L&T Housing Finance recognizes that owning property fulfills two essential roles: providing a comfortable residence and serving as a valuable investment.

By offering financing options covering up to 90% of your property’s value at competitive interest rates starting from 8.65% p.a., L&T Housing Finance ensures a dependable and convenient route to homeownership, appealing to both residents and investors.

L&T Finance Home Loan Interest Rates by Employment

L&T Finance adjusts home loan interest rates based on whether you’re salaried, self-employed, or have a professional practice. Below is a quick look at how your employment type can influence your rate.

L&T Finance Home Loan Interest Rates for Salaried Employees

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| Home Loan For Salaried | 8.65% p.a. onwards |

L&T Finance Home Loan Interest Rates for Self Employed

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| Home Loan For Self Employed | 8.75% p.a. onwards |

L&T Finance All Schemes Home Loan Interest Rates

L&T Finance offers multiple home loan schemes, each with its own interest rate structure and features. Here’s an overview of the current rates for various L&T Finance schemes.

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| L&T Finance Home Loan | 8.65%p.a onwards |

| L&T Finance Home Loan Balance Transfer | 8.65%p.a onwards |

| L&T Finance Loan Against property | 9.60% p.a onwards |

Source: L&T Home Loan Interest Rates

All Schemes Offered by L&T Finance: A Detailed Overview

L&T Finance has a range of home loan schemes catering to diverse needs, from home construction to balance transfer plus top-up schemes. Read on to find the best fit for your housing requirements.

L&T Finance Home Loan

- L&T Finance offers home loans with flexible floating interest rates.

- Get home loans up to 90% of the property value.

- It offers home loans from ₹20 lakhs to up to ₹10 crores.

| Features | Details |

|---|---|

| Interest Rate | 8.65%p.a onwards |

| Tenure | 25 years |

| Processing Fee | Up to 3% of sanctioned amount + applicable taxes |

| Eligibility | 23 years – 62 years |

L&T Finance Home Construction Loan

- Individuals looking to rebuild or renovate their homes can opt for L&T Finance’s construction loan.

- This loan is available for constructing a residential house on self-owned land.

- Salaried and non-salaried individuals both are eligible for a construction loan.

Read More: What is a Construction Loan?

L&T Finance House Purchase Loan

- L&T Finance provides home loans for both ready-to-move-in properties and those under construction.

- Individuals can secure funding to buy a completed home or invest in an under-construction property with ease.

L&T Finance House Improvement Loan

- Individuals looking to upgrade their homes can opt for L&T Finance’s house improvement loan, covering repairs and maintenance costs.

- Homeowners with tailored loan options can enhance their living space without any financial strain.

L&T Finance House Extension Loan

- L&T Finance provides home extension loans to help individuals add extra space, whether by constructing an additional room or an entire floor.

- With tailored loan solutions, homeowners can upgrade their living space without financial strain.

L&T Finance Home Loan Balance Transfer Interest Rates

- L&T Finance offers home loan balance transfers from ₹25 lakhs to up to ₹7.5 crores.

- L&T Finance allows borrowers to transfer their high-interest home loans for better rates.

- Customers can also avail additional funds during the transfer process.

- Customers having a minimum repayment track record of 12 months are eligible for a balance transfer.

- Customers having residential properties are only applicable.

| Features | Details |

|---|---|

| Interest Rate | 9.60% p.a. onwards |

| Tenure | 25 years |

| Processing Fee | 1% of the amount borrowed + relevant taxes. |

| Eligibility | 23 years – 62 years |

L&T Finance Composite Loan

- L&T Finance offers home loans for purchasing a plot and building a home within a set timeframe.

- This option helps individuals secure funds for both land and construction seamlessly.

L&T Finance Balance Transfer Plus Top-Up Loan

- Self-employed professionals and business owners gets benefit from balance transfer plus top up loan.

- Individuals with regular income from approved financial institutions like business owners and self-employed borrowers are applicable for it.

L&T Finance Loan Against Property Interest Rates

- L&T Finance offers home loan balance transfers from ₹25 lakhs to up to ₹7.5 crores.

- L&T Finance facilitates home loan funding within 72 hours.

- Offers tranche-based EMIs and part prepayment options for easier loan management.

| Features | Details |

|---|---|

| Interest Rate | 9.60% p.a onwards |

| Tenure | 15 years |

| Processing Fee | Up to 3% of sanctioned amount + applicable taxes |

| Eligibility | 23 years – 62 years (For Salaried Individuals) 25 years – 70 years (For Self Employed Individuals) |

Also Read: LAP Without Income Proof

How to Get Lowest and Best L&T Finance Home Loan Interest Rates?

- Aim for a 750+ Credit Score to secure preferential rates.

- Select the Right L&T Finance Scheme that matches personal requirements for cost efficiency.

- Leverage Special Concessions offered to government employees, women borrowers, and defense personnel.

- Use the Check-Off Facility for direct salary deductions, which may lower interest rates.

- Make a Higher Down Payment to reduce the principal and potentially get better terms.

- Watch Out for Festive Offers or promotional discounts from L&T Finance.

- Keep Income Documents Updated for quicker approvals and more favorable rates.

- Maintain Steady Employment to boost financial credibility and rate eligibility.

- Build a Strong Relationship with L&T Finance for possible preferential pricing.

- Always Negotiate to explore discounts on interest rates or processing fees.

Also Read: CIBIL Score Range

Types of Home Loan Interest Rates

| Interest Rate Type | Definition | Pros | Cons |

|---|---|---|---|

| Fixed | Rate remains constant throughout a predetermined period or entire tenure. | – Predictable EMIs for budgeting- Protection against rising interest rates | – Typically, higher rates compared to floating- No benefit if market rates go down |

| Floating (Variable) | Linked to market benchmarks (e.g., Repo Rate, MCLR) and changes over time | – Often cheaper when rates fall- Can partly or fully prepay with lower penalties | – EMIs fluctuate with market conditions- Costs may rise if rates increase |

| Hybrid | Combination of fixed and floating phases. | – Stability in the initial fixed period- Potential cost savings in the variable phase | – Transition from fixed to floating can carry uncertainties- May incur a shift-related fee |

How to Switch Your L&T Home Loan from Fixed to Floating Rate?

L&T allows you to switch from fixed to floating rate during the tenure of the loan.

- Visit your L&T branch or contact your relationship manager.

- Complete the necessary forms or applications for the switch.

- Once approved, sign a supplemental agreement reflecting the new floating-rate terms.

- Pay the applicable conversion charges or any other administrative costs.

- Verify updated EMIs, as floating rates can fluctuate with market conditions.

How to Obtain L&T Finance Home Loan Interest Certificate?

To obtain an L&T Finance home loan interest certificate, follow the mentioned steps:

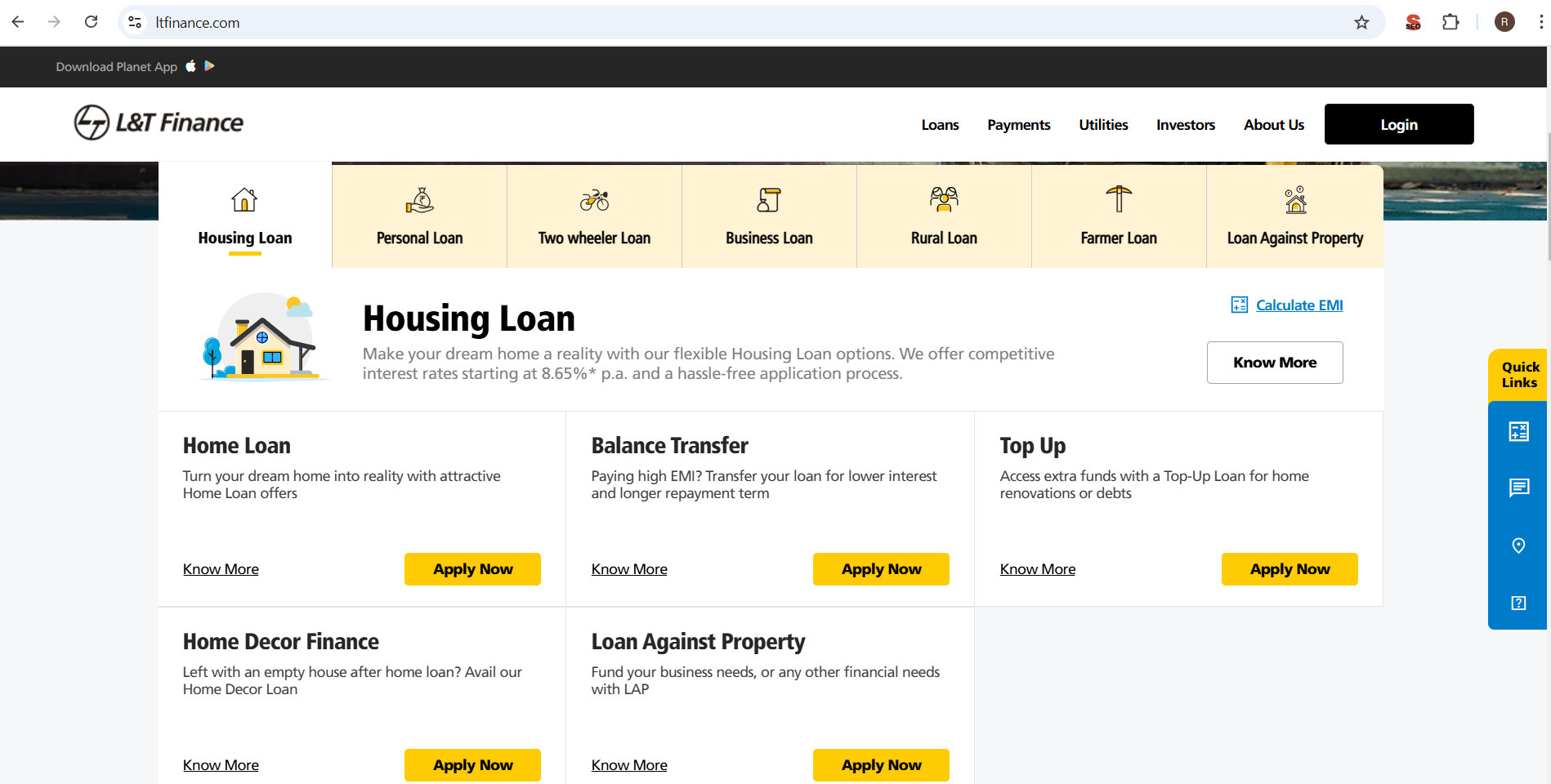

- Visit the Official Website

Visit the L&T housing finance official website.

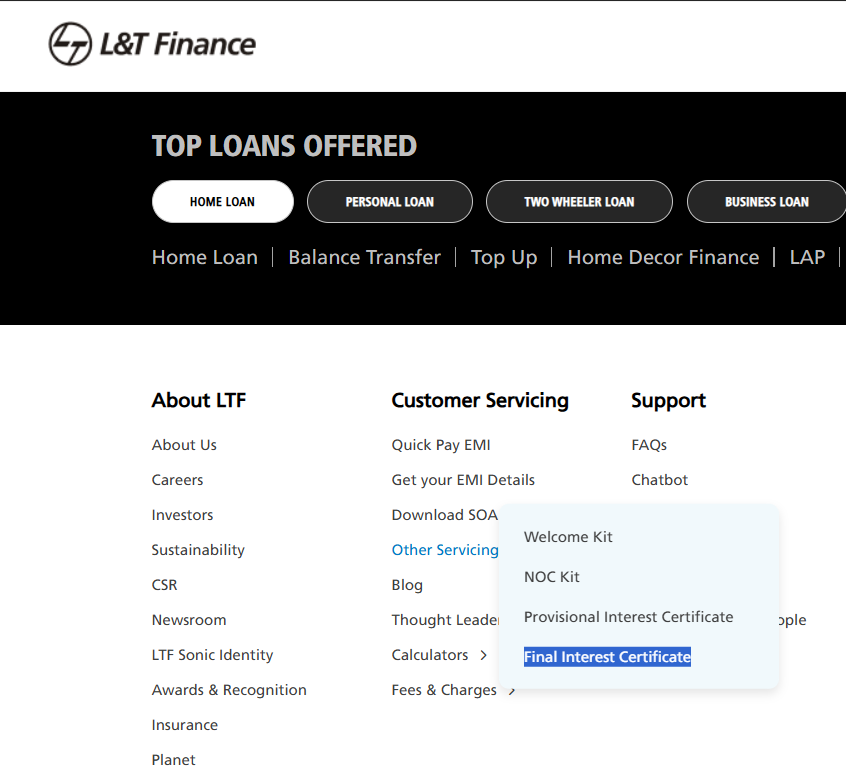

- Select Certificate Type

– Scroll down the website, and In the customer servicing section, click on Other Servicing Documents.

– In that, click on Provisional Interest Certificate or Final Interest Certificate.

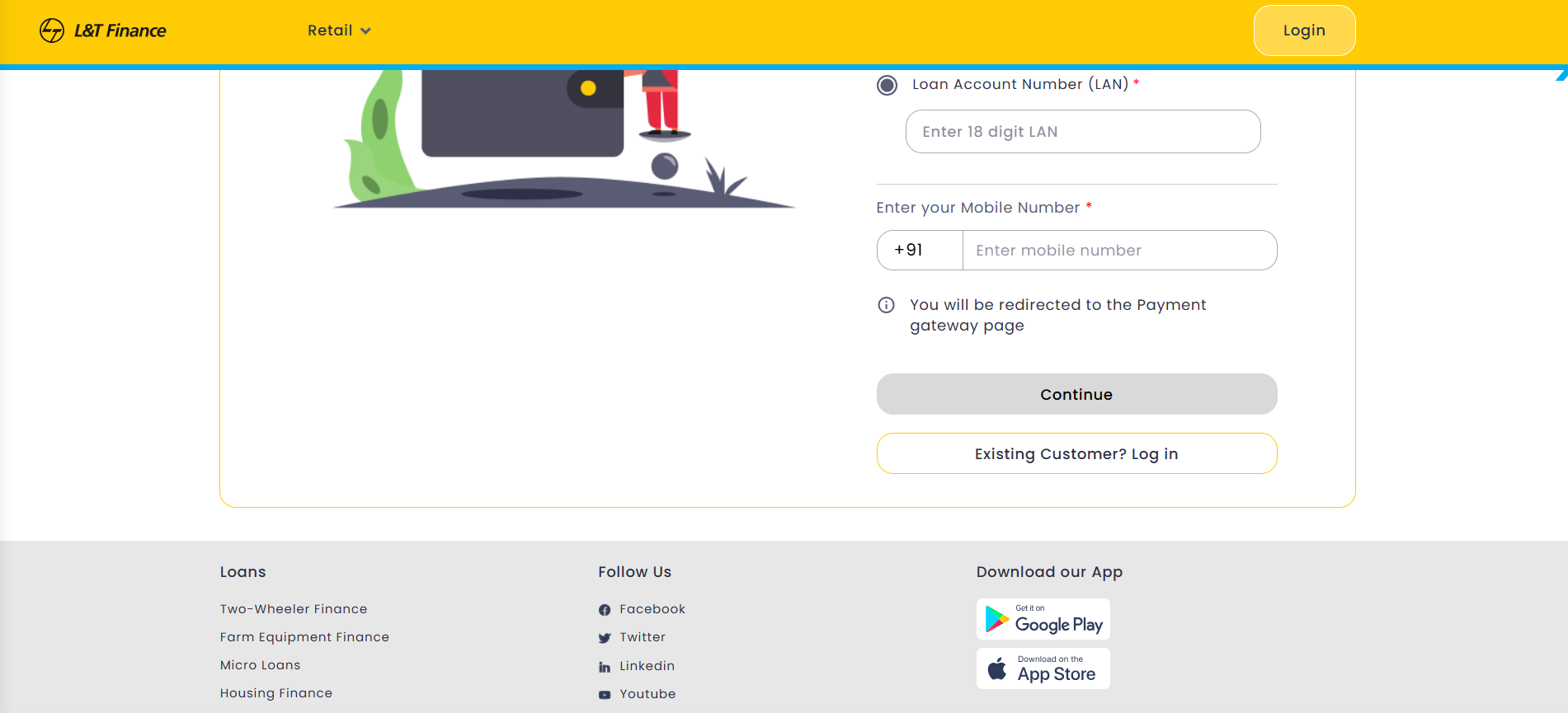

- Enter Login Details

Enter your Mobile number or Loan Account Number (LAN).

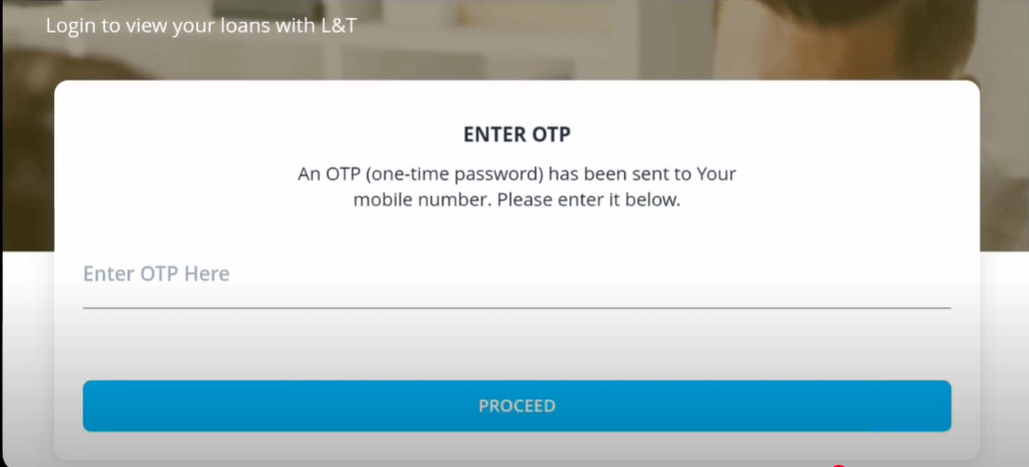

- Login & Download

Use the OTP to log in and download your Home Loan Interest Certificate.

Check: L&T Home Loan Eligibility Calculator

Secure the Lowest L&T Finance Home Loan Interest Rates with Credit Dharma

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

L&T Finance home loan interest rates start from 8.65% per annum and may vary based on loan amount, tenure, and applicant profile.

Co-applicants can include spouses, parents, siblings, or children with a shared financial interest in the property.

Applicants can boost eligibility by maintaining a high credit score, declaring additional income sources, opting for a longer tenure, or applying with a co-applicant.

A minimum credit score of 750 is generally required for better approval chances and lower interest rates.

Home loan benefits include deductions under Section 80C (₹1.5 lakh) on principal, Section 24(b) (₹2 lakh) on interest, and Section 80EE/80EEA for additional savings.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan