Prepaying your home loan can be a strategic move to reduce your financial burden and save on interest costs. From the borrower’s perspective, prepayment charges are a significant consideration when planning the early settlement of a housing loan. If you’re considering settling your LIC Housing Finance home loan early, here’s everything you need to know about LIC home loan prepayment policies.

LIC Home Loan Prepayment Charges 2025

| Payment Source | Prepayment Charge |

|---|---|

| Own Funds | NIL |

| Other Sources | 2% on prepaid loan amount |

Suggested Read: LIC Home Loan Balance Transfer

How to Make LIC Home Loan Prepayment Online?

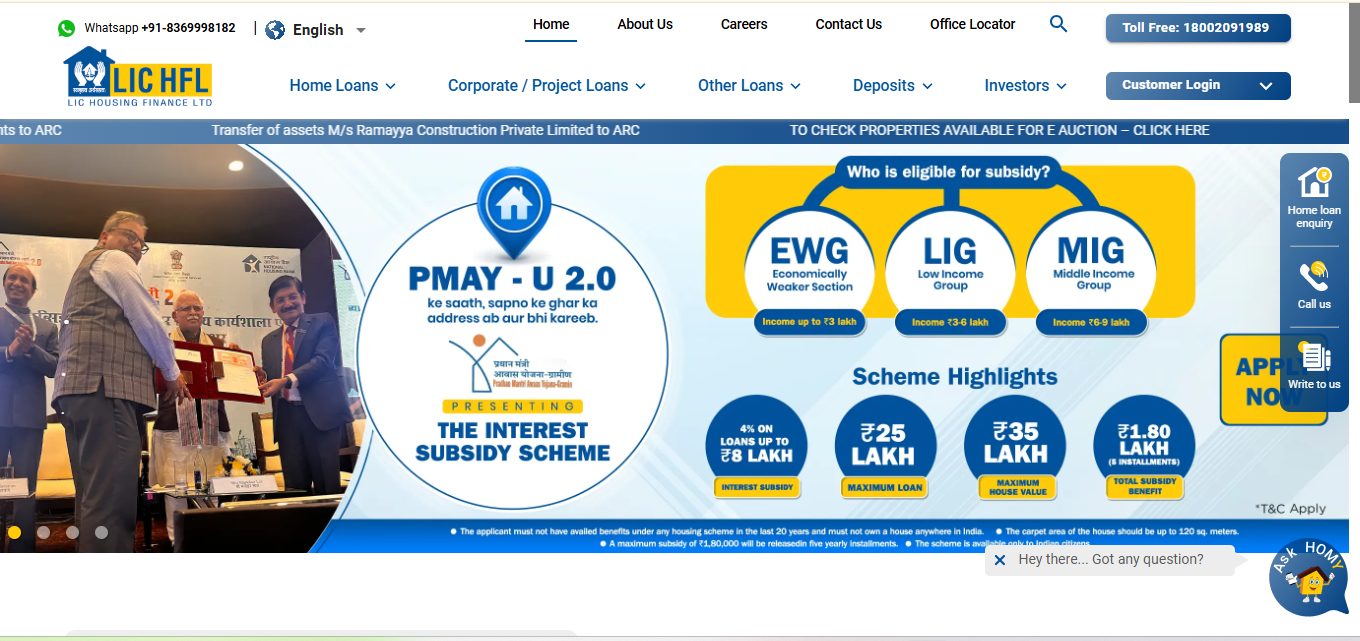

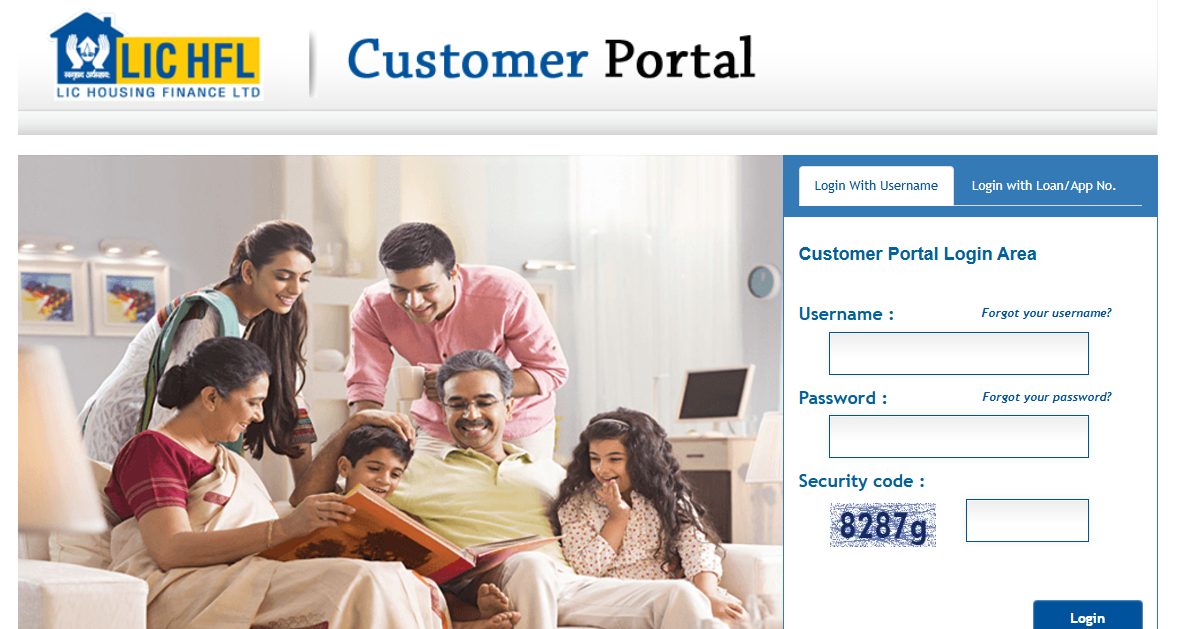

- Visit the LIC HFL official website and click on the ‘Customer Portal’ link.

- Log in using your username and password.

- Navigate to the ‘Pay Online’ section.

Select your loan account and click on ‘Get Dues’ to view the outstanding amount.

Enter the amount you wish to prepay. - Confirm Payment.

After completing the transaction, a payment acknowledgment will be generated.

Suggested Read: LIC Home Loan Statement Download

Home Loan Prepayment Case Study

Sanjay, a 40-year-old IT professional, took a home loan of ₹90 lakh from LIC Housing Finance to purchase his dream home in Mumbai.

| Parameter | Value |

|---|---|

| Loan Amount | ₹90,00,000 |

| Interest Rate | 8.75% |

| Loan Tenure | 30 years (360 EMIs) |

| Number of EMIs Paid | 60 |

| EMI Amount | ₹70,803 |

| Total Interest Payable | ₹1,64,89,093 |

After reviewing these numbers, Sanjay realized that he would end up paying nearly ₹1.65 crore in interest alone, which was almost twice the loan amount.

The Solution: Prepayment Strategy

Sanjay decided to prepay ₹8 lakh from his savings and annual bonus. This prepayment directly reduced the outstanding principal amount, leading to major financial benefits.

Loan Details (After Prepayment of ₹8 Lakh)

| Parameter | Before Prepayment | After Prepayment | Impact |

|---|---|---|---|

| Outstanding Principal | ₹86,03,996 | ₹78,03,996 | Reduced |

| Total Interest Payable | ₹1,64,89,093 | ₹1,19,85,541 | Saved ₹45,03,552 |

| Loan Tenure Remaining | 25 years (300 EMIs) | 19 years (225 EMIs) | Reduced by 6 years |

| EMI Amount | ₹70,803 | ₹70,803 | Unchanged |

Key Benefits of Prepayment

- Saved ₹45.03 lakh in total interest payments.

- Loan tenure reduced by 11 years (from 30 years to 19 years).

- The EMI remained unchanged at ₹70,803, but the loan would be closed much earlier.

- Sanjay could now focus on other financial goals such as investments and retirement planning.

Benefits of Prepaying LIC Home Loan

- Interest Savings: Reduces overall interest paid over the loan tenure.

- Faster Loan Closure: Helps close the loan earlier, reducing financial burden.

- Improved Credit Score: Timely prepayments enhance creditworthiness.

- Lower EMI or Shorter Tenure: Choose between reducing EMI or shortening the loan duration.

- Increased Loan Eligibility: Reducing outstanding debt improves future borrowing capacity.

- Reduced Financial Stress: Lesser monthly commitments lead to better financial flexibility.

- No Prepayment Penalty: LIC HFL does not charge prepayment fees for individual borrowers with floating-rate loans.

- Better Investment Opportunities: Frees up funds for higher-return investments.

Suggested Read: LIC Home Loan Customer Care

Who Should Consider Prepaying their LIC Home Loan?

- High-Interest Payers: If the interest burden is high, prepayment can reduce overall costs.

- Stable Financial Condition: Those with surplus funds or steady income can benefit.

- Short-Term Borrowers: If planning early loan closure, prepayment is ideal.

- Low-Return Investors: Those earning lower returns on savings than loan interest rates.

- Debt-Averse Individuals: If you prefer financial freedom over long-term liabilities.

- Retirement Planners: Ideal for those nearing retirement to avoid post-retirement EMIs.

- Future Borrowers: Reducing existing debt can improve eligibility for other loans.

Suggested Read: Home Loan Prepayment vs. Investing

Conclusion

Prepaying your LIC Home Loan is a smart financial move that can help reduce interest costs, close the loan sooner, and improve overall financial stability. Whether you aim to lower EMIs, shorten the loan tenure, or enhance future loan eligibility, prepayment offers multiple benefits.

Looking to reduce your home loan burden further? Consider a home loan balance transfer for lower interest rates and better repayment terms. Book a FREE consultation call with Credit Dharma to explore your options today!

Frequently Asked Questions

Yes, LIC Housing Finance permits prepayment of home loans without any penalty after you have paid 6 EMIs.

Prepaying your home loan can reduce overall interest and shorten the loan tenure, but it’s essential to assess your financial situation and other investment opportunities before deciding.

Yes, you can foreclose your LIC home loan before the end of your loan tenure, and LIC does not charge any foreclosure fees if you repay using your own funds.

Yes, LIC Housing Finance offers an online payment facility through their customer portal, allowing you to make EMI payments and prepayments conveniently.

You can prepay up to 25% of the outstanding principal in a year, with a maximum of 10% in a single transaction.

To repay your home loan in five years, consider making higher EMI payments, utilizing bonuses or windfalls for prepayments, and reducing unnecessary expenses to allocate more funds toward the loan.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan