When buying resale property, understanding TDS on purchase of property is essential. This ensures compliance with tax regulations and simplifies the transaction process for both buyers and sellers.

How to Pay TDS for Property Sales

Time needed: 3 minutes

Paying the TDS when you buy a resale property is straightforward. Here’s how to do it:

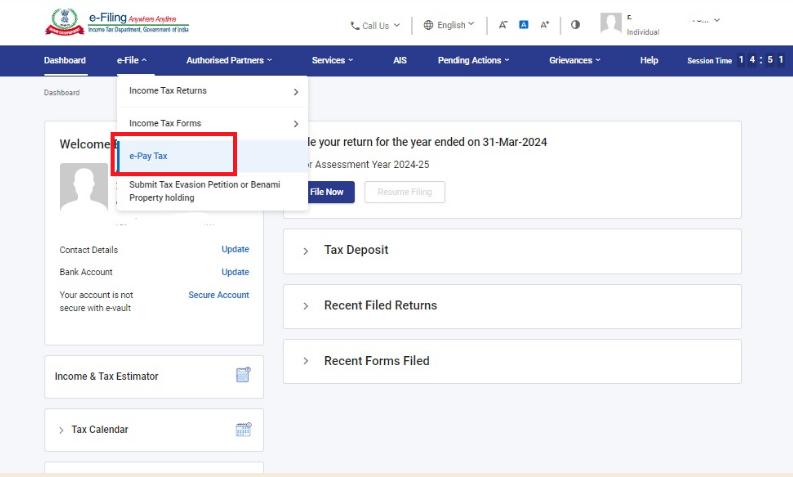

- Start at the Income Tax Website

First, visit the Income Tax e-filing portal at incometax.gov.in.

- Choose to Pay Tax:

Click on ‘e-Pay Tax’ under the ‘e-File’ menu. Then, select ‘New Payment’.

- Fill Out Form 26QB:

Choose the option for ‘TDS on sale of property’ (Form 26QB). You will need to enter details about the buyer, seller, and the property, including tax payment information.

- Provide Payment Details:

After filling in all the necessary information, move to the next page to select your payment method. Choose ‘Pay Now’ to proceed.

- Download Your Acknowledgment:

Once your payment is processed, you can download the Form 26QB acknowledgment.

- Get Your TDS Certificate:

Later, log in to the TRACES portal to download your TDS certificate (Form 16B).

Also Read: TDS on Sale of Property

TDS Rates for Property Purchases

When buying a resale property, it’s important to understand TDS—Tax Deducted at Source. Here’s what you need to know:

- Threshold for TDS: TDS is only required if the property’s sale price exceeds Rs. 50 lacs. For anything below that, no TDS is needed.

- Inclusion in Sale Price: The sale price for TDS calculation includes the cost of the property along with any additional fees for amenities like parking or club memberships.

- Rate of Deduction: The standard TDS rate on property sales is 1%. However, to relieve economic pressures during the pandemic, this rate was temporarily reduced to 0.75% for sales between May 14, 2020, and March 31, 2021.

- Calculation Base: TDS should be calculated on the total sale amount, not just the excess over Rs. 50 lacs.

Example of TDS Calculation:

| Sale Amount | TDS (May 14, 2020 – Mar 31, 2021) | TDS (From Apr 1, 2021) |

|---|---|---|

| Rs. 45,00,000 | Rs. 0 | Rs. 0 |

| Rs. 50,00,000 | Rs. 0 | Rs. 0 |

| Rs. 50,01,000 | Rs. 37,508 | Rs. 50,010 |

| Rs. 55,00,000 | Rs. 41,250 | Rs. 55,000 |

- Seller’s PAN: Always ensure you have the seller’s PAN details. If the seller does not provide their PAN, TDS is deducted at a higher rate of 20%.

Also Read: TDS on Purchase of Property

How to Download Form 26QB?

Downloading Form 26QB is simple. Follow these steps to get it done:

1. Visit the Tax Website: Go to incometax.gov.in to start.

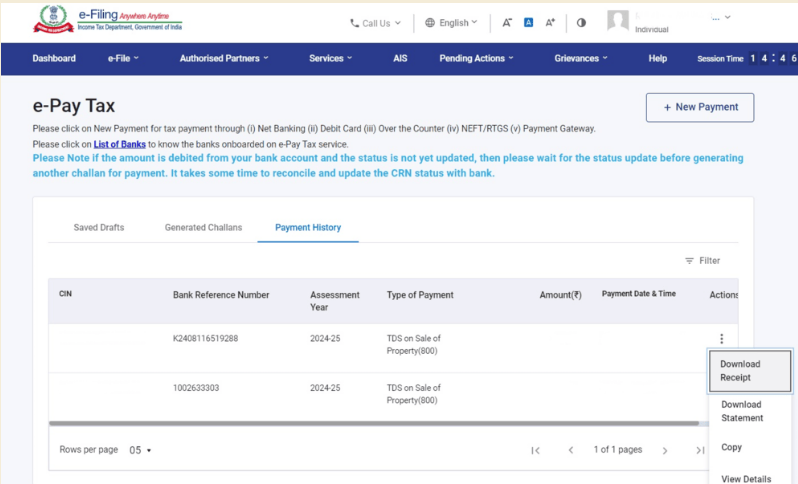

2. Scroll to Tax Payment: Click on ‘e-Pay Taxes.’ This will take you to the payment section.

3. Check Payment History: Next, click on ‘Payment History.’ If you’ve completed Form 26QB, it will appear here. Look for ‘TDS on Sale of Property (800)’.

4. Download the Form: You can download your Form 26QB from this section. This is your receipt for the TDS payment.

Suggested Read: TDS on Rent Limit

How Do You Get Your TDS Certificate Form 16B from TRACES?

Getting your TDS Certificate, Form 16B, through TRACES is simple. Here’s a quick guide:

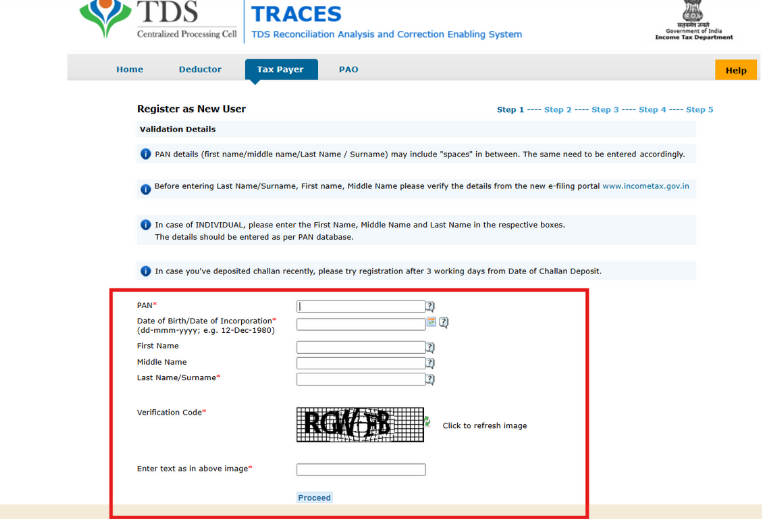

1. Register on TRACES: Go to the TRACES website at tdscpc.gov.in. You can register three days after making your TDS payment. Enter your PAN, and then click ‘Proceed’ to register. Choose your user type and fill in the required details. After this, you’ll confirm your account with OTPs sent to your email and phone.

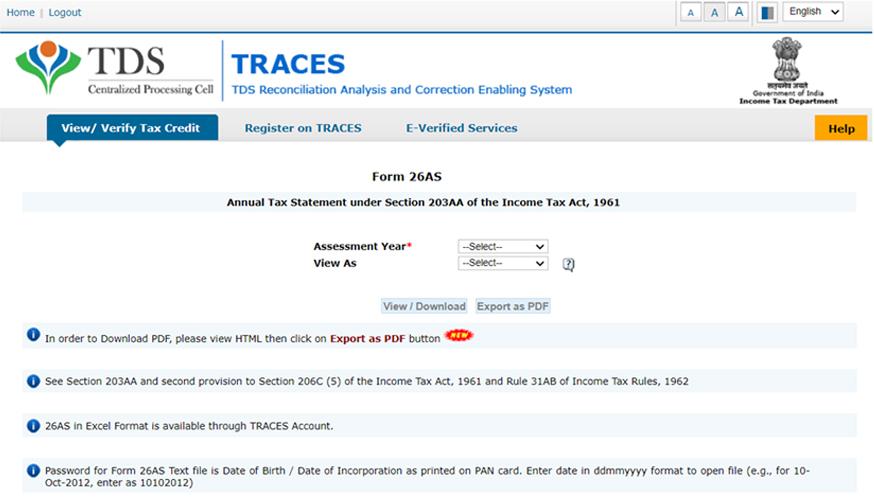

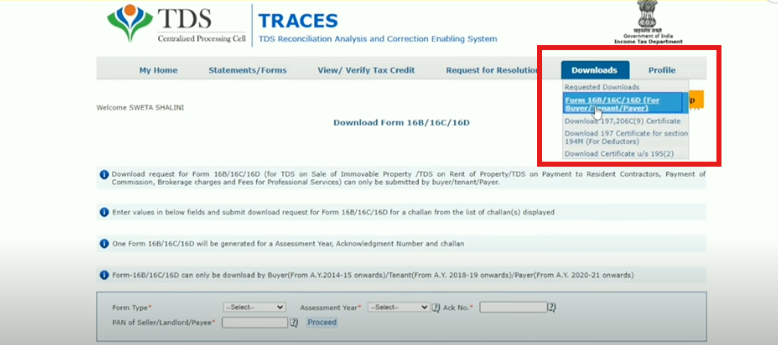

2. Log In to Your Account: Once registered, log into TRACES. It may take up to a week for your TDS details to show in Form 26AS. Use your PAN and the password you created to log in. Then, select the ‘Form 16B/16C/16D’ option for buyers.

3. Request Your Form 16B: Enter the details like Form Type (26QB), the assessment year, and the seller’s PAN. After verifying the transaction details, submit your request. TRACES processes most requests for Form 16B within a few hours.

4. Download Your Form 16B: Once ready, download Form 16B from the ‘Requested Downloads’ section. Print it out and give it to the seller.

Suggested Read: How to pay your property tax online in India?

Recent Updates to TDS Regulations for Property Sales

Starting October 1, 2024, there have been significant updates to the TDS rules affecting property transactions. Here’s what you need to know:

- Changes in TDS Rates: The TDS rate on property sales has been adjusted. This means you might pay more or less TDS based on the new rates.

- New Thresholds Introduced: There’s a new limit on the sale price that affects how much TDS you need to deduct. This helps simplify your tax calculations.

- Updated Filing Procedures: The way you file and document TDS has changed. These updates make the process clearer and help avoid mistakes.

Also Read: 194IA TDS on Property Sale – Key Things You Need to Know

TDS Deductions on Property Rent

When you rent out a property, TDS (Tax Deducted at Source) applies. Here’s what you should know:

- TDS on Rental Income: TDS is taken from the rent you earn. This is because the rent is considered additional income.

- Relevant Tax Section: The deduction falls under Section 194IB of the Income Tax Act. This section specifically targets rental income.

Conclusion

Understanding TDS on purchase of property is crucial when buying resale properties. This ensures you comply with tax laws and simplifies the process for both buyers and sellers. Remember, correctly handling TDS helps avoid future legal and financial issues.

Frequently Asked Questions

When buying property worth Rs. 50 lakh or more, deduct 1% TDS under Section 194IA. This applies to homes, commercial spaces, and land.

Buyers must use Form 26QB to report TDS for property purchases. It’s required for transactions that fall under Section 194IA of the Income Tax Act.

The buyer is responsible for deducting 1% TDS on property transactions, as specified under Section 194IA, when the seller provides their PAN.

TDS must be paid within 30 days from the month’s end in which the property TDS was deducted.

Buyers must deduct TDS at 0.1% on purchases over ₹50 lakh from Indian residents, given the seller provides their PAN. This rule enhances tax compliance and transparency.

Calculate TDS at 1% of the property’s total value. For a property priced at ₹70 lakh, the TDS would be ₹70,000. Always confirm the seller’s PAN before making the payment.

Failing to deduct TDS on property can lead to a penalty up to ₹1 lakh under Section 271H. Avoid penalties by paying the TDS, interest, and any late fees promptly upon notice.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan