Punjab National Bank (PNB) offers home loan insurance to ensure that borrowers and their families are financially protected in case of unforeseen circumstances like death or disability. With affordable premiums, flexible coverage options, and easy application processes, PNB home loan insurance plans help borrowers safeguard their home loan repayments.

Eligibility Criteria for PNB Home Loan Insurance

To apply for PNB home loan insurance, you must meet the following eligibility criteria:

| Eligibility Criteria | Details |

|---|---|

| Age Limit | Between 18 to 65 years of age |

| Loan Type | Must have an active home loan with PNB |

| Health Status | Medical assessment may be required, depending on the plan |

| Loan Amount | Must have a sanctioned home loan with the bank |

| Employment Status | Borrowers must be employed or self-employed with a steady income |

| Loan Purpose | Available for residential properties, either for purchase or construction |

Also Read: A Detailed Guide on Choosing Home Loan Insurance

Types of PNB Home Loan Insurance Plans

PNB provides multiple insurance options that can be tailored to the borrower’s needs:

| Home Loan Insurance Plan | Details |

|---|---|

| Life Protection – Death Benefit | Provides coverage for death, ensuring the loan amount is paid off in case of the borrower’s demise. |

| Life Protection Plus – Death Benefit + Accelerated Terminal Illness Cover | Covers death and includes additional coverage for terminal illness, accelerating the claim payout if diagnosed. |

| Accidental Safeguard – Death Benefit + Additional Accidental Death Cover | Covers death along with extra coverage for accidental death. |

| Critical Illness Safeguard – Death Benefit + Accelerated Critical Illness Cover | Provides death benefit along with coverage for critical illnesses, ensuring financial protection during illness. |

| Disability Safeguard – Death Benefit + Accelerated Accidental Total Permanent Disability Cover | Covers death and includes protection for accidental total permanent disability, ensuring repayment of the loan. |

These plans offer tailored protection based on individual needs, ensuring comprehensive security for your home loan. For more details, visit PNB’s official website: PNB Home Loan Insurance.

Check Out: Home Loan Insurance Premium in India

Documents Required for PNB Home Loan Insurance

The list of essential documents required for applying for PNB home loan insurance:

| Document | Description |

|---|---|

| Identity Proof | Aadhar Card, PAN, Passport, Voter ID, etc. |

| Address Proof | Utility Bills, Bank Statements, Aadhar |

| Income Proof | Salary Slips, Income Tax Returns, Bank Statements |

| Home Loan Agreement | Copy of sanctioned home loan agreement |

| Medical Reports | If applicable, depending on the insurance plan |

Also Read: Home Loan Insurance for Green Homes

How to Apply for PNB Home Loan Insurance

The process to apply for PNB home loan insurance is straightforward:

Time needed: 3 minutes

- Step 1

Apply for a home loan insurance with PNB, either online or at the branch.

- Step 2

During the loan application process, you will be offered the option to buy home loan insurance.

- Step 3

Choose the insurance plan that suits your needs.

- Step 4

Submit necessary documents like proof of identity, income proof, and the home loan agreement.

- Step 5

Pay the premium either as a lump sum or through EMIs as per the terms of the policy.

- Step 6

Receive the insurance policy document and a copy of the home loan insurance terms.

Suggested Read: Should you get an insurance for your home loan?

How to Claim PNB Home Loan Insurance Benefits

To claim benefits under PNB home loan insurance, follow these steps:

- Inform the Insurer: In case of the borrower’s death or disability, notify PNB or the insurance provider immediately.

- Submit Required Documents: Provide the necessary documents, including a death certificate, home loan details, and any medical reports if applicable.

- Claim Processing: PNB or the insurance company will verify the claim and process it as per the policy terms.

- Loan Repayment: Upon claim approval, the insurer will pay off the outstanding loan amount directly to PNB, settling the borrower’s debt.

Also Read: Home Loan Insurance for Green Homes

Why Should You Consider Getting Home Loan Insurance?

Home loan insurance is an important safeguard for both borrowers and their families. Here are some reasons why you should consider it:

- Debt-Free Future: Home loan insurance ensures that the outstanding loan is paid off in case of the borrower’s death, preventing the family from losing their home.

- Financial Protection: It provides financial protection against events such as accidents, critical illness, or disability, which may affect the borrower’s ability to repay the loan.

- Peace of Mind: Borrowers can have peace of mind knowing that their family won’t face financial struggles or the risk of home foreclosure if something happens to them.

- Tax Savings: Premiums paid towards home loan insurance are tax-deductible under Section 80C of the Income Tax Act, offering additional benefits.

Also Read: Should You Choose a Term Insurance for Home Loan?

Home Loan Insurance vs Term Insurance

Home Loan Insurance and Term Insurance are both types of life insurance, but they serve different purposes:

| Features | Home Loan Insurance | Term Insurance |

|---|---|---|

| Cost of Premium | Lump sum Added to loan amount Higher rates | Paid annually, half yearly, or quarterly Low rates |

| Coverage | Decreases with loan repayment Expires when loan is paid | Fixed periodPays death benefit in lump sum |

| Tax Benefits | Deduction under Section 80C, up to Rs. 1.5 lakh | Deduction under Section 80C, up to Rs. 1.5 lakh |

| Flexibility | Limited flexibility Mainly serves to protect against loan default. | High flexibility in terms of coverage amount, term, and beneficiaries. |

Also Read: LIC Term Insurance vs Home Loan Insurance

Benefits of PNB Home Loan Insurance

PNB Home Loan Insurance offers several benefits to borrowers, including:

- Financial Security: Covers the outstanding loan amount, ensuring your family is not burdened.

- Affordable Premiums: Competitive premium rates tailored to suit your budget.

- Flexible Tenure: Coverage matches the loan tenure.

- Tax Benefits: Premiums paid are eligible for tax deductions under Section 80C.

- Peace of Mind: Protects your family’s future and ensures loan repayment in case of emergencies.

Suggested Read: Section 80C: Tax Benefits for Home Buyers.

Conclusion

PNB Home Loan Insurance offers essential protection for borrowers and their families, ensuring home loan repayment in case of unforeseen circumstances. With flexible coverage options and affordable premiums, it’s an invaluable safeguard.

For more information and to explore your options, visit Credit Dharma today!

Frequently Asked Questions

No, insurance is not mandatory for home loans in PNB. However, it is recommended to protect your loan and ensure your family is secure in case of unexpected events like death or disability.

While the Reserve Bank of India (RBI) doesn’t mandate property insurance for home loans, most banks and financial institutions strongly encourage or even require it to protect their interests and the value of the collateral.

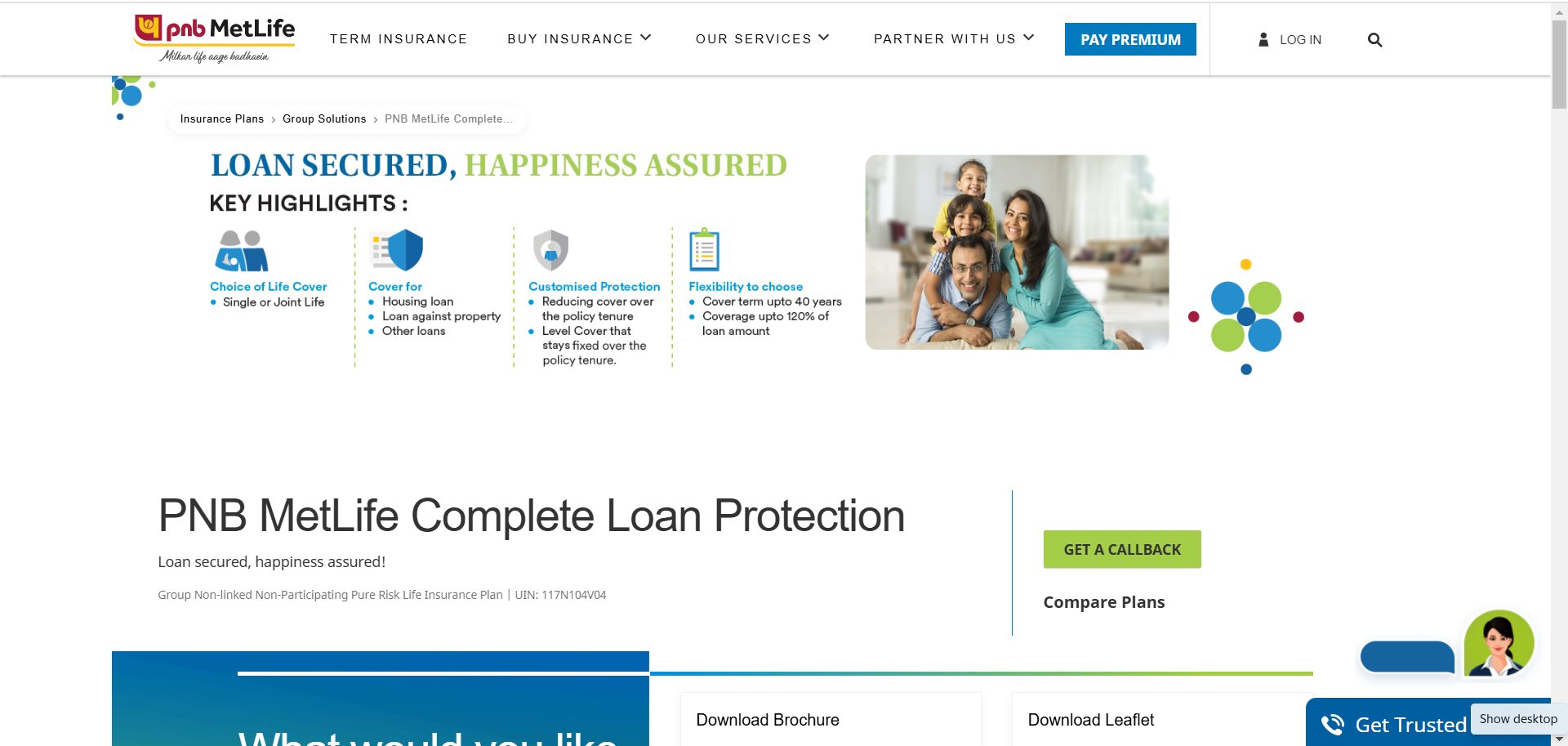

Yes, Punjab National Bank (PNB) has partnered with PNB MetLife India Insurance Company Limited for bancassurance, offering home loan protection plans and other insurance products.

A home loan insurance policy covers the outstanding loan in case of the borrower’s death, disability, or critical illness, protecting their family from debt.

Yes, home loan insurance is recommended as it protects your family from loan repayment burdens in case of unforeseen events.

Yes, you can claim a home loan insurance policy if the circumstances outlined in the policy occur, such as the death or disability of the borrower. The insurance company will then settle the outstanding loan amount with the lender.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan