RERA Delhi, established under the Real Estate (Regulation and Development) Act, serves as the principal authority overseeing the real estate sector in the state. This regulatory body is committed to enforcing stringent standards that ensure transparency, accountability, and ethical practices in property transactions, thereby safeguarding the interests of both developers and homebuyers.

RERA Delhi: Fees and Charges

| Category | Fees and Charges |

|---|---|

| RERA Registration for Individuals | ₹10,000 |

| RERA Registration for Entities (Other than Individuals) | ₹50,000 |

Suggested Read: Circle Rates in Delhi

Source: RERA Filing

RERA Delhi: Rules and Regulations

| Criteria | Registration Requirement |

|---|---|

| Location | All projects in planned or unplanned areas (e.g., Abadi areas, Lal Dora) must be registered with RERA Delhi. |

| Plot/Building Size | If the plot or building exceeds 500 sq. meters and is being converted into apartments, commercial use, or industrial housing, prior registration is mandatory. |

| Construction Units | If a project includes more than 8 units (across all phases), registration is required regardless of plot size. |

| Pre-2017 Projects | Any real estate project not registered before May 1, 2017, must be registered with Delhi RERA. |

Suggested Read: Land Records in Delhi

Source: RERA Filing

Documents Required for RERA Delhi Registration

| Document | Requirement |

|---|---|

| PAN Card | PAN of the real estate agent/partners. |

| Aadhaar Card | Aadhaar of the real estate agent/partners. |

| Photograph | Recent passport-size photo of the agent/partners. |

| Registration Proof | Partnership Deed or Certificate of Incorporation (COI) for companies. |

| Business PAN Card | Required for partnerships and companies. |

| Address Proof (Commercial) | Authenticated copy of the business location. |

| ITR | Income Tax Returns (ITR) for the last 3 years. |

| Local Address Proof (Commercial) | Proof of business address in Delhi. |

Suggested Read: Home Loan in Delhi

How to Register as a Builder Under RERA Delhi?

- Visit the official website of RERA Delhi.

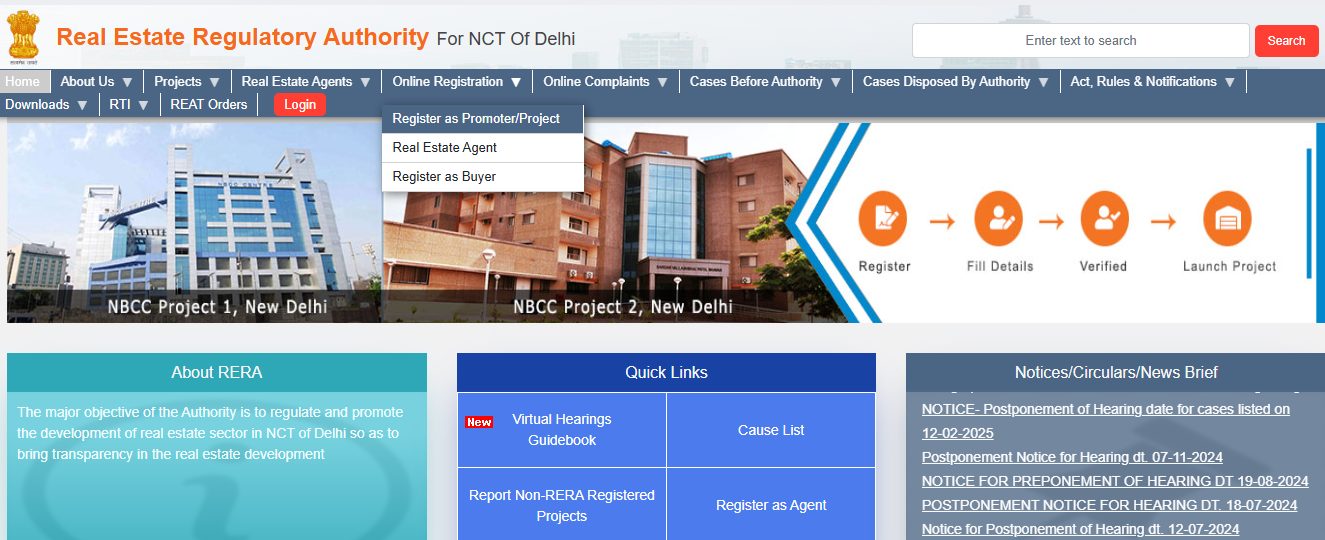

- Click on “Register as Promoter/Project” under the “Online Registration” tab.

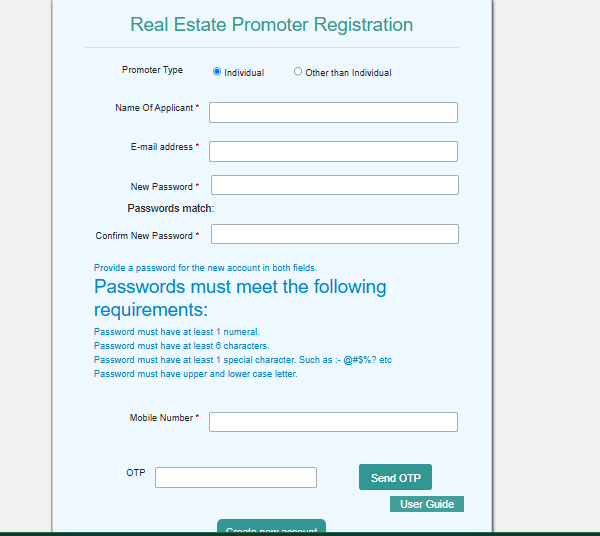

- Fill in the form and click on “Create New Account”

- Click “Add Project” and enter all the project details

Project Name & Description

Type & Status of the Project

Land Area & Location

Building & Apartment Details

Stages of Construction

Amenities & Facilities - Add Key Professionals

Enter the details of: Chartered Accountant (CA), Architect and Engineer & Structural Engineer

- Upload Required Documents

Land-related Documents

Project Approvals

Promotional & Performa Documents

Other Necessary Documents - Make Payment

Use the online payment option on the RERA Delhi website to pay the registration fee.

Suggested Read: Luxury Properties in Gurgaon

How to Register as a Real Estate Agent Under RERA Delhi?

- Go to rera.delhi.gov.in and click on “Register as Agent” under the “Online Registration” tab.

- Complete the registration form with personal and business information.

- Upload necessary documents and submit the application.

- Click on “Real Estate Agents” tab to verify approval status.

- Buyers can also check an agent’s registration status for authenticity.

Suggested Read: Stamp Duty and Registration Charges in Delhi

RERA Approved Projects in Delhi NCR

- Visit the RERA Delhi Website – Go to rera.delhi.gov.in.

- Select ‘Projects’ Tab – Click on ‘List of Registered Projects’ to view approved projects.

- Check the Project List – If the project is not listed, check other categories for its status.

Suggested Read: Delhi vs. Mumbai – Real Estate Investment

How to File a Complaint on RERA Delhi Website?

| Step | Action |

|---|---|

| Step 1: Register as a Buyer | Visit rera.delhi.gov.in and click on ‘Register as Buyer’ under the ‘Online Registration’ tab. |

| Step 2: Complete Registration | Enter name, father’s name, email, and mobile number, then verify via OTP authentication. |

| Step 3: File a Complaint | Log in and select ‘Online Complaint’, choose ‘Complaint to Authority’ (Form M), and confirm intent to file. |

| Step 4: Choose Complaint Type | – Form M – Complaint to RERA Regulatory Authority. – Form N – Complaint to Adjudicating Officer. – Complaints can be filed against builders, agents, or non-registered projects. |

Suggested Read: Cost of Living in Delhi

RERA Delhi Registration: Timeline

- Standard Processing Time: The RERA certificate is typically issued within 30 days by the RERA department.

- Possible Variations: In some cases, the approval may be granted earlier or delayed due to procedural requirements.

Source: RERA Filing

Get a Home Loan

with Highest Eligibility

& Best Rates

RERA in Various States

Comparing RERA implementations across different states can provide insights into best practices and areas for improvement. States with notable RERA implementations include:

- Karnataka

- Maharashtra

- Rajasthan

- Punjab

- Delhi

- Haryana

- Telangana

- Tamil Nadu

- Bihar

- Uttar Pradesh

- Chandigarh

- Uttarakhand

- Madhya Pradesh

- West Bengal

- Himachal Pradesh

- Goa

- Chhattisgarh

- Andhra Pradesh

- Kerala

- Jharkhand

- Mizoram

- Tripura

- Assam

- Manipur

Conclusion

RERA Delhi provides the transparency and security you need, while Credit Dharma takes care of your home loan requirements. From eligibility checks to quick approvals, our dedicated team is here to support you every step of the way.

Frequently Asked Questions

RERA Delhi is the state-specific implementation of the Real Estate (Regulation and Development) Act, aimed at regulating and promoting the real estate sector in Delhi.

You can register your project by filling out the application form on the RERA Delhi website, submitting necessary documents, and paying the required fees.

The fees vary based on the project size and type, with specific fee structures for different types of projects.

You can check the registration status online on the RERA Delhi website or by visiting the RERA office.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan