Looking to download your TATA Capital Home Loan Statement? This essential document provides a detailed summary of your loan repayment, including EMIs, interest paid, and outstanding balance, helping you manage your finances effectively.

Access it online for a seamless experience and stay updated on your loan status. Let us help you with this guide to make the process simple and hassle-free!

How to Download TATA Capital Loan Statement for Income Tax Online

TATA Capital offers the best way to stay organized, plan your finances, and ensure you’re on top of your loan obligations. By downloading your statement, you gain a clear overview of your repayment journey, making it easier to manage your loan effectively.

Here’s how the step-by-step process helps you access your TATA Capital Loan Statement seamlessly:-

- Visit the Official Website or App:

Visit the official TATA Capital website or download the TATA Capital app from the ‘App Store’

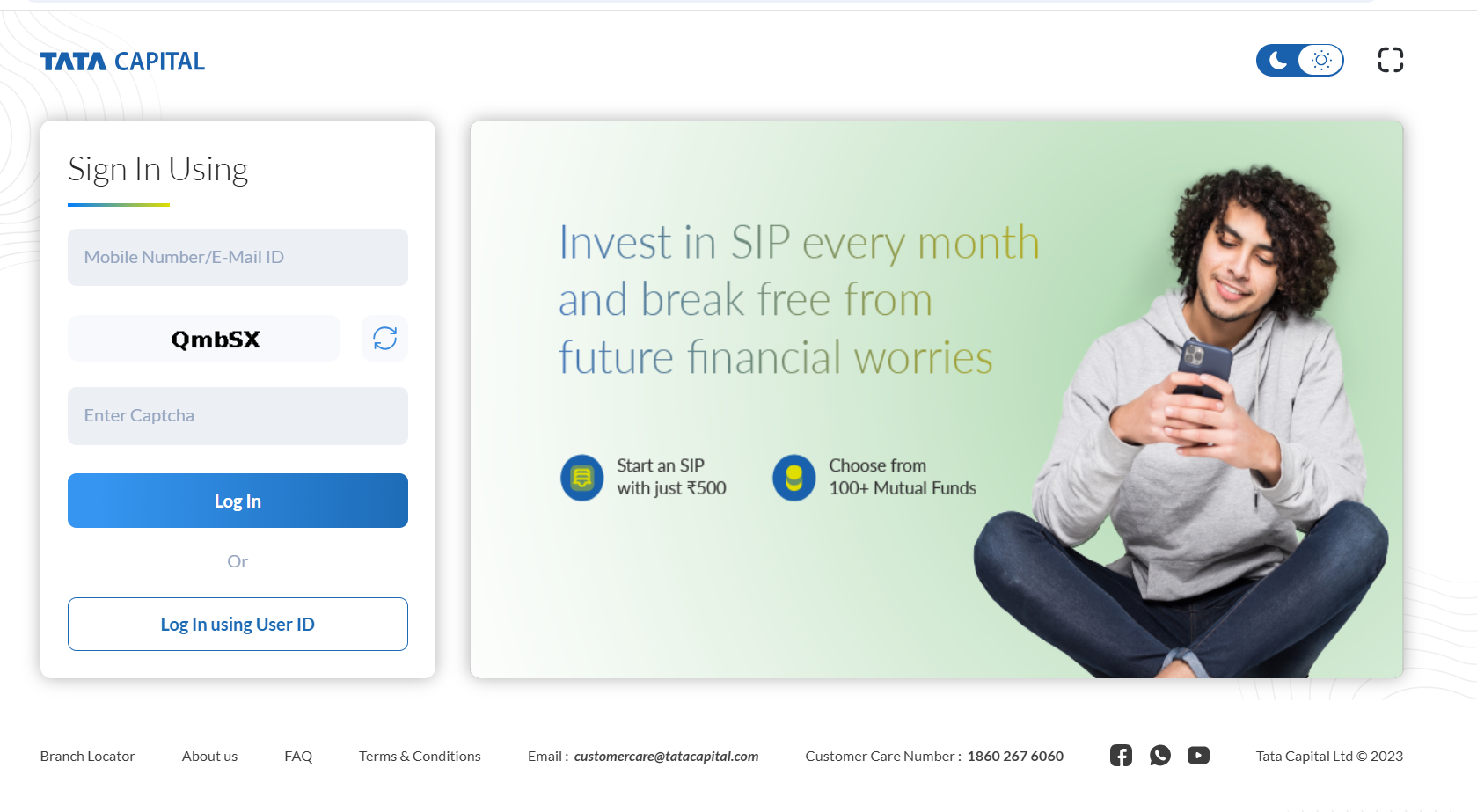

- Login

– Enter your registered mobile number or your user ID and password.

– Click on ‘Get OTP‘ or Login to access your account.

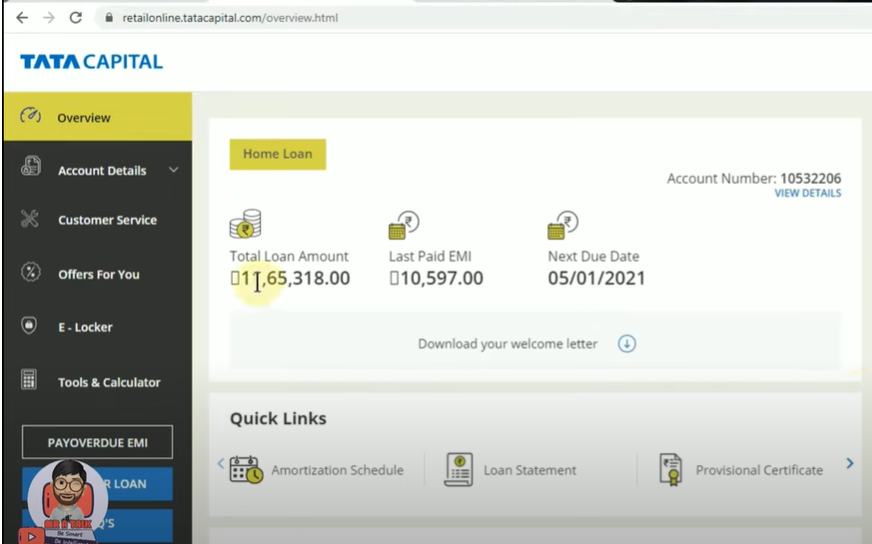

- Navigate to Loan Statements

– Once logged in, go to the ‘Loans’ section.

– Select the type of loan (e.g., Home Loan or Personal Loan).

- Download Your Statement

– Choose the desired date range for your statement.

– Select the preferred format (PDF or Excel).

– Click on ‘Download’ to save the statement to your device.

Check Out: TATA Capital Home Loan Interest Rates 2025

How to Obtain TATA Capital Loan Statement for Income Tax Offline

If you need a TATA Capital loan statement offline, the process is straightforward. Follow these simple steps to obtain your loan statement by visiting a TATA Capital branch.

Steps to Obtain TATA Capital Loan Statement Offline:

1. Visit the nearest TATA Capital branch by locating it with the help of the TATA Capital Branch locator.

2. Go to the branch during working hours.

3. Carry out your loan account details, ID proof, and any necessary documentation for verification.

4. Approach the customer service desk, and speak with a representative regarding your loan statement. Provide your loan account number and other requested details.

5. Once your details are verified, the representative will provide you with a printed copy of your loan statement. Check the statement for accuracy before leaving.

6. If needed, Request additional assistance with other services like refinancing, loan term adjustments, or options for a partial payment plan.

Visiting the branch allows you to directly interact with TATA Capital representatives, ensuring a smooth process for obtaining your loan statement and addressing any related concerns.

Note: Some Branches may charge a nominal fee for providing physical statements, especially for older records.

It’s advisable to call your branch beforehand to confirm any charges and the expected processing time.

Check Out: TATA Capital Home Loan EMI Calculator

How to Download TATA Capital Home Loan Statement for Income Tax via Mobile Application?

To download your TATA Capital Home Loan Statement for income tax purposes using the TATA Capital mobile application, follow these steps:

- Download the TATA Capital App:

- Available on both Android and iOS platforms. Search for “TATA Capital Loan App” in your device’s app store.

- Register or Log In:

- Open the app and register using your registered mobile number or email ID.

- If you’re a new user, complete the one-time registration process.

- Existing users can log in using their credentials.

- Access Loan Details:

- Once logged in, navigate to the ‘Loans’ section on the dashboard.

- Select your Home Loan account to view the details.

- Download Statement:

- Inside your loan account, find the option labeled ‘Download Statement’ or ‘Account Statement’.

- Select the date range you need (for example, the financial year for income tax).

- Choose the format (typically PDF) and download it directly to your device.

Also Read: TATA Capital Travel and Home Insurance

Key Details Included in Your TATA Capital Home Loan Statement

- Loan Account Number:

This unique identifier for your loan account ensures that the statement is linked to your specific home loan. - Personal Information:

This section includes your name, address, and other personal details associated with the loan account. - Loan Disbursement Date and Amount:

The statement provides the date when the loan was disbursed and the total loan amount that was granted. - Interest Rate Details:

It outlines the interest rate applicable to your home loan, whether fixed or floating, and any changes to the rate over time. - Repayment Schedule:

The statement includes your repayment plan, detailing the number of EMIs, the EMI amount, and the due date for each payment. - Principal and Interest Breakdown:

A detailed breakdown showing how each EMI payment is divided between the principal amount and the interest. - Outstanding Loan Balance:

This section shows the remaining balance on your loan, which helps you understand how much you still owe. - Payments Made:

A record of all payments made towards the loan, including EMIs, prepayments, or any extra payments made towards principal reduction. - Late Fees and Penalties:

If any late fees or penalties have been incurred due to delayed payments, these will be clearly listed in the statement. - Tax Certificate:

Some statements may include a tax certificate or a summary of interest paid, which is useful for claiming deductions under Section 24(b) of the Income Tax Act.

How to Use Your Home Loan Statement for Tax Benefit Claims?

1. Interest Payment Deductions:

- Self-Occupied Property: Under Section 24(b) of the Income Tax Act, you can claim a deduction of up to ₹2 lakh on the interest paid for a self-occupied property.

- Let-Out Property: For properties that are rented out, there’s no upper limit on the interest deduction. The entire interest paid can be claimed, subject to certain conditions.

2. Principal Repayment Deductions:

- Under Section 80C, you can claim a deduction of up to ₹1.5 lakh for the principal repayment of your home loan. This benefit is available for both self-occupied and let-out properties.

3. Tax Benefits on Joint Home Loans:

- If the home loan is taken jointly, each borrower can independently claim deductions on interest (up to ₹2 lakh) and principal repayment (up to ₹1.5 lakh), provided both are co-owners and co-borrowers, and both are servicing the loan.

4. Home Loan Statement as Proof:

- While earlier a Completion Certificate was required to claim tax benefits, recent rulings allow you to claim these benefits using the home loan statement from your bank, provided it contains necessary details like the housing society’s name.

Get a Home Loan

with Highest Eligibility

& Best Rates

Troubleshooting TATA Capital Home Loan Statement Issues

While downloading your TATA Capital home loan statement, you might encounter a few issues. Here are some common problems and their solutions:

Common Problems When Downloading TATA Capital Loan Statements

- Login Issues: Check credentials and reset password if necessary.

- Incomplete Statement Download: Refresh the page or clear cache to resolve the issue.

- Incorrect Statement Details: Cross-check payment records and contact customer support if needed.

- Date Range Selection Problems: Double-check the selected period to ensure accuracy.

What to Do If Your Tax Certificate Is Incorrect

- Verify the Details: Cross-check interest, principal, and balance information.

- Contact Customer Support: Reach out for assistance with discrepancies.

- Request a Re-issue: Ask for a corrected tax certificate if needed.

- Check for Pending Payments: Confirm all payments are processed correctly.

Conclusion

Managing your TATA Capital home loan statement online is simple and highly advantageous. By following the steps provided, you can easily access your financial information, empowering you to make well-informed decisions about your home loan.

Leverage the TATA Capital online platform to efficiently manage your accounts. For further assistance with your TATA Capital loan payments, loan details, or tracking your loan status, our team of experts is here to guide you every step of the way. Credit Dharma is your reliable partner in navigating loans, credit, and financial planning.

Frequently Asked Questions

You can obtain your TATA Capital loan statement by logging into the customer portal or by visiting the nearest TATA Capital branch. Online access requires your loan account credentials, while offline access requires valid ID proof and loan account details.

Your co-applicant for a TATA Capital home loan can be an immediate family member, such as your spouse, parents, or children. All co-applicants must meet the eligibility criteria and provide necessary documentation as required.

The interest rate for TATA Capital home loans varies based on factors such as the loan amount, tenure, and applicant’s credit profile. Check the latest rates on the TATA Capital website or contact their customer service.

You can download your loan documents by logging into the TATA Capital online portal. Navigate to the ‘Loan Details’ section, select the desired document, and download it. Alternatively, you can request it at your nearest branch.

To check your loan details using your PAN number, visit the TATA Capital online portal or mobile app. Enter your PAN number in the required section to access all loan-related information, including outstanding balance and payment history.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan