Owning property in Thane, comes with the responsibility of paying property taxes. These taxes contribute to the maintenance and development of the city’s infrastructure, ensuring a better living environment for all residents.

How to Pay Thane Property Tax Online?

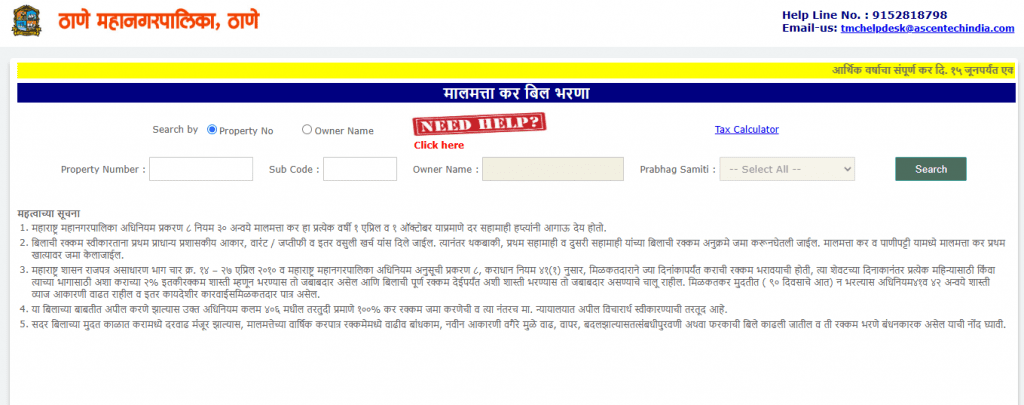

- Visit the official TMC website: https://propertytax.thanecity.gov.in.

- Search for your property using filters like property ID or owner’s name.

- Enter your details, including a valid mobile number and email address.

- Review your outstanding dues and click on the “Pay Now” option.

- Choose a payment method such as UPI, credit/debit card, or net banking.

- Complete the payment and download the receipt for future reference.

How to Pay Thane Property Tax Offline?

For those who prefer traditional methods, TMC also accepts offline payments.

- Visit the nearest TMC office during working hours.

- Go to the property tax counter and provide details like property ID or owner’s name.

- Make the payment using cash, cheque, or demand draft (DD).

- Collect your payment receipt from the counter.

How to Download Property Tax Thane Receipt?

After paying your property tax in Thane, it is important to download the receipt for your records. The Thane Municipal Corporation (TMC) makes it easy to access and download the receipt online.

- Visit the official TMC property tax portal: https://propertytax.thanecity.gov.in.

- Log in using your registered mobile number or email ID.

- Search for your property by entering your property ID or other relevant details.

- Review the payment history to find the specific transaction.

- Click on the receipt option next to the payment record.

- Download the receipt and save it for future use.

Read More: What is Index2 Document?

Key Factors Affecting Property Tax

- Carpet Area: The actual usable area of the property.

- Usage Factor: Determines the purpose of the property, such as residential, commercial, or industrial.

- Age Factor: Older properties may have a lower tax rate compared to newer ones.

- Floor Factor: Properties on higher floors might have a different tax value.

- Building Type: Includes classification as independent houses, apartments, or vacant plots.

How is Property Tax in Thane Calculated?

The Thane Municipal Corporation (TMC) uses a formula to calculate property tax based on property size, usage, and other factors. Knowing this formula can help property owners estimate their tax amount before making payments.

Formula for Property Tax Calculation

Property Tax = Tax Rate × Carpet Area × Usage Factor × Age Factor × Floor Factor × Building Type

Read More: Cost of Living in Mumbai

Thane Property Tax Penalties and Rebates

| Category | Details |

|---|---|

| Late Payment Penalties | Penalty Rate: 2% per month on the delayed property tax amount. Accumulation: Penalty continues to accrue until the full tax is paid. Increased Interest: After 90 days of non-payment, the interest rate escalates. Legal Actions: Potential legal measures, including property seizure, may be initiated. Recovery Expenses: TMC may deduct additional recovery costs when collecting overdue taxes. |

| Early Payment Rebates | Rebate Percentage: 2%–3% discount on the total property tax amount. Eligibility: Available to property owners who pay their taxes before the due date. Benefit: Encourages timely payments and provides financial incentives for early compliance. |

Read More: The Impact of Expressways on Real Estate

Exemptions on TMC Property Tax

Certain property owners are eligible for tax deductions. These exemptions typically include:

- Owners with Disabilities

- Female Property Owners

- Senior Citizens

- Agricultural Institutions

- Educational Institutions

- Former Military Personnel (Army or Navy)

How to Change Your Name on TMC Property Tax Records Online?

- Visit the TMC portal: Go to the official Thane Municipality website.

- Fill out the form: Locate and complete the name change application form with your property tax details.

- Attach documents: Include proof of ownership, the last property tax receipt, and other required documents.

- Submit the application: Submit the form online to finalize the process.

Read More: Delhi vs. Mumbai: Where to Invest?

Thane Property Tax: Customer Care

- Helpline Number: Call 9152818798 for assistance during working hours.

- Office Timings: Visit your nearest TMC office between 10:00 AM and 5:00 PM on working days.

- Email Support: For written queries, send an email to the designated TMC email address provided on their official website.

- Online Query Submission: Use the feedback or complaint section on the TMC portal for non-urgent issues.

Conclusion

Paying property tax Thane on time is essential for maintaining the city’s infrastructure and ensuring uninterrupted civic services. Delayed payments can lead to penalties and additional charges, so it is better to clear dues within the deadlines.

The Thane Municipal Corporation has simplified the payment process by offering online methods, making it more convenient and time-saving. Use the online platform to avoid long queues and ensure a hassle-free experience.

Frequently Asked Questions

You can pay online through the Thane Municipal Corporation portal by entering your property details and completing the payment.

Log in to the TMC portal, find your payment record, and download the receipt from the transaction details.

You need a sale deed, NOC, photo ID, and previous tax receipts to update records with TMC.

The tax must be paid twice a year, by April 1st and October 1st.

Yes, exemptions apply to senior citizens, female owners, disabled individuals, and agricultural properties.

TMC charges a 2% monthly penalty on the unpaid amount until it is cleared.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan