Estimated reading time: 13 minutes

Nagar Nigam Lucknow, the governing body of Lucknow, is vital to the city’s development.

Beyond cultural and historical significance, Lucknow is a growing metropolis requiring efficient governance and public services. This article explores how Nagar Nigam Lucknow manages property taxes and provides city services, influencing the lives of residents and the city’s overall progress.

Lucknow Nagar Nigam House Tax

The Lucknow Nagar Nigam property tax system is structured around the Annual Rental Value (ARV) of properties, which serves as the basis for calculating various tax rates. Here’s a detailed overview of the tax rates and brackets applicable for property owners in Lucknow.

Tax Rates

The property tax in Lucknow consists of several components, each with its own rate:

- General Tax: 15% of the ARV

- Water Tax: 12.5% of the ARV

- Sewer Tax: 3% of the ARV

These rates apply to both residential and commercial properties, ensuring that all property owners contribute to local infrastructure maintenance and services.

Calculation Method

The formula for calculating the property tax is as follows:

House Tax = Annual Rental Value (ARV) * Applicable Tax Rate

The ARV is determined based on various factors, including:

- Size of the property

- Location and zone classification

- Type of construction (residential or commercial)

- Age of the property.

Example Calculation

For instance, if a residential property has an ARV of ₹60,000, the general tax would be calculated as:

House Tax = 60,000 * 0.15 = ₹9,000

Tax Brackets and Categories

The Lucknow Nagar Nigam also categorizes properties into different brackets based on their usage and location, which can influence the specific rates applied:

| Property Category | Zone A Rate | Zone B Rate | Zone C Rate |

|---|---|---|---|

| Residential Self-Occupied | 0.5% | 0.4% | 0.3% |

| Residential Rented | 1.5% | 1.2% | 1.0% |

| Commercial Properties | 2.5% | 2.0% | 1.5% |

| Industrial Properties | 2.0% | 1.8% | 1.5% |

| Educational Institutions | 1.0% | 0.8% | 0.6% |

| Hospitals/Nursing Homes | 1.2% | 1.0% | 0.8% |

| Vacant Land | 0.3% | 0.2% | 0.1% |

This categorization allows for a more tailored approach to taxation based on property type and location.

Rebates and Discounts

Property owners may also be eligible for rebates based on the number of years they have owned their property:

- 10 years: 20%

- 11-20 years: 32.5%

- 20+ years: 40%

Additional rebates may be available for properties that are severely damaged or for specific groups such as veterans or physically challenged individuals.

Conclusion

Understanding the property tax structure in Lucknow is essential for homeowners and investors alike, as it impacts financial planning and compliance with local regulations. The Lucknow Nagar Nigam provides both online and offline payment options to facilitate timely tax payments, helping maintain essential city services that benefit all residents[3][6].

How To Register House With Nagar Nigam Lucknow

To register a house with the Lucknow Nagar Nigam, follow these steps for both online and offline processes:

Online House Registration Process

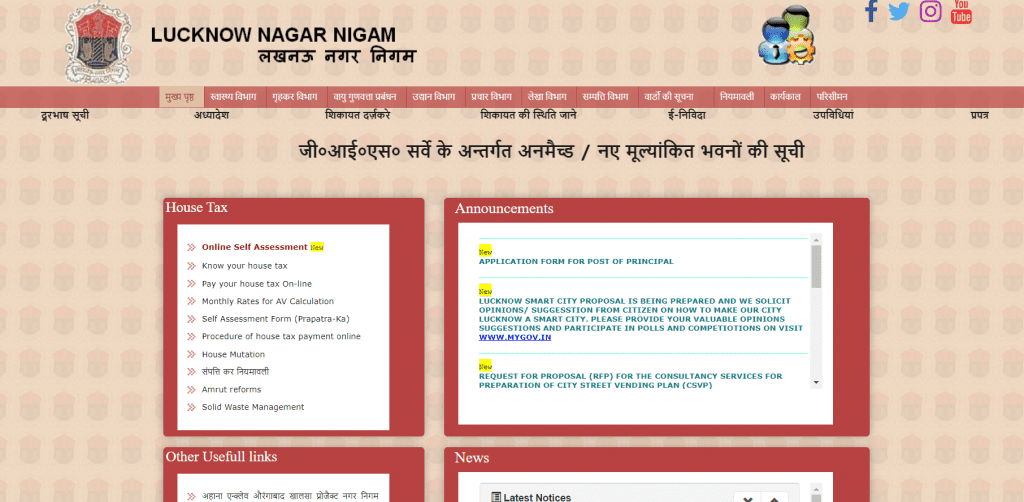

- Visit the Official Website: Go to the Lucknow Nagar Nigam’s official website.

- Register Your House:

- Click on the “Register Your House” tab.

- Enter your mobile number and new house ID.

- Submit the form.

- Create an Account (if you are a new user):

- Select the option for new registration.

- Fill in your district, tehsil, and registrar’s office details.

- Provide your mobile number to receive an OTP for verification.

- Fill in Property Details:

- Complete the property registration form by entering details such as:

- Tehsil of the district

- Type of area (rural/urban)

- Property type (plot/building/agricultural land)

- Click on “Next” after filling in all required fields.

- Calculate Fees:

- After entering property details, click on “Calculate Fee” to determine applicable stamp duty and registration charges.

- Upload Documents:

- Upload necessary documents such as ID proofs (PAN, Aadhaar), sale deed, occupancy certificate, etc.

- Provide Transaction Details:

- Enter details of other parties involved in the transaction and two witnesses.

- Prepare Deed Document:

- Click on the “deed document” button to prepare the deed and save it.

- Payment of Registration Charges:

- Choose a payment method and confirm your transaction.

- Save the receipt for future reference.

- Complete Registration at SRO:

- Use your application ID to book a time slot at the Sub-Registrar’s Office (SRO).

- On the appointment day, visit the SRO with your application copy and fee receipt to finalize registration.

- Download Registration Certificate:

- After verification, you can log into the portal to download your registration certificate.

Offline House Registration Process

- Visit Sub-Registrar’s Office (SRO): Go directly to the SRO in your area during working hours.

- Submit Required Documents: Bring all necessary documents such as the sale deed, occupancy certificate, ID proofs, etc., for submission.

- Complete Payment Process: Pay applicable fees at the office.

- Receive Confirmation: After processing, you will receive confirmation of registration.

Required Documents

- Sale deed

- Copy of agreement to sale

- Encumbrance certificate

- Sanctioned building plan

- Occupancy certificate

- Power of attorney (if applicable)

- Tax-paid receipts for the last three months

- Previous registered agreements (for resale properties)

- Electricity bill

- ID Proofs (including PAN Card)

By following these steps, you can successfully register your house with the Lucknow Nagar Nigam.

Understanding House Tax Lucknow Nagar Nigam

House tax, also known as property tax, is a mandatory payment made by property owners in Lucknow. It is collected by Lucknow Nagar Nigam (LNN) to fund essential public services like maintaining roads, street lighting, waste management, and sewage systems. All homeowners, whether they own residential, commercial, or industrial properties, are required to pay this tax every year.

Who Needs to Pay House Tax?

Anyone who owns property within the jurisdiction of Lucknow Nagar Nigam must pay house tax. This includes residential homeowners, businesses, and owners of industrial properties. The collected funds help maintain and improve local infrastructure, which benefits the entire community.

House Tax Rates for 2024

The house tax in Lucknow is calculated based on the Annual Rental Value (ARV) of the property.

| Category | Rates |

|---|---|

| General Tax | 15% of the ARV |

| Water Tax | 12.5% of the ARV |

| Sewer Tax | 3% of the ARV |

Factors Affecting House Tax Calculation

| Factor | Impact on Property Tax |

|---|---|

| Property Size | Larger properties usually incur higher taxes. |

| Location | Properties in prime or well-developed areas are taxed at higher rates compared to those in less developed zones. |

| Usage | Commercial properties have higher tax rates than residential ones. |

| Age of Property | Older properties generally have lower tax rates, while newer ones are taxed higher. |

| Type of Construction | The materials and type of building also play a role in determining the tax. |

Lucknow Nagar Nigam Customer Care Details

To register a house with the Lucknow Nagar Nigam, follow these steps for both online and offline processes:

Online House Registration Process

- Visit the Official Website: Go to the Lucknow Nagar Nigam’s official website.

- Register Your House:

- Click on the “Register Your House” tab.

- Enter your mobile number and new house ID.

- Submit the form.

- Create an Account (if you are a new user):

- Select the option for new registration.

- Fill in your district, tehsil, and registrar’s office details.

- Provide your mobile number to receive an OTP for verification.

- Fill in Property Details:

- Complete the property registration form by entering details such as:

- Tehsil of the district

- Type of area (rural/urban)

- Property type (plot/building/agricultural land)

- Click on “Next” after filling in all required fields.

- Calculate Fees:

- After entering property details, click on “Calculate Fee” to determine applicable stamp duty and registration charges.

- Upload Documents:

- Upload necessary documents such as ID proofs (PAN, Aadhaar), sale deed, occupancy certificate, etc.

- Provide Transaction Details:

- Enter details of other parties involved in the transaction and two witnesses.

- Prepare Deed Document:

- Click on the “deed document” button to prepare the deed and save it.

- Payment of Registration Charges:

- Choose a payment method and confirm your transaction.

- Save the receipt for future reference.

- Complete Registration at SRO:

- Use your application ID to book a time slot at the Sub-Registrar’s Office (SRO).

- On the appointment day, visit the SRO with your application copy and fee receipt to finalize registration.

- Download Registration Certificate:

- After verification, you can log into the portal to download your registration certificate.

Offline House Registration Process

- Visit Sub-Registrar’s Office (SRO): Go directly to the SRO in your area during working hours.

- Submit Required Documents: Bring all necessary documents such as the sale deed, occupancy certificate, ID proofs, etc., for submission.

- Complete Payment Process: Pay applicable fees at the office.

- Receive Confirmation: After processing, you will receive confirmation of registration.

Required Documents

- Sale deed

- Copy of agreement to sale

- Encumbrance certificate

- Sanctioned building plan

- Occupancy certificate

- Power of attorney (if applicable)

- Tax-paid receipts for the last three months

- Previous registered agreements (for resale properties)

- Electricity bill

- ID Proofs (including PAN Card)

By following these steps, you can successfully register your house with the Lucknow Nagar Nigam.

House Tax Calculation Formula

The formula for calculating house tax in Lucknow Nagar Nigam is:

House Tax = Annual Rental Value (ARV) x Applicable Tax Rate

- The ARV is based on property characteristics like size, location, and usage.

- Even if the property is not rented, an estimated rental value is used for tax

How to Pay Lucknow Nagar Nigam House Tax?

Paying your house tax on time is important to avoid penalties. Lucknow Nagar Nigam offers both online and offline options.

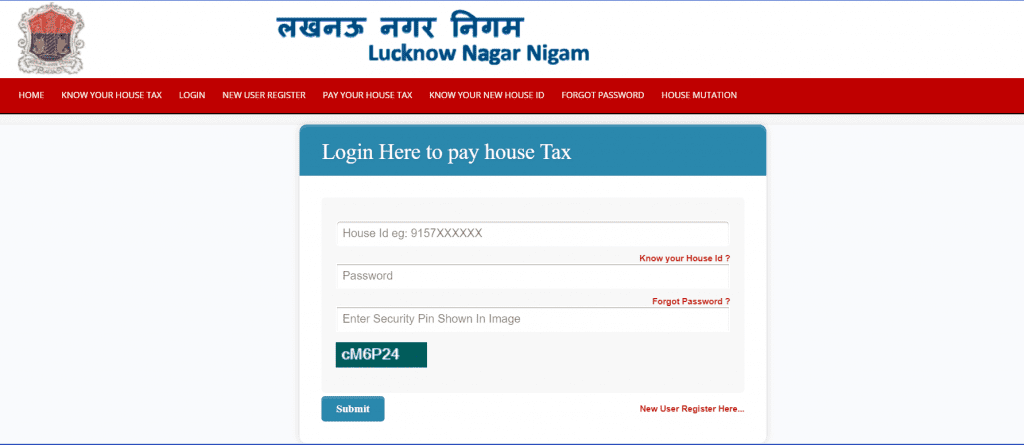

Online Payment Process

Paying online is quick and hassle-free. You can do it from the comfort of your home. Here’s how:

- Visit the Official Website: Go to the Lucknow Nagar Nigam website at lmc.up.nic.in.

2. Click on ‘House Tax Payment’: On the homepage, find and click the ‘House Tax Payment’ option.

3. Enter Property Details: Provide your property details like the House ID or owner’s name.

4. View Your Dues: The system will display the total tax amount for your property.

5. Make Payment: Choose your payment method (credit/debit card, net banking, or UPI) and complete the transaction.

6. Download the Receipt: Once the payment is made, download the receipt for future reference.

Offline Payment Options

If you prefer paying offline, visit the nearest Lucknow Nagar Nigam office. Here’s what you need to do:

- Go to the Municipal Office: The main office is located at Bhopal House, Trilokinath Marg, Lucknow. Visit during office hours (10 AM – 5 PM).

- Carry Necessary Documents: Bring your property ID or past tax receipts for a smooth process.

- Pay the Tax: After verifying your details, pay the amount at the counter. You will receive a receipt as proof of payment.

Rebates and Discounts

Paying your property tax on time not only helps avoid penalties but can also help you save money. Lucknow Nagar Nigam offers several rebates and discounts to encourage timely payments and provide relief to certain groups of taxpayers.

Early Payment Rebates

- Discounts: Save 5-10% on your total tax by paying early.

- Timing: Rebates are available if you pay within the first quarter of the financial year.

- Benefit: Reduces your tax bill while ensuring compliance.

Special Rebates for Senior Citizens, Women, and Special Categories

- Senior Citizens: Additional discounts to lessen the tax burden for older property owners.

- Women Property Owners: Rebates for properties registered in a woman’s name.

- Special Categories: Discounts available for individuals with disabilities, veterans, and ex-servicemen.

- Purpose: Designed to support these groups and promote equitable tax relief.

How to Avail Rebates?

- Pay Early: Check Lucknow Nagar Nigam deadlines for early payment rebates.

- Verify Eligibility: Confirm eligibility for special category rebates with the municipal office.

- Submit Documents: Provide required documents like age proof, disability certificates, or service records.

How to Check Your Property Tax Status and Fix Errors?

Staying updated with your property tax status helps you avoid penalties. Lucknow Nagar Nigam simplifies this process with an online platform to view and correct your tax details.

- Visit the Website: Go to lmc.up.nic.in.

- Navigate to House Tax Payment: Click on the ‘House Tax Payment’ option on the homepage.

- Enter Property Details: Input your Property ID or the owner’s name.

- View Payment Status: Check if your tax is paid, pending, or if there are any arrears.

How to Correct House Tax Assessment Errors

If you find an error in your tax assessment, such as an incorrect property value or overcharged tax, you can correct it by following these steps:

Certainly! Here’s the information presented in a two-column table for clarity:

| Step | Details |

|---|---|

| 1. Visit the Municipal Office | – Documents to Bring: Tax receipts, property papers, and valid ID. – Location: Nearest Lucknow Nagar Nigam office. |

| 2. Submit a Written Complaint | – Content: Clearly explain the error and request a reassessment. – Format: Formal letter detailing the discrepancies. |

| 3. Request Property Verification | – Process: A municipal officer will inspect your property to verify details. – Outcome: Necessary corrections based on verification. |

| 4. Receive Revised Assessment | – Notification: Updated tax amount will be calculated and communicated to you. – Next Steps: Pay the revised tax or address further discrepancies if any. |

House Mutation Process

When you sell a property, transferring ownership in the records of Lucknow Nagar Nigam is essential. This process, known as house mutation, ensures the new owner is listed as the official taxpayer. Failing to complete this process can leave the previous owner responsible for unpaid taxes.

Why House Mutation is Important?

House mutation updates the property ownership in municipal records. It’s important for several reasons:

- It transfers tax liability to the new owner.

- It ensures the new owner can pay taxes and access municipal services.

- It prevents any legal disputes about ownership in the future.

Without mutation, the original owner may still be held responsible for tax payments, even after selling the property.

How to Complete the House Mutation Process Online?

Lucknow Nagar Nigam offers an easy way to complete house mutation online. Follow these steps to transfer ownership:

1. Visit the Official Website: Go to lmc.up.nic.in.

2. Log in to Your Account: Use your credentials to access the portal.

3. Select ‘House Mutation’: Click on the ‘House Mutation’ option on the homepage.

4. Create a New Mutation Request: Enter the property details, including the new owner’s information.

5. Submit Required Documents: Upload the necessary documents, such as the sale deed, property papers, and ID proofs.

6. Pay the Mutation Fee: There is a small fee for the mutation process, usually 1% of the property’s registration cost.

7. Track Your Request: You can monitor the status of your mutation request on the website.

Once the mutation is complete, the new owner’s name will be reflected in the property records, ensuring that all tax-related responsibilities are transferred.

Latest News and Updates

Extended Rebate Deadline

- Discount: 10% off property tax

- Deadline: Pay by September 30, 2024

- Purpose: Encourage early payments and reduce penalties

New Tax Calculation Rules

- Standardized Formula: Applied across all Uttar Pradesh municipal bodies, including Lucknow Nagar Nigam

- Benefits: Ensures fair tax assessments and simplifies the process for property owners

Upcoming Projects and Initiatives

Lucknow Nagar Nigam is launching innovative projects to enhance service accessibility and efficiency. Key initiatives include:

- Lucknow One App

- Property Tax Payments: Pay property taxes directly from smartphones.

- Emergency Services: Access fire, ambulance, and police services.

- Documentation Services: Apply for birth certificates and vehicle registrations.

- Municipal Service Bookings: Book water tankers and other municipal services online.

- Platform Availability: Available for both Android and iOS users.

Conclusion

Nagar Nigam Lucknow stands as a testament to effective municipal governance, balancing the complexities of urban management with the aspirations of its citizens. Through meticulous property tax administration and a wide array of city services, the municipal corporation ensures that Lucknow remains a vibrant, livable, and progressive city.

Frequently Asked Questions

Visit the official website of Lucknow Nagar Nigam and enter your property details to see the Lucknow Nagar Nigam result of your tax payments.

The Nagar Nigam office in Lucknow is located at Trilokinath Marg, near Lalbagh, Lucknow.

You can visit the official Nagar Nigam Lucknow website to check the zone list by entering your area details for accurate information.

You can find the Nagar Nigam Lucknow contact number on their official website or by visiting the nearest municipal office.

Jalkal Vibhag Nagar Nigam Lucknow manages water supply, sewage systems, and sanitation services across the city.

You can complete your Nagar Nigam Lucknow house registration online by visiting their official website and submitting your property details.

In Lucknow, the house tax is calculated based on the property’s Annual Rental Value (ARV), which considers factors such as property size, location, type (residential or commercial), and age. The tax rate varies by property type and is generally expressed as a percentage of the ARV.

Additionally, property owners may be eligible for rebates based on the length of occupancy, with discounts ranging from 25% for ten years to 40% for properties occupied for over twenty years. The Lucknow Nagar Nigam offers both online and offline payment methods for convenience.

To check house tax online in Uttar Pradesh, property owners should visit the official website of their respective municipal corporation.

Once on the site, locate the ‘Property Tax’ or ‘House Tax’ section. Users will need to enter specific details such as the property ID, assessment number, or address to retrieve their tax status.

This process allows homeowners to view outstanding dues, previous payments, and total amounts due without needing to visit local offices, making it a convenient option for managing property tax obligations.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan