Introduction

Stamp duties and registration fees are crucial government-imposed taxes during property purchases or ownership transfers in Kolkata. These taxes ensure the transaction is legally valid and are essential to understand before making any property purchase.

Key Points:

- Importance: Ensures legal validity of transactions.

- Variation: Different rates across various states.

- Basis: Calculated on the property’s market value.

- Components: Includes document registration costs.

Impact on Property Expenses

These charges significantly affect overall property expenses. Mandated under Section 3 of the Indian Stamp Act, 1899, these fees authenticate sale agreements and maintain property records. The state government sets these fees, so it’s essential to know the local charges before purchasing.

Localized Knowledge

In Bengaluru, stamp duty and registration charges differ from other cities and states, highlighting the need for localized knowledge in real estate transactions.

Example Rates in Kolkata

| Location of the Property | Less than Rs.25 lakh | Above Rs.40 lakh |

|---|---|---|

| Corporation (Howrah or Kolkata) area | 6.00% | 7.00% |

| Notified area / Municipality / Municipal Corporation | 6.00% | 7.00% |

| Areas not included in the above-mentioned categories | 5.00% | 6.00% |

Registration fees: 1% for all categories

What are Registration Charges and Stamp Duty?

When buying a property in Kolkata, you must pay registration charges to the local government. These fees, which are a set percentage of your property’s price, officially document your new ownership. There’s also Stamp Duty, which acts as a tax on the property deal. It varies based on the property’s cost, location, and type.

Key Points:

- Registration Charges: Document new ownership officially.

- Stamp Duty: Confirms all paperwork is legitimate and recognized legally.

Get a Home Loan

with Highest Eligibility

& Best Rates

Primary Documents for Stamp Duty Payment

To complete the process, you need several key documents:

- Original Property Deed: Shows previous ownership, crucial for establishing the property’s chain of ownership.

- Government ID Proofs: Valid identification (e.g., passport, driver’s license, Aadhaar card) for all parties involved.

- PAN Card: Required for any property transaction exceeding a certain amount under tax laws.

- Property Registration Application: Filled out and submitted to the local registrar’s office to officially record the transaction.

Steps to Calculate Stamp Duty Charges in Kolkata

Calculating stamp duty charges involves several steps. Here’s a detailed guide:

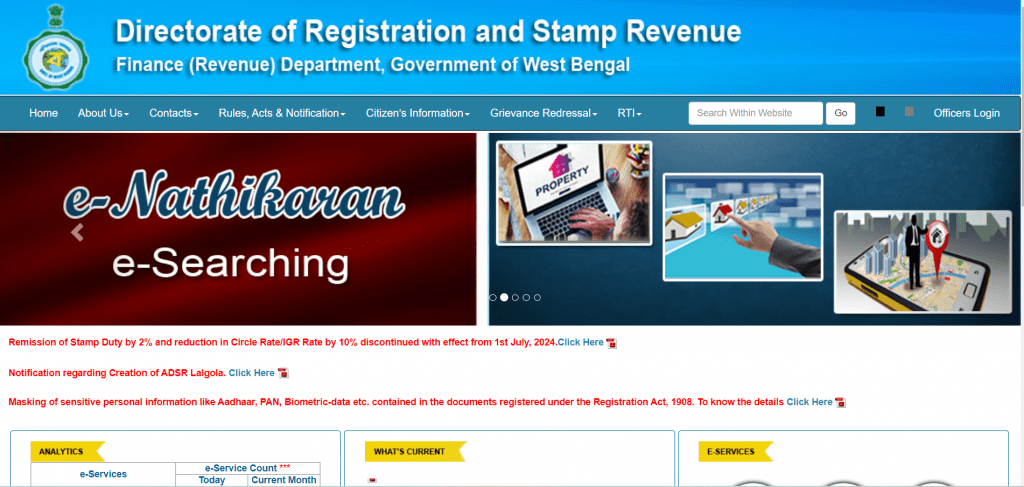

1. Visit the WB registration website.

2. Select the nature of the document from the drop-down menu.

3. Click on ‘Proceed’.

4. Enter the required details.

5. Click on ‘Calculate’.

Detailed Examples of Calculating Charges

Stamp Duty Calculation:

- Rate: 4%

- Property Value: Rs 10,00,000

- Calculation: Stamp Duty = (10,00,000 x 4%) = Rs 40,000

Registration Charges Calculation:

- Rate: 1%, capped at Rs 30,000

- Property Value: Rs 10,00,000

- Calculation: Registration Charges = (10,00,000 x 1%) = Rs 10,000

Conclusion

Understanding stamp duty and registration charges is vital when purchasing property in Kolkata, as these costs significantly affect your total expenses. Governed by Section 3 of the Indian Stamp Act, 1899, these fees ensure legal validity and proper documentation of property transactions.

- Stamp Duty: Varies from 2% to 6% based on property value and ownership structure.

- Registration Charges: Generally 1%.

Being aware of these charges and the steps to calculate them helps in better financial planning and avoiding surprises during property transactions.

For any queries, contact Credit Dharma’s team of experts.

Frequently Asked Questions

These charges authenticate the sale agreement and maintain official property records, ensuring the transaction is legally recognized.

Primary documents include the original property deed, government ID proofs (passport, driver’s license, Aadhaar card), PAN card, and a property registration application.

GST is not applicable on stamp duty and registration fees.

The stamp duty rate in Kolkata is 4% if your property value is below 25 lakh rupees. If your property value is more than the mark of 40 lakhs of rupees, 5% is the charge.

Typically, 1% of the property’s total market value is applied as the registration fee, though this amount can vary depending on the property type and location.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan