In today’s ever-changing financial world, managing your home loan efficiently is more important than ever. Tata Capital’s Home Loan with Overdraft offers a fresh, practical approach that combines the benefits of a home loan with the flexibility of an overdraft. It’s designed to help homeowners not only save on interest but also gain easy access to funds when needed—without the hassle of additional paperwork.

By making extra deposits into your loan account, you can reduce the outstanding balance and lower your interest payments, giving you more financial freedom. Here’s how this unique offering can empower you to take control of your home loan and make the most of your money.

Tata Capital Home Loan with Overdraft Highlights

Get a quick glance at the key features—interest rate, loan amount, tenure, and processing fees—to decide if this loan suits your needs.

| Categories | Highlights |

|---|---|

| Interest Rate | 8.75% p.a. onwards |

| Loan Amount | ₹5 Lakh to ₹2 Crore |

| Tenure | Up to 15 Years |

| Processing Fees | Up to 2% of the Loan Amount + GST |

Suggested Read: Tata Capital Home Loan Interest Rates 2025

Tata Capital Home Loan with Overdraft Interest Rates 2025

Explore the interest rates for salaried individuals and self-employed professionals to understand your potential EMI.

| Employment Type | Interest Rates |

|---|---|

| Salaried Individuals | 10.20% p.a. onwards |

| Self Employed Professionals | 10.20% p.a. onwards |

Suggested Read: Will Home Loan Interest Rates Go Down in 2025?

Tata Capital Home Loan with Overdraft Eligibility Criteria

Ensure you meet the age, credit score, and employment status requirements before applying for the loan.

| Eligibility Criteria | Details |

|---|---|

| Age | You must be between 24 to 65 years old. |

| Existing Home Loan | You must have taken a home loan from Tata Capital against a housing property. |

| Employment Status | You should be a salaried professional or a self‑employed individual. |

| Credit Score | Your credit score should be 750 or more to qualify for the loan. |

Suggested Read: Home Loan Eligibility for Salaried vs. Self Employed

Tata Capital Home Loan with Overdraft Documents Required

Prepare the necessary identity, income, and employment documents to streamline your loan application process.

Identity Proof

These documents verify your personal information and help confirm your age, identity, and address.

| Document Type | Details |

|---|---|

| Age Proof | Passport/ Driving License/ Life Insurance Policy/ Birth Certificate/ PAN Card/ School Leaving Certificate |

| Photo Identity Proof | Voter ID Card/ Passport/ Driving License/ Aadhaar Card/ PAN Card. |

| Address Proof | Utility Bill/ Bank Statement/ Property Registration Documents/ Property Tax Receipt/ Voter ID Card. |

| Employment Proof | Salaried persons: Recent salary slips Self-employed individuals: Business proof documents like Income Tax Returns/ Business Registration Certificate. NRIs: Pay slips for last 6 months, appointment letter/ previous employment history. |

Suggested Read: Home Loan without Property Documents

Income Proof

Income documents help Tata Capital assess your repayment capacity.

| Document Type | Details |

|---|---|

| Income Proof | Salaried Persons: Salary slips for the last three months Self-employed: Proof of income, such as profit & loss statements, or business tax returns. NRIs: Overseas salary account details (NRE/NRO). |

| Existing Loan Details | If you have any existing loans, provide loan account statements from your bank to ensure the new loan doesn’t exceed your capacity to repay. |

Other Documents

These additional documents complete your loan application and verify your financial history.

| Document Type | Details |

|---|---|

| Processing Fee Cheque | A cheque to cover the processing fee for the loan application. |

| Credit Report | Your credit score is a key part of the loan approval process. Ensure you submit the Credit Report showing your current financial history. |

Suggested Read: NRI vs. Indian Home Loan Property Documents

Tata Capital Home Loan with Overdraft Processing Fees

Understand the processing fees involved, so you know exactly what costs to expect upfront.

| Fees Type | Charges |

|---|---|

| Processing Fees | Up to 2% of the Loan Amount + GST |

Check Out: Home Loan Overdraft Calculator

Tata Capital Home Loan with Overdraft Other Charges

Be aware of any additional charges, such as overdue or statutory fees, that could impact your repayment schedule.

| Fees Type | Charges |

|---|---|

| Statutory Charges | As applicable in the respective States |

| Overdue Charges /Late Payment Charges (Dropline OD) | 24% p.a. |

How to Apply to Tata Capital Home Loan with Overdraft?

The online application process is simple—fill in your details, upload documents, and wait for your e-sanction.

- Visit the Tata Capital official website.

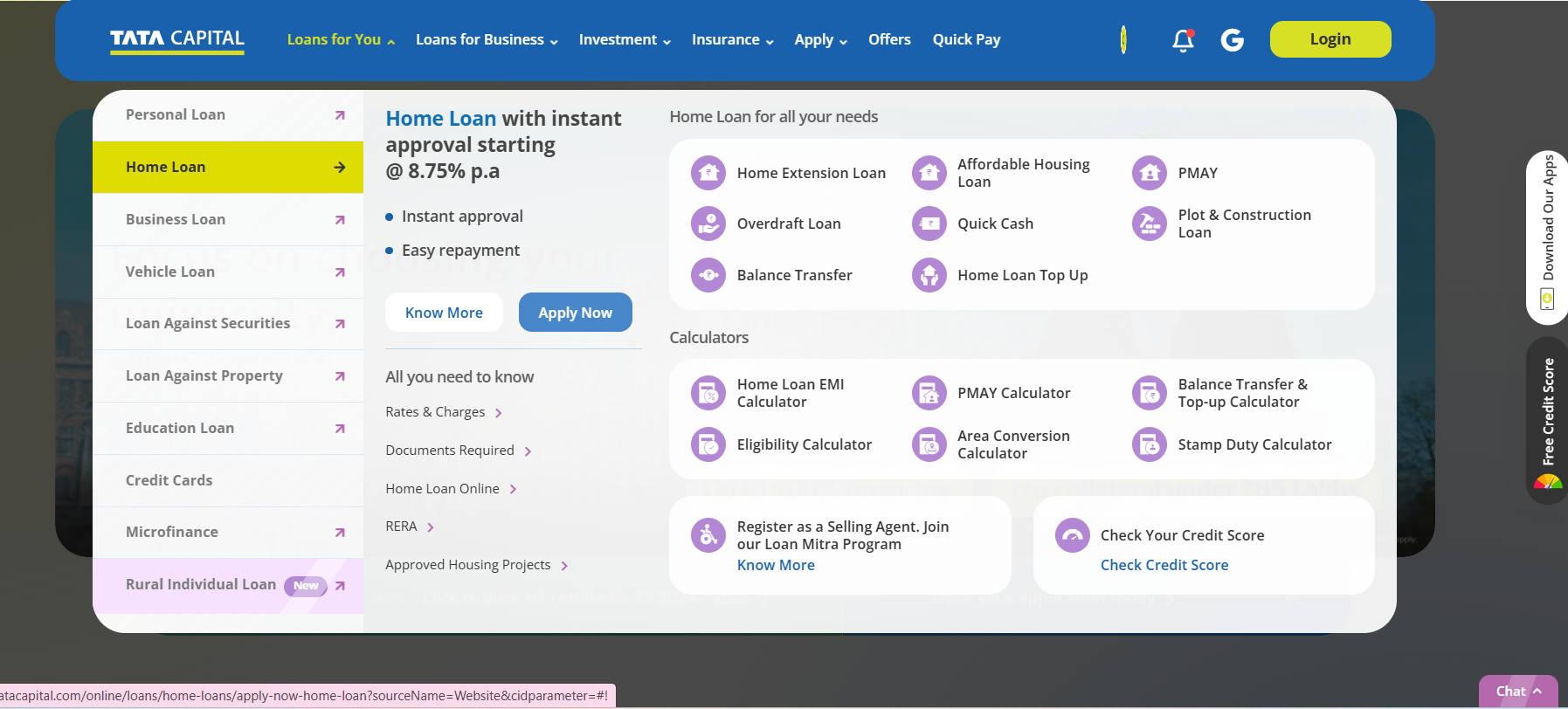

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Overdraft > Apply Now” to begin your application.

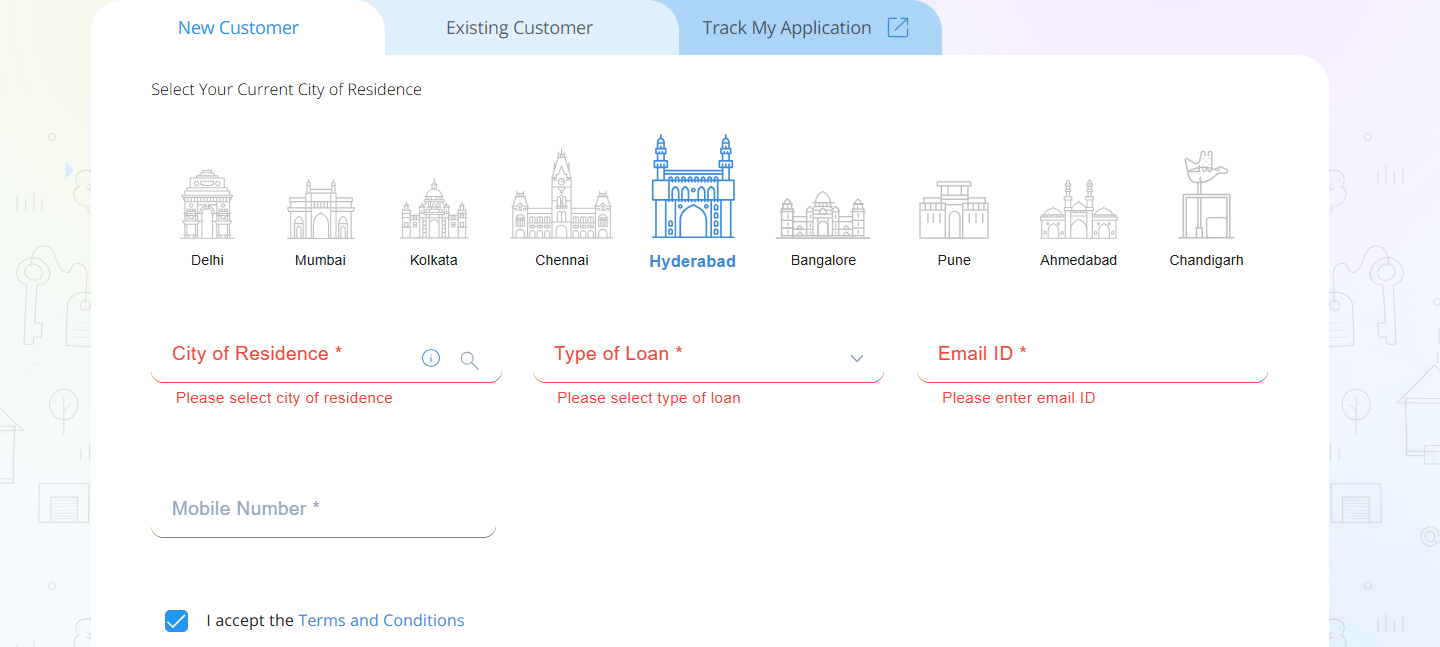

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

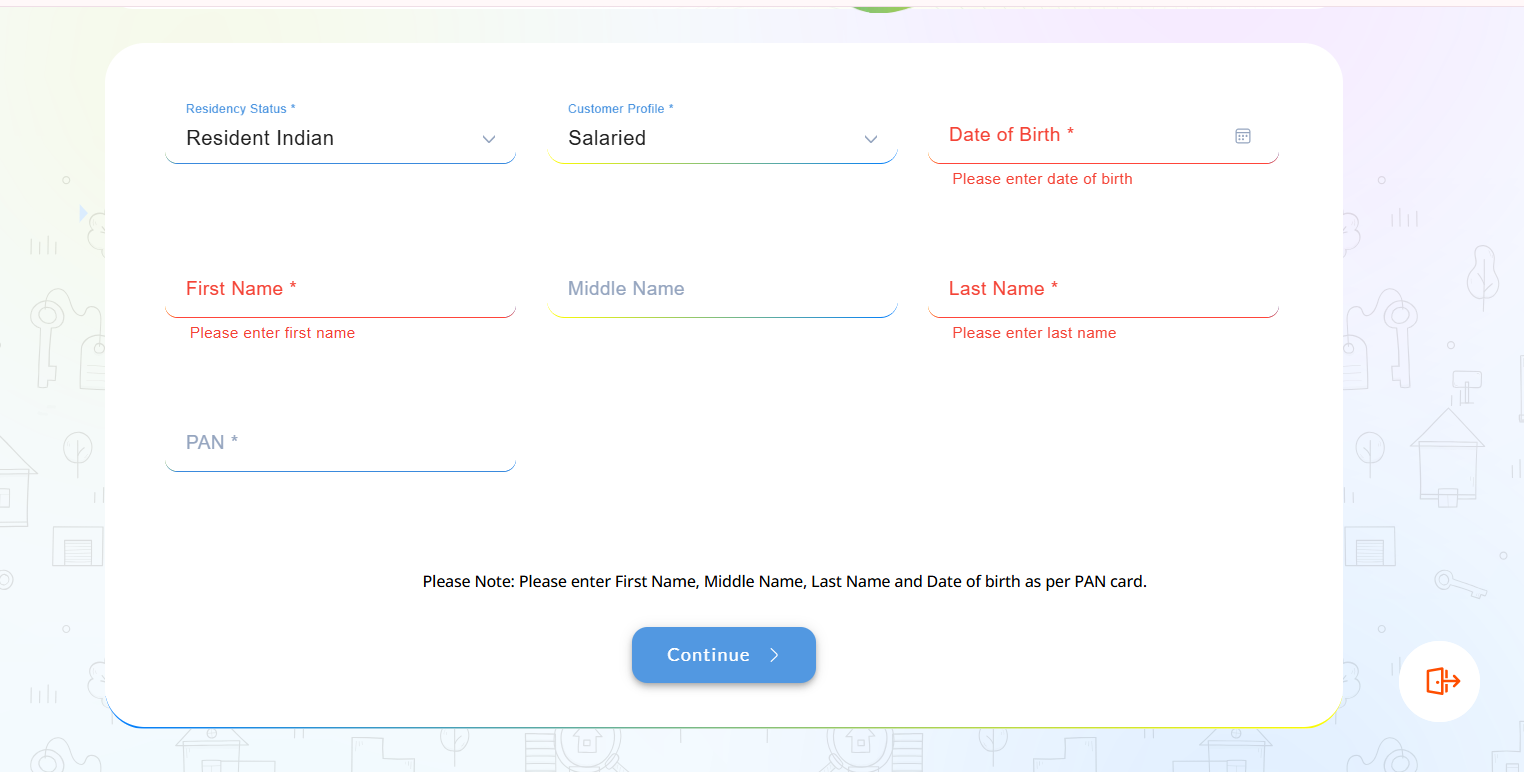

- Provide your basic information and click “Continue” to move to the next step.

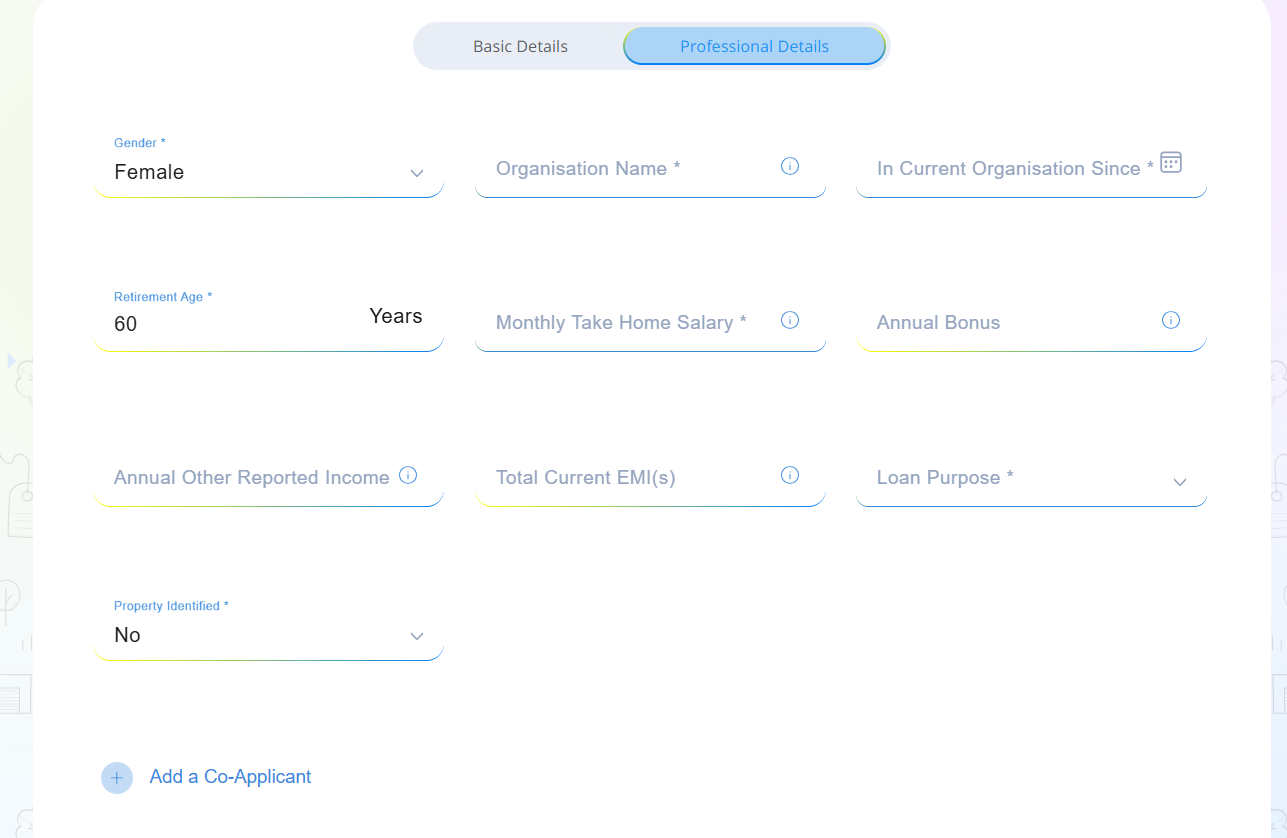

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: How to Reduce Home Loan Interest Payment with Overdraft?

Compare Top Banks Home Loan with Overdraft Interest Rates

Check and compare interest rates across top banks to ensure you’re getting the best deal for your home loan with overdraft.

| Bank/NBFC | Interest Rates |

|---|---|

| SBI Maxgain | 8.50% p.a. – 9.45% p.a. |

| Axis Bank | 10.50% p.a. onwards |

| ICICI Bank | 9.00% p.a. onwards |

| Bank of India | 8.25% p.a. onwards |

| Bank of Baroda | 8.00% p.a. onwards |

| Central Bank of India | 8.15% p.a. onwards |

Conclusion

Buying a home is a big step, and managing your loan shouldn’t be a burden. With Credit Dharma’s Home Loan with Overdraft, we make it easy for you. We offer expert advice and personalized assistance to ensure everything goes smoothly. You’ll receive timely updates on your loan application and overdraft account progress, so you’re always in the loop.

From the initial application to managing your overdraft facility, we provide complete support. Enjoy clear and honest communication at every stage, with no hidden surprises. Let us simplify your home loan experience, while giving you the flexibility of an overdraft.

Frequently Asked Questions

The overdraft facility offers a loan limit of up to ₹2 crores, depending on your eligibility and property value. This substantial limit provides ample funds for various financial needs.

Interest rates for the Home Loan Overdraft facility start at 8.75% per annum. The rate may vary based on factors such as your credit score and the loan amount.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan