Checking your LIC HFL home loan status is important in staying updated on your application progress and avoiding unnecessary delays. Whether you have applied online, via mobile, or offline, checking your home loan status ensures transparency and timely action.

This guide walks you through the step-by-step process of tracking your LIC HFL home loan application using different methods, and the key documents required. Manage your home loan process with the help of this guide with ease!

How to Check LIC HFL Home Loan Status?

You can check your LIC HFL home loan status through multiple methods, where we’ll walk you through how to track your home loan application status by various available online and offline options.

How to Check LIC HFL Home Loan Application Status Online?

Checking your LIC HFL home loan status online is quick and hassle-free through the official LIC Housing Finance portal.

Follow these steps to check your home loan status online:

- Visit the official website of LIC Housing Finance Limited

- Click on the “Customer Login” tab on the upper right-hand side.

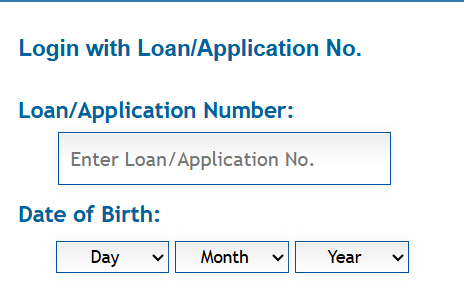

- Select the “Login with Username” or “Login with Loan/App No.” Option.

- Enter your “Username and Password” or “Application Number and Date of Birth”.

- Fill in the security code displayed on the screen.

- Click the “Submit” button to view your loan status.

Read More: LIC Home Loan Eligibility Checklist

How to Check LIC HFL Home Loan Application Status via Mobile App?

Checking your LIC HFL home loan status is now simpler and easier with the LIC Housing Finance mobile app.

Follow these steps to check your home loan status via mobile app:

- Download the official LIC Housing Finance app from the Play Store.

- Enter your registered mobile number or loan number.

- Provide your date of birth for verification.

- Submit the details to view your home loan application status.

How to Check LIC HFL Home Loan Application Status via SMS?

Checking your LIC HFL home loan status via SMS or call is a quick and easier way to stay updated without internet access.

Check your Home Loan status via SMS:

- Opt for SMS updates while applying for your home loan.

- Receive automatic status updates on your registered mobile number.

For further queries, you can also use the online feedback form on the LIC HFL website.

How to Check LIC HFL Home Loan Application Status Offline?

You can check your LIC HFL home loan application status offline by contacting LIC Housing Finance executives.

Steps to check your loan status offline:

- Visit the LIC HFL website and go to the Call Us page.

- Select your state and nearest area office.

- Find the contact details of the concerned official.

- Call the number and provide your loan details.

- Receive real-time status updates from the executive.

Also Read: LIC Housing Finance Home Loan Interest Rates

Why Should You Check Your LIC Home Loan Status?

Tracking your LIC HFL home loan status helps you stay updated on your application progress and avoid unnecessary delays. It ensures you can quickly respond to any document requirements, making the approval process smoother.

You can check your loan status online via the LIC Housing Finance portal or through SMS and email updates. The secure system verifies your details using your application number and date of birth, keeping your information safe.

Staying informed about your loan status reduces uncertainty, allowing you to plan better while waiting for approval. Whether online or offline, tracking your application keeps you in control of the process.

How Long Does it Usually Take to Get the Status Update After Applying for an LIC Home Loan?

After applying for an LIC home loan, you can usually get a status update within 24 to 48 hours if all documents are submitted correctly. The processing time may vary based on verification and internal approvals. You can track the status online through the LIC HFL portal or via SMS and customer support for real-time updates.

Also Read: How To Track Your Home Loan Application Status

What Documents are Required to Check the Status of the LIC HFL Home Loan?

To check your LIC HFL home loan status, you need basic documents for verification.

- PAN card, Aadhaar card, or residence proof.

- Latest salary slips, Form 16, or bank statements.

- Ownership document or allotment letter for flats.

Keep these documents ready for a smooth status check online or offline.

Are There Any Common Issues That Might Delay the Approval of a LIC Home Loan?

Several common issues can delay the approval of an LIC home loan:

| Common Issues | Reason for Delay |

|---|---|

| Incomplete Documents | Missing or incorrect paperwork. |

| Low Credit Score | Poor credit history affects approval. |

| Unstable Employment | Frequent job changes raise concerns. |

| Property Issues | Legal disputes or unclear titles. |

| High Existing Debts | Too many loans impact eligibility. |

How Can I Improve My Credit Score to Avoid Delays in the Approval Process?

Improving your credit score is essential to avoid delays in the home loan approval process. Here’s how you can enhance your creditworthiness:

- Ensure all bills are paid on time to maintain a positive payment history.

- Aim to keep your credit utilization ratio below 30% by paying down existing debts.

- Regularly review your credit reports and dispute inaccuracies that could harm your score.

- Keep older credit accounts open to demonstrate a lengthy and stable credit history.

Read More: How to Increase CIBIL Score

Why should you use the LIC HFL customer portal?

| Feature | Benefit |

|---|---|

| Repayment Certificates | Download yearly statements for records. |

| Disbursement Details | Track loan payouts easily. |

| Repayment Schedule | View upcoming payments for 12 months. |

| PDCs/ECS Details | Check post-dated cheques & ECS status. |

| Submit Queries | Get quick assistance for any concerns. |

| Online Payments | Pay dues securely from anywhere. |

Summing Up

Staying updated on your LIC HFL home loan status helps you track progress and avoid delays. With easy online, mobile, and offline options, checking your status is simple and convenient. Stay proactive and manage your home loan journey smoothly.

Frequently Asked Questions

You need your loan application number, registered mobile number, and date of birth for verification. These details help you check your LIC HFL home loan status online, via mobile app, or through customer support.

Yes, you can edit certain details of your application through the LIC HFL customer portal. However, major modifications may require you to contact customer support or visit the nearest LIC HFL branch for assistance.

Your LIC HFL loan number is mentioned in the loan sanction letter, welcome kit, or monthly statements. You can also check it by logging into the LIC HFL customer portal or by contacting customer support.

Visit the LIC HFL customer portal, select “Login with Loan/App No.,” enter your application number, date of birth, and security code, then click submit. Your application status will be displayed on the screen.

LIC HFL home loan approval usually takes 7 to 10 working days, depending on document verification and eligibility checks. Delays may occur due to incomplete paperwork or additional verification requirements.

Regularly checking your loan status helps you stay updated, address any missing documents, avoid delays, and plan your finances better. It ensures a smooth loan approval process without unexpected rejections or pending verifications.

Yes, you can track your application using the LIC Housing Finance mobile app. Simply enter your registered mobile number and date of birth to get real-time updates on your home loan status.

You can get your LIC HFL home loan statement by sending an SMS to the LIC HFL customer service number. Type “LOANSTAT [Your Loan Number]” and send it to the designated SMS service. You’ll receive your loan statement details instantly.

The processing time for an LIC Housing Finance home loan takes typically up to 15 working days, depending on document verification, property evaluation, and other factors. Timelines may vary based on applicant profile, loan amount, and completeness of submitted documents.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan