If you’re planning to buy property in Bangalore or elsewhere in Karnataka, you’ve likely heard about A Khata and B Khata. These terms can be confusing but are critical to understanding property legality and eligibility for loans, resale, or construction approval.

In this guide, we break down the difference between A Khata vs B Khata, why it matters, and how to check or convert your Khata status.

What is Khata?

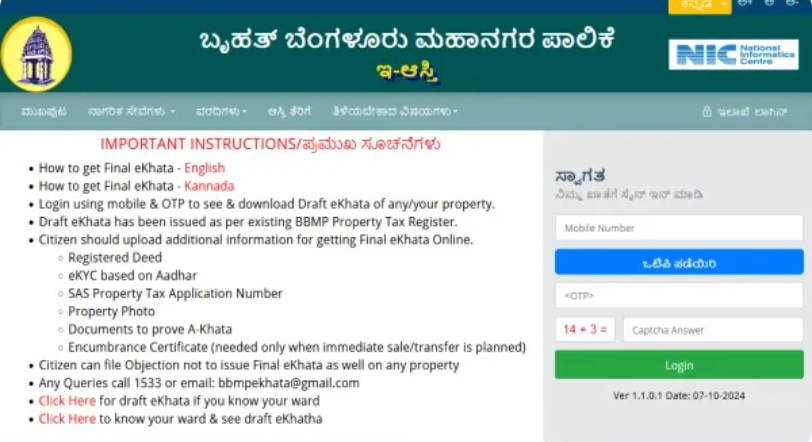

A Khata is an official property account registered with the BBMP (Bruhat Bengaluru Mahanagara Palike) or local municipal authority. It contains property details and is essential for paying property tax, applying for building permits, and selling your property.

A Khata vs B Khata: Key Differences

The table includes some of the key differences between A Khata and B Khata.

| Feature | A Khata | B Khata |

|---|---|---|

| Legal Status | Fully legal, compliant with building and zoning laws | Semi-legal; built without approvals or on revenue land |

| Issued By | BBMP (Under ‘A’ Register) | BBMP (Under ‘B’ Register – unofficial or temporary list) |

| Building Plan Approval | Eligible for plan approval and construction permits | Not eligible for any legal approvals |

| Loan Eligibility | Accepted by banks and NBFCs for home loans | Rejected by most banks due to legal risks |

| Ownership Transfer | Can be legally transferred or sold | Transfer is restricted or complicated |

| Government Schemes | Eligible for subsidies and schemes | Not eligible until regularized |

Why Should You Get Khata Certificate?

The concept emerged in 2007 when BBMP attempted to bring unauthorized properties into the tax net through the ‘B Register’, hence the name B Khata. While it allowed property tax collection, it did not legalize the property.

This system was designed to:

- Identify and record irregular constructions

- Encourage regularization through penalties

- Maintain revenue flow for BBMP

Why Banks Reject B Khata Properties for Home Loans?

Most banks and financial institutions require A Khata for property financing because:

- B Khata properties lack legal clarity

- Cannot be mortgaged or auctioned easily

- Pose high risk in case of loan default

- Often built on revenue land or without approvals

Therefore, if you’re applying for a home loan, ensure the property has A Khata.

How to Convert B Khata to A Khata?

Converting a B Khata property to A Khata is an important process to regularize your property, making it legally compliant and eligible for loans, building approvals, and easier transactions.

Step-by-Step Process to Convert B Khata to A Khata

1. Verify Eligibility

- Ensure your property is located in an area where A Khata conversion is allowed.

- The property should comply with local zoning and building regulations.

- Properties built on non-convertible land or with major violations may not be eligible.

2. Collect Necessary Documents

Prepare the following documents for submission:

- Sale deed or ownership proof

- Latest tax paid receipts

- Encumbrance certificate

- Property layout plan or approved building plan

- Identity proof of the owner

- B Khata certificate

3. Apply for Conversion at Local Municipal Office

- Visit the local municipal corporation office (e.g., BBMP in Bangalore).

- Obtain and fill out the application form for converting B Khata to A Khata.

- Submit the application along with all the required documents.

4. Pay Outstanding Taxes and Regularization Fees

- Clear all pending property taxes.

- Pay any applicable penalties or regularization fees as prescribed by the municipal authority.

- Sometimes, a one-time betterment charge or conversion fee is applicable.

5. Site Inspection and Verification

- The municipal authorities will conduct an inspection of the property.

- They will verify compliance with building bylaws, zoning norms, and other regulations.

6. Approval and Issuance of A Khata

- After successful verification and clearance of dues, the municipal corporation will approve the conversion.

- You will receive an A Khata certificate confirming the property’s legal status.

How do I find out if the property iam looking at is A or B khata.

by u/DarkJunior9761 in Bengaluru

Importance of Verifying the Khata Certificate Before Buying a Property

- Confirms Legal Ownership

Ensures the seller is the rightful owner recognized by municipal authorities. - Validates Legal Status of Property

Confirms the property is approved and regularized (A-Khata), not illegal (B-Khata). - Avoids Hidden Liabilities

Shows if property taxes and penalties are cleared—protects you from future dues. - Essential for Loans & Utilities

Banks require it for home loans; it’s also needed for electricity, water, and building permits. - Enables Smooth Registration & Transfer

Prevents disputes and delays in registering the property in your name.

Final Thoughts: Which One Should You Buy?

Buy A Khata property for:

- Legal security

- Access to bank loans

- Smooth resale or transfer

- Eligibility for building approvals

Avoid B Khata properties unless you’re ready to take legal risks or go through the conversion process.

Property documents complete? Unlock your home loan approval now

Frequently Asked Questions

A Khata means the property is fully regularized and recognized by BBMP.

It complies with building bylaws, zoning rules, and tax norms.

Allows you to:

Get building plan approvals

Get occupancy certificate

Obtain bank loans

Legally transfer or sell property

B Khata is for unauthorized or irregular properties:

Built without proper approvals

In revenue sites or unapproved layouts

BBMP collects taxes but does NOT recognize ownership legally.

No construction approvals, loans, or occupancy certificates.

Check the Khata Certificate & Khata Extract:

A Khata mentions “Form A”

B Khata mentions “Form B”

Verify in BBMP records or online (if available).

Usually NO.

Banks typically don’t finance B Khata as it’s not fully legal.

No.

You can’t get BBMP approvals for construction or renovation

Ideally, NO, unless:

You clearly understand the risks

You plan to convert it to A Khata

You confirm eligibility for regularization

Not exactly illegal, but it’s irregular / unauthorized.

BBMP accepts tax payments but does not confer ownership rights.

A Khata always commands higher value because:

It is legally recognized

Eligible for loans

Safe for buyers

Yes, if:

The layout is eligible for regularization.

You pay all betterment charges and dues.

You have necessary approvals and documents.

Not all B Khata properties can be converted.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan