Calculate how much you can save by prepaying your home loan using our online calculator:

Navigating the complexities of home loan management can be a daunting task. This is where Credit Dharma’s Home Loan Prepayment Calculator, alongside tools like a home loan calculator India and a home loan mortgage calculator India, becomes an indispensable resource.

It helps homeowners understand how prepayment can impact their loan’s tenure and the total interest payable. Whether you are considering a part time payment calculator for flexibility or exploring other repayment options, this blog will delve into the nuances of these calculators, ensuring you have all the information needed to make informed decisions.

Do you want to prepay and close your home loan quicker?

What is Home Loan Prepayment?

Home loan prepayment is when you pay extra money towards your home loan, on top of your regular monthly payments. This additional payment goes directly towards reducing the principal amount (the original amount you borrowed).

Types of Prepayment

- Partial Prepayment: When you pay an additional amount towards your home loan on top of your regular EMI.

- Lump Sum Prepayment: Also known as foreclosure, lump sum pre-payment is when you pay off the entire remaining loan balance before the end of the loan tenure.

Note: Check with your lender for any prepayment penalties or special rules that may apply.

Prepaying your home loan can be a strategic move to reduce overall loan costs and shorten your loan tenure.

Save lakhs on your home loan interest with smart prepayment strategies

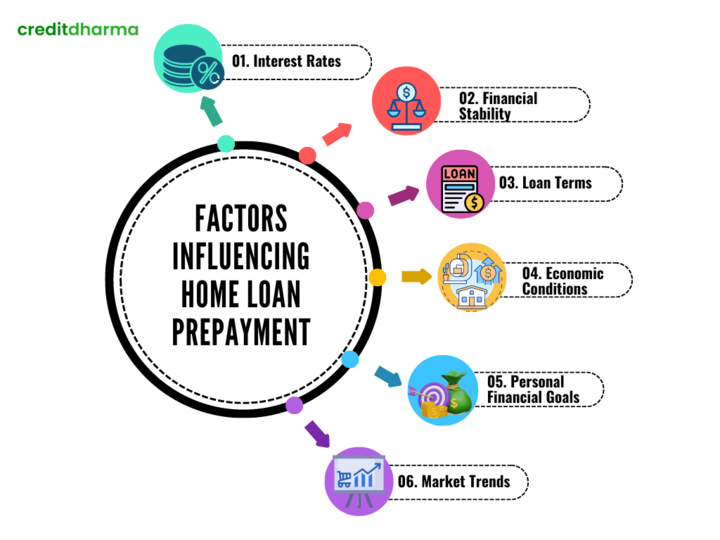

Factors Influencing Home Loan Prepayment

- Interest Rates: Lower rates may encourage prepayment to save on total interest costs.

- Financial Stability: Availability of surplus funds can prompt homeowners to prepay.

- Loan Terms: Terms that allow prepayments without penalties are more conducive.

- Economic Conditions: Economic stability or uncertainty can impact prepayment decisions.

- Personal Financial Goals: Alignment with long-term financial planning and goals.

- Market Trends: Real estate market trends can influence decisions on property investment and loan repayment.

Importance of Prepaying Your Home Loan

| Benefit | Description |

|---|---|

| Interest Savings | During prepayment, the extra money you pay is deducted from the principal amount. Since interest is calculated on the outstanding principal, reducing the principal reduces the interest burden over time. |

| Loan Tenure Reduction | When you make a prepayment, you have the option to either keep the EMI constant and reduce the loan tenure or reduce the EMI and keep the tenure constant. Most people choose to keep the EMI constant, which reduces the tenure of the loan. |

| Improved Credit Score | Consistent reduction in debt levels can boost your credit score, indicating that you are a lower-risk borrower. |

| Increased Home Equity | Prepayment increases the equity you hold in your home. Higher equity provides financial flexibility, including the option to secure loans against the property if needed. [Equity: Difference between the property’s market value and the outstanding loan amount.] |

| Financial Freedom | Paying off your home loan early can free up your monthly budget. Without a monthly home loan EMI, you have more financial flexibility to invest, save, or spend on other life goals. |

The Mechanics of the Home Loan Prepayment Calculator

A prepayment calculator is a financial tool designed to help borrowers understand the impact of making extra payments towards the principal of their loan ahead of schedule. It calculates the potential savings on interest and the reduction in the loan tenure that can result from prepaying a part of the loan.

Key Inputs for the Calculator:

| Parameter | Description |

|---|---|

| Loan Amount | The total amount borrowed. |

| Tenure | The original duration of the loan. |

| Rate of Interest | The interest rate applied to your loan. |

| Instalments Paid | The number of EMIs paid till date. |

| Prepayment Amount | The amount you wish to prepay. |

How Does the Credit Dharma Home Loan Prepayment Calculator Work?

Example Scenario

| Parameter | Value |

|---|---|

| Loan Amount | Rs. 1.2 Crore |

| Tenure | 15 years |

| Interest Rate | 8.5% p.a. |

| EMIs Paid | 10 |

| Prepayment Amount | Rs. 3 lakh |

Results from Calculator

| Parameter | Value |

|---|---|

| Total Interest Saved | Rs. 6,64,147 |

| EMI Tenure Reduction | 8 months |

Explanation:

After the prepayment, the new loan parameters (remaining balance, remaining tenure, or EMI) can be recalculated in two ways:

- Reduce the Tenure: Keep the EMI constant but calculate how many months can be shaved off the loan tenure due to the reduced principal.

- Reduce the EMI: Keep the tenure constant but reduce the monthly payment amount. In this scenario, the tenure reduction is chosen.

With the reduced principal and potentially reduced tenure, the total amount of interest paid over the life of the loan decreases significantly. This is calculated by comparing the total interest that would have been paid on the original schedule against the total interest to be paid on the new schedule.

Get a Home Loan

with Highest Eligibility

& Best Rates

Eligibility for Home Loan Prepayment

Most individuals can make full or partial prepayments on their home loans. However, lender policies vary, and some may restrict prepayment to minimize their losses. It’s crucial to check your loan agreement for any prepayment clauses or penalties.

Home Loan Prepayment Charges

The Reserve Bank of India has set forth guidelines for banks and housing finance companies regarding prepayment charges:

When Prepayment Charges Apply:

| Loan Type | Details |

|---|---|

| Non-Individual Borrowers | Banks may impose penalties. |

| Fixed-Rate Loans | Charges applicable by banks and HFCs. |

| Dual-Rate Loans | Banks can levy charges if prepayment occurs during the fixed-rate period. |

When Prepayment Charges Do Not Apply:

| Loan Type | Details |

|---|---|

| Floating-Rate Loans | Banks cannot charge penalties. |

| Prepayment with Own Funds | HFCs cannot impose charges if prepayment is made with personal funds. |

| Dual-Rate Loans (Floating Period) | No charges during the floating-rate tenure. |

Pros and Cons of Prepaying your Home Loan

Home loan prepayment can be an attractive option for many homeowners, offering the promise of interest savings and reduced debt. However, like any financial decision, it comes with its own set of advantages and disadvantages.

Pros of Home Loan Prepayment

- Interest Savings: By reducing the principal amount earlier than scheduled, you decrease the total interest paid over the life of the loan.

- Reduced Loan Tenure: Prepayment can shorten the duration of your loan, allowing you to become debt-free sooner than anticipated.

- Peace of Mind: Paying off debt early can provide emotional and psychological benefits, including reduced stress and increased financial security.

Cons of Home Loan Prepayment

- Opportunity Cost: The funds used for prepayment could be invested elsewhere with a potentially higher return. This is especially true in low-interest-rate environments where the cost of borrowing is cheap, and investment opportunities may yield greater returns.

- Liquidity Concerns: Prepaying a home loan reduces your liquid assets, which could be problematic in case of an emergency or unforeseen financial needs. Maintaining liquidity is important for financial flexibility and security.

- Loss of Tax Benefits: For some borrowers, the interest paid on a home loan is tax-deductible, reducing their overall tax liability. Prepaying the loan reduces the amount of deductible interest, which could lead to a higher tax bill for some homeowners.

How to Plan for a Home Loan Prepayment?

Planning for a home loan prepayment involves a strategic approach to managing your finances, ensuring that you can make additional payments towards your loan without compromising your financial stability.

This section provides a step-by-step guide to effectively plan for home loan prepayment, helping you achieve the goal of paying off your mortgage early while maintaining financial health.

Budgeting for Prepayment

Assess Your Monthly Finances

- Start by taking a comprehensive look at your monthly income and expenses. Identify areas where you can cut back on non-essential spending to free up more money for loan prepayment. Creating a detailed budget can help you track your spending and find opportunities to save.

Set Aside Funds for Prepayment

- Once you’ve identified potential savings, allocate a specific amount of money each month towards your home loan prepayment. Consider setting up a separate savings account for this purpose to avoid the temptation to spend these funds elsewhere.

Setting Prepayment Milestones

Establish Prepayment Goals

- Set clear, achievable milestones for your prepayment efforts. For example, aim to reduce the loan tenure by a certain number of years or to reach a specific principal amount by a predetermined date. These goals will keep you motivated and focused on your prepayment plan.

Monitor Your Progress

- Regularly review your loan statements to monitor your progress towards your prepayment milestones. Seeing the principal amount decrease and knowing you’re getting closer to your goal can be incredibly rewarding and motivate further savings.

Consultation with Financial Advisors

Seek Professional Advice

- Before making significant prepayments, it’s wise to consult with a financial advisor. They can help you assess the impact of prepayment on your overall financial plan, including tax implications, investment opportunities, and your emergency fund adequacy.

Tailor Your Prepayment Plan

- A financial advisor can help you tailor your prepayment plan to your specific financial situation. They can advise on how much to prepay and when, considering your other financial goals and obligations.

Additional Strategies for Prepayment

Utilize Windfalls Wisely

- Any unexpected financial windfalls, such as bonuses, tax refunds, or inheritances, can be directed towards your home loan prepayment. These amounts can make a significant impact on reducing your loan balance and interest payments over time.

Incremental Prepayment Approach

- If large prepayments are not feasible, consider making smaller, more frequent additional payments. Even modest extra payments can lead to significant interest savings and a shorter loan tenure over time.

Considerations Before Making a Home Loan Prepayment

Before opting for prepayment, consider the following

| Factor | Description |

|---|---|

| Age Factor | If nearing retirement, prepaying is advisable to avoid post-retirement financial stress. |

| Future Cash Needs | Assess your upcoming financial requirements to ensure prepayment doesn’t deplete your savings. |

| Tax Benefits | Prepayment might affect your eligibility for tax deductions on home loans. |

| Interest Savings | Calculate the total interest savings to determine if prepayment is financially beneficial. |

| Investment Opportunities | Compare potential investment returns with savings from prepayment. |

Conclusion

Before considering prepayment, eliminate high-interest debts and secure an emergency fund. Prepaying your home loan can be beneficial if you aim to own your home sooner or decrease interest expenses.

Ready to take control of your home loan and save on interest? Use the Credit Dharma Home Loan Prepayment Calculator today and make informed decisions to achieve financial freedom faster. Start planning your prepayment strategy now!

Frequently Asked Questions

Repaying a home loan refers to settling the entire loan amount. Prepayment, on the other hand, involves paying off a portion of the loan ahead of schedule.

Yes, making partial payments typically leads to a reduction in the monthly EMI of the home loan.

While a home loan EMI calculator estimates your monthly loan payments, a prepayment calculator shows how these payments change if you pay off part of your loan early. It also calculates potential savings from such prepayments.

Making partial payments on your home loan can be beneficial as it may reduce either the loan’s tenure or the monthly EMI.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan