Dreaming of your own home but worried about the upfront cost? Axis Bank’s Asha Home Loan bridges that gap with a pocket-friendly solution tailored for aspiring homeowners across India.

Whether you’re buying a compact 300-sq-ft studio or a family flat worth up to ₹35 – 45 lakhs (location-dependent), Asha lets you borrow from just ₹1 lakh to ₹35 lakhs while funding up to 90 % of the property price. Even better, the plan rewards long-term borrowers by waiving 12 EMIs—four each at the end of the 4th, 8th and 12th years—easing your repayment journey.

With eligibility starting at a combined monthly income of only ₹8,000 and additional savings under the Credit Linked Subsidy Scheme, Asha Home Loan makes stepping into your own home simpler, sooner and smarter.

Axis Bank Asha Home Loan Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 10.50% p.a. onwards |

| Maximum Loan Amount | ₹35,00,000 |

| Maximum Tenure | 30 Years |

| Processing Fees | 1% of the loan amount + GST |

Suggested Read: West Bengal Housing Scheme for All

Axis Bank Asha Home Loan Interest Rates

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

| Home Loan Amount | Salaried | Self Employed |

|---|---|---|

| Any Amount | 10.50% p.a. – 12.85% p.a. | 12.00% p.a. – 13.30% p.a. |

Suggested Read: Investment Opportunities in Andheri’s Slum

Axis Bank Asha Home Loan Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a home loan.

| Aspect | Salaried Individuals | Professionals | Self Employed |

|---|---|---|---|

| Age | 21 years – 65 years | 21 years – 65 years | 21 years – 65 years |

| Work Experience | Stable employment history | Consistent income | Consistent income through tax returns. |

| Work History | Government sectors or reputed companies. | Doctors/ Lawyers/ Chartered Accountants/ Management Consultants | Business owners or entrepreneurs |

| Minimum Salary | ₹8,000 per month | ₹8,000 per month | ₹8,000 per month |

Suggested Read: The Growth of Affordable Housing in India

Axis Bank Asha Home Loan Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan.

| Fees | Amount |

|---|---|

| Processing Fees | 1% of the loan amount + GST (Minimum ₹10,000) |

| Upfront Processing Fees | ₹5,000 (collected at the time of application, balance fee will be collected at the time of disbursement) |

Suggested Read: PMAY Eligibility Criteria

Axis Bank Asha Home Loan Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan.

| Charges Category | Fees |

|---|---|

| Repayment Instruction / Instrument Return | ₹339 /- per instance |

| Admin Charges | ₹0 |

| Duplicate Statement Issuance Charges | ₹250 /- per instance |

| Issuance Charges for Photocopy of Title Documents | ₹500 /- per document set |

| Charges of Customer-Initiated Requests for Copies of Documents | ₹500 /- per document set |

| Prepayment Charges for Floating Rate Loan | NIL |

| Equitable Mortgage Creation Charges | As applicable in the state |

| Issuance Charges of Credit Report | ₹50 /- per instance |

| Cheque / Instrument Swap Charges | ₹500 /- per instance |

| Duplicate Amortization Schedule Issuance Charges | ₹250 /- per instance |

| Duplicate Interest Certificate Issuance Charges | ₹50 /- per instance |

| Prepayment Charges for Fixed Rate Loan | 2% of outstanding principal / amount prepaid |

| Duplicate No Dues Certificate / NOC | ₹50 /- per instance |

| CERSAI Charges (Loans up to 5 lakhs) | ₹50 |

| CERSAI Charges (Loans above 5 lakhs) | ₹100 |

| Penal Charges | 8% p.a. above applicable interest rate on overdue amount |

| CERSAI Charges | Loan up to ₹5 Lakh: ₹50Loan Above ₹5 Lakh: ₹100 |

Suggested Read: PMAY 3.0

Axis Bank Asha Home Loan Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the home loan application process smooth.

General Documents

| Category | Documents Required |

|---|---|

| Proof of Identity | PAN Card/ Driver’s License / Voter ID / Passport / Aadhar Card |

| Proof of Address | Driver’s License / Ration Card / Voter ID / Passport / Aadhar Card / Registered Rent Agreement |

| Date of Birth Proof | Passport/ Driving Licence/ PAN Card/ Birth Certificate/ 10th Marksheet |

| Signature Proof | Passport/ PAN Card |

Check Out: List of Documents required for Home Loan Disbursement

Proof of Income

| Salaried | NRI Salaried | Self-Employed |

|---|---|---|

| 3 months pay slip | 3 months pay slip | 2 years ITR, Computation of Income, P&L, Balance Sheet with CA seal and sign |

| 6 months pay slip/2 years bonus proof (in case of variable pay) | Appointment letter/contract letter | For Asha HL – 1 year ITR, Computation of Income, P&L, Balance Sheet with CA seal and sign |

| 6 months bank statement showing salary credits | Continuous Discharge Certificate for Shipping cases | Tax Audit Report (if gross turnover exceeds ₹1 crore or gross receipts exceed ₹25 lakh) |

| 2 years Form 16 (or employment continuity proof) | 6 months Domestic NRE/NRO account statement | 6 months bank statements of personal and business accounts |

| 6 months international salary account statement | CPC and tax paid challan | |

| Overseas credit report | Atleast 3 years of business continuity proof | |

| Valid visa copy/OCI card | ||

| Passport copy | ||

| POA details |

Suggested Read: Real Estate Investment in Bangalore

Home Loan Balance Transfer

| Category | Details |

|---|---|

| For Balance Transfer / Takeover of Loan from Other Bank / Financial Institution | 12 months loan account statement with latest outstanding letter |

| Existing loan details and 6 months bank statement from where EMI is deducted |

Suggested Read: Axis Bank Home Loan Balance Transfer

Other Important Documents

| Other Documents |

|---|

| Completely filled and duly signed application form along with all applicants’ latest passport size photo |

| Aadhar card is mandatory for Credit Linked Subsidy Scheme (PMAY) applicants |

| PAN card is mandatory for all financial applicants |

| Processing Fee and CERSAI cheques |

| Self-attestation of borrowers on all documents submitted |

Suggested Read: Axis Bank Home Loan Minimum CIBIL Score

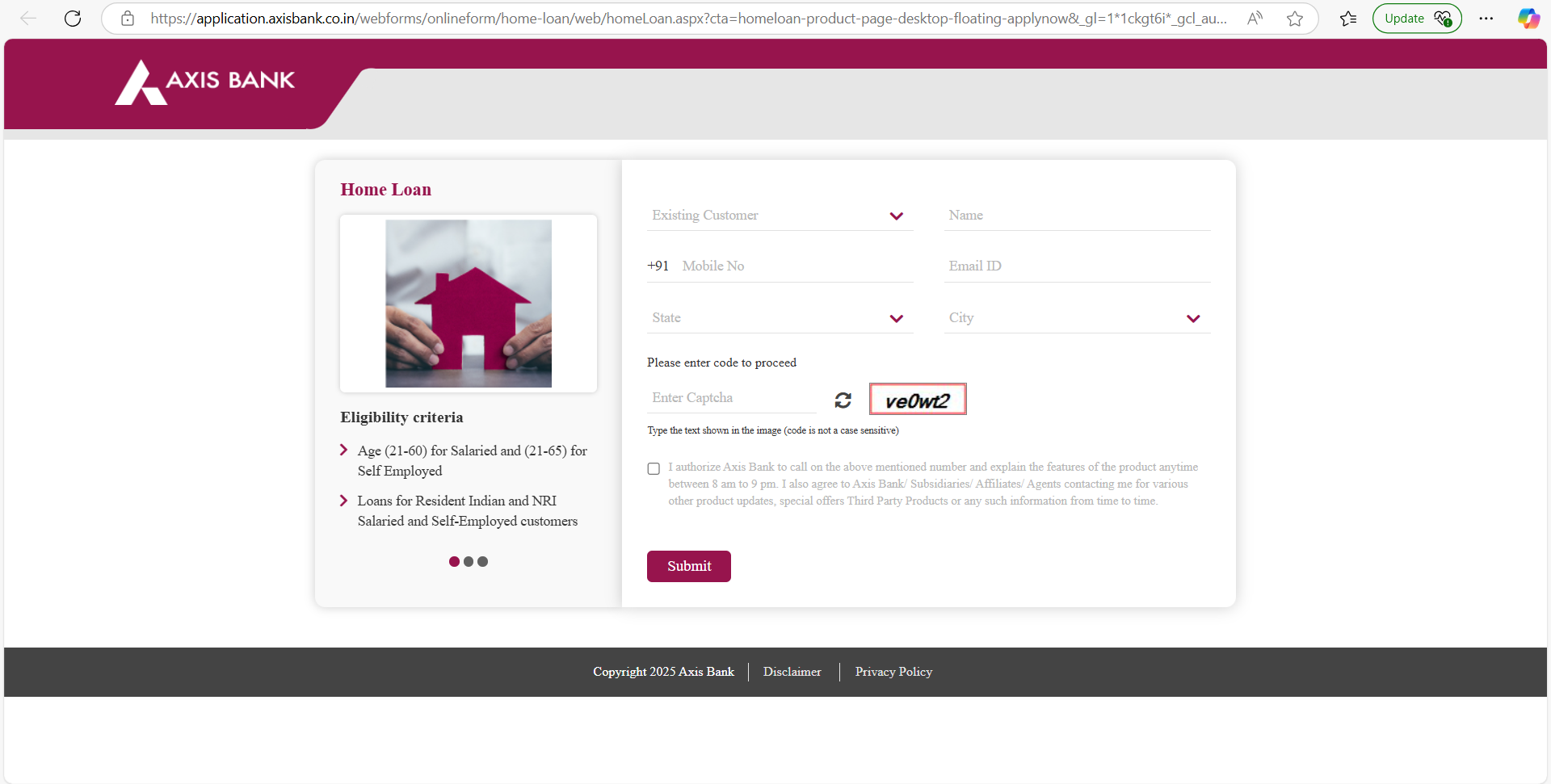

How to Apply for Axis Bank Asha Home Loan?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan.

- Visit the Official Website

Go to the Axis Bank home loan page.

- Select Home Loan Option

Choose the type of home loan you want to apply for (e.g., home loan, balance transfer, etc.).

- Fill the Online Application

Enter personal, contact, and financial details in the application form. Make sure to provide accurate information for quick processing.

- Upload Documents

Submit required documents like ID proof, address proof, income proof, and property details online.

- Eligibility Check

Axis Bank will evaluate your eligibility based on the information provided.

- Submit the Application

Review your details and submit the application. You will receive an acknowledgment along with the reference number.

- Approval and Processing

Once your application is reviewed, the bank will process the loan. If approved, they will send you an offer letter and discuss the next steps.

- Sign the Agreement

After receiving the offer, sign the loan agreement electronically or at the bank’s branch.

Suggested Read: Axis Bank Home Loan Customer Care

Compare Top Banks Home Loan Interest Rates

Explore home loan offers from different banks to find the best deal that fits your needs.

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Frequently Asked Questions

Yes. The scheme’s minimum combined income requirement is ₹8,000, so you clear that hurdle. However, banks cap EMIs at roughly 35-40 % of net monthly income (the FOIR rule). With ₹9,500 coming in, your affordable EMI is ~₹3,500–₹3,800. At today’s indicative rate of 10.50 % p.a. for 30 years, that translates to a loan of only about ₹4 – ₹4.5 lakh.

You’re within the property-value ceiling for metros (₹45 lakh). The catch is that Asha’s loan amount maxes out at ₹35 lakh, so you must fund the remaining ₹5 lakh (plus stamp duty/registration) from your own pocket. If that works for you, Asha remains an option; otherwise you can look at Axis Bank’s standard Home Loan or Fast Forward variants, which scale higher.

Asha is linked to Axis Bank’s Repo-Rate-Linked Lending Rate (RLLR). That means:

The margin over the repo rate is fixed when the loan is sanctioned.

Whenever the RBI changes the repo rate, your effective rate—and hence your EMI or tenure—moves in the next reset cycle (usually every three months).

So it’s a floating-rate product from day one; there is no fixed-rate window.

CLSS is tied to household income, carpet area and whether you already own a pucca house. For Asha-sized tickets you’ll usually fall into the EWS/LIG bracket (annual income ≤ ₹6 lakh). If so, you can get:

Interest subsidy: 6.5 % on a loan of up to ₹6 lakh.

Effective benefit: Present-value savings of up to ₹2.67 lakh, credited upfront to reduce your principal.

Axis will check your Aadhaar, income proof and property size at sanction and claim the subsidy on your behalf.

Penalty: ₹339 per bounce plus 8 % p.a. additional interest on the overdue amount for the days delayed.

Waiver impact: A single late EMI usually voids your eligibility for the 4-EMI waiver in that 4-year block. Keep payments flawless to preserve the benefit.

Collection timing: ₹5,000 (plus GST) is debited when you file the application. The balance of the 1 % fee is taken just before first disbursement.

Refund policy: The ₹5,000 covers legal & technical evaluation. If the loan is declined (or you back out) this amount is non-refundable; only any excess you paid over actual expenses would be returned.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan