The market value of land plays a crucial role in determining property transactions, as it directly impacts stamp duty and registration charges. Understanding these valuations is essential for buyers and sellers to ensure fair pricing and compliance with legal requirements.

In Andhra Pradesh, the AP market value is assessed through the government’s Computer-aided Administration of Registration Department (CARD), providing transparency in property dealings. Check more about it in this article.

What is the Market Value in Andhra Pradesh in 2025?

The market value in Andhra Pradesh represents the price at which a property is traded under normal conditions. In urban areas, non-agricultural land values are typically revised annually, while agricultural land in rural regions undergoes updates every two years. Staying informed about these changes is essential for making smart property decisions.

Land Market Value Revision in Andhra Pradesh

The Andhra Pradesh government has announced changes to land market values, effective from February 2025. This update aims to align property prices with current real estate trends, impacting stamp duty and registration charges.

However, the capital city area of Amaravati will remain unaffected by these revisions. Buyers and sellers should be aware of these changes to make informed property decisions and ensure compliance with legal requirements.

How to Check the IGRS Market Value of Land in Andhra Pradesh Online

Follow these simple steps to check the land market value in Andhra Pradesh through the official portal:

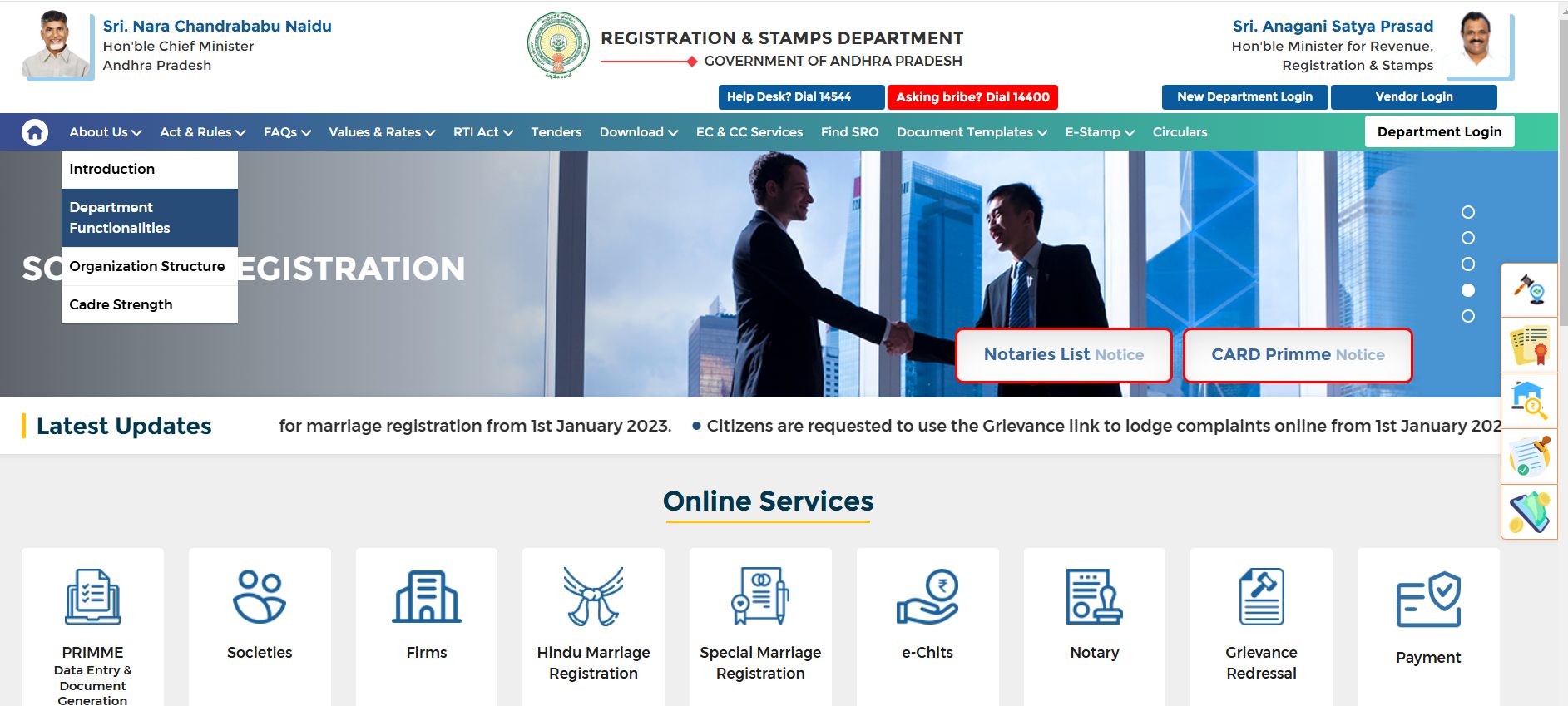

- Visit official website

– Visit the official website of the Andhra Pradesh Registration and Stamps Department

- Click “Market Value” Option

– On the homepage, locate and click on the “Market Value” option in the left-hand menu.

- Select Property Type and Click Submit

– You will be redirected to a new page.

– Choose between Agricultural or Non-Agricultural land.

– Select the property type, district, and village from the dropdown menus.

– Click “Submit”

- Land Details will be Displayed

– The land market value details will be displayed on the screen, providing the latest updated rates for your selected location.

This process ensures quick and easy access to property valuation details, helping buyers and sellers make informed decisions.

How to Check the Land Market Value in Andhra Pradesh Offline

If you prefer to check the land market value in Andhra Pradesh through offline means, follow these simple steps:

- Visit the Nearest Sub-Registrar Office (SRO) – Locate the Sub-Registrar Office in your area and visit during working hours.

- Request Assistance from the SRO Staff – Approach the concerned officials and submit a request to check the market value of the land.

- Obtain the Computer-Generated Revenue Slip – Once your request is processed, a system-generated slip will be provided, displaying the applicable market value.

- Pay the Required Fee – A nominal charge of ₹10 is applicable to access the market rate details. Ensure you collect the receipt for the payment.

By following these steps, you can easily verify the latest land market value in Andhra Pradesh without relying on online resources.

Also Read: How to value a property?

Importance of Land Value Certificate in AP Land Market

A land value certificate plays an important role in property transactions, legal verification, and financial assistance. It serves as an official document that provides accurate details about a property’s market value, ensuring transparency in the AP land market. Here’s why obtaining a land value certificate is important:

1. Know the Updated Land Value

The certificate contains the latest market valuation of the land, helping buyers and sellers make informed decisions based on current rates.

2. Verification of Property Price

With this certificate, property buyers can verify that the land value is correct, preventing overpricing or undervaluation in transactions. It also ensures that sellers receive a fair price for their property.

3. Loan Approvals

Financial institutions consider the land value certificate a key document when granting loans against agricultural or residential land. It serves as proof of the property’s worth, making it easier to secure funding.

4. Legal Compliance

As per the Land Acquisition Act, a land valuation certificate must be updated every 3-5 years for any property undergoing acquisition. This ensures compliance with government regulations and prevents legal disputes.

With the AP market value being a crucial factor in real estate dealings, obtaining a land value certificate provides clarity, financial benefits, and legal security for property owners and investors.

Formation of New Districts and Growth in Land Value in Andhra Pradesh

| District | District HQ |

|---|---|

| Anakapalli | Anakapalli |

| Parvathipuram Manyam | Parvathipuram |

| NTR | Vijayawada |

| Konaseema | Amalapuram |

| Sri Satya Sai | Puttaparthi |

| Palnadu | Narasaraopet |

| Alluri Sitharama Raju | Paderu |

| Sri Balaji | Tirupathi |

| Eluru | Eluru |

| Kakinada | Kakinada |

| Bapatla | Bapatla |

| Nandyal | Nandyal |

| Annamayya | Rayachoti |

Under the Andhra Pradesh District Formation Act, Section 3 (5), the state government doubled its districts to 26, inaugurating 13 new districts on April 4, 2022.

Following this, land market values were revised, increasing by 15% to 25% on average, with a maximum hike of 75% in select commercial areas. These revisions impacted newly formed district headquarters and surrounding suburban and rural regions.

Also Read: Is It a Right Time to Invest in Bangalore’s Real Estate Market?

How to Check the Previous Landowner of a Property in AP Online?

You can easily find details of a property’s previous landowner in Andhra Pradesh through the Meebhoomi portal by following these steps:

- Visit the official Meebhoomi website: https://www.meebhoomi.ap.gov.in.

- Navigate to the “Land Conversion Details” section.

- Select the required details – District, Zone, Village Name, and Survey Number.

- Click on “Submit” to access the ownership details of the selected property.

This will provide official land records, helping buyers verify property ownership before transactions.

Market Values in AP for Prominent Places

| S.No. | Ward No. | Locality | Rate of Land (Rs per sq. ft.) | Composite Rate (Ground Floor) | Composite Rate (First Floor) | Composite Rate (Other Floor) | Classification |

|---|---|---|---|---|---|---|---|

| 1. | BALASANIPALLE | 1800 | 1,800 | 1,000 | Residential | ||

| 2. | 3 – 0 | BADDIPALLE | 1000 | 1,800 | 1,000 | 1,000 | Residential |

| 3. | 2 – 0 | THAKATAMVARIPALLE | 1200 | 1,800 | 1,000 | 1,000 | Residential |

| 4. | 4 – 0 | AYYAVARIPALLI | 800 | 1,800 | 1,000 | 1,000 | Residential |

| 5. | 3 – 0 | DEGANIPALLE | 1200 | 1,800 | 1,000 | 1,000 | Residential |

| 6. | 5 – 0 | PAASAM STREET MAIN-1 | 28000 | 1,850 | 1,050 | 1,050 | Residential |

| 7. | 5 – 0 | APPARAO STREET | 30000 | 1,850 | 1,050 | 1,050 | Residential |

| 8. | 6 – 0 | HARIMANDIRAM STREET | 18000 | 1,850 | 1,050 | 1,050 | Residential |

| 9. | 5 – 0 | PASAM STREET | 20000 | 1,850 | 1,050 | 1,050 | Residential |

| 10. | 6 – 0 | SANTHA BAZARU STREET MAIN-6 | 18000 | 1,850 | 1,050 | 1,050 | Residential |

| 11. | 6 – 0 | VYSYA BAZAR-6 | 12000 | 1,850 | 1,050 | 1,050 | Residential |

| 12. | 7 – 0 | SANTHA BAZAR STREET | 8000 | 1,850 | 1,050 | 1,050 | Residential |

| 13. | 7 – 0 | DARGA STREET | 10000 | 1,850 | 1,050 | 1,050 | Residential |

| 14. | 9 – 0 | BABATALKIES | 8000 | 1,850 | 1,050 | 1,050 | Residential |

| 15. | 8 – 0 | SIMHAM STREET | 6000 | 1,850 | 1,050 | 1,050 | Residential |

| 16. | 9 – 0 | BC COLONY | 4000 | 1,850 | 1,050 | 1,050 | Residential |

How to Check Andhra Pradesh plot details?

You can easily access your land records and plot details in Andhra Pradesh by following these steps:

- Visit the official Meebhoomi website: www.meebhoomi.ap.gov.in.

- Navigate to the main menu and select your district, zone, and village.

- Enter the required details, such as owner’s name, survey number, Aadhaar number, account details, and village title.

- Fill in the captcha code and click on Submit to view your plot details.

IGRS Market Value 2025 – Steps to File a Grievance

- Visit http://grievancers.ap.gov.in/grievance and click on “Lodge Grievance“.

- Enter details like name, contact number, email ID, district, mandal, and SRO.

- Describe your grievance and attach any necessary supporting documents.

- Click “Submit” to complete the process and track your complaint online.

Implications on Property Tax in AP Market Value 2025

In 2025, Andhra Pradesh revised property registration rates, increasing them by 5% to 10% across the state, effective February 1. This adjustment is expected to influence property tax assessments, as these taxes are typically based on the property’s annual rental value, which is affected by market valuations.

Property owners should anticipate potential changes in their tax liabilities due to these updated market values.

Read More: Is the Market Value of Your Property About to Skyrocket?

Get the Best Plot/Land Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Plot/Land Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Plot/Land Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Understanding the AP market value is crucial for property buyers and sellers, as it impacts transaction costs and tax obligations. Keeping up with these valuations ensures fair property dealings and adherence to state regulations. Once aware of these updates, you can reach out to Credit Dharma experts for guidance on securing a home loan tailored to your needs.

Frequently Asked Questions

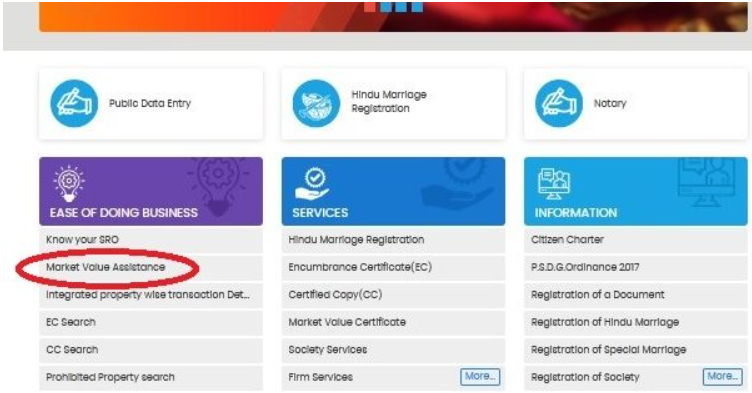

To determine your property’s market value in Andhra Pradesh, visit the official IGRS AP website and use the ‘Market Value Assistance’ tool by selecting your district, Mandal, and village.

Government value, or guidance value, is the minimum price set by authorities for property registration, while market value is the estimated price a property would fetch in an open market between a willing buyer and seller.

Market value can be calculated using methods like the sales comparison approach, which involves comparing the property with similar properties recently sold in the area, and the income approach, which considers the property’s income-generating potential.

To check plot details in Andhra Pradesh, access the IGRS AP portal, navigate to the ‘Encumbrance Search (EC)’ section, and enter relevant details such as district, SRO, and document number to retrieve information.

As of 2025, Andhra Pradesh imposes a stamp duty of 5% on the property’s market value for sale deeds, with additional charges including a 1% registration fee and a 1.5% transfer duty.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan