Keeping track of your home loan payments doesn’t have to be difficult. Tata Capital‘s online portal lets you effortlessly log in, view your loan details, and monitor repayment schedules in real-time.

No more visiting branches or long wait times; access your account instantly to manage EMIs and loan statements from the comfort of your home.

How to Login to Your Tata Capital Home Loan Account via Net Banking?

Managing your home loan is easier when you can access your account online. Logging in via net banking takes just a few steps. Whether you want to check your loan balance, view statements, or make payments, here’s how to get started quickly and securely.

Time needed: 2 minutes

Step-by-step guide for logging in to your Tata Capital home loan account via net-banking:

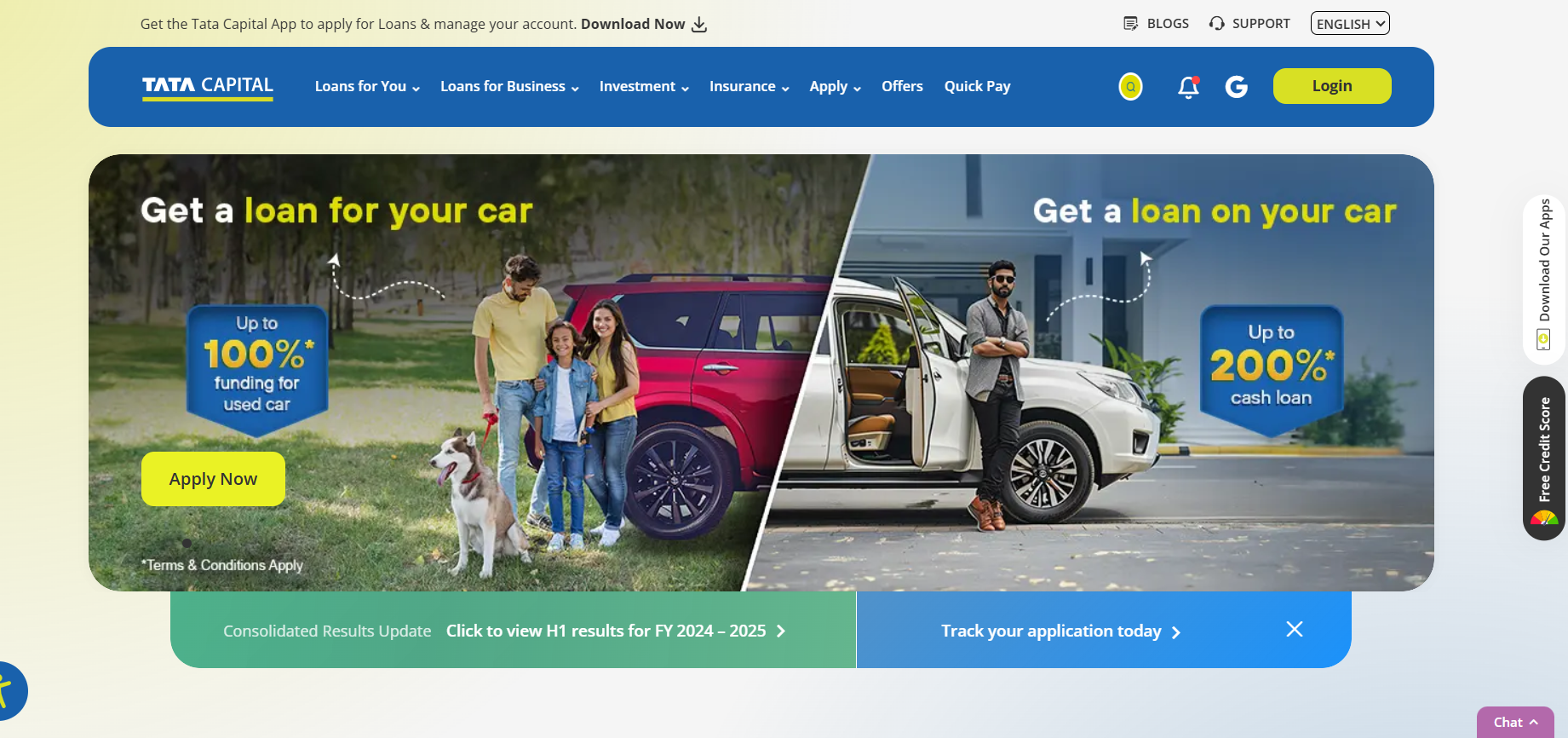

- Visit Tata Capital’s official website. Click on “Login”

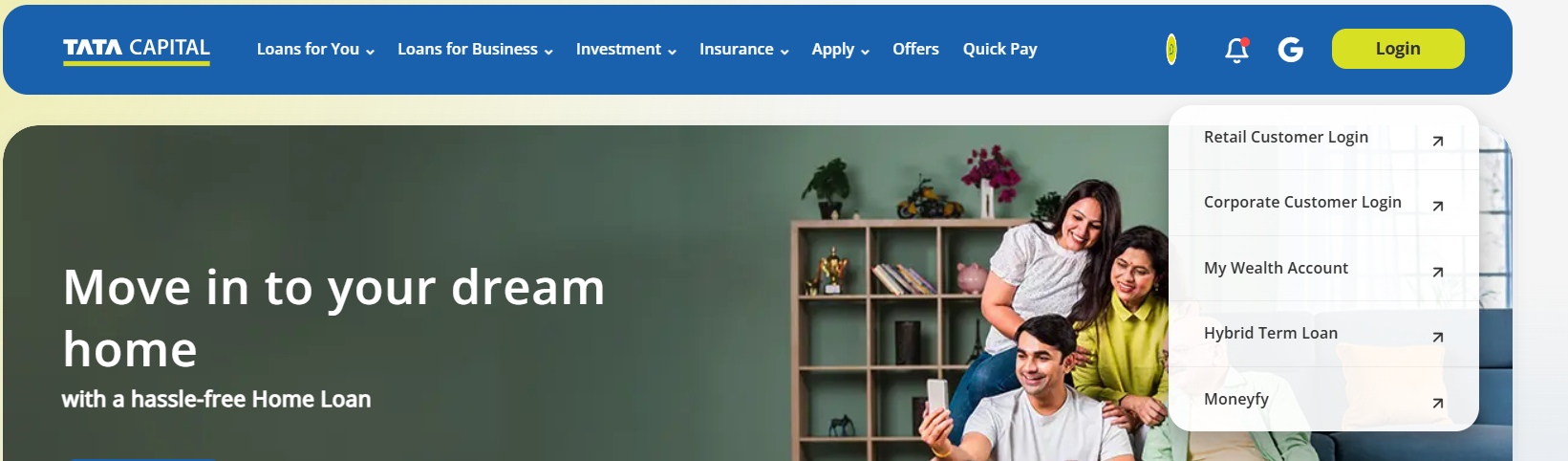

- Click “Login” at the top-right corner of the homepage. Select “Retail Customer Login” from the dropdown menu.

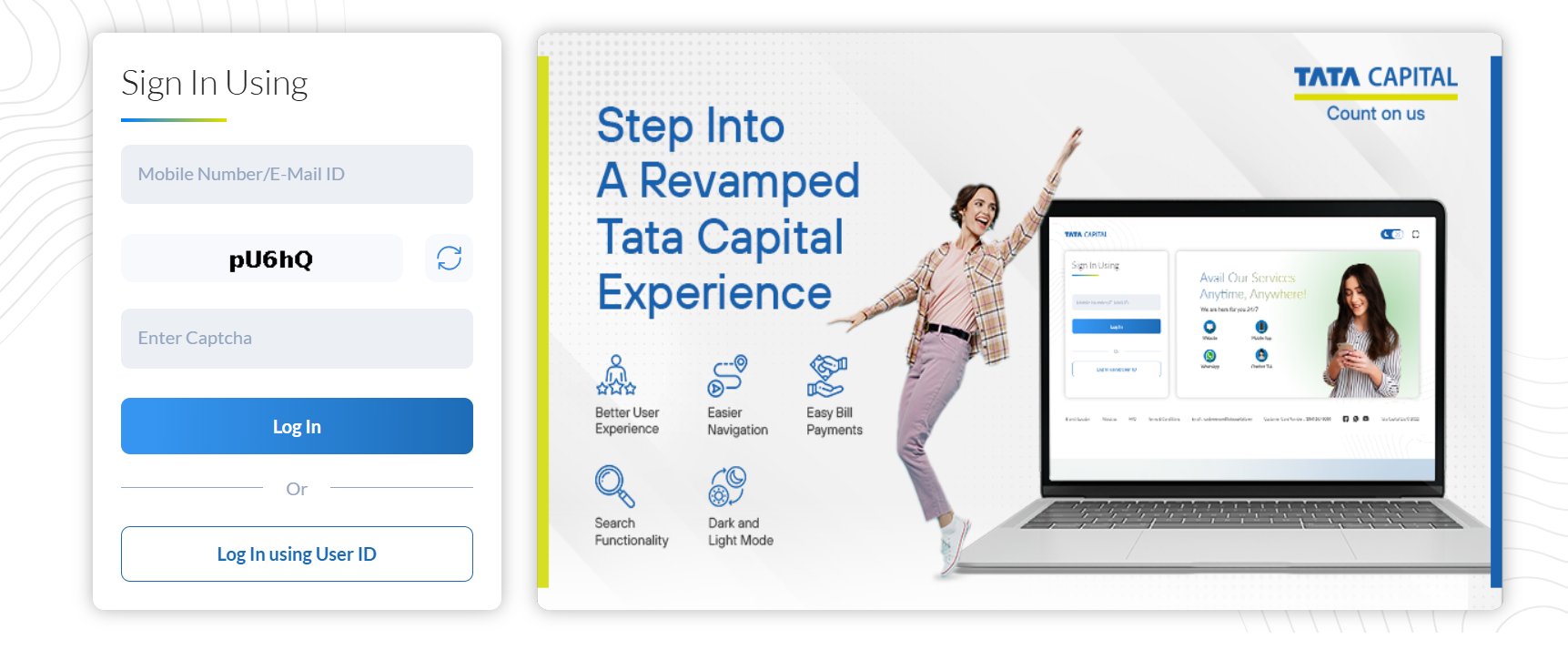

- Use your registered mobile number or email ID to register.

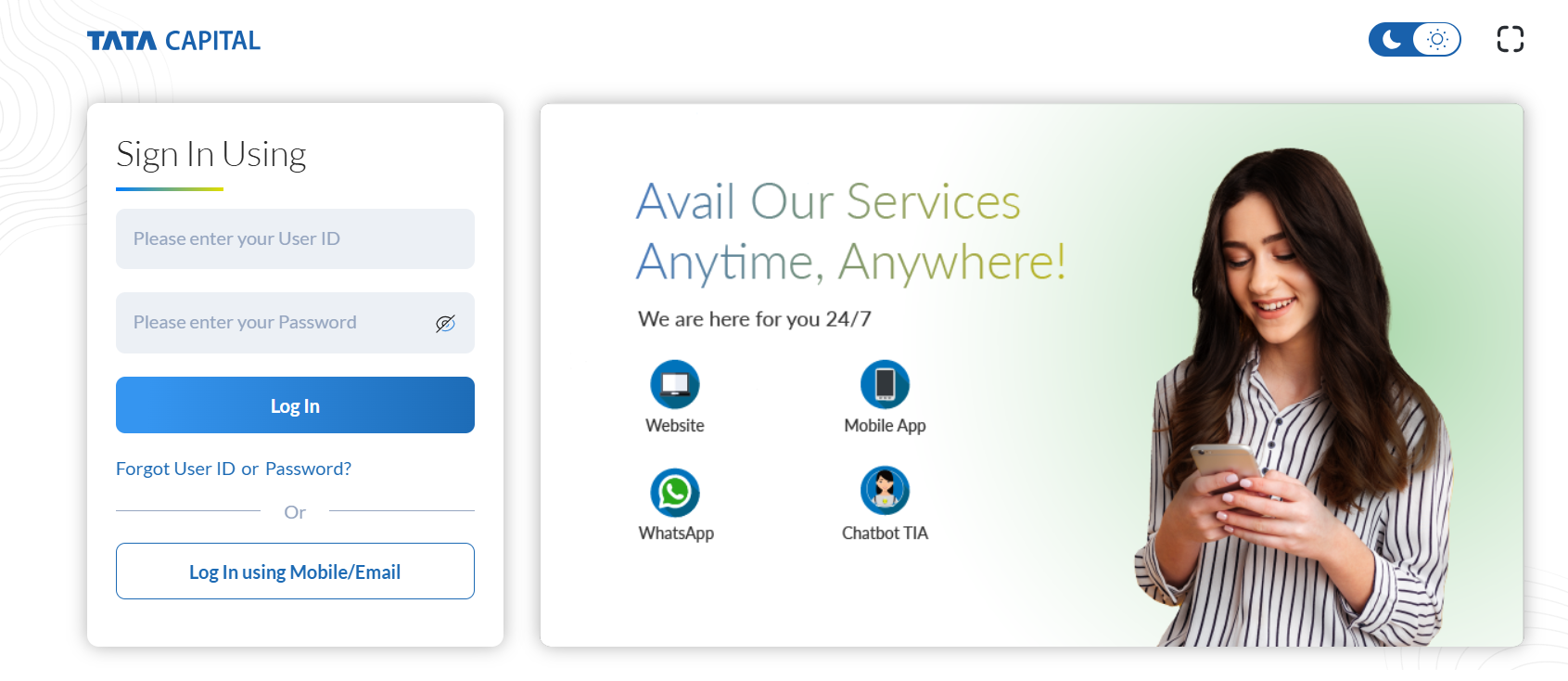

- Alternatively, you can also login using your user ID and password

Suggested Read: How do you view and download your Tata Capital home loan statement?

How to Login to Your Tata Capital Home Loan Account via Mobile Application?

- Download and install the official Tata Capital mobile app from your play store.

- Launch the app.

- Tap the “Login” button displayed on the welcome screen.

- Enter your registered mobile number, email, or user ID along with your password.

- Complete any additional authentication, such as entering an OTP.

- Access your account dashboard after successful login.

Features and Benefits of Tata Capital Home Loan Portal

- Apply for home loans online, eliminating the need for branch visits.

- Submit documents digitally with real-time verification and approval tracking.

- Use the EMI calculator and eligibility tools to estimate loan amounts and payments.

- View account details, schedules, and notifications on a personalized dashboard.

- Enjoy secure access with multi-factor authentication and data encryption.

- Experience paperless approvals with electronic signatures for faster processing.

- Receive real-time updates on application progress and repayment milestones.

Calculate your monthly home loan EMI (and amortization details) using our online EMI calculator.

Details Required for Tata Capital Home Loan Account Login

Before logging in, make sure you have the right information ready. From your loan account number to your password, we’ll list exactly what you need to access your account smoothly. No surprises—just straightforward prep!

| Category | Details |

|---|---|

| Login Credentials | Customer ID / User ID (provided by the bank at loan disbursal) Password (set by the user during registration) |

| Mobile Verification | Registered Mobile Number (linked with the bank account) One Time Password (OTP) (received on registered mobile/email) |

| Email Verification (optional but common) | Registered Email ID (for OTP verification or account recovery) |

| Personal and Loan Details | Loan Account Number Customer Identification File (CIF Number) (sometimes mandatory) Date of Birth (DOB) of the account holder Permanent Account Number (PAN) EMI Amount (sometimes used as a verification detail) |

| Security Verification | Security Questions & Answers (set during initial account setup, often used for password recovery) |

Troubleshooting Tata Capital Home Loan Login Issues

Forgot your password? Facing an error message? Login issues can be frustrating, but most have quick fixes. We’ll cover common problems and solutions, so you can resolve them without stress. Let’s get you back into your account!

Forgotten Login Password

- Navigate to the Tata Capital login page.

- Click on the “Forgot Password” or similar recovery link.

- Enter your registered email ID or mobile number as prompted.

- Follow the instructions sent to your email or SMS to reset your password.

Account Access Issues

- Check if your account is temporarily locked due to multiple failed attempts and contact support if needed.

- Clear browser cache/cookies, try another browser/device, and disable blocking extensions.

- Verify the portal’s operational status via service alerts or maintenance notifications.

- Ensure network/firewall settings aren’t blocking access; test with a different network.

- Update your browser to the latest version for compatibility.

- Contact Tata Capital support with account details and error messages if issues persist.

Best Security Practices for Your Tata Capital Home Loan Account

- Use a strong, unique password with a mix of letters, numbers, and symbols, and update it periodically.

- Enable two-factor authentication (2FA) for an added layer of security during login.

- Avoid phishing scams by verifying emails/SMS and never sharing OTPs, passwords, or personal details.

- Monitor transactions regularly via the official portal/app and report suspicious activity immediately.

- Secure devices and networks with antivirus software, updates, and avoid public Wi-Fi for account access.

Suggested Read: Check out the official customer care contact details for Tata Capital Home Loans.

Conclusion

Managing your Tata Capital home loan account online is convenient, secure, and hassle-free. With easy login options, simple registration steps, and efficient troubleshooting methods, the online portal ensures you have full control over your loan details anytime, anywhere. By practicing recommended security measures, you further safeguard your account from potential threats.

Frequently Asked Questions

If you’ve forgotten your password, click on the ‘Forgot Password’ link on the login page. Follow the prompts to reset your password securely.

Yes, Tata Capital offers the ‘Tata Capital Loan & Wealth App’ for both Android and iOS devices, allowing you to manage your home loan account on the go.

Yes, by logging into your Tata Capital account, you can view the status of your home loan application and track its progress.

Yes, once logged in, you can access and download your home loan statements from the ‘Statements’ section for your records.

Yes, Tata Capital employs advanced security measures to protect your data, including encryption and secure login protocols.

Yes, after logging in, you can apply for a top-up loan by navigating to the ‘Loan Services’ section and selecting ‘Top-Up Loan’.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan