipal Corporation office or designated branches. Here’s how:

- Go to the IMC office or an authorised payment centre.

- Fill out the required property tax form.

- Pay your tax amount at the counter.

- Collect the receipt after payment.

Both methods are simple, but the online option offers more convenience and saves time.

Check Out: How To Pay Property Taxes Online?

What is IMC Property Tax?

Property tax is a type of tax that homeowners pay to the government based on the value of their property. This tax helps fund public services such as road maintenance, infrastructure, and basic civic amenities. The government body responsible for collecting property tax can vary. In Indore, it is the Indore Municipal Corporation (IMC) that manages property tax collection.

The IMC ensures that property owners pay their dues on time, which helps maintain and improve city services. IMC uses property tax funds to enhance local infrastructure, such as roads, water supply, and sanitation. It also plays a key role in the city’s overall development, making it an essential part of urban management.

How is IMC Property Tax Calculated?

IMC property tax depends on various factors. These factors include the area, location, and type of property. The total area of the property, including any garages or balconies, plays a key role. Additionally, the location of the property influences the tax rate. Properties in prime areas might have higher tax rates than those in less developed zones. The type of property, such as residential or commercial, also affects the calculation.

A formula is used to calculate property tax for residential properties. Here’s how it works:

- Plinth Area (PA): This refers to the total area of the property, including extra spaces like garages and balconies.

- Monthly Rental Value (MRV): This is the rent per square foot of the property, based on current market rates.

Once you have these values, use the following formula to calculate the annual property tax for residential properties:

Annual Property Tax = PA x MRV x 12x (0.17-0.30) -10 + 8

The tax rate can vary depending on the area. Since 2015, tax rates in Indore have ranged from 1% to 6%, with different zones having different rates. The exact rate is determined by the property’s location and size.

Also Read : How to Pay Navi Mumbai Property Tax

Key Dates to Remember

The property tax payment in Indore has a fixed due date.

- You must pay the tax by June 30th every year. This is the last day to avoid any penalties.

- If you pay your property tax before the due date, you might be eligible for rebates.

- IMC offers discounts for early payment, so make sure to check for these benefits when you pay.

- On the other hand, if you miss the deadline, penalties will apply.

- These penalties increase over time, so it’s important to pay on time to avoid extra charges.

Also Read: Home Loans in Indore

Self-Assessment for Property Tax

The Indore Municipal Corporation (IMC) offers a self-assessment form on its website. This form helps property owners estimate their property tax.

By filling out the form, you can calculate the tax based on your property’s details, like size and location. The self-assessment form allows you to check the amount you need to pay before submitting your payment. It’s an easy way to avoid mistakes and ensure you pay the correct amount.

Contact Information for IMC Property Tax

If you face any issues with property tax, you can reach out to the mayor of Indore Municipal Corporation (IMC) for help. You can contact them through the following:

- Helpline Number: +91 7440440103

- Email Address: advpushyamitra@gmail.com

- Office Address: Indore Municipal Corporation, MG Road, Indore

Conclusion

Paying your IMC property tax on time is crucial to avoid penalties and ensure the smooth running of municipal services. Timely payment helps maintain the infrastructure and services that benefit residents. For ease and convenience, the online payment system is available and encourages residents to complete their payments from home. By using the online portal, you can save time and avoid unnecessary delays. Make sure to use the available tools for a hassle-free property tax experience.

Frequently Asked Questions

IMC property tax is a tax that property owners in Indore must pay to the Indore Municipal Corporation for the upkeep of local services.

You can pay IMC property tax online through the IMC portal or offline at designated branches.

The due date for property tax payment is June 30th each year.

If you miss the deadline, you will face penalties and extra charges on your taxes.

Yes, IMC offers a rebate for early property tax payments, helping you save money.

Property tax is calculated based on the property’s size, location, and type, using a specific formula.

You can find the self-assessment form on the IMC website to help you estimate your property tax.

For any issues, you can contact IMC helplines or visit the local IMC office for assistance.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan