Need to show proof of the interest you paid on your LIC Housing Finance home loan? Good news—it’s only a few clicks away. Whether you call it a tax certificate or an interest certificate, the document lives inside LIC Housing Finance’s digital self‑service options.

Log in, hit download, and you’re done. Below, you’ll find a quick walkthrough that works on both the web portal and the mobile app, plus tips on what to do if you’ve forgotten your credentials. Let’s get your paperwork sorted so you can move on with filing—or just cross one more task off today’s list.

How to Download the Home Loan Tax Certificate Online from LIC Housing Finance?

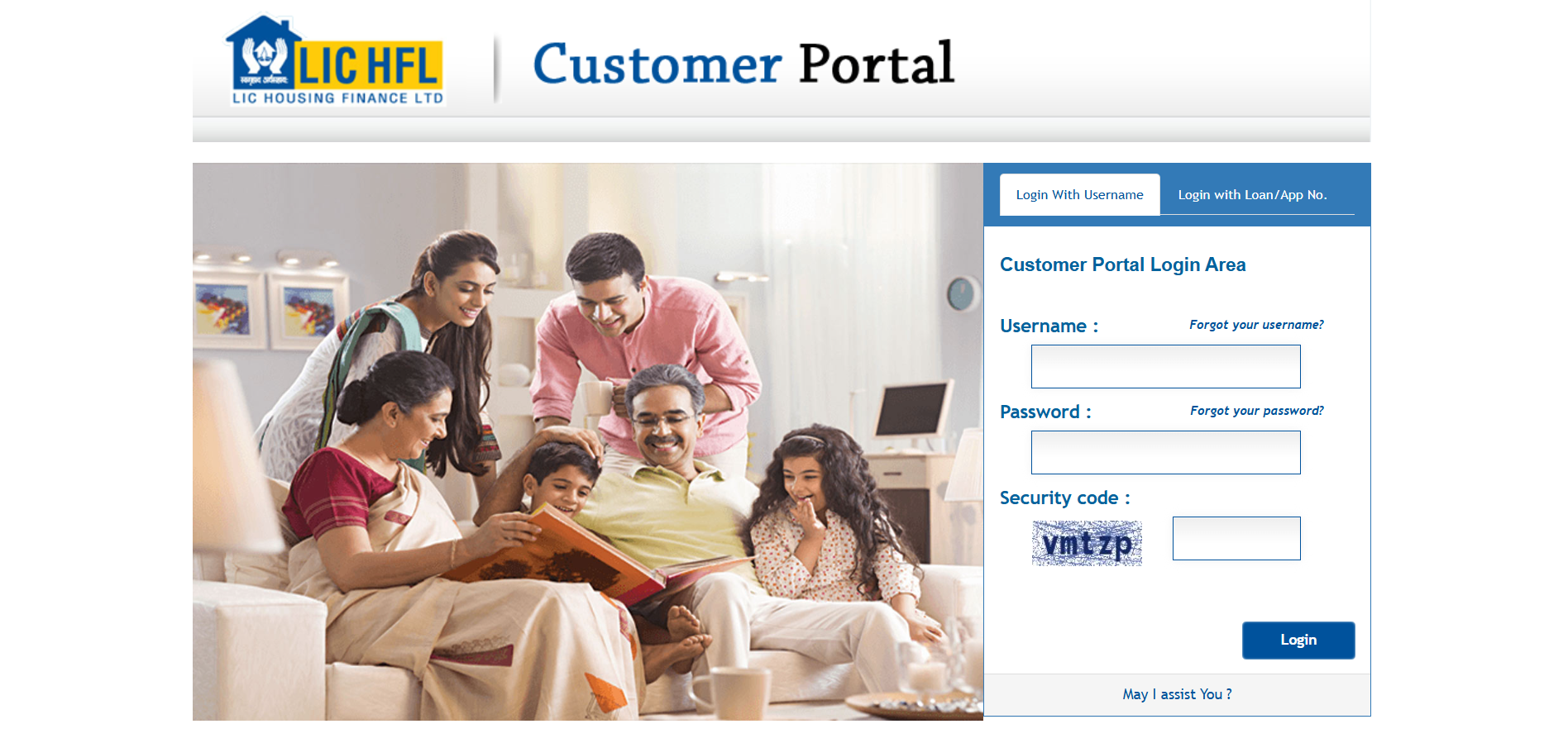

- Visit the official LIC Housing Finance customer care portal.

- Sign in with your user-ID and password.

- Once you’re in, choose the Activities tab on the dashboard. Select Repayment Certificate from the list.

- In the drop-down menus, choose the specific loan account (if you have more than one) and the financial year you need.

- When you pick the ongoing financial year, the portal instantly shows a provisional interest certificate.

- For any completed financial year, click Download Repay Certificate to save the officially finalised document to your device.

Suggested Read: When Does a Home Loan Become a Non Performing Asset?

How to Get LIC Housing Finance Home Loan Tax Certificate Offline?

- Locate your nearest LIC Housing Finance branch and take along a photo ID plus your home‑loan account number.

- Ask the service desk for the “Home Loan Interest/Tax Certificate” request form.

- Complete, sign, and submit the form (attach an ID copy if asked).

- Receive an acknowledgement slip noting when the physical certificate will be ready (often same day or within 1–2 working days).

- Return to the branch—or collect when notified—to pick up your hard‑copy interest certificate.

You can also contact your relationship manager: Ask them to arrange a hard copy; expect the document in 1–2 business days.

What are the Tax Benefits of a Home Loan with LIC Housing Finance?

If you’re eyeing a LIC Housing Finance Home Loan, remember the real savings lie beyond the headline rate—tax deductions can trim your out‑of‑pocket cost every year. Below is a snapshot of the main breaks the Income Tax Act offers and how to structure your loan (and property choices) to capture the maximum benefit.

Deduction for Interest Paid on Housing Loan (Section 24)

- Loan must fund purchase or construction of a house property.

- Construction must finish within 5 years from the end of the financial year the loan was taken; otherwise, deduction drops to ₹30,000 a year.

- Self‑occupied property: claim up to ₹2 lakh interest per year.

- Let‑out property: claim full interest with no cap; any loss offsets income from other house properties only.

- Choose which property is “self‑occupied” to maximise total deductions.

Interest Paid During Pre‑Construction Period

- Interest paid before completion is called pre‑construction interest.

- Claim it only after construction ends, spread equally over five years.

- Each year’s 1/5 share plus current‑year interest is limited to ₹2 lakh under Section 24(b) for a self‑occupied home.

- Section 80EEA can add up to ₹1.5 lakh extra interest deduction if eligible.

Deduction on Principal Repayment (Section 80C)

- Principal component of EMI is deductible up to ₹1.5 lakh a year.

- Selling the house within five years adds back all earlier principal deductions to your income.

Deduction for Joint Home Loan

- Each co‑owner‑borrower may claim up to ₹2 lakh interest deduction and ₹1.5 lakh principal deduction.

- Deduction is allowed only if all borrowers are co‑owners of the property.

Deduction for Stamp Duty and Registration Charges (Section 80C)

- Stamp duty and registration fees paid on purchase are deductible in the year of payment.

- These amounts share the overall ₹1.5 lakh Section 80C ceiling with principal repayment.

Can I Claim Both HRA and Home Loan Tax Benefits Together?

You can combine House Rent Allowance (HRA) and home‑loan interest deductions, but only when your living and ownership situations meet specific Income‑tax Act rules. Use the checklist below to see if you qualify—and to avoid cases where the double benefit is disallowed.

When you can claim both

- Work in one city, own a home in another, and pay rent where you work.

- Pay rent while your self‑occupied house is still under construction; claim HRA now and home‑loan interest once the house is ready.

- Let out your owned property and live in a rented home elsewhere; claim HRA on the rent and full interest deduction under Section 24(b) for the let‑out house.

When you cannot claim both

- Live in the very home for which you pay the loan interest—only interest is deductible, HRA is not.

- Own a livable house in the same city yet choose to rent another place, unless you can prove your job requires the separate accommodation.

Suggested Read: How to Save Tax on Rental Income?

What is the Difference Between 80C and 24B Sections of Income Tax Act, 1961?

| Aspect | Section 80C | Section 24(b) |

|---|---|---|

| Expense covered | Home‑loan principal (plus PPF, ELSS, etc.) | Home‑loan interest |

| Annual cap | ₹1.5 lakh (total of all 80C items) | Self‑occupied: ₹2 lakh Let‑out: no limit (loss set‑off capped at ₹2 lakh) |

| Who can claim | Individuals & HUFs | Any property owner paying interest |

| Key condition | Keep the house for 5 years after possession | Finish construction within 5 years, else cap drops to ₹30,000 |

| New tax regime | Not allowed | Allowed only for let‑out homes |

Suggested Read: Which Regime to Choose as a Home Buyer?

What is a LIC Housing Finance Home Loan Tax Certificate or Interest Certificate?

A LIC Housing Finance Home Loan Interest Certificate is an lender‑issued statement that sums up how much interest you paid and how much principal you repaid on your LIC Housing Finance home loan during a specific financial year (provisional for the year in progress, final after 31 March).

You attach it to your income‑tax return or give it to your employer to unlock deductions under Sections 24(b) (interest) and 80C (principal) of the Income‑tax Act, and it doubles as a handy one‑page tracker of your loan status.

What the Certificate Shows

Borrower’s personal details (name, address, PAN)

• Home‑loan account number

• Total loan sanctioned & current outstanding principal

• Financial‑year period covered (start & end dates)

• Applicable interest rate and whether it’s fixed or floating

• Interest paid during the period (claimable under § 24(b))

• Principal repaid during the period (claimable under § 80C)

• Any missed or part‑repayments and resulting principal adjustments

• Upcoming EMI/repayment amount due for the rest of the year

Can I Download the Home Loan Tax Certificate Directly from the LIC Housing Finance Mobile Application?

Yes. LIC Housing Finance’s mobile app lets you pull both provisional and final interest (tax) certificates yourself:

- Launch the LIC Housing Finance mobile app and sign in with your registered ID and password.

- Choose your home‑loan account from the dashboard.

- Tap Interest Certificate (pick “Provisional” or “Final” as needed).

- Hit Download to save the PDF on your phone.

- Check your device’s downloads folder (or in‑app “Documents”) for immediate access.

How Long Does it Take to Receive the Home Loan Tax Certificate via E-Mail?

LIC Housing Finance’s official turnaround time for emailing a home‑loan tax (interest) certificate is up to 3 working days after you place the request (weekends and public holidays don’t count).

Are There Any Fees Associated with Downloading the Home Loan Tax Certificate?

- Downloading the LIC Housing Finance home‑loan tax (interest) certificate yourself—either from the mobile app or the online customer portal—is free.

- A fee applies only when you ask the branch for a printed (physical) certificate; that costs ₹ 200 per request + GST.

Suggested Read: Tax Benefits on Purcashing Second Home

What are the Differences Between a Home Loan Tax Certificate and a Home Loan Interest Certificate?

In India, the Home Loan Tax Certificate and Home Loan Interest Certificate serve distinct purposes for tax filing. Here’s a structured breakdown of their differences:

| Aspect | Tax Certificate | Interest Certificate |

|---|---|---|

| Coverage | Principal + Interest | Only Interest |

| Key Sections | 80C (principal), 24(b) (interest) | 24(b) (interest) |

| Details Included | Loan account, property info, EMI breakdown | Total interest paid annually |

| Use Case | Comprehensive tax filing | Specific interest-related claims |

Suggested Read: Carpet Area vs. Built Up Area vs. Super Built Up Area

Why Do You Need a Home Loan Tax Certificate from LIC Housing Finance?

- Claim tax deductions on interest (Section 24(b)) and principal (Section 80C/80EEA)

- Submit proof to your employer for accurate TDS and smoother year‑end tax reconciliation

- Check how much interest and principal you’ve repaid for precise ITR filing

- Track repayment progress and decide whether a prepayment will save interest

- Provide lender‑verified evidence when seeking a balance‑transfer or top‑up loan

- Use as supporting financial proof for visa applications, personal loans, or credit cards

How to Use LIC Housing Finance Home Loan Tax Certificates for Income‑Tax Filing?

Your LIC Home Loan Tax Certificate contains critical details required for accurate income-tax filing. Key elements to identify include:

- Borrower Details : Full name, address, and Permanent Account Number (PAN) as registered with LIC Housing Finance.

- Loan Account Number : Unique identifier for your home loan.

- Interest Certificate : A breakdown of the total interest paid during the financial year (under “Interest on Loan” or “Interest Paid”).

- Principal Repayment : Total principal amount repaid in the year (required for claiming deductions under Section 80C).

- PAN of LIC Housing Finance : The lender’s PAN (e.g., [LIC Housing Finance’s PAN here]) for reporting TDS (if applicable).

How to Use the Information When Filing Taxes?

- Interest (Sec 24(b)) – In Schedule HP → “Interest payable on borrowed capital,” enter the total interest; cap ₹2 lakh for self‑occupied, no cap for let‑out.

- Principal (Sec 80C) – In Schedule VI‑A → “80C,” add the principal repaid, up to ₹1.5 lakh.

- Lender details – In Schedule HP, copy the lender’s name, PAN and address exactly as on the certificate.

- Certificate PDF – Keep the file handy; the e‑filing portal may ask you to upload it if your return is scrutinised.

LIC Housing Finance Home Loan Address and Details for Income‑Tax Forms

Where to find LIC Housing Finance’s address and other required details

- On the tax/interest certificate – Most certificates display the lender’s registered office, PAN and contact number in the header or footer.

- On the sanction letter or loan statement – These documents repeat the same statutory information.

- On LIC Housing Finance’s website – The “Contact Us” page lists the registered office and customer‑care number for quick reference.

Specific Sections of Tax Forms Where the Details Must be Entered

| ITR Form | Field/Section |

|---|---|

| ITR‑1 (SAHAJ) | Schedule HP → “Name & Address of lender” and “PAN of lender” |

| ITR‑2 / ITR‑3 | Schedule HP (same block) |

| ITR‑4 (SUGAM) | Part A – General → “Details of lender (for Sec 24/80C claims)” |

Suggested Read: Home Loan vs. SIP

How to Get LIC Housing Finance Home Loan Tax Documents for Specific Years?

Every tax return asks for the exact figures from that specific financial year—no more, no less. If you’ve held a LIC Housing Finance home loan for several years, you may need certificates going back to 2016‑17 or earlier to support past deductions or respond to a notice.

The good news: with the portal, app, and a few customer‑care options, you can retrieve any year’s tax or interest certificate in minutes (and still get a stamped copy if the PDF isn’t online).

Getting Historical LIC Housing Finance Tax Certificates

- Log in to the LIC Housing Finance Customer Portal or mobile app with your registered mobile / email and OTP/password.

- Select the relevant loan account on the dashboard.

- Tap “Interest Certificate (Final/Provisional)”.

- Use the Financial‑Year dropdown and pick the year you need—FY 2016‑17, 2017‑18, 2018‑19, or 2019‑20.

- Click Download (PDF) or Email to send it to your registered ID.

- Save the file for your tax records.

What to do if older certificates are not available online

- Raise a service request inside the portal (Menu → Service Requests → “Historical Interest Certificate”).

- Email your loan account number and the required year.

- Call customer care on 1860 267 6060 and quote your loan details.

- Visit the nearest branch with your photo ID; staff can print and stamp a hard‑copy certificate.

- Allow 7 working days for older‑year requests to be processed (as per LIC’s customer‑service TAT).

Suggested Read: ITR Filing Guide

Troubleshooting Common Issues with LIC Housing Finance Home Loan Certificates

Even the best online systems can hit a snag. If you’re stuck while viewing, downloading, or correcting your LIC Housing Finance home‑loan documents, the quick fixes below should get you back on track.

Can’t Access the LIC Housing Finance Online Portal

- Double‑check user ID and password entries—look out for extra spaces or caps‑lock mistakes.

- Clear browser cache → refresh the page → try again in an incognito/private window.

- Update outdated browsers or switch to another browser/app version.

- Disable ad‑blockers or VPNs that may block LIC Housing Finance’s login script.

- Hit “Forgot Password” to reset credentials by OTP or email.

- Still locked out? Call LIC Housing Finance customer care or email for account recovery.

Unable to Find or Download the Tax Certificate

- Verify you’ve selected the correct loan account under “Account Details.”

- Look for a “Financial Year” filter; select the year, then click “Generate.”

- If the document stalls, wait a minute and refresh; heavy server load can delay generation.

- Pop‑ups disabled? Allow downloads in your browser settings.

Issues with LIC Housing Finance Home Loan Statement for Income Tax

- Cross‑verify interest and principal figures with bank debits and prior statements.

- Spot a mismatch? Email the statement and supporting proof (e.g., bank EMI alerts).

- Request a “Revised Interest Certificate” in the email subject line for faster routing.

- Follow up through customer care if no response within two working days.

- For urgent filing deadlines, collect a corrected hard copy from the branch and attach it to your return.

Suggested Read: Mutation of Property

Conclusion

Utilizing tax benefits from your LIC Housing Finance home loan can ease your financial burden. The LIC Housing Finance Home Loan Tax Certificate is key for claiming these deductions. Follow the steps to maximize your benefits and manage finances efficiently.

For expert assistance and guidance on home loan tax-related matters, contact Credit Dharma today!

Frequently Asked Questions

The income-tax department asks for a consolidated certificate because it clearly separates interest (eligible for Section 24 deduction) and principal (eligible for Section 80C), whereas monthly EMI slips rarely do that. Lenders issue the certificate so you (and your employer, if you submit it for TDS) have an authoritative, year-to-date figure.

You can still claim the deduction, but the tax officer may ask for the certificate later. Uploading or retaining it now avoids a notice and speeds processing because the certificate is accepted as prima-facie proof of the interest you paid.

Most banks host a DIY download link in internet banking or their mobile app. For example, SBI customers log in, choose “e-Services › Home-Loan Interest Certificate” and download the PDF instantly; similar options sit under “Repay Certificate” on LIC HFL’s customer portal.

Yes. Each co-borrower may download an individual certificate that lists the loan share and PAN so both can independently claim their proportionate deductions in their own tax returns.

Yes. The same statement lists both the interest paid and the principal repaid, so you can use it for both Section 24 and Section 80C deductions in one go.

There’s no statutory deadline, but lenders release the final certificate in April; downloading it early ensures you have accurate numbers before your employer’s June TDS cut-off or the ordinary 31 July ITR filing due date.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan