Are you planning to pay off your SBI home loan ahead of schedule? If so, you may be wondering how prepaying your loan affects your finances. With the help of the SBI Home Loan Prepayment Calculator, you can easily estimate the impact of extra payments on your loan.

Save Lakhs on Your SBI Home Loan with Prepayments!

SBI Home Loan Prepayment Charges

No pre-payment/ pre-closure penalty will be levied on floating interest home loans irrespective of the period for which the account has run or source of funds, as per SBI home loan prepayment rules.

Who is Eligibile to Make SBI Home Loan Prepayment?

If you’re a SBI home loan borrower, here’s what you need to know about eligibility for prepayment:

- The primary borrower of the SBI home loan is eligible to make the prepayment.

- In case of a joint home loan, co-applicants can also make the prepayment, provided the loan is in their name as well.

- Your account should be free of defaults or overdue payments. Prepayment is typically allowed only if your repayment track record is consistent.

- Some lenders require borrowers to complete a minimum number of EMIs (e.g., 6–12 months) before allowing prepayment. Check your loan agreement for specific terms.

How Does SBI Home Loan Prepayment Calculator Work?

To calculate the impact of prepayment on your home loan, the formula involves adjusting the remaining principal and recalculating either the loan tenure or the EMI. The formula is:

Remaining Principal = (Remaining Principal – Prepayment Amount) × (1 + i/n)^(n × t)

Where:

- Remaining Principal: The remaining loan amount after accounting for the prepayment.

- Prepayment Amount: The extra payment made towards the loan over and above the regular EMI.

- i: The annual interest rate on the home loan.

- n: The number of times the interest is compounded per year (usually 12 for monthly compounding).

- t: The remaining term of the loan in years.

Home Loan Prepayment Case Study

Mr. Ram, a resident of Mumbai, took a home loan from SBI to purchase a property. He opted for a loan amount of ₹50,00,000 at an interest rate of 9.75% p.a., with a loan tenure of 30 years.

His monthly EMI was ₹42,958. Over the years, Mr. Ram diligently paid his monthly installments. After 15 years of repayment, he decided to make a prepayment of ₹5,00,000 to reduce his loan burden and save on interest payments. Below is an analysis of how this prepayment impacted his loan status.

| Category | Details |

|---|---|

| Loan Amount | ₹50,00,000 |

| Rate of Interest | 9.75% p.a. |

| Tenure | 30 years |

| EMI | ₹42,958 |

| Total Interest to be Paid in 30 Years | ₹1,04,64,779 |

| Total Amount to be Paid in 30 years | ₹ 1,54,64,779 |

Prepayment Details

Mr. Ram decides to make a prepayment of ₹5,00,000 at the 15-year mark. Let’s analyze the impact of this prepayment.

| Prepayment Amount | ₹5,00,000 |

|---|---|

| New Principal After Prepayment | ₹41,69,068 – ₹5,00,000 = ₹36,69,068 |

Loan Status at Year 15

At the 15-year mark, Mr. Ram has already made 180 EMIs and has 180 EMIs remaining. Here’s the status of the loan at that point:

| Category | Amount |

|---|---|

| Opening Balance (Year 15) | ₹41,69,068 |

| EMIs Paid | 180 months (15 years) |

| EMIs Remaining | 180 months |

| Interest Already Paid | ₹1,04,64,779 – Remaining Interest ≈ ₹36,08,226 |

Impact of Prepayment

Below is the detailed impact of the prepayment on Mr. Ram’s home loan:

| Category | Before Prepayment | After Prepayment | Savings |

|---|---|---|---|

| Remaining Principal | ₹41,69,068 | ₹36,69,068 | ₹5,00,000 |

| Remaining Tenure | 15 years (180 months) | 11.5 years (138 months) | 3.5 years (42 months) |

| Monthly EMI | ₹42,958 | ₹42,958 | – |

| Total Future Payments | ₹77,32,440 | ₹59,28,204 | ₹18,04,236 |

| Interest Component | ₹35,63,372 | ₹22,59,136 | ₹13,04,236 |

Financial Benefits:

- Reduction in Loan Tenure: The prepayment of ₹5,00,000 reduces Mr. Ram’s loan tenure by 3.5 years (from 15 years to 11.5 years).

- Interest Savings: Mr. Ram will save approximately ₹13,04,236 in interest payments.

- Total Cash Flow Savings: The total amount of money saved in future payments, including the reduction in principal and interest, is ₹18,04,236.

Documents Required for SBI Home Loan Prepayment

- Prepayment Request Form (duly filled and signed).

- Identity & Address Proof : PAN card, Aadhaar, passport, etc.

- Loan Account Details : Loan account number and original loan agreement.

- Payment Instrument : Cheque/DD/online payment proof for prepayment amount.

Suggested Read: SBI Housing Finance Home Loan Statement Download

How to Make SBI Home Loan Prepayment Online?

- Visit the SBI Official website. Click on “Net Banking” on the right hand side.

- Click on “Log in” under Personal Banking.

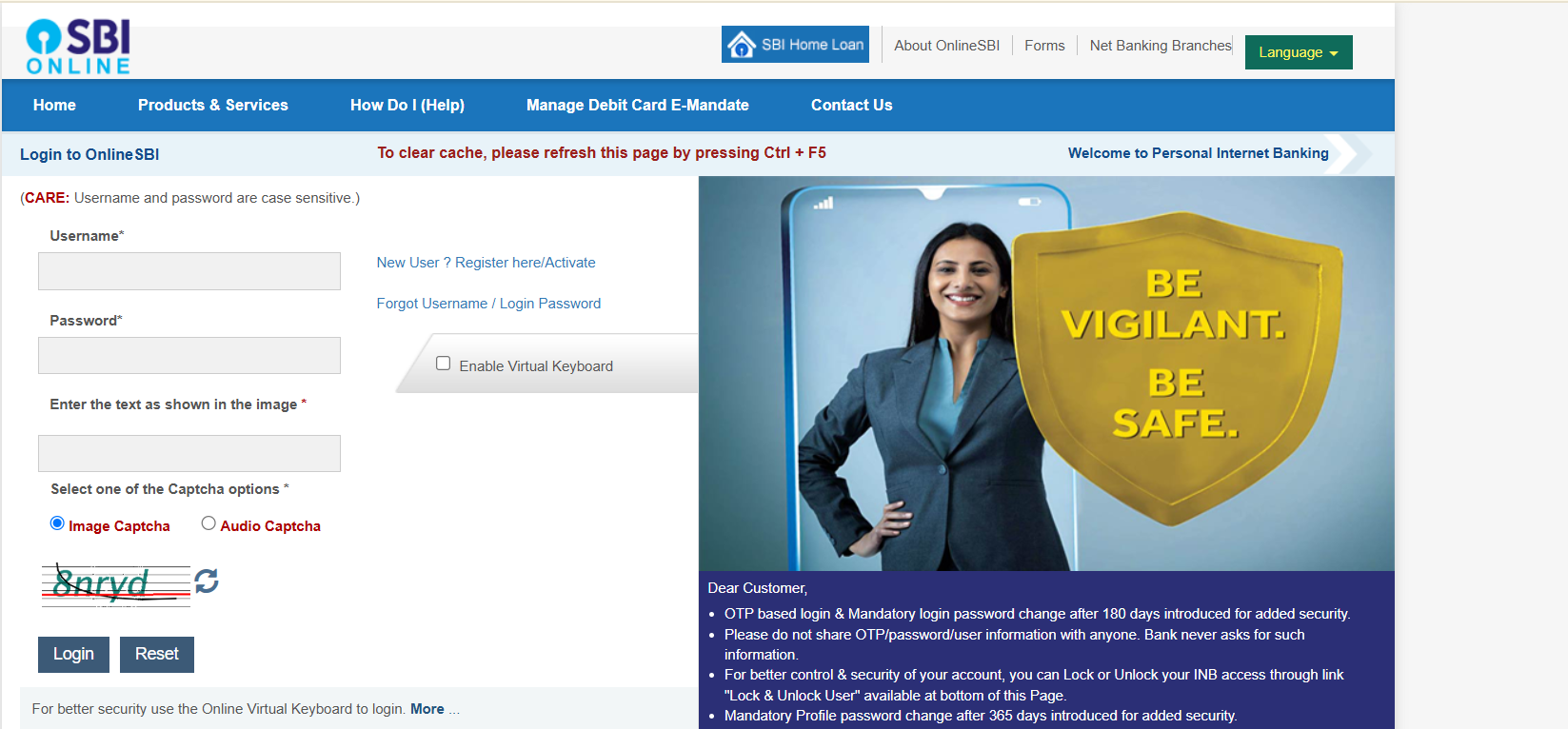

- Enter your username, password, and CAPTCHA.

- Once logged in, go to the ‘Loans’ tab and click on ‘Prepayment’ under the Home Loan options.

- Enter the amount you wish to prepay and select the account from which the payment will be debited.

- Review the details and confirm the transaction. A confirmation message will appear upon successful completion.

Suggested Read: Home Loan Closure

How to Make SBI Home Loan Prepayment Offline?

| Step | Description |

|---|---|

| 1. Visit a SBI Branch | Locate and visit the nearest SBI branch during working hours. |

| 2. Prepare the Payment | – Cheque Payment: Issue a cheque in favor of “State Bank of India”. – Cash Payment: Ensure the exact amount as change may not be available. |

| 3. Submit the Payment | Submit the cheque or cash along with a written application specifying your loan account number, amount being prepaid, and whether it’s a partial or full prepayment. |

| 4. Pay Applicable Charges | – Partial prepayments and full prepayments have charges. Refer to the Schedule of Charges under the “Fair Practice Code” on the SBI website. |

| 5. Obtain Acknowledgment | Request an acknowledgment receipt for the payment. |

| Important Notes | – Prepayments are accepted between the 6th and 24th of each month. – It may take up to 7 working days for the prepayment to reflect in your loan account. |

Suggested Read: Impact on Home Loan Insurance During Home Loan Balance Transfer?

Why Does SBI Charge You on Making Home Loan Prepayment?

SBI, like other housing finance companies (HFCs), charges prepayment fees on home loans primarily for the following reasons:

| Reason | Explanation | Key Points |

|---|---|---|

| Compensation for Lost Interest | Lenders lose future interest income when loans are prepaid. | – Fee offsets financial loss from foregone interest. – Ensures recovery of anticipated revenue. |

| Administrative Costs | Prepayment involves documentation, verification, and record updates. | – Covers operational expenses. – Secondary reason compared to lost interest. |

| Regulatory Framework | HFCs (like PNB Housing) are regulated by NHB, not RBI. | – NHB permits prepayment fees forboth fixed and floating-rate loans. – RBI bans fees for banks’ floating-rate loans. – Borrowers must verify updated regulations. |

| Market Practices & Profit | Prepayment fees act as a revenue stream in competitive markets. | – HFCs may prioritize profitability. – Borrowers can negotiate terms or switch lenders. |

Suggested Read: Top 5 Banks for Home Loan Balance Transfer

When are Banks Not Allowed to Charge Prepayment Fees?

- Floating-Rate Home Loans (Individuals): RBI prohibits prepayment charges on floating-rate loans for individuals, allowing flexibility for partial and full prepayments.

- Government Scheme Loans: Loans under schemes like PMAY cannot have prepayment charges to promote affordable housing.

- Refinancing/Balance Transfer: Banks can’t charge prepayment fees when a loan is refinanced or transferred to another lender, except for standard processing fees.

Suggested Read: Toilet Directions as per Vastu

Things to Consider While Making SBI Home Loan Prepayment

- Loan Type: Check if you have a fixed or floating rate loan to determine if prepayment charges apply.

- Prepayment Charges: Fixed-rate loans may attract a 2% charge on the outstanding principal for loan transfer.

- Partial vs. Full Prepayment: Partial prepayment reduces EMI or tenure, full prepayment eliminates the loan entirely.

- Loan Tenure Impact: Prepayment can shorten your tenure or reduce your EMI.

- Prepayment vs. Investing: Consider if investing the prepayment amount gives higher returns than saving on interest.

- Tax Implications: Prepayment may reduce home loan interest deductions under Sections 80C and 24(b).

- CIBIL Score Impact: Prepayment might temporarily affect your credit score.

- Emergency Fund: Ensure sufficient funds remain after prepayment for unforeseen expenses.

- Loan Agreement Terms: Review your agreement for any specific prepayment penalties or conditions.

- Long-Term Financial Goals: Align prepayment with your broader financial strategy and goals.

- EMI and Interest Reduction: Prepayment reduces both your EMI and total interest payable.

- Loan Balance: Ensure the prepayment amount is sufficient to meet your financial objectives.

Suggested Read: Can Home Loan Balance Transfer Backfire?

When is it the Right Time to Make Home Loan Prepayment?

- When interest rates on your loan exceed potential returns from investments (e.g., stock markets, FDs).

- After building an emergency fund (3–6 months of expenses) and clearing high-interest debts.

- When prepayment penalties are low or waived (e.g., RBI prohibits banks from charging fees on floating-rate home loans for individuals).

- To shorten loan tenure significantly (prioritize prepayment if reducing tenure aligns with financial goals like retirement).

- If tax benefits (e.g., Section 24 deductions) are no longer a priority (prepayment reduces interest, lowering tax savings).

Suggested Read: Mutual Funds vs. Rental Income

Home Loan Part Pre Payment vs. Full Pre Payment

Here’s a concise comparison of Home Loan Part Prepayment vs. Home Loan Full Prepayment in a tabular format:

| Criteria | Part Prepayment | Full Prepayment |

|---|---|---|

| Definition | Paying a portion of the outstanding loan amount before tenure ends. | Paying the entireremaining loan balance to close the loan immediately. |

| Impact on Loan | Reduces tenure(if EMI unchanged) or lowers EMI(if tenure unchanged). | Loan is closed permanently; no further EMIs or interest. |

| Key Benefit | Saves interest over the loan term; retains liquidity for other needs. | Eliminates debt entirely; improves cash flow post-closure. |

| Processing Fees | Lower or nil fees (varies by lender). May have annual prepayment limits. | Higher fees (e.g., 1–3% of outstanding amount). Some lenders waive fees. |

| Tax Implications | Tax benefits on interest (if applicable) continue for the reduced tenure. | Tax benefits (e.g., Section 24/80C in India) cease post-closure. |

| Eligibility | Allowed multiple times (subject to lender terms). No lock-in period in most cases. | One-time closure. Requires sufficient funds to settle the entire balance. |

| Example | Loan: ₹50L @ 8% for 20 years. Part-prepay ₹10L → Tenure reduces to ~15 years. | Loan: ₹50L outstanding. Full prepayment closes the loan, saving ₹XXL in future intere |

Suggested Read: Can You Pay Rent to Your Parents and Claim HRA?

Advantages and Disadvantages of Home Loan Prepayment

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Interest Savings | Reduces overall interest paid over the loan tenure. | May not be ideal if the prepayment does not significantly reduce interest. |

| Loan Tenure | Shortens the loan tenure, allowing you to repay the loan faster. | Could lead to a higher monthly EMI if the loan tenure is reduced. |

| Financial Freedom | Provides peace of mind and reduces debt burden. | Might strain finances if the prepayment amount is large. |

| Credit Score Improvement | Can boost credit score by reducing outstanding debt. | Prepayment might temporarily lower liquidity. |

| Flexibility in Loan Terms | Offers the option to re-adjust loan tenure or EMI based on new principal. | Could incur prepayment penalties, especially in fixed-rate loans. |

| Opportunity for Investment | Frees up funds for other investments once the loan is repaid earlier. | Potential opportunity loss if funds used for prepayment could have been invested elsewhere for better returns. |

Suggested Read: Cities for Profitable Airbnb Investment in India

Conclusion

Before considering prepayment, eliminate high-interest debts and secure an emergency fund. Prepaying your home loan can be beneficial if you aim to own your home sooner or decrease interest expenses.

If you’re considering a home loan balance transfer, trust Credit Dharma to find the perfect solution for you.

Frequently Asked Questions

Prepayment can lead to a reduction in the loan tenure and/or EMIs, depending on the option the borrower chooses. By reducing the principal amount, the interest component decreases, allowing for these adjustments.

Prepaying a home loan can reduce liquidity, incur opportunity costs from foregone investment returns, lead to prepayment penalties, potentially affect your credit score, decrease tax benefits, and reduce financial leverage, so it’s crucial to weigh these risks against the benefits.

Yes, you can make prepayments on your home loan every month, provided your lender allows frequent prepayments without penalties.

Deciding between prepayment or continuing with a home loan depends on your financial situation. Prepayment can save on interest costs but may deplete your cash reserves. Consider your financial goals and consult with a financial advisor to make an informed decision.

It calculates how prepayments impact your loan tenure, showing how early you can finish repayments by making extra payments.

Prepayment may reduce tax benefits under Sections 24(b) and 80C for interest and principal payments.

Provides accurate, instant results, saves time, and reduces the risk of calculation errors.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan