TDS on the purchase of property is essential for compliance with tax laws when buying real estate. It’s mandated by Section 194-IA of the Income Tax Act, focusing on the importance of tax deduction at the source for transactions over a certain threshold.

Understanding TDS and Section 194-IA Requirements

When you buy a property, you need to know about Tax Deducted at Source (TDS). This helps the government keep track of big sales.

Requirements of Section 194-IA

Under Section 194-IA of the Income Tax Act, buyers must deduct TDS when they purchase property over a certain value. This rule makes sure that taxes are collected upfront during the transaction, making the process transparent and straightforward for both parties.

Properties That Are Covered

Here are the types of properties you need to pay TDS on:

- Homes and apartments.

- Office buildings and shops.

- Pieces of land (but not farmland).

Suggested Read: How to pay your property tax online in India?

TDS Deduction Process

When you buy property, it’s important to handle Tax Deducted at Source (TDS) correctly. This part of your purchase helps the government track big transactions.

Who is Required to Deduct TDS?

It’s the buyer’s job to deduct TDS. When you buy a property worth more than 50 lakh rupees, you need to take out a bit of money for taxes and send it to the government.

How to Deduct TDS on Property Purchase?

To deduct TDS, first determine the total cost of the property. Next, calculate 1% of this total amount—that’s the TDS you need to deduct. Make sure to do this before you complete the payment to the seller.

When Do You Need to Deduct TDS?

You should deduct TDS at two main times:

- When you are about to pay the seller.

- When you agree to buy the property and sign the papers.

Payment and Filing Procedures for TDS on Property Purchase

When you buy property, you must handle taxes carefully. This section explains how to pay your TDS and file the necessary forms.

Time needed: 3 minutes

Steps to Pay TDS through Challan 26QB:

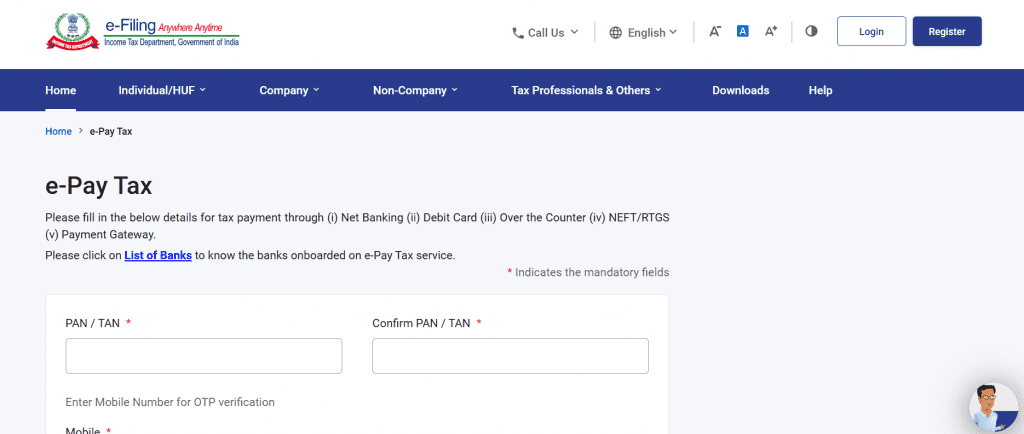

- Access the Tax Payment Portal:

Visit the Income Tax e-Filing portal and log in to your account.

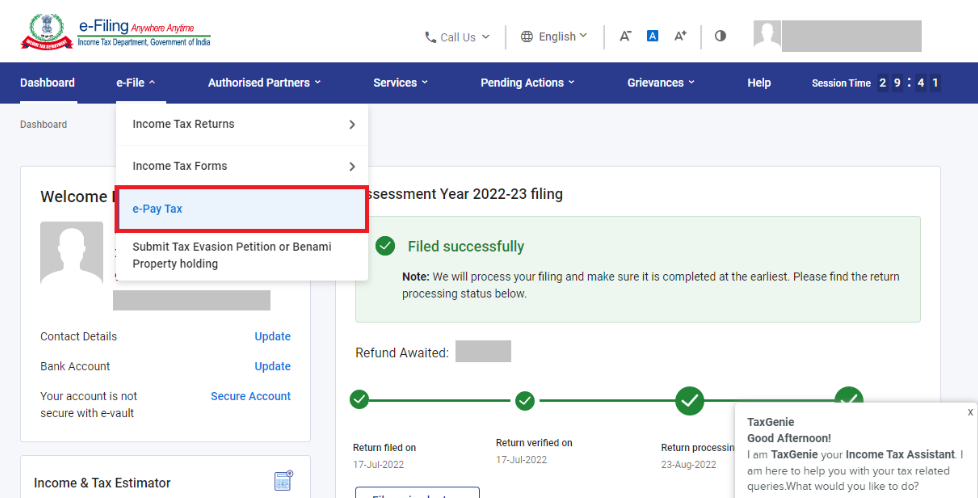

- Go to the e-Pay Tax Section:

After logging in, select the ‘e-Pay Tax’ option under the e-File menu.

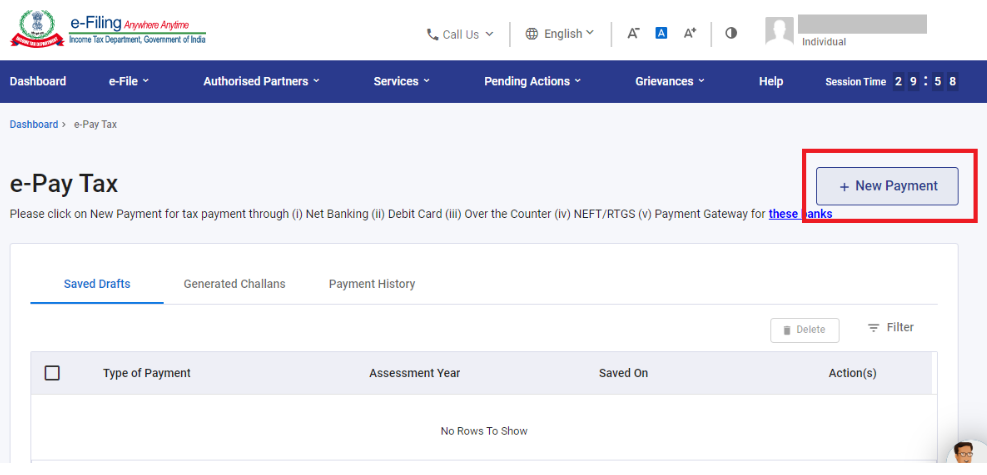

- Initiate New Payment:

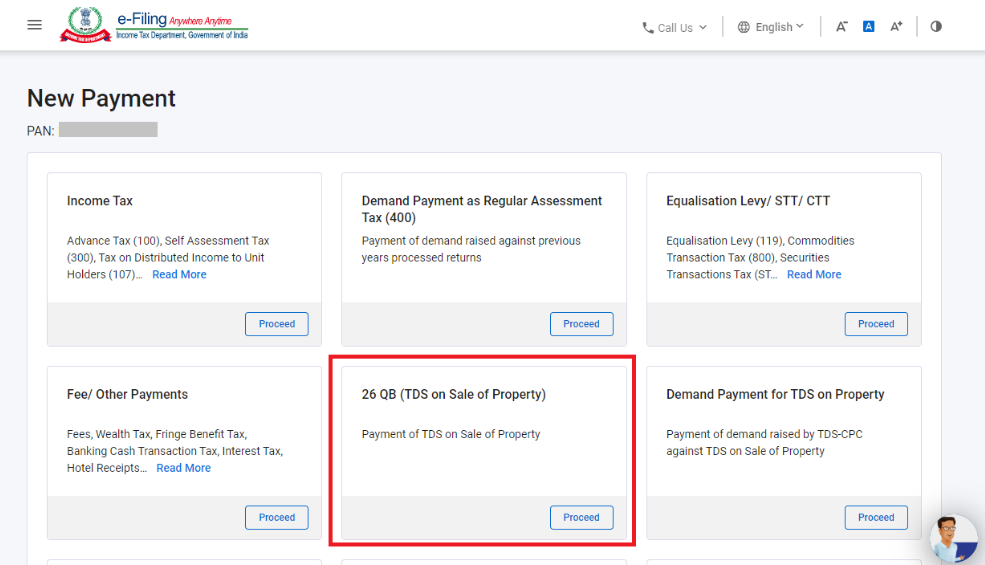

Click on ‘+ New Payment’ and choose ‘26QB – TDS on Property’.

- Enter Details:

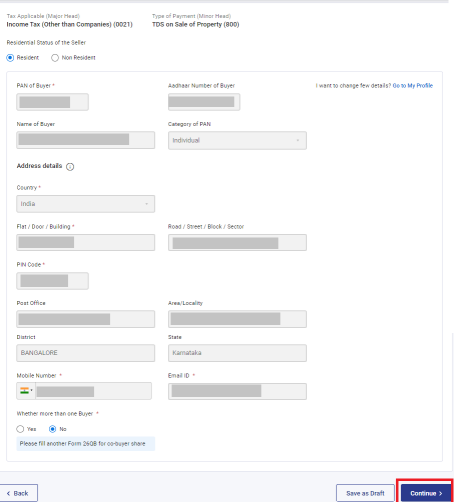

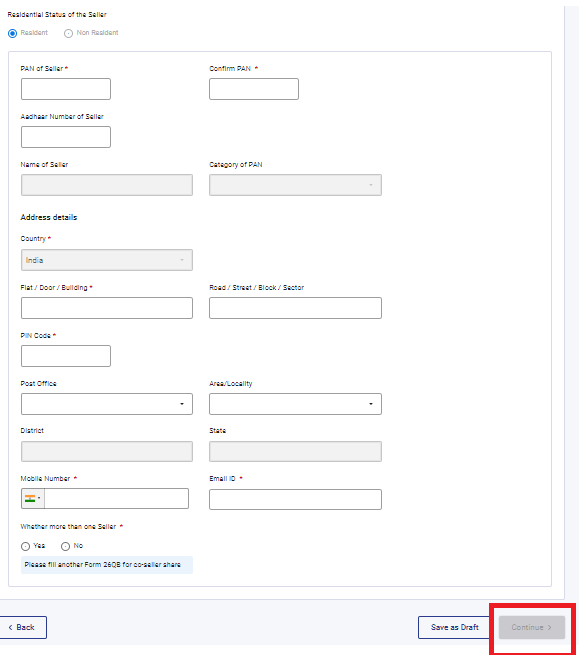

Fill out the form with the following:

– Buyer’s Details: Verify and update your PAN and contact information.

– Seller’s Details: Add the seller’s PAN and address.

–Property Details: Include the type of property, address, and agreement details.

–Payment Details: Enter the sale value and let the system calculate the TDS.

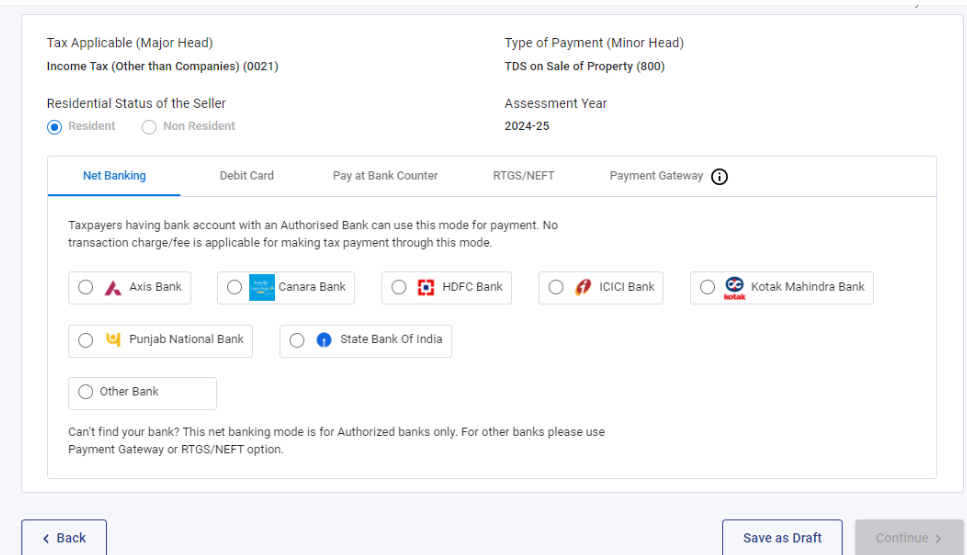

- Make Payment:

Select your payment method (net banking or other available options) and complete the transaction. A challan will be generated once payment is successful.

- Register on TRACES (if new):

First-time users must register on the TRACES portal using PAN and challan details.

- Download Form 16B:

After seven days, log in to TRACES, request Form 16B, and download it to provide to the seller.

How to Pay TDS Online?

Here are the simple steps to pay TDS online in India:

1. Visit the income tax website.

2. Click on ‘e-Pay Tax’ and choose ‘TDS on Sale of Property’.

3. Enter the required details in the online form

4. Confirm the information and proceed to pay using your bank’s net banking.

5. Once paid, download and save the receipt.

Mandatory Filing of Form 26QB

It’s important to file Form 26QB for every property purchase transaction over ₹50 lakh. This form records the TDS payment details and ensures legal compliance.

Issuance of TDS Certificates in Form 16B Downloaded from TRACES

After you pay the TDS, you can download Form 16B from the TRACES website. This form is a TDS certificate that you need to give to the seller, showing that the tax was deducted and paid.

Details Required for the Payment of the TDS

To complete the TDS payment, you need several details:

- Date of the transaction.

- The total cost of the property.

- PAN numbers of both buyer and seller.

- Address and details of the property.

Also Read: 194IA TDS on Property Sale: Key Things You Need to Know

Legal and Financial Implications of TDS Non-Compliance

It’s important to manage your taxes correctly when you buy a property. This part of our guide talks about what happens if you don’t handle your taxes right.

| Feature | Details |

|---|---|

| Implications of Non/Late Filing of TDS Statements | If you don’t file your TDS on time or at all, you can get into trouble. The law requires you to file TDS statements promptly. Failing to do so can lead to fines and delays in your property transaction. |

| Notice for Non-filing Form 26QB | Sometimes, the tax office might send you a notice if you forget to file Form 26QB. This notice tells you that you need to file the form to avoid further penalties. |

| Penalties Applicable on Non-filing of Form 26QB | If you don’t file Form 26QB, you could have to pay a fine. The law might require you to pay extra money based on how late you are with your filing. |

Suggested Read: 15 Things You Must Check Before Moving in Your New Home.

Special Considerations and Exemptions for TDS on Property Purchase

When you buy property, there are special rules for taxes that you need to know about. This part explains some special situations where TDS rules are different.

TDS on Purchase of Property from NRI

Buying property from a non-resident Indian (NRI) involves higher TDS rates. Usually, you need to deduct 20% to 30% TDS, depending on how long the seller owned the property. Make sure to check these details before you

Lower Deduction of TDS on Purchase of Property

Sometimes, you might not need to deduct the full TDS rate. If the seller gives you a certificate from the Income Tax Department, you can deduct less or no TDS. To get this certificate, the seller must apply to the tax office, showing they have lower tax dues.

Interesting Read: ITR Filing Guide: Simple Steps & Complete Checklist for Hassle-Free Filing

Essential TDS Guidelines for Property Transactions

When buying property, remember these key points to stay compliant with TDS regulations:

- Check Property Value: Always verify if the property value is above ₹50 lakh to determine TDS applicability.

- Deduct TDS on Time: Deduct 1% TDS before making any payment to the seller.

- Use Correct Forms: Fill out and submit Challan 26QB for TDS payment immediately after the transaction.

- Download Form 16B: After paying TDS, download Form 16B from TRACES to provide proof to the seller.

- Keep Records: Save all documents related to TDS payments for your records and future reference.

- Report Accurately: Ensure all details (amount, PAN numbers of buyer and seller) are accurate on the TDS submission to avoid penalties.

- Consult If Unsure: Seek advice from a tax professional if you are unsure about the TDS process for complex transactions.

Conclusion

It’s crucial to handle TDS on the purchase of property carefully and follow all rules. Remember, doing things right saves you from trouble and extra costs later. If you’re unsure about any part of the TDS process or face complex transactions, always ask for help from a tax expert. This ensures everything goes smoothly and you stay on the right side of the law.

Frequently Asked Questions [FAQs]

When buying property worth Rs. 50 lakh or more, you must deduct 1% TDS under Section 194IA. This rule applies to residential, commercial properties, and land.

To calculate TDS for property purchases, simply take 1% of the total property cost. For instance, TDS on a ₹70 lakh property would be ₹70,000.

The buyer must pay the 1% TDS on the total value of the property. They have to deduct this amount, not the seller’s.

TDS must be paid within 30 days from the end of the month when it was deducted, using Form 26QB. After payment, issue Form 16B to the seller.

Buyers must deduct TDS at 0.1% on property values over ₹50 lakh from resident sellers who provide their PAN, enhancing tax compliance and transparency.

Yes, TDS can be refunded if you overpay. File your income tax return to initiate the refund process. Excess tax paid is refunded to your bank account.

No, TDS does not apply to stamp duty and registration charges. It only applies to the payment made for property transactions exceeding certain thresholds.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan