In 2025, India’s real estate market and land price will continue to be a focal point for investors and homebuyers alike.

This analysis provides insights into the top-tier real estate markets across the country, highlighting the factors driving these premium valuations.

Top 5 Cities with Highest Land Price in India – 2025

| Rank | City | Key Localities | Avg. Price (₹/sq. ft.) | Highlights |

|---|---|---|---|---|

| 1 | Mumbai | South Mumbai, Bandra, Lower Parel | ₹20,000–₹30,000 | Most expensive; limited land; metro/coastal road boosts demand |

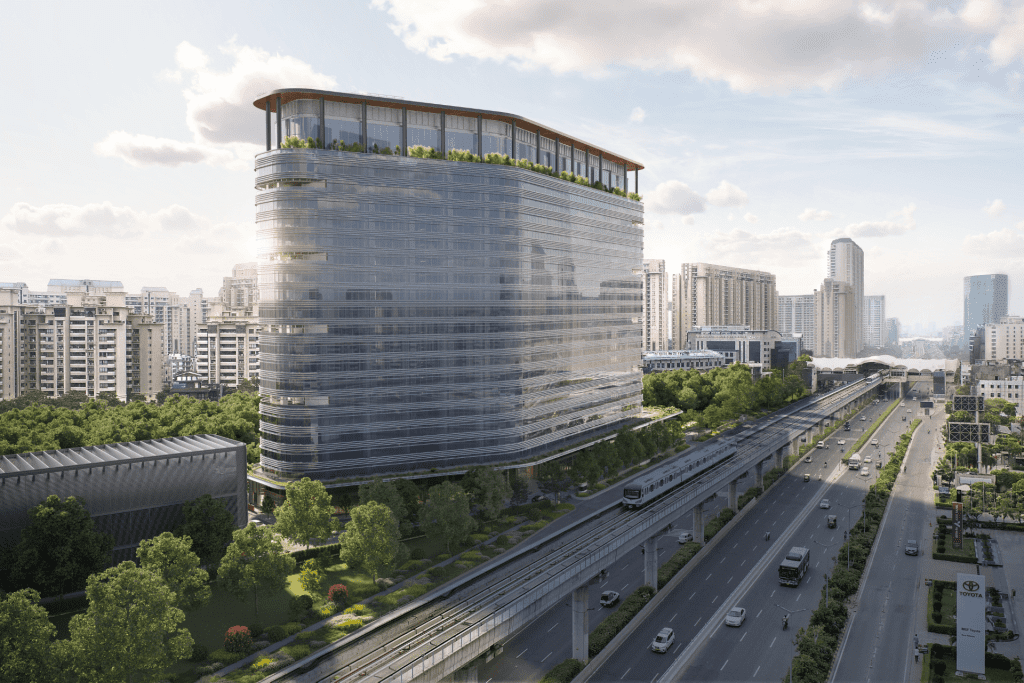

| 2 | Delhi NCR | Lutyens’ Delhi, Golf Course Rd (Gurgaon), Noida | ₹10,000–₹18,000 | Growth from RRTS, smart city initiatives |

| 3 | Bengaluru | Indiranagar, Koramangala, Whitefield | ₹10,000–₹18,000 | IT hub; 29% growth in Whitefield in 3 years |

| 4 | Hyderabad | Jubilee Hills, Banjara Hills, Gachibowli | ₹9,000–₹12,500 | IT growth; record auctions (₹100.75 Cr/acre in Kokapet) |

| 5 | Chennai | Adyar, Anna Nagar, Besant Nagar | ₹12,000–₹16,000 | Industrial expansion; Metro Phase II spurring land demand |

Also Read: 1 Acre Land Price in India in 2025

Mumbai’s Altamount Road: The Pinnacle of Indian Real Estate

Altamount Road in Mumbai stands as the epitome of luxury real estate in India, boasting the highest land prices in the country as of 2025. With an approximate value of ₹8,00,000 per square foot, it outpaces all other locations in terms of cost.

Key factors contributing to Altamount Road’s premium pricing:

- Limited Availability: The scarcity of land in this prime area drives up prices.

- Premium Locality: Known for its exclusivity and high-end amenities.

- Celebrity Residences: Home to numerous high-profile individuals, adding to its prestige.

Investment Potential:

- Stability: Prices remain relatively stable due to consistent demand.

- High Entry Cost: The exorbitant prices make it challenging for smaller investors to enter this market.

- Modest Appreciation: Future growth may be limited due to already inflated prices.

While Altamount Road represents the peak of India’s real estate market, it’s important to note that such investments are typically reserved for ultra-high-net-worth individuals.

Should You Invest in Plot or Save For Loan Prepayment? Calculate Now.

Must Read: Capital Gain on Sale of Land

Land Price in Delhi’s Aurangzeb Road

Aurangzeb Road in Delhi, with its current land price of approximately ₹7,50,000 per square foot, stands as the second most expensive real estate location in India for 2025. This area epitomizes the intersection of political influence and premium real estate in the nation’s capital.

Factors driving high prices on Aurangzeb Road:

- Political Significance: Proximity to key government institutions and embassies.

- Business Importance: Preferred location for corporate headquarters and luxury hotels.

- Heritage Value: Historical significance adds to its prestige and desirability.

Investment Potential:

- High-Net-Worth Focus: Primarily suitable for investors with substantial capital.

- Long-Term Gains: Potential for appreciation over extended periods.

- Regulatory Considerations: Subject to changes in government policies affecting land use and ownership.

Must Read: What is Undivided Share of Land?

Bengaluru’s Sadashivanagar: A Prime Location in India’s Most Expensive Land Price 2025

Bengaluru’s Sadashivanagar stands out as one of the most expensive land areas in India for 2025, with prices reaching approximately ₹6,40,000 per square foot.

Factors Contributing to High Land Prices

- Proximity to IT Hub: Sadashivanagar’s strategic location near Bengaluru’s tech corridors significantly drives up land values.

- Affluent Neighborhood: The area is home to high-net-worth individuals, including tech moguls and business leaders.

- Limited Land Availability: The scarcity of undeveloped land in this prime locality fuels price inflation.

- High-End Amenities: The presence of luxury facilities and services adds to the area’s desirability.

Investment Potential

Sadashivanagar presents a compelling opportunity for luxury residential investments. However, the high entry cost poses a significant barrier for many investors due to high land prices. Here’s a breakdown of the investment landscape:

| Aspect | Details |

|---|---|

| Minimum Investment | Approx. ₹64 crores for a 1000 sq ft plot |

| Target Investors | Ultra-high-net-worth individuals, corporate entities |

| ROI Potential | 8-10% annually (based on historical trends) |

| Rental Yield | 2-3% per annum |

Despite the steep prices, Sadashivanagar continues to attract investors due to its prestige and potential for appreciation. The area’s connection to Bengaluru’s booming tech industry suggests a steady demand for high-end residential properties.

Growth Prospects

The growth prospects for Sadashivanagar remain moderate but positive. Factors influencing future appreciation include:

- Continued expansion of Bengaluru’s IT sector

- Infrastructure improvements in surrounding areas

- Limited new land releases, maintaining scarcity

Also Read: PMAY Affordable Housing Schemes by Government of India.

Hyderabad’s Jubilee Hills: A Rising Star in India’s Most Expensive Land Prices 2025

Hyderabad’s Jubilee Hills has emerged as a significant player in India’s luxury real estate market, with land prices reaching approximately ₹4,50,000 per square foot in 2025. This places it fourth on the list of India’s most expensive land prices, showcasing the city’s growing economic prowess and desirability.

Key Drivers of High Land Prices

- Film Industry Presence: Jubilee Hills is a favored residential area for Tollywood celebrities, adding a glamour factor.

- Business Elite Preferences: The area attracts top executives and entrepreneurs, driving demand for high-end properties.

- Strategic Location: Proximity to key business districts and entertainment hubs enhances its appeal.

- Limited Supply: The scarcity of available land in this sought-after locality contributes to price inflation.

Investment Potential Analysis

Jubilee Hills offers a unique investment proposition, balancing high demand with strong potential for rental income due to growing land prices. Here’s a detailed look at the investment landscape:

| Aspect | Details |

|---|---|

| Average Plot Size | 500-1000 sq yards |

| Investment Range | ₹20-40 crores for a standard plot |

| Potential Rental Yield | 3-4% per annum |

| Capital Appreciation | 10-12% annually (based on recent trends) |

The area’s popularity among both residential buyers and commercial tenants creates a diverse investment opportunity. The high demand leads to the potential for significant rental income, especially for properties catering to the luxury segment or converted for commercial use.

Growth Prospects and Market Trends

Jubilee Hills’ growth prospects remain positive, supported by Hyderabad’s expanding commercial sector. Key factors influencing future appreciation include:

- Continued expansion of IT and pharmaceutical industries in Hyderabad

- Infrastructure developments, including improved connectivity

- Rising international interest in Hyderabad’s real estate market

Recent market trends indicate a steady increase in land prices, with experts projecting sustained growth over the next 5-10 years. The area’s established reputation and limited new land releases are expected to maintain upward pressure on prices.

Also Read: Market Analysis for Land Investment

Chennai’s Poes Garden Land Price Trends

Poes Garden, located in Chennai, ranks fifth among the Most Expensive Land Prices in India in 2025. This exclusive residential area commands a premium price of approximately ₹3,70,000 per square foot, making it one of the costliest real estate locations in South India.

Key Factors Driving High Land Prices:

- Political Stature: Home to several prominent political figures

- Historic Significance: Rich cultural heritage dating back to colonial times

- Limited Availability: Scarcity of land in this prime location

- Prestigious Address: Symbol of social status and affluence

The investment potential in Poes Garden is somewhat limited due to cultural and infrastructural factors. Despite its high-value status, the area faces challenges in terms of growth prospects. Real estate experts predict a slow appreciation rate due to market saturation, although demand remains stable.

| Aspect | Details |

|---|---|

| Current Land Price (2025) | ₹3,70,000 per sq. ft. |

| Area Size | Approximately 110 acres |

| Notable Residents | Politicians, Business Tycoons, Celebrities |

| Average Property Size | 3,000 – 10,000 sq. ft. |

Investors considering Poes Garden should be aware of the following:

- High entry costs limit accessibility to ultra-high-net-worth individuals

- Annual property value appreciation rate: 3-5% (lower than some other premium areas)

- Rental yield: 2-3% per annum (relatively low compared to commercial properties)

While Poes Garden maintains its status as one of India’s most expensive residential areas in 2025, its growth trajectory differs from rapidly developing urban centers. The area’s charm lies in its exclusivity and historical significance rather than rapid price appreciation or development potential.

Check Out: Plot vs Flat vs Bungalow

Land Price in Pune’s Koregaon Park

Koregaon Park in Pune secures the sixth position in the list of Most Expensive Land Prices in India in 2025. With land prices hovering around ₹3,00,000 per square foot, this area represents a significant investment opportunity in the burgeoning Pune real estate market.

Factors Contributing to High Land Prices:

- Cosmopolitan Appeal: International restaurants and cultural hotspots

- Excellent Amenities: High-end shopping centers, schools, and healthcare facilities

- Green Spaces: Tree-lined avenues and parks enhance quality of life

- Proximity to Business Districts: Easy access to IT hubs and commercial centers

Koregaon Park’s investment potential is particularly attractive for NRIs and luxury property seekers. The area has shown steady growth, with property prices appreciating at an average rate of 8-10% annually over the past five years.

| Feature | Statistics |

|---|---|

| Current Land Price (2025) | ₹3,00,000 per sq. ft. |

| Average Apartment Size | 1,500 – 4,000 sq. ft. |

| Rental Yield | 3-4% per annum |

| Property Appreciation Rate | 8-10% annually |

Key points for potential investors:

- High demand for both residential and commercial properties

- Growing interest from international buyers and corporations

- Steady appreciation due to ongoing infrastructure developments

- Potential for good returns through both capital appreciation and rental income

Suggested Read: How to Choose the Right Property for Maximum rental Yield?

Kolkata’s Alipore: A Prestigious Enclave in India’s Real Estate Landscape

Alipore, situated in Kolkata, stands as one of the most expensive land areas in India in 2025. With land prices reaching approximately ₹2,85,000 per square foot, it ranks among the top 10 costliest real estate locations in the country.

Key Factors Contributing to High Land Prices:

- Historical Prestige: Alipore’s rich colonial history adds significant value to its properties.

- Elite Residences: Home to numerous high-profile individuals and families.

- Limited Availability: The scarcity of land in this prime area drives up prices.

- Superior Infrastructure: Well-developed roads, utilities, and amenities.

Investment Potential:

- Niche Market: Attracts high-net-worth individuals and institutional investors.

- High Societal Relevance: Owning property in Alipore is considered a status symbol.

- Steady Appreciation: Despite slow growth, prices have consistently increased over time.

Growth Prospects:

While Alipore’s real estate market is mature, it continues to evolve:

- Slow but Steady Growth: Annual appreciation rate of 3-5% expected.

- Modernization Impact: Redevelopment projects may increase property values.

- Limited New Supply: Restrictions on new constructions maintain exclusivity.

Suggested Read: Mutual Fund vs Rental Income

Noida’s Sector 15: A Rising Star in India’s Premium Real Estate Market

Noida’s Sector 15 has emerged as one of the most expensive land areas in India in 2025, with prices reaching approximately ₹2,60,000 per square foot. This rapid rise in land values places it among the top 10 costliest real estate locations in the country.

Factors Driving High Land Prices:

- Proximity to Delhi: Just 10 km from the capital, offering easy access.

- Business Expansion: Growing corporate presence and commercial developments.

- Infrastructure Development: Metro connectivity and well-planned roads.

- Limited Land Availability: Scarcity of prime plots in this established sector.

Investment Potential:

- High Demand: Both commercial and residential sectors show strong interest.

- Mixed-Use Development: Opportunities for diverse property investments.

- Rental Yield: Potential for 3-4% annual rental returns on residential properties.

Growth Prospects:

Noida’s Sector 15 shows promising growth trends:

- Projected Annual Appreciation: 8-10% expected in the next 5 years.

- Urban Development: Continued improvements in amenities and infrastructure.

- Commercial Expansion: Increasing demand from IT and service sectors.

Also Read: Top Cities with Highest Rental Yield

Land Price in Gurgaon’s Golf Course Road

Golf Course Road in Gurgaon stands out as one of the most expensive land areas in India for 2025, with prices reaching approximately ₹2,40,000 per square foot.

This prestigious location has become a hotspot for luxury real estate investments, driven by several key factors:

- Corporate Hub Proximity: The area is surrounded by numerous multinational corporations, attracting high-net-worth individuals and executives.

- Luxury Living: Golf Course Road offers a plethora of high-end residential options, including gated communities and penthouses.

- Infrastructure: The area boasts excellent connectivity and world-class amenities, justifying its premium pricing.

Investment potential for Golf Course Road remains high, particularly for Real Estate Investment Trusts (REITs). Here’s why:

- Steady Rental Yields: The area consistently delivers 3-4% annual rental yields.

- Capital Appreciation: Historical data shows a 7-10% year-on-year price appreciation.

- Corporate Demand: With over 250 Fortune 500 companies in Gurgaon, the demand for premium housing remains strong.

Growth prospects for Golf Course Road are promising, fueled by:

- Upcoming Metro Connectivity: The proposed metro extension is expected to boost property values by 15-20%.

- Commercial Expansion: Plans for new office spaces totaling 5 million sq ft in the next 5 years.

- Luxury Retail: High-end malls and shopping complexes continue to attract affluent residents.

| Factor | Impact on Land Prices |

|---|---|

| Corporate Presence | +15-20% |

| Infrastructure Development | +10-15% |

| Luxury Amenities | +8-12% |

Investors considering Golf Course Road should be prepared for high entry costs but can expect stable returns and potential for significant long-term appreciation in this prime segment of India’s most expensive land prices in 2025.

Check Out: Holiday Homes Investment Trends in 2025

Ahmedabad’s SG Highway’s Land Price Trends

Sarkhej-Gandhinagar (SG) Highway in Ahmedabad emerges as a surprising entrant in the list of India’s most expensive land prices for 2025, with rates touching approximately ₹2,00,000 per square foot.

This rapid rise in land values can be attributed to:

- Business-Friendly Environment: Gujarat’s pro-business policies have attracted numerous industries to the area.

- Infrastructure Growth: Significant investments in road networks, public transport, and smart city initiatives.

- Educational Hubs: Presence of renowned institutions like IIM Ahmedabad and CEPT University nearby.

Investment potential for SG Highway is particularly promising for long-term investors due to:

- Diverse Industry Presence: The area hosts IT parks, pharma companies, and manufacturing units, ensuring a steady demand for both commercial and residential spaces.

- Rapid Urbanization: Ahmedabad’s population is expected to reach 10 million by 2030, driving real estate demand.

- SEZ Developments: Special Economic Zones along the highway are attracting foreign investments.

Growth prospects remain robust, supported by:

- GIFT City Proximity: The nearby Gujarat International Finance Tec-City is expected to create 500,000 direct jobs by 2028.

- Metro Rail Project: The upcoming metro connectivity is projected to boost property values by 20-25%.

- Smart City Initiatives: Ahmedabad’s selection in the Smart Cities Mission is driving infrastructure upgrades.

| Development | Expected Impact on Land Prices |

|---|---|

| GIFT City Expansion | +15-20% |

| Metro Rail Completion | +20-25% |

| Smart City Projects | +10-15% |

For investors eyeing India’s most expensive land prices in 2025, SG Highway offers a unique blend of affordability and growth potential compared to other metro cities, making it an attractive option for diversifying real estate portfolios.

Conclusion

As we’ve explored the most expensive land prices in India for 2025, it’s clear that the real estate market continues to offer diverse investment opportunities across major cities. From Mumbai’s Altamount Road at ₹8,00,000 per square foot to Ahmedabad’s SG Highway at ₹2,00,000 per square foot, each location presents unique advantages and challenges for investors.

Key takeaways for potential investors:

- Price Range: The top 10 most expensive areas range from ₹2,00,000 to ₹8,00,000 per square foot.

- Location Diversity: Prime areas span established metros like Mumbai and Delhi, as well as emerging cities like Ahmedabad and Pune.

- Growth Drivers: IT hubs, corporate presence, and infrastructure development are common factors driving high land prices.

Consideration factors for young investors:

- Budget Alignment: With entry prices starting at ₹2,00,000 per square foot, careful financial planning is crucial.

- Long-Term Goals: Areas like Noida’s Sector 15 and Ahmedabad’s SG Highway offer growth potential for patient investors.

- Risk Appetite: High-value areas like Mumbai’s Altamount Road offer stability but require substantial capital.

| City | Price per sq ft (₹) | Key Investment Factor |

|---|---|---|

| Mumbai | 8,00,000 | Stability & Prestige |

| Delhi | 7,50,000 | Political Significance |

| Bengaluru | 6,40,000 | Tech Hub Growth |

| Ahmedabad | 2,00,000 | Emerging Market Potential |

For those looking to navigate India’s complex real estate landscape in 2025, Credit Dharma can provide valuable insights for informed decision-making. Remember, while these areas represent the pinnacle of India’s real estate market, opportunities exist at various price points across the country.

Frequently Asked Questions

Urban India’s real estate premiums are driven by high demand, rapid urbanization, limited land availability, and robust economic growth. Cities like Mumbai and Delhi often have prices influenced by the density of population, commercial importance, and global interest.

As of 2025, cities like Mumbai, Delhi, Bangalore, and Chennai are typically among the cities with the highest land prices due to their economic significance, population density, and continual demand for both residential and commercial space.

In recent years, record-breaking sales have been seen, particularly of luxury homes and apartments in Mumbai’s high-profile areas and sprawling villas in other metropolitan regions, often involving film stars, industrialists, and foreign investors.

Mumbai has the most expensive land in India, with South Mumbai’s Tardeo area reaching approximately ₹56,000 per square foot. In Hyderabad’s Kokapet area, land prices have surged to ₹75-80 crore per acre, making it the priciest IT corridor in the country.

Antilia, owned by Mukesh Ambani, is India’s most expensive property, valued at approximately $2 billion.

Mumbai in Maharashtra is one of the costliest places in India due to high living expenses, real estate prices, and lifestyle costs. Other expensive states include Delhi, Karnataka (Bengaluru), and Tamil Nadu (Chennai), known for high urbanization and infrastructure costs.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan