When it comes to repaying your home loan, Tata Capital understands that flexibility is key. They offer a range of repayment options designed to make your financial journey smoother.

From standard EMI plans to unique options tailored to your income patterns, Tata Capital home loan gives you the ability to choose the plan that works best for your lifestyle and repayment capacity, ensuring stress-free home loan management.

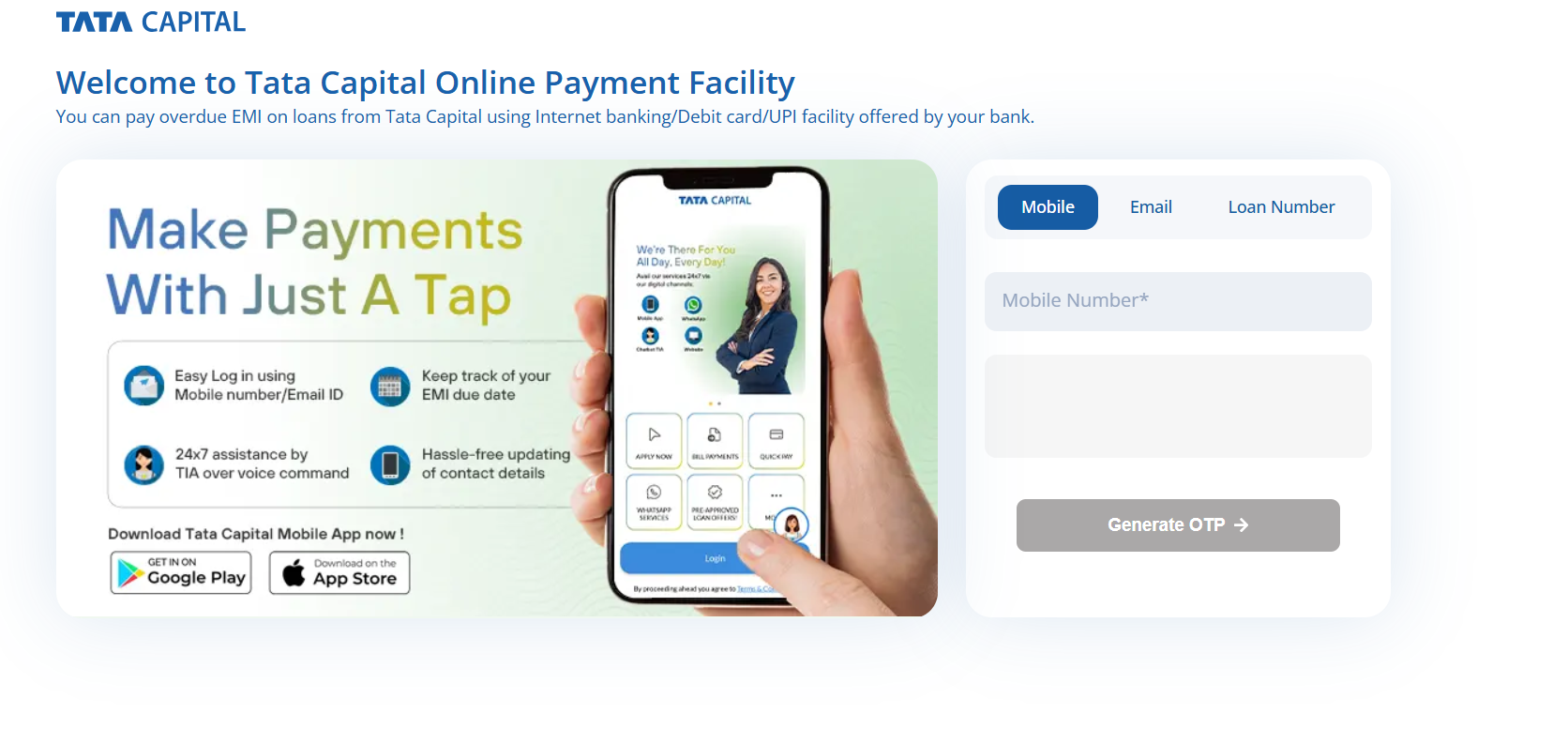

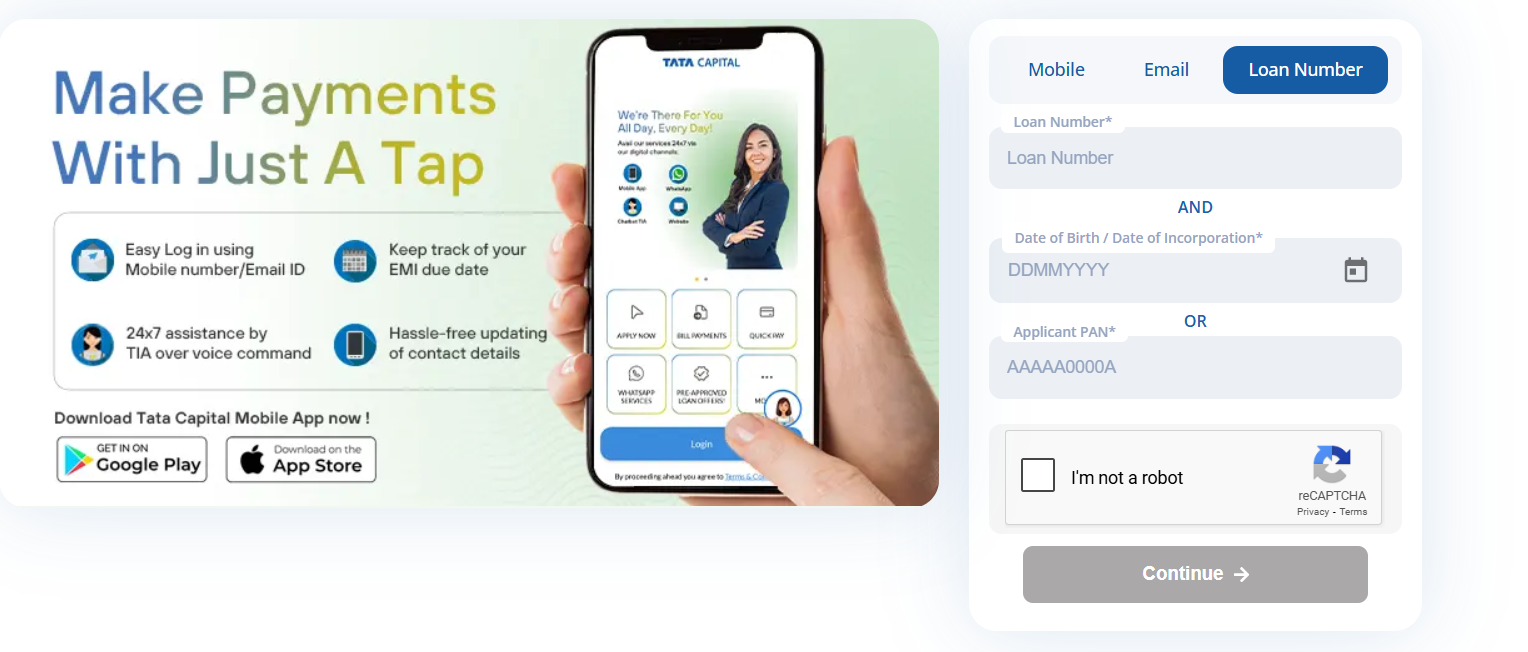

How to Repay Tata Capital Home Loan EMI Online via Official Website?

Time needed: 2 minutes

Step-by-step guide for repaying your Tata Capital home loan online:

- Visit the Tata Capital Online Payment Portal.

- Enter your Loan Account Number/ Registered Mobile Number/ Email ID.

- Click on “Get Payable Amount” to view your due EMI.

- Choose a payment method—Net Banking, Debit Card, or UPI.

- Proceed to complete the payment securely.

How to Repay Tata Capital Home Loan EMI Online via Mobile Application?

- Download the Tata Capital App from the Google Play Store or Apple App Store.

- Log in with your credentials or register if you’re a new user.

- Navigate to the “Bill Payments” section.

- Select your home loan account to view the EMI due.

- Choose your preferred payment method—Net Banking, Debit/Credit Card, or UPI—and complete the transaction.

Also Read: Check your monthly home loan EMIs with a Tata Capital Home Loan.

How to Repay Tata Capital Home Loan EMI Online via UPI Applications?

To repay your Tata Capital Home Loan EMI online via UPI, follow these steps:

Prerequisites:

- Ensure your bank account is UPI-enabled and linked to a UPI app (e.g., Google Pay, PhonePe, BHIM, Paytm).

- Have your Tata Capital loan account details handy.

- Sufficient funds in your UPI-linked bank account.

Step-by-Step Process:

- Open the UPI application on your mobile device.

- Navigate to the ‘Loan EMI Payment’ section.

- Select ‘Tata Capital’ as your lender.

- Enter your Loan Account Number.

- Click on ‘Get Payable Amount’ to fetch your EMI details.

- Choose your preferred payment method (e.g., UPI, debit card, credit card, Paytm Wallet).

- Complete the payment and save the receipt for your records.

How to Repay Tata Capital Home Loan EMI Offline?

If you’re someone who prefers making payments in person, Tata Capital also offers multiple offline options to repay your home loan EMI. These methods are safe, widely accepted, and can be done by visiting authorized branches or through simple banking channels.

| Modes of Offline Payment | Steps & Key Details |

|---|---|

| Post-Dated Cheques (PDCs) | – Submit a series of cheques to Bajaj Housing Finance at the start of your loan. – Ensure the cheque date and amount match the EMI schedule. – Mention loan account number on the back. – Collect acknowledgement receipt. |

| Electronic Clearing Service (ECS) | – Fill out the ECS mandate form at your bank. – Submit it to Bajaj Housing Finance with bank details. – Monthly EMI auto-debited from your account. – No manual effort required every month. |

| NACH Mandate | – Fill and sign the NACH form. – Authorizes automatic EMI deductions. – Submit it at the branch or through your bank. – Secure and hassle-free recurring payment method. |

| Cash Payment at Branch | – Visit the nearest Bajaj Housing Finance branch. – Make payment in cash for the EMI amount. – Get an official payment receipt. – Useful for one-time or overdue payments. |

| Cheque/Demand Draft (DD) | – Write cheque/DD in favor of “Bajaj Housing Finance Limited.” – Mention your loan account number on the back. – Drop it at the branch or authorized collection point. – Always collect a receipt for confirmation. |

Suggested Resource: Check Tata Capital Home Loan Customer Care Contact Details.

Tata Capital Home Loan Repayment Options

When you take a home loan, knowing your repayment options helps you manage finances better. Tata Capital offers flexible ways to repay your loan:

1. EMIs (Equated Monthly Instalments)

- You repay the loan in fixed monthly instalments.

- Each EMI includes both principal and interest.

- EMIs are auto-debited from your bank account on a set date.

- You can choose a repayment tenure that suits your budget — longer tenure means smaller EMIs, but higher total interest.

2. Part Prepayment

- You can pay a lump sum amount (more than your EMI) toward the loan.

- Helps reduce the outstanding principal faster.

- Leads to either lower EMIs or a shorter loan tenure.

- Tata Capital usually does not charge fees for part prepayment if it’s a floating-rate loan taken by an individual.

3. Foreclosure (Full Loan Prepayment)

- You can repay the entire outstanding loan amount before the end of tenure.

- Saves you from paying future interest.

- Ideal when you have a surplus of funds.

- Like part payment, foreclosure charges are usually nil for floating-rate individual loans.

Suggested Read: How Does Foreclosure Affect Your Home Loan Interest?

Tata Capital Home Loan Pre-Payment Charges

You can pay extra lump sum amounts toward your home loan before the end of the tenure. Or if you decide to close your home loan before the tenure ends, Tata Capital allows foreclosure with specific terms based on your loan type and purpose:

| Interest Rate Category | Eligible Borrowers | Charges for Full Early Closure* | Partial Repayment Fees |

|---|---|---|---|

| Floating Rate | Individuals and Non-Individuals (including co-borrowers) | – Complete payout via personal funds – Transfer of balance to another lender | – Part-prepayments using own resources |

| Fixed Rate | Individuals and Non-Individuals (including co-borrowers) | 2% plus applicable GST | (For loans that begin with a fixed rate but later shift to floating, any charges for early closure or partial payment follow the floating-rate terms then in effect.) |

GST (Goods and Services Tax) is levied at the prevailing government rate.

Factors to Consider When Choosing a Home Loan Repayment Options

- Monthly Budget: Choose an EMI that fits comfortably within your monthly income.

- Loan Tenure: A longer tenure reduces EMI but increases total interest outgo.

- Interest Rate Type: Fixed rates offer stability; floating rates may help save if rates fall.

- Prepayment Flexibility: Check if part prepayment or foreclosure is allowed without penalty.

- Income Stability: Opt for flexible plans if your income is variable or business-based.

- Future Financial Goals: Align your repayment plan with other financial commitments.

- Total Interest Payable: Compare repayment options based on total interest over the loan term.

- Charges & Fees: Be aware of hidden costs like processing fees, foreclosure charges, etc.

- Lender’s Terms: Always review the fine print of repayment clauses before signing.

Is it Better to Prepay your Home Loan or Invest in a Mutual Fund?

| Factors | Home Loan Prepayment | SIP Investment |

|---|---|---|

| Interest Rate vs. Returns | Compare your home loan interest rate (post-tax) with SIP returns. – If loan rate > SIP returns (e.g., loan at 12% vs. SIP at 8%), prepay. – If SIP returns > loan rate (e.g., loan at 8% vs. SIP at 10–12% long-term), invest. | Historically, equity SIPs average 10–12% returns over 5+ years. Returns are market-dependent and not guaranteed. |

| Tax Implications | Loss of tax deductions on home loan interest (if applicable). | Tax-efficient if investing in equity (LTCG taxed at 10% post-₹1 lakh exemption). ELSS SIPs offer tax deductions under Section 80C. |

| Risk Tolerance | No risk: Guaranteed savings via reduced interest. | Market risk: Volatile in short-term but potential for higher long-term gains. |

| Financial Goals | Prioritize becoming debt-free (short-term goals). | Build wealth for long-term goals (retirement, education). |

| Job Security/Income | Safer if income is unstable. | Requires stable income to withstand market volatility. |

| Age/Life Stage | Better for those nearing retirement (debt reduction). | Ideal for younger investors (long compounding horizon). |

| Emotional Factor | Peace of mind from reduced debt burden. | Motivation from growing wealth and financial freedom. |

| Loan Tenure Impact | Prepay early to save more interest. Partial payments reduce tenure. | No direct impact on loan; focus on wealth creation. |

| Emergency Fund | Ensure 6–12 months of expenses saved before prepaying. | Ensure emergency funds exist before investing. |

| Future Credit Needs | Closing a loan may affect credit mix/score. | Maintaining a loan in good standing boosts credit score. |

| Expert Opinion | – Prepay if the loan rate is high (e.g., 12–15%). – Avoid prepayment if leveraging low-interest loans for real estate gains. | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield higher corpus over 20+ years. |

Key Takeaways

Prepay If :

- Loan interest rate > SIP returns (post-tax).

- You prioritize stability and debt freedom.

- Uncertain income or nearing retirement.

Invest in SIP If :

- SIP returns > loan rate (e.g., equity SIPs over 8–10% loan rates).

- Comfortable with market risk and focused on long-term wealth.

- Younger with stable income and a 5–10+ year horizon.

Example :

- A ₹50 lakh loan at 9% (20 years) costs ₹76 lakh total. Prepaying ₹5 lakh early saves ₹12+ lakh in interest.

- Investing ₹25,000/month via SIP averaging 12% returns yields ₹3.5 crore in 20 years.

Suggested Resource: Investment vs Prepayment Calculator

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Question

To prepay your Tata Capital home loan, you can initiate an online fund transfer to the designated account provided by Tata Capital. After completing the transfer, send the transaction details, including the UTR number, to Tata Capital’s customer care via email.

Tata Capital does not levy prepayment charges when you repay your home loan using your own funds. However, if the prepayment is made using funds from another financial institution, charges may apply. It’s advisable to review your loan agreement or contact Tata Capital directly for detailed information.

For floating interest rate loans, changes in the RBI’s repo rate can influence your home loan interest rates, potentially altering your EMI amounts. However, fixed-rate loans remain unaffected by such changes.

Yes, after making a part-payment, you can choose to either reduce your EMI amount or shorten your loan tenure. It’s generally advisable to opt for reducing the tenure while keeping the EMI constant, as this approach can lead to significant interest savings over the loan period.

You can access your home loan account statement by logging into Tata Capital’s customer portal or mobile app. Alternatively, you can request the statement by visiting a Tata Capital branch or contacting their customer service.

If you’re facing financial difficulties, it’s crucial to communicate with Tata Capital promptly. They may offer solutions such as restructuring your loan or providing a temporary relief period. Avoiding communication can lead to penalties and negatively impact your credit score.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan