TDS online payment is a system in which payers deduct taxes at the source of income, ensuring timely tax collection. It plays a crucial role in India’s taxation system by simplifying compliance and reducing evasion. The move to online payments has made the process more efficient and user-friendly.

Steps to Make Online TDS Payment

Time needed: 3 minutes

Paying your Tax Deducted at Source (TDS) online is simple.

Just follow these steps to ensure you pay your taxes on time and without any hassle:

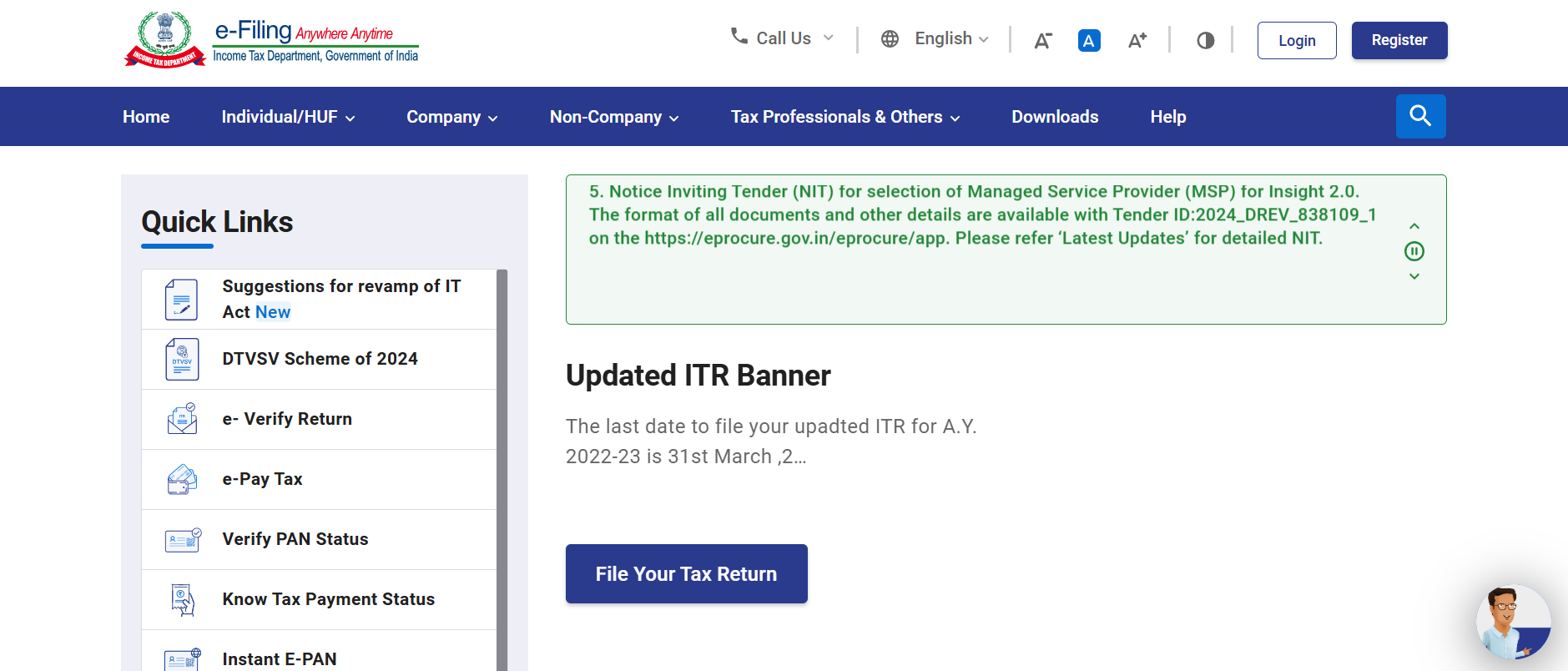

- Go to the Website:

Start by visiting the official Income Tax website.

- Access Tax Payment Section:

Click on ‘e-pay tax’ on the homepage.

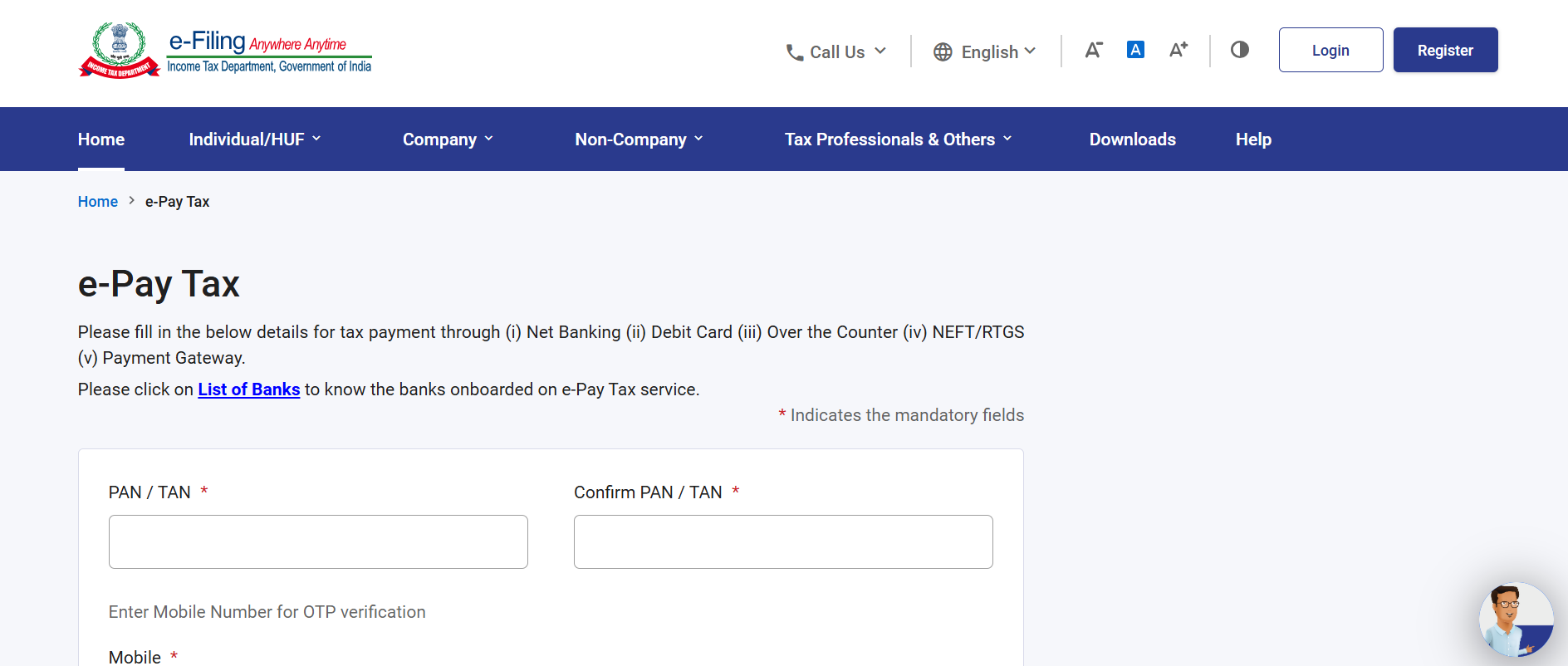

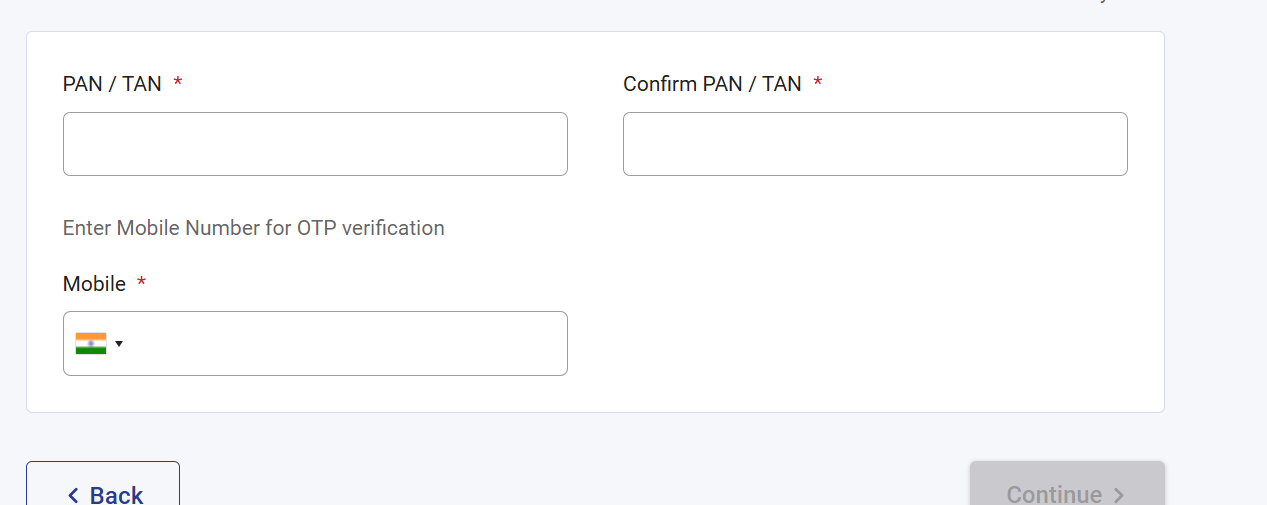

- Enter Your Details:

Type in your PAN or TAN and your mobile number, then click ‘Continue’.

- Verify with OTP:

You’ll receive an OTP on your phone. Enter this OTP to proceed.

- Select Tax Type:

Choose ‘Income Tax’ from the options and click ‘proceed’.

- Choose the Year:

Select the correct Assessment Year (AY) and then click ‘Proceed’ under the ‘Pay TDS’ section.

- Fill in Payment Details:

Add details about the nature of your payment, the tax breakdown, and your preferred payment method.

- Confirm with Captcha:

Fill in the Captcha code and press ‘Proceed’ to confirm.

- Choose Your Bank:

Pick the bank you want to use for the payment.

- Make the Payment:

Log into your bank’s net banking service and complete the payment.

- Save the Receipt:

After you make the payment, the system displays a challan with details such as the Corporate Identity Number (CIN) and the bank’s name. Download this challan for your records.

What is TDS?

TDS stands for Tax Deducted at Source. It’s a way the government collects tax directly from the money we earn or pay. When you earn money or make certain payments, a small part of it goes straight to the government as tax. This helps keep taxes up-to-date and reduces tax evasion. Now, let’s learn how you can pay this tax online, easily and quickly.

Who Needs to Pay TDS Online?

Tax Deducted at Source (TDS) applies to various types of income. Here are the situations where TDS payment is required:

EPF Withdrawals: The government taxes early withdrawals that exceed the specified limit.

Salary: Employers deduct TDS directly from employee salaries.

Dividends: TDS applies to income from dividends.

Interest: If you earn interest on securities, TDS may be deducted.

Professional Services: Payments for technical services, freelance work, or contractors are subject to TDS.

Commissions: Earnings from brokerage or insurance commissions also attract TDS.

Games and Lotteries: Winnings from lotteries, horse races, or other games require TDS deductions.

Property Sales: TDS is deducted on income from transferring immovable property.

Due Dates for TDS Online Payment

It’s important to pay your TDS (Tax Deducted at Source) on time. Here’s when you need to make those payments:

- For Most Months: Pay your TDS by the 7th of the month following the month in which you deduct the tax. For example, if you deduct tax in June, you must pay it by July 7th.

- For March: If tax is taken out in March, pay your TDS by April 30th.

- For Government Workers:

- Right Away: If your workplace doesn’t use a challan, pay the TDS the same day it’s taken out.

- With a Challan: Pay by the 7th of the next month.

- Taxes on Benefits Given by Employers: These also need to be paid by the 7th of the next month.

- If You Pay Quarterly:

- End of June: Pay by July 7th.

- End of September: Pay by October 7th.

- End of December: Pay by January 7th.

- End of March: Pay by April 30th.

When you buy a house and deduct the tax, you must pay the TDS by the 30th of the month following your purchase. For example, if you buy a house in June, you need to pay the TDS by July 30th.

How to Verify Your TDS Payment Status Online?

Want to check if your Tax Deducted at Source (TDS) payment has gone through? Follow these easy steps to verify your TDS status online quickly:

Log in to your net banking portal and check the TDS status through the tax credit statements available there.

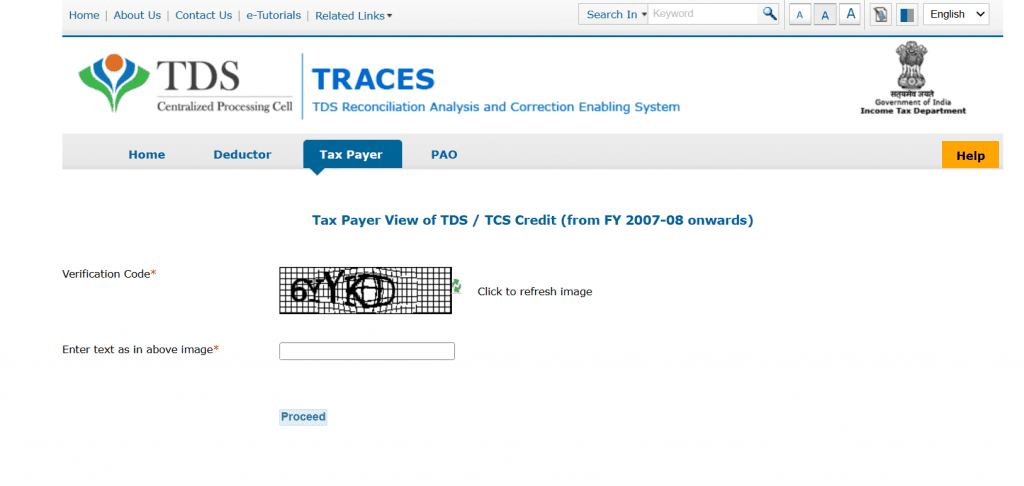

1. Visit the TDS Portal:

- Go to TDS CPC Website.

- Enter the ‘verification code’ and click ‘Proceed’.

- Fill in your PAN and TAN details.

- Choose the financial year, the quarter, and the type of returns.

- Hit ‘Go’ to see your TDS status.

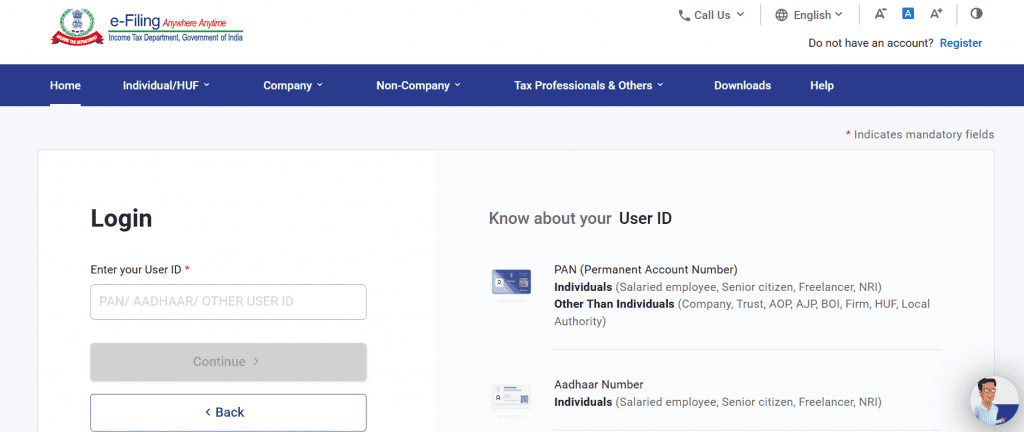

2. Use the Income Tax e-Filing Website:

- Access the Income Tax e-Filing Website.

- Register or log in with your credentials.

- Go to ‘My Account’ and select ‘View Form 26AS’.

- Pick the year and download the form in PDF format. The password is your date of birth in ddmmyyyy format (e.g., 07061991).

Via Net Banking:

- Make sure your PAN is linked to your net banking account.

- Log in to your net banking portal and check the TDS status through the tax credit statements available there.

Why Choose Online TDS Payment?

Paying TDS online offers several practical benefits that make the process easier and more efficient:

- Convenience: Make payments anytime, anywhere, using your net banking account.

- 24/7 Availability: The online payment portal is always accessible.

- Instant Processing: The system transfers the payment immediately to the Income Tax Department.

- No Paperwork: Avoid submitting physical challans.

- Immediate Acknowledgment: Get an e-challan as proof of payment right away.

- Error-Free: Minimise errors commonly made during manual payments.

Consequences of Delaying TDS Payment

Delaying TDS payments can lead to financial penalties. Here’s what happens:

- Failure to Deduct TDS: If you don’t deduct TDS on time, you must pay interest at 1% per month. We calculate the interest from the due date of deduction until the date on which the deduction actually occurs.

- Delay in Paying Deducted TDS: If you deduct TDS but fail to pay it, you’ll incur interest at 1.5% per month. We begin the calculation on the deduction date and continue it until you make the payment.

Conclusion

Paying your taxes on time is essential to avoid penalties and maintain compliance. With TDS online payment, the process has become simple, quick, and error-free. Use the steps outlined above to ensure your payments are accurate and timely, keeping your financial obligations stress-free.

Frequently Asked Questions

Go to the income tax portal and click on “e-Pay Tax.” Select “Challan No./ITNS 281,” provide your TAN, assessment year, and other required details, and complete the payment process.

Log in to the e-filing portal with your TAN credentials. Go to the ‘e-File’ section, select ‘e-Pay Tax,’ click ‘New Payment,’ choose the relevant tax tile, and complete the payment.

Yes, TAN is mandatory for anyone deducting or collecting tax at source. You must quote it in TDS returns, payment challans, certificates, and any communications with the Income Tax Department.

TDS rates are: Up to ₹3,00,000: Nil; ₹3,00,001-₹5,00,000: 5%; ₹5,00,001-₹10,00,000: ₹10,000 + 20% over ₹5,00,000; Above ₹10,00,000: ₹1,10,000 + 30% over ₹10,00,000.

Once the request is submitted, the landlord or agent must respond. If they agree, the TDS return is typically processed within 5 working days, ensuring a quick resolution.

Employers calculate TDS on salary using the average income tax rate. This rate is determined by dividing the total tax payable (based on slab rates) by the employee’s estimated annual income for the financial year.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan