Getting a loan against LIC policy is a simple way to access funds without giving up your policy. If your policy has acquired a cash value, you can apply online or offline by submitting minimal documents. With quick processing and competitive interest rates, it’s a hassle-free financing option.

LIC Loan Against Policy Interest Rate

The LIC loan against policy interest rate generally falls between 9-10% per annum, though it may vary as per LIC’s latest policies. Borrowers have the flexibility to repay through installments or a lump sum, ensuring convenience. However, timely interest payments are crucial to prevent policy lapse, as any unpaid interest might be deducted from the final maturity amount.

Also Read: LIC Home Loan Interest Rates in 2025

Key Features of Loan against LIC Policy

A loan against LIC policy offers a quick and secured way to access funds without giving up the policy.

| Feature | Details |

|---|---|

| Loan Amount | Up to 90% of the policy’s cash value |

| Interest Rate | Varies annually as per LIC’s latest guidelines |

| Minimum Tenure | 6 months from loan disbursement |

| Maximum Tenure | Aligned with the policy term |

| Repayment | Interest payable half-yearly; principal repayment based on the policyholder’s financial convenience |

Eligibility Criteria for Loan Against LIC Policy

To avail a loan against LIC policy, policyholders must meet certain eligibility conditions set by LIC.

| Eligibility Criteria | Details |

|---|---|

| Loan Amount | Up to 90% of the policy’s cash value |

| Minimum Age | Policyholder must be at least 18 years old |

| Policy Status | The policy must be active and not lapsed |

| Eligible Policies | Only traditional LIC policies (excluding term plans) qualify |

| Loan Determination | The loan amount is based on the policy’s cash value, typically 85-90% of it |

Read More: LIC Loan Against Property Eligibility Criteria

What is a Loan Against LIC policy?

A loan against LIC policy is a secured loan where policyholders can borrow money using their LIC policy as collateral after it acquires a cash value. The loan amount is typically up to 90% of this value, and LIC retains the right to deduct any outstanding dues from the policy benefits if not repaid.

How to Apply for Availing for Loan Against LIC Policies?

Applying for a loan against LIC policy is a simple process that can be done online or by visiting an LIC branch.

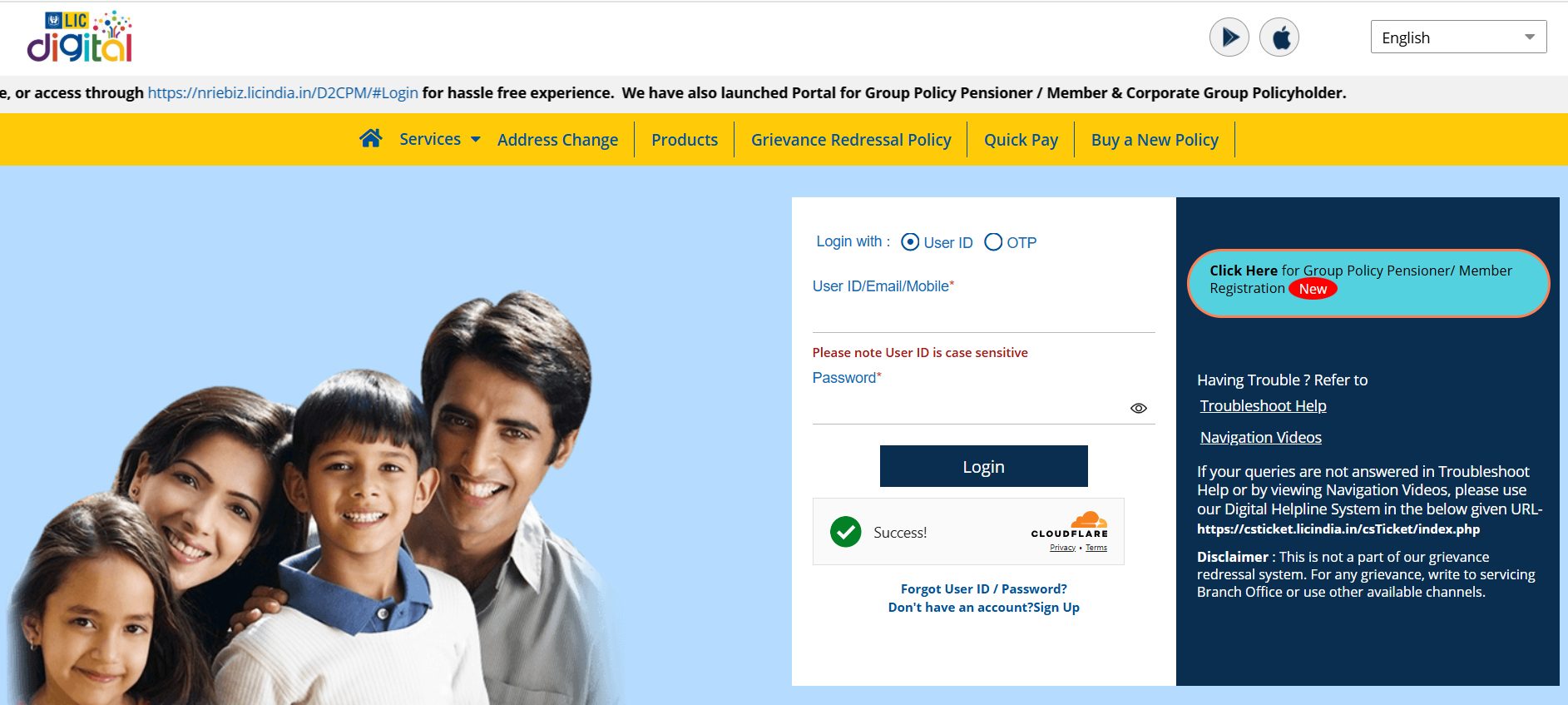

- Visit LIC Branch or Website

Apply in person at the nearest LIC branch or online via the LIC Customer Portal.

- Fill Out the Application Form

Complete the loan application form with accurate details.

- Submit Required Documents

Provide necessary documents, including identity proof and the original LIC policy document for verification.

- Loan Assessment

LIC evaluates the loan amount based on the policy’s cash value.

- Approval & Disbursement

Upon approval, the loan amount is transferred directly to the policyholder’s bank account.

Also Read: How to Check LIC Home Loan Status Online

Other Loan Options to Loan Against LIC Policy

Before opting for a loan against LIC policy, individuals looking for substantial funds can consider a home loan as a better alternative. Home loans offer higher loan amounts, longer repayment tenures, and lower interest rates compared to loans against insurance policies. Additionally, they come with tax benefits and do not impact the financial security provided by the policy.

Loan Options Available in LIC Endowment Plans

| LIC Endowment Plan | Eligibility | Maximum Loan Amount | Interest Rate |

|---|---|---|---|

| LIC Bima Jyoti | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | 10-year G-Sec Rate + 3% (compounded half-yearly) |

| LIC Bima Ratna | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | 10-year G-Sec Rate + 3% or yield on Non-Linked fund + 1% |

| LIC Dhan Sanchay | Regular/Limited: 2 years; Single Premium: 3 months after issue or after Free-look Period | Regular/Limited: Up to 90% (active), 80% (paid-up); Single Premium: Up to 75% of surrender value | 10-year G-Sec Rate + 3% or yield on Non-Linked fund + 1% |

| LIC Jeevan Azad | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | 10-year G-Sec Rate + 3% or yield on Non-Linked fund + 1% |

| LIC New Endowment Plan | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | As per IRDAI (Insurance Regulatory and Development Authority of India) – approved method |

| LIC New Jeevan Anand | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | As per IRDAI-approved method |

| LIC Single Premium Endowment Plan | At least 1 policy year completed | Up to 90% of surrender value | As per IRDAI-approved method |

| LIC Jeevan Lakshay | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | As per IRDAI-approved method |

| LIC Jeevan Labh | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | As per IRDAI-approved method |

| LIC Aadhaar Stambh | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | 10-year G-Sec Rate + 3% or yield on Non-Linked fund + 1% |

| LIC Aadhaar Shila | Premiums paid for at least 2 years | Up to 90% (active policy), 80% (paid-up) of surrender value | 10-year G-Sec Rate + 3% or yield on Non-Linked fund + 1% |

Loan Options Available in Whole Life Plans

| Plan | Eligibility | Maximum Loan Amount | Interest Rate |

|---|---|---|---|

| LIC Jeevan Utsav | Premiums paid for at least 2 years | Before Benefits Start: Up to 75% (in-force), 50% (paid-up). After Benefits Start: Up to 75% (in-force), 50% (paid-up) + 50% of unwithdrawn Flexi Income Benefits. | Higher of (10-year G-Sec Rate + 3%) or LIC’s Non-Linked Fund Yield + 1% |

| LIC Jeevan Umang | Premiums paid for at least 2 years | During Premium Term: 90% (in-force), 80% (paid-up). After Premium Term: Loan capped at 50% of annual survival benefit. | As per IRDAI-approved method |

Loan Options Available in Money Back Schemes

| Policy Name | Eligibility | Loan Amount | Interest Rate |

|---|---|---|---|

| LIC Dhan Rekha | Regular: 2+ years; Single: After 3 months or Free-look expiry | Regular: 90% (active), 80% (paid-up); Single: 75% of surrender value | (10Y G-Sec +3%) or Non-Linked Fund Yield +1%, whichever is higher |

| LIC New Bima Bachat | 1+ policy year | Up to 90% of surrender value | As per IRDAI guidelines |

| LIC Money Back 20 & 25 Years | 2+ years premiums paid | 90% (active), 80% (paid-up) | As per IRDAI guidelines |

| LIC Jeevan Umang | 2+ years premiums paid | During term: 90% (active), 80% (paid-up); Post-term: Capped at 50% of annual survival benefit | As per IRDAI guidelines |

| LIC New Children’s Money Back | 2+ years premiums paid | 90% (active), 80% (paid-up) | As per IRDAI guidelines |

| LIC Jeevan Tarun | 2+ years premiums paid | 90% (active), 80% (paid-up) | As per IRDAI guidelines |

| LIC Jeevan Shiromani | 2+ years premiums paid | 90% (active), 80% (paid-up) | As per IRDAI guidelines |

| LIC Bima Shree | 2+ years premiums paid | 90% (active), 80% (paid-up) | As per IRDAI guidelines |

Loan Options Available in Pension Plans

| Pension Plan | Eligibility | Maximum Loan Amount | Interest Rate |

|---|---|---|---|

| LIC Jeevan Dhara II | Available after 2 years (regular premium) or 3 months (single premium). | Up to 80% of surrender value. | (10-year G-Sec Rate* + 3%) or Non-Linked fund yield +1%. |

| LIC Saral Pension | Available after 6 months. Joint annuitant can avail on death of annuitant. | Interest must not exceed 50% of annuity. | (10-year G-Sec Rate* + 2%) or Non-Linked fund yield +1%. |

| LIC Jeevan Akshay VII | Available after 3 months or free-look period. | Up to 80% of surrender value, with interest capped at 50% of annuity. | (10-year G-Sec Rate* + 3%) or Non-Linked fund yield +1%. |

| LIC New Jeevan Shanti | Available after 3 months. Primary or secondary annuitant can avail. | Up to 80% of surrender value, interest capped at 50% of annuity. | (10-year G-Sec Rate* + 3%) or Non-Linked fund yield +1%. |

Also Read: LIC Term Insurance vs Home Loan Insurance – Which one is Better?

What Documents are Required for Loan Against LIC Policy?

| Document Type | Details |

|---|---|

| Application Form | Duly filled loan application form |

| Policy Document | Original LIC policy document for verification |

| Identity Proof | PAN Card, Aadhaar Card, Voter ID, etc. |

| Address Proof | Utility bill, Passport, Aadhaar Card, etc. |

| Bank Account Proof | Bank passbook or statement for loan disbursement |

Conclusion

A loan against LIC policy is a smart way to access quick funds without losing policy benefits. With minimal documentation, flexible repayment, and competitive interest rates, it offers a hassle-free borrowing option. However, timely repayments are crucial to avoid impacting policy benefits. Consider all aspects before applying to make the most of this financial tool.

Frequently Asked Questions

A loan against an LIC policy allows policyholders to borrow funds by pledging their life insurance policy as collateral. This enables access to funds without surrendering the policy, ensuring continued insurance coverage.

Loans can be availed against traditional LIC policies such as endowment plans, whole life plans, and money-back plans that have acquired a surrender value, typically after paying premiums for at least three years. Term insurance policies are generally not eligible for loans.

Policyholders can borrow up to 80%–90% of the policy’s surrender value. The exact percentage depends on the policy’s status and terms.

Interest rates for loans against LIC policies typically range from 9% to 10%, which is generally lower than rates for unsecured personal loans.

Applications can be made online through the LIC customer portal or offline by visiting the nearest LIC branch. Online applicants must register on the LIC portal, while offline applicants need to submit the original policy document, a loan application form, and KYC documents.

The loan processing time typically ranges from 3 to 5 working days, depending on documentation and verification processes.

There might be nominal processing fees, documentation charges, or service fees associated with taking a loan on an LIC policy. These charges vary, so it’s advisable to check with your LIC branch for exact details.

Policyholders can choose flexible repayment options, such as paying only the interest regularly and settling the principal later. If the loan and accumulated interest exceed the surrender value, LIC may terminate the policy to recover the dues.

The life cover on the policy continues even after taking a loan. However, if the loan is not repaid, the outstanding amount with interest will be deducted from the policy’s maturity or death benefits.

Yes, several banks offer loans against LIC policies or policies issued by other private insurers. Some of these banks include Kotak Mahindra Bank, Axis Bank, State Bank of India, and HDFC Bank. However, most banks offer loans or overdrafts against LIC or other insurance policies only to existing account holders.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan