As Pune continues its meteoric rise as one of India’s premier urban centers, the role of effective property tax management within the Pune Municipal Corporation (PCMC) becomes increasingly pivotal. In 2024, PCMC has embarked on transformative initiatives aimed at modernizing property tax systems, fostering transparency, and promoting sustainable urban growth.

This article explores the calculation process, payment method and tax waiver options in PCMC property tax for 2024.

PCMC Meaning

PCMC stands for the Pune Municipal Corporation, which is the governing body responsible for the administration and development of Pune, a major city in the Indian state of Maharashtra.

Established in 1982 to manage the city’s infrastructure, public services, and regulatory functions, PCMC plays a crucial role in ensuring Pune’s growth and sustainability.

What is PCMC Property Tax?

PCMC Property Tax refers to the annual tax levied by the Pune Municipal Corporation on property owners within its jurisdiction.

This tax is a primary source of revenue for PCMC, enabling the corporation to fund various municipal services such as:

- Infrastructure Development: Maintenance and development of roads, bridges, public parks, and sanitation systems.

- Public Services: Provision of clean water, waste management, street lighting, and public transportation.

- Urban Planning: Implementation of zoning regulations, building permits, and development projects to ensure organized urban growth.

- Community Amenities: Development of recreational facilities, libraries, and healthcare centers.

Who is Required to Pay PCMC Property Tax?

Property owners within the Pune Municipal Corporation area (Pimpri, Bhosari, Chinchiwad, and Akurdi) are obligated to pay property tax. This includes:

- Residential Properties: Owners of houses, apartments, and other residential units.

- Commercial Properties: Owners of shops, offices, restaurants, and other commercial establishments.

- Industrial Properties: Owners of factories, warehouses, and industrial units.

- Vacant Land: Owners of undeveloped land parcels.

Pay PCMC Property Tax Online

- Visit the official website of Pimpri Chinchwad Municipal Corporation.

- Click on Pay Property Tax.

- Search your property for the tax payment by UPIC ID, QR Payment, Property No. or Old Property No.

- Enter the details according the type of search you choose and click on Find the Property.

- The property tax will be displayed on the screen.

- Choose a payment method: credit/debit card, UPI, wallet, or net banking.

- After completing the payment, a tax receipt will be generated. This receipt is essential for future reference.

PCMC Property Tax Exemptions

The Pune Municipal Corporation (PCMC) offers several exemptions from property tax to support various community and societal functions. These exemptions include:

- Religious and Heritage Properties:

- Buildings/ lands designated for places of worship, public burial or cremation sites, and heritage conservation areas are exempt from property tax.

- Buildings/ lands designated for places of worship, public burial or cremation sites, and heritage conservation areas are exempt from property tax.

- Charitable, Educational, and Agricultural Buildings:

- Properties used exclusively for charitable organizations, educational institutions, or agricultural purposes are not subject to property tax.

- Properties used exclusively for charitable organizations, educational institutions, or agricultural purposes are not subject to property tax.

- Small Residential Units:

- Residential structures that are smaller than 500 square feet are exempt from property tax.

PCMC Property Tax Calculation Process

Calculating your PCMC property tax for 2024 is straightforward and can be done online using the PCMC’s official property tax calculator. Follow these simple steps to determine your tax amount:

Access the PCMC Property Tax Self-Assessment Portal

Visit the official PCMC website and navigate to the Property Tax Self-Assessment section to start the calculation process.

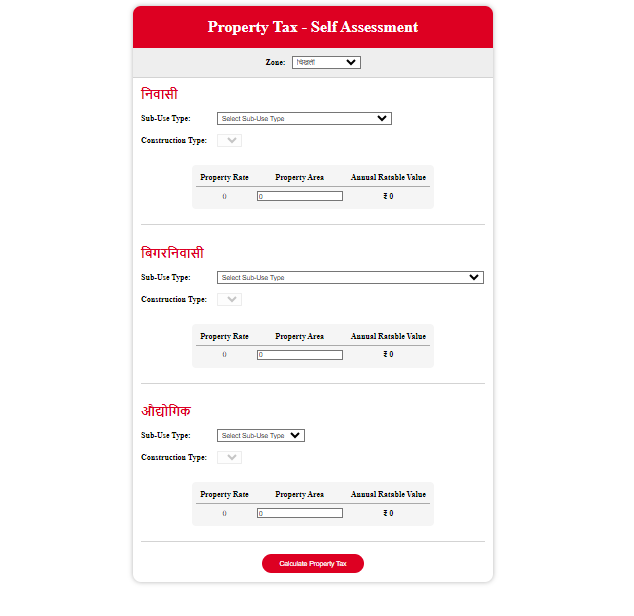

Select Your Property Zone and Type

- Choose the Zone: Identify and select the zone where your property is located within the PCMC area.

- Select Property Category: Indicate whether your property is residential, commercial, or belongs to an NRI (Non-Resident Indian).

Specify Property Details

- Sub-Use Type: Select the specific use category of your property (e.g., residential, commercial).

- Construction Type: Choose the construction type of your building.

- Property Area: Enter the total area of your property in square feet or square meters.

Calculate Your Property Tax

After entering all the necessary details, the calculator will automatically generate the estimated property tax amount for your property.

What to Do If Your PCMC Property Tax Receipt Is Not Generated?

Encountering issues with generating your PCMC property tax receipt online can be frustrating. Follow these straightforward steps to resolve the situation:

1. Verify the Payment in Your Bank Account

- Check Your Transaction History: Log into your bank account or review your bank statement to confirm that the property tax payment has been successfully deducted.

- Ensure Correct Amount: Make sure the amount debited matches the property tax payment you intended to make.

2. Allow Processing Time

- Wait for Up to Three Working Days: If the payment has been deducted but the receipt is not immediately visible on the PCMC website, it may be due to a processing delay.

- Refresh the Portal: After a few days, revisit the PCMC Property Tax portal to check if the receipt has been updated.

3. Contact PCMC Support if Necessary

- Reach Out for Assistance: If the receipt does not appear within three working days, contact PCMC customer support for help.

- Provide Payment Details: When contacting support, have your transaction reference number and payment details ready to expedite the resolution process.

When is the Last Date to Make PCMC Property Tax 2024 Payment?

For the fiscal year 2024, the Pune Municipal Corporation (PCMC) has structured the property tax payments into two convenient installments. Here are the deadlines you need to be aware of:

1. First Installment: April to September

- Due Date: May 31, 2024

- Coverage Period: This installment covers the property tax for the first six months of the fiscal year, from April to September.

- Benefits of Early Payment:

- Avoid late payment penalties.

- Possible discounts or incentives for early or timely payments.

- Simplifies financial planning by spreading the tax burden.

2. Second Installment: October to March

- Due Date: December 31, 2024

- Coverage Period: This installment covers the remaining six months of the fiscal year, from October to March.

Rebates on PCMC Property Tax 2024

Property owners in Pune can take advantage of attractive rebates on their PCMC property tax for the year 2024 by ensuring full payment by May 31. The available discounts are structured based on property type and the implementation of sustainable initiatives. Here’s a detailed overview of the rebates:

1. General Property Tax Rebates

a. Residential and Specific Non-Residential Properties

- Eligibility:

- Residential properties

- Non-residential properties

- Open plots registered specifically as residential buildings

- Discount Structure:

- 10% Discount: Applicable if the property’s annual rateable value is up to ₹25,000.

- 5% Discount: Applicable if the property’s annual rateable value exceeds ₹25,000.

2. Sustainable Property Rebates

a. Eco-Friendly Residential Properties

- Eligibility: Residential properties that have implemented one or more of the following sustainable practices:

- Solar Installations: Utilization of solar panels for energy generation.

- Vermiculture: Implementation of vermiculture systems for organic waste management.

- Rainwater Harvesting: Systems installed for collecting and storing rainwater.

- Discount Structure:

- 5% to 10% Discount: The exact rebate percentage depends on the number and extent of sustainable projects installed on the property.

- 5% Discount: For properties with one sustainable initiative.

- Up to 10% Discount: For properties that have implemented multiple sustainable projects.

- 5% to 10% Discount: The exact rebate percentage depends on the number and extent of sustainable projects installed on the property.

How to Register a Complaint About PCMC Property Tax?

Visit the Suvidha Platform

- Go to the official Suvidha website: Suvidha Portal.

Create an Account

- Click on the “Register” button.

- Fill in your personal details such as name, email address, and phone number.

- Create a username and password.

- Verify your account through the confirmation link sent to your email or phone.

Log In to Your Account

- Enter your username and password on the Suvidha login page.

- Click “Login” to access your dashboard.

File a Complaint

- Navigate to the “File a Complaint” section.

- Select “Property Tax” from the list of available categories.

- Fill out the complaint form with the necessary details, including:

- Your property details

- Description of the issue

- Any relevant documentation or evidence

- Click “Submit” to lodge your complaint.

Track Your Complaint

- After submission, go to the “Track Complaint” section.

- Enter your complaint reference number or log in to view the status.

- Monitor updates and responses from PCMC regarding your complaint.

PCMC Property Tax: Contact Details

| Category | Contact Informations |

|---|---|

| PCMC Sarathi Helpline Number | 8888 00 6666 |

| PCMC Sarathi Website | https://pcmcsmartsarathi.org/ |

Conclusion

The evolution of PCMC property tax in 2024 underscores a commitment to modernization, transparency, and sustainability. As Pune continues to grow, these initiatives will not only ensure a robust revenue stream for municipal services but also promote a harmonious and sustainable urban environment.

Frequently Asked Questions

PCMC Property Tax is an annual tax levied by the Pune Municipal Corporation on property owners within its jurisdiction. This tax funds essential municipal services such as infrastructure development, waste management, water supply, and public amenities, ensuring the smooth functioning and growth of Pune’s urban environment.

PCMC Property Tax is calculated based on the property’s annual rateable value, which considers factors like location, size, usage (residential, commercial), and amenities. The applicable tax rate varies accordingly.

For the fiscal year 2024, PCMC Property Tax is payable in two installments. The first installment, covering April to September, is due by May 31, 2024. The second installment, covering October to March, must be paid by December 31, 2024. Timely payments help avoid late fees.

To register a complaint regarding PCMC Property Tax, visit the Suvidha platform. Create an account, log in, and navigate to the “File a Complaint” section. Select “Property Tax,” fill in the necessary details, and submit your complaint. You can also track the status of your complaint through the same portal.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan