Applying for a home loan is easier with Axis Bank home loan apply, offering simple steps and quick approvals. By understanding eligibility criteria, required documents, and associated fees, you can make informed decisions. A streamlined application process ensures faster loan disbursal, helping you secure your dream home with ease.

Axis Bank Home Loan: Online Application Process

To apply for an Axis Bank home loan online, follow these steps for a smooth and hassle-free process.

Time needed: 5 minutes

- Visit the Official Website

Go to the Axis Bank home loan page.

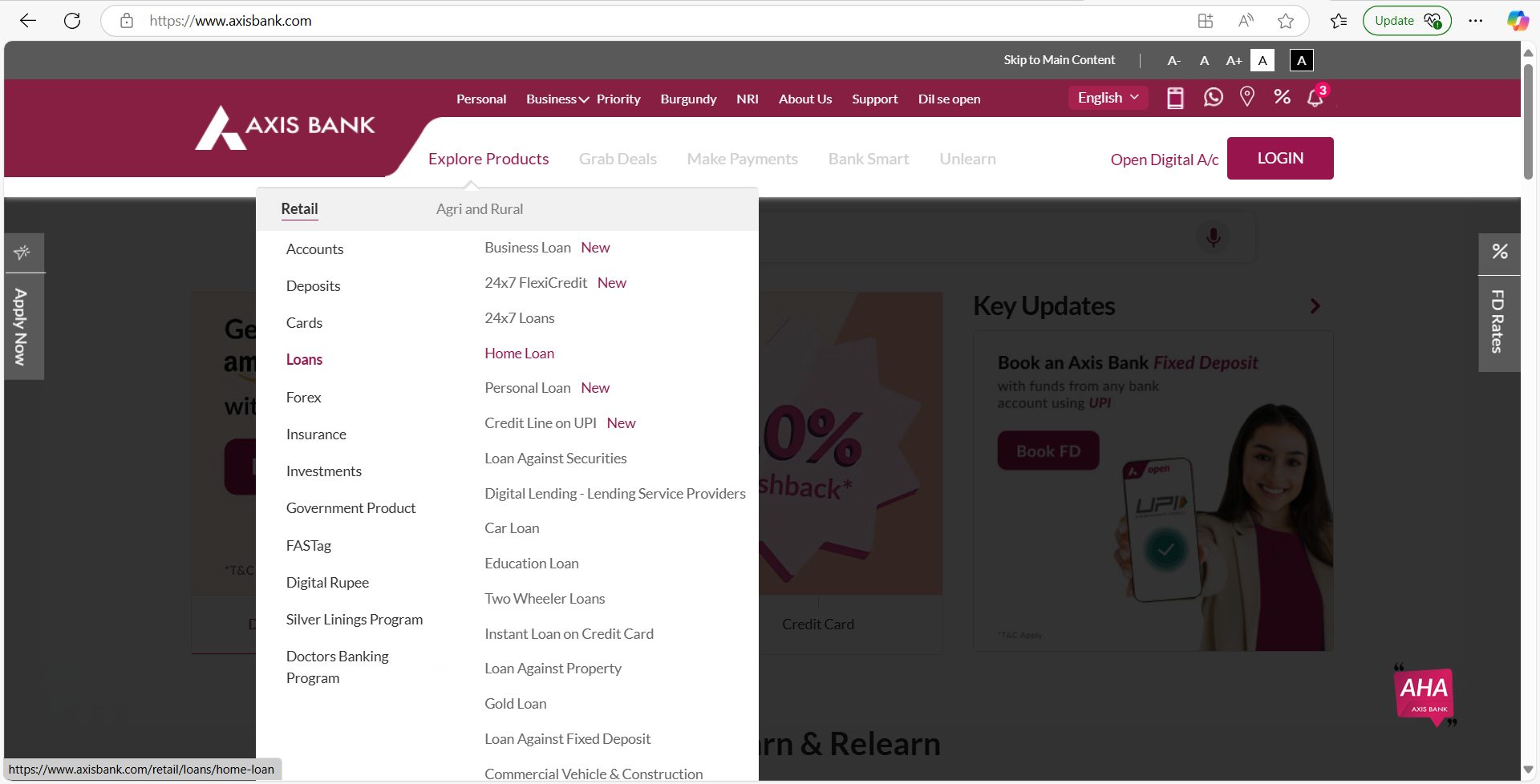

- Select Home Loan Option

Choose the type of home loan you want to apply for (e.g., home loan, balance transfer, etc.).

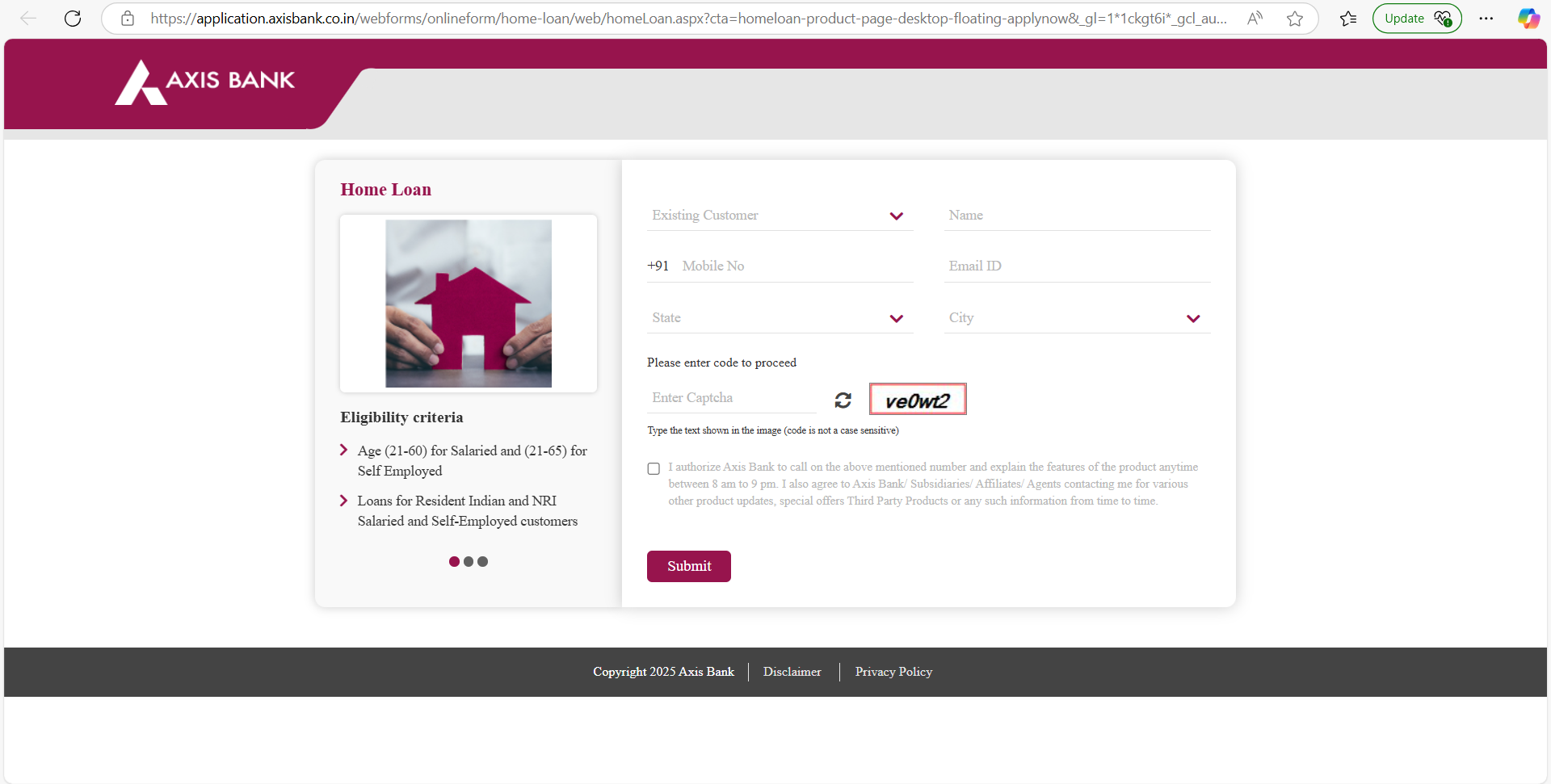

- Fill the Online Application

Enter personal, contact, and financial details in the application form. Make sure to provide accurate information for quick processing.

- Upload Documents

Submit required documents like ID proof, address proof, income proof, and property details online.

- Eligibility Check

Axis Bank will evaluate your eligibility based on the information provided.

- Submit the Application

Review your details and submit the application. You will receive an acknowledgment along with the reference number.

- Approval and Processing

Once your application is reviewed, the bank will process the loan. If approved, they will send you an offer letter and discuss the next steps.

- Sign the Agreement

After receiving the offer, sign the loan agreement electronically or at the bank’s branch.

Also Read: Axis Bank Home Loan Interest Rates

Axis Bank Home Loan: Offline Application Process

To apply for an Axis Bank home loan offline, follow these steps for a seamless application process.

| Step | Description |

|---|---|

| 1. Visit the Nearest Branch | Go to your nearest Axis Bank branch to initiate the home loan application process. |

| 2. Fill Out the Application Form | Request and complete the home loan application form with your personal and financial details. |

| 3. Provide Required Documents | Submit necessary documents, including ID proof, address proof, income proof, and property details. |

| 4. Eligibility Assessment | The bank will assess your eligibility based on the information and documents provided. |

| 5. Loan Discussion | The bank representative will discuss the loan amount, tenure, and interest rates. |

| 6. Sign the Loan Agreement | Once approved, you will need to sign the home loan agreement. |

| 7. Disbursement Process | After completing all formalities, the loan will be disbursed as per the agreed terms. |

Axis Bank Home Loan Application Process with Credit Dharma

- Visit Credit Dharma’s official website.

- Enter your name, city of residence, and mobile number.

- Choose your preferred loan type, for example, “home loan”.

- Enter the OTP and click on “verify.”

- Enter your property details, employment type, income, and CIBIL score.

- Now sit back and relax. Home Loan Experts from Credit Dharma will call you within the next 24 Hours.

Axis Bank Home Loan Application Approval to Disbursement Stages

| Stage | Description |

|---|---|

| Loan Approval Notification | Receive loan approval notification via email/SMS, including approved loan details. |

| Loan Agreement Signing | Receive a formal sanction letter with final loan amount, interest rate, EMI, and loan tenure. |

| Submission of Original Documents | Submit all required original property documents and sale agreements. |

| Verification of Documents | Axis Bank conducts legal and technical verification of submitted documents. |

| Final Sanction Letter Issuance | Receive a formal sanction letter with the final loan amount, interest rate, EMI, and loan tenure. |

| Payment of Processing Fees | Submit a formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Request for Loan Disbursement | Submit formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Loan Amount Disbursal | Begin regular EMI payments as per the repayment schedule in your loan agreement. |

| Loan Repayment Commencement | Begin regular EMI payments as per repayment schedule in your loan agreement. |

Also Read: How to Track Your Application Status?

How Long Does it Take to Process a Home Loan Application?

| Stage | Key Activities | Estimated Time | Factors Affecting Time |

|---|---|---|---|

| 1. Application Submission | Submit application (online/offline) with documents. | Online: Instant Offline: 1–2 days | Document completeness, submission mode (online vs. offline). |

| 2. Eligibility Check | Credit profile, income stability, and existing debts. | 3–5 business days | Credit profile, income stability, existing debts. |

| 3. Property Valuation | Credit score assessment, income verification, and debt analysis. | 3–7 days | Property type (under-construction/ready), legal clarity. |

| 4. Loan Sanction | Approval of loan amount, interest rate, and terms. | 2–3 days post-valuation | Compliance with LTV ratio, valuation report. |

| 5. Legal & Technical Check | Verify property title, ownership, structural safety, and regulatory approvals. | 5–10 days | Property disputes, regulatory compliance, builder delays. |

| 6. Documentation | Loan agreement signing, mortgage registration, EMI setup. | 1–3 days | Applicant responsiveness, document accuracy. |

| 7. Disbursement | Funds transferred to seller/builder. | 1–3 days (ready property) | Builder coordination, escrow formalities. |

Total Processing Time

- Best Case: 2–3 weeks (ready property, no delays).

- Typical Case: 4–6 weeks (standard processing).

- Under-Construction: 6–8 weeks (phased disbursement).

Also Read: What to Do Once Your Home Loan Gets Rejected?

Get a Home Loan

with Highest Eligibility

& Best Rates

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Applying for an Axis Bank home loan is easy, with a simple process from checking eligibility to getting the loan. Just gather your documents and fill out the application form.

Credit Dharma offers home loans at competitive interest rates and provides expert financial advice. Helping you make informed decisions for a better financial future.

Frequently Asked Questions

Axis Bank typically sanctions a home loan within 5 business days and completes approval and disbursement within 15 days after document verification and property appraisal.

You can check the status of your Axis Bank home loan application online by visiting their website, entering your application reference number or registered mobile number, or by visiting the nearest branch or calling customer care at 1860 419 5555 for assistance.

The Axis Bank home loan approval process typically includes application submission, document verification, property valuation, loan underwriting, and loan disbursement.

Visit the Axis Bank official website.

Click on the “Track Application” option.

Enter your application reference number or registered mobile number.

View the status of your home loan application.

For an Axis Bank home loan, you will need documents such as proof of identity, proof of address, income proof, property documents, and bank statements

Yes, Axis Bank charges a processing fee of up to 1% of the loan amount or ₹10,000, whichever is higher, plus applicable GST.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan