Your business’s new potentials can be tapped into with the right financial assistance. If you are a new startup or an existing small business owner, obtaining the capital can transform your spending power.

This guide will assist you in the straightforward and stress-free process of applying for SBI Mudra Loan so that you can grow and succeed with confidence.

SBI Mudra Loan Highlights

Here the the top highlights of SBI mudra loan:

| Feature | Details |

|---|---|

| Interest Rate | One-Year MCLR+2.75% |

| Facility | Term loan & working capital |

| Loan Amount | Upto ₹10 Lakhs |

| Loan Tenure | Up to 5 years (Loan amount < ₹5 Lakh) Up to 7 years (₹5 Lakh < Loan amount < ₹10 Lakh) |

| Processing Fee | 0.50% of the loan amount (+ applicable taxes) (For tarun loan (₹5 lakh to ₹10 lakh) |

SBI PM MUDRA & e- Mudra Yojana Eligibility Criteria

| SBI Mudra Loan Applicants | Condition |

|---|---|

| Micro-entrepreneurs | Involved in manufacturing, trading, or service sectors. |

| Businessman | Involved in agricultural activities related businesses |

| SBI Account Holders | Having SBI savings or current account for at least six months. |

Margin Requirements

| Loan Amount | Margin Requirement |

|---|---|

| Up to ₹50,000 | NIL |

| ₹50,001 to ₹10 lakh | 20% |

Collateral Requirement

No collateral is required, as the loans are covered under the Credit Guarantee Fund for Micro Units (CGFMU). However:

- For term loans: Hypothecation of plant and machinery is needed.

- For cash credit (CC): Hypothecation of stocks and receivables is required.

Additionally, all eligible borrowers under SBI Mudra Loan will receive an MUDRA RuPay Card, enhancing financial accessibility and flexibility for business transactions.

Also Read: SBI Home Loan Eligibility

SBI E-Mudra Loan – Interest Rates

The SBI Mudra Loan offers competitive interest rates, ensuring affordable financing for small businesses. While SBI has not officially disclosed fixed rates, they are linked to the Marginal Cost of Funds-Based Lending Rate (MCLR).

According to the SBI official website,

Interest Rate = One-Year MCLR+2.75%.

Check: MCLR Updated Rates

Get a SBI Mudra Home Loan

with Highest Eligibility

& Best Rates

Loan Amount & Repayment Tenure of SBI PM MUDRA Yojana

The SBI Mudra Loan is designed to provide financial assistance to small businesses and entrepreneurs, categorized based on loan amount and repayment tenure. The loan structure ensures flexibility and accessibility for different business needs.

Loan Categorization & Amount

| Category | Loan Amount |

|---|---|

| Shishu | Up to ₹50,000 |

| Kishor | ₹50,001 to ₹5 lakh |

| Tarun | ₹5,00,001 to ₹10 lakh |

| Tarun Plus (Proposed) | ₹10,00,001 to ₹20 lakh |

SBI e-Mudra Loan

For quick access to funds, SBI e-Mudra Loan offers:

- Instant loans up to ₹50,000 (subject to eligibility).

- Loan amounts up to ₹1 lakh with a maximum repayment tenure of 5 years.

These loans assist small-scale enterprises correctly plan their finances, while ensuring growth through sustainable repayment options.

Source: MUDRA Loan for Homestays Creates Opportunity

Processing Fee & Other Charges

When applying for SBI Mudra Loan, understanding the associated processing fees and charges is essential. Depending on the type of loan, the fees change, making them affordable for micro and small businesses.

Processing Fee Structure

| Loan Category | Processing Fee |

|---|---|

| Shishu (Up to ₹50,000) | Nil |

| Kishore (₹50,001 to ₹5 lakh) | Nil |

| Tarun (₹5 lakh to ₹10 lakh) | 0.50% of the loan amount (+ applicable taxes) |

For business who are seeking financial support, the zero processing fee for Shishu and Kishore loans ensures accessibility, while a nominal fee of 0.50% charge for Tarun loans keeps the financing cost-effective. These structured charges make it easier for small businesses to secure funding without excessive costs.

Also Read: SBI Home Loan Interest Rates 2025

Calculate Your Eligibility for SBI Mudra Home Loan

Documents Required for SBI Mudra Loan Application

Applying for SBI Mudra Loan requires submitting essential documents to verify business legitimacy and applicant eligibility. Whether applying online or offline, keeping the necessary paperwork ready ensures a smooth application process.

General Document Requirements

For online applications, documents must be in JPEG, PNG, or PDF format and not exceed 2MB in size. Applicants should provide a photocopy or scanned copy of any of the following:

- GST Registration Certificate

- Shop & Establishment Certificate

- Udyog Aadhaar

- Any other valid business registration document

SBI e-Mudra Loan Specific Documents

| Document Type | Requirement |

|---|---|

| Bank Details | SBI savings/current account number & branch details |

| Business Proof | Name, start date, and address of the business |

| Aadhaar Number | Must be linked to the bank account (UIDAI verified) |

| Community Details | General/SC/ST/OBC/Minority |

| Additional Proof | GSTN, Udyog Aadhaar, Shop & Establishment proof, or any business registration document (if available) |

Since SBI has not explicitly listed the documents required for SBI PM MUDRA Yojana, applicants are advised to visit their nearest branch for detailed guidance. Preparing the required documents in advance can enhance approval chances and expedite loan processing.

How to Apply for SBI E-Mudra Loan

Applying for SBI Mudra Loan online is a simple and hassle-free process. Follow these 7 easy steps to complete your application and secure funding for your business.

Steps to Apply Online

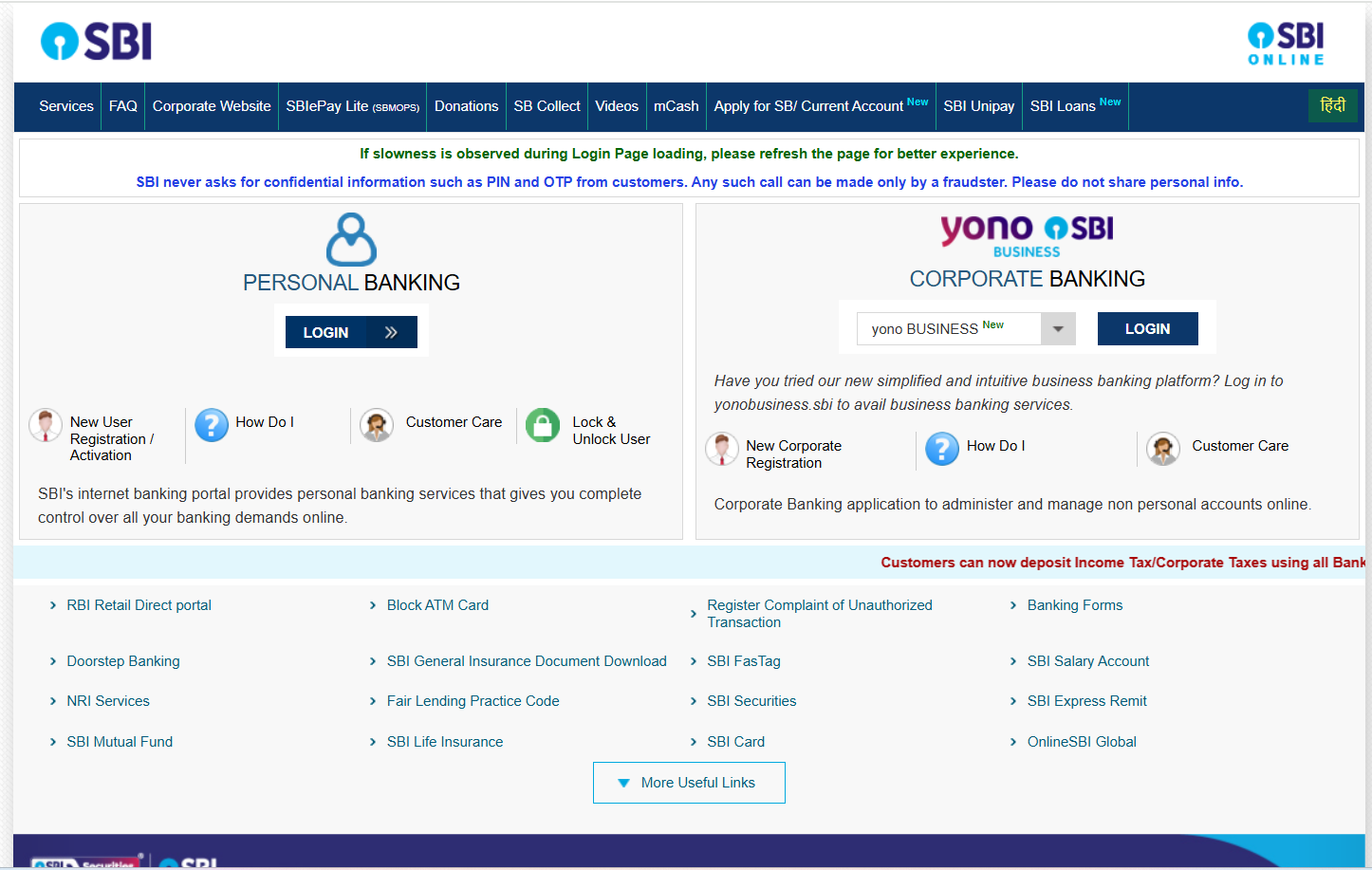

- Visit Official Website

– Visit the SBI e-Mudra Portal on the official SBI website.

- Apply Now

– Click on the ‘Apply Now’ button on the homepage to begin the application process.

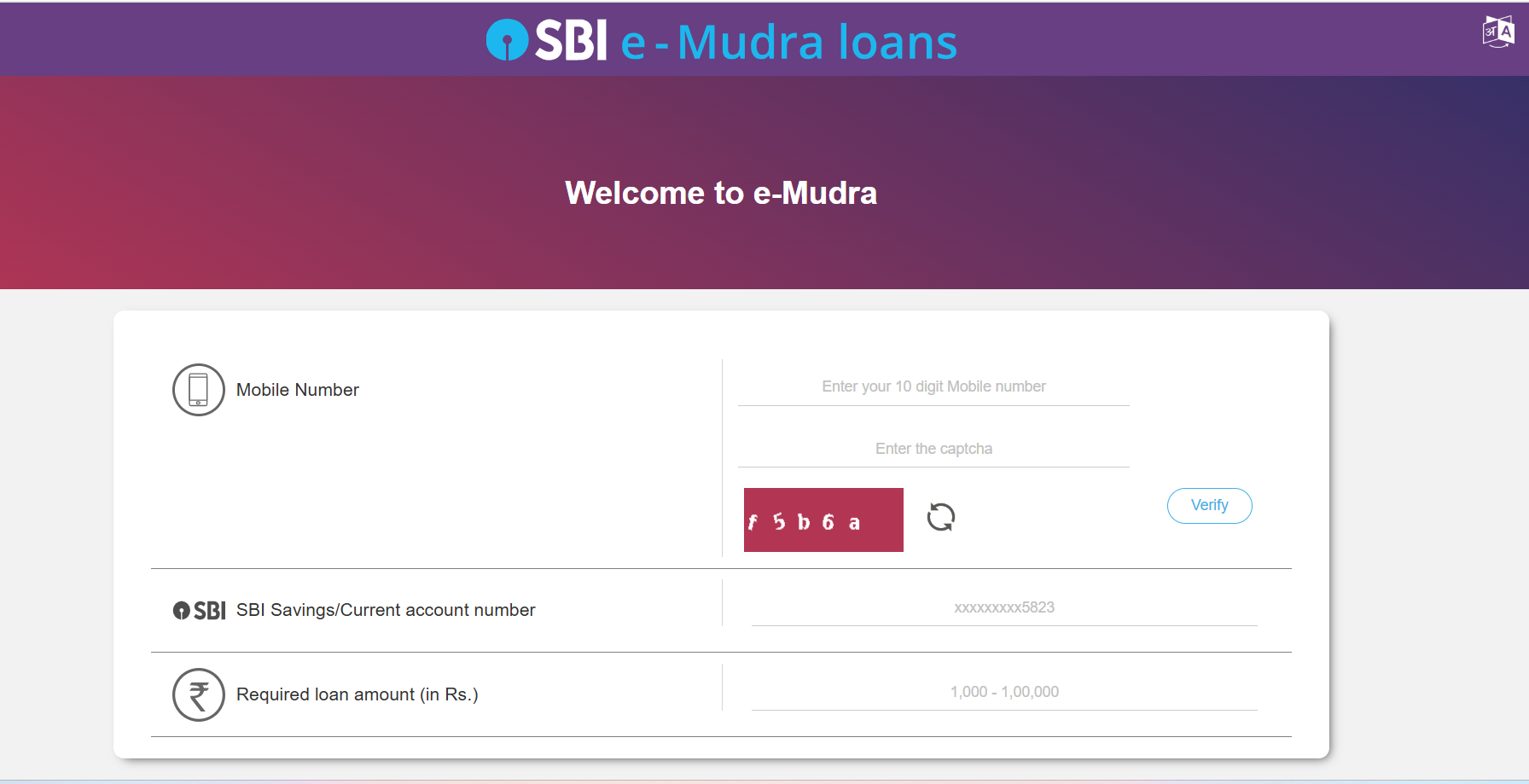

- Enter Details

– Enter your mobile number, SBI savings/current account number, and desired loan amount, then click ‘Proceed’.

- Fill Online Application Form

– Fill out the online application form with your business details and select relevant options from the dropdown menus.

- Upload Important Documents

– Upload the necessary documents, such as business registration proof, Aadhaar details, and GSTN (if applicable).

- Terms & Condition

– Accept the terms and conditions with an e-Sign by entering your Aadhaar number and verifying it with an OTP sent to your registered mobile number.

- Verification Process

– Once submitted, your application will be processed and verified by the bank. Upon approval, the loan amount will be disbursed directly into your SBI account.

Steps to Apply Offline

For those preferring an offline application, the process for securing an SBI Mudra Loan is simple and straightforward. Follow these 5 easy steps to apply at your nearest SBI branch.

1. Visit the nearest SBI branch that is eligible to offer MUDRA loans under PMMY, as per RBI guidelines.

2. Collect and fill out the SBI Mudra Loan application form with accurate business details. Attach the required documents and submit them at the bank counter.

3. Complete any additional loan formalities as directed by the bank officials.

4. The bank will verify your documents and application before approving the loan request.

5. Upon approval, the loan amount will be disbursed directly to your SBI bank account within the specified working days.

Alternatively, applicants can also apply through the Udyami Mitra portal for a streamlined loan application process.

Read More: How to Download SBI Home Loan Statement

Are you looking for lower interest rate home loans? Get expert consultation from Credit Dharma!

Benefits of SBI Mudra Loan for Small Businesses & Startups

To help small businesses and new enterprises grow with greater ease, the SBI Mudra Loan is structured as a financial aid. This scheme has the following key benefits.

| Feature | Details |

|---|---|

| 100% Digital Process | Online application with minimal paperwork. |

| No Collateral Required | Unsecured loan, no asset pledge needed. |

| Flexible Loan & Repayment | Loan from ₹50,000 to ₹10 lakh, tenure up to 5 years. |

| Competitive Interest Rates | Linked to MCLR for affordable credit. |

| Quick Approval & Disbursal | Fast verification and fund transfer. |

Get the Best SBI Mudra Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best SBI Mudra Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best SBI Mudra Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

The SBI Mudra Loan provides small businesses and startups with easy access to funding, helping them grow without financial hurdles. With flexible repayment, a digital application process, and no collateral requirement, it empowers entrepreneurs to expand confidently.

By fostering financial inclusion, it plays a key role in strengthening India’s MSME sector and economic growth.

Frequently Asked Questions

A Mudra Loan is a government-backed scheme under the Pradhan Mantri Mudra Yojana (PMMY) that provides financial support to micro and small enterprises in the manufacturing, trading, and service sectors with loan amounts up to ₹20 lakh, without requiring collateral.

While SBI has not specified a minimum CIBIL score, having a good credit history improves approval chances. A higher credit score (usually 650 and above) may help in securing better loan terms, including lower interest rates and higher eligibility.

Applicants can apply for an SBI Mudra Loan through offline mode by visiting the nearest SBI branch or via online platforms like the SBI e-Mudra portal and Udyami Mitra portal. The process varies based on loan amount and business eligibility.

Yes, borrowers can apply for a second Mudra Loan if they have successfully repaid the previous loan and meet eligibility criteria. However, approval depends on factors like business needs, repayment history, and bank policies regarding multiple loans.

The repayment tenure depends on the loan category. For Shishu loans (up to ₹50,000), tenure is up to 5 years. Kishore and Tarun loans (above ₹50,000) offer tenures up to 7 years, providing borrowers with flexible repayment options.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan