The down payment wiped out your savings, yet bare walls stare back? Rather than swipe a card for every sofa and appliance, top up your existing loan in minutes.

With Star Home Loan – Furnishing, Bank of India disburses funds exclusively for interiors at housing‑loan rates. All expenses merge under one schedule, so budgeting stays simple and transparent.

Quick digital processing means no fresh property valuation or lengthy paperwork. Decorate now, pay gradually, and keep your cash cushion intact.

Bank of India Star Home Loan – Furnishing Highlights

| Category | Highlights |

|---|---|

| Interest Rates | 8.25% p.a. onwards |

| Loan Amount | Up to 15% of the Loan Amount |

| Loan Tenure | 10 Years |

| Processing Fees | 0.25% of the Loan Amount |

Suggested Read: Bank of India Home Loan Interest Rates 2025

Bank of India Star Home Loan – Furnishing Interest Rates 2025

Bank of India provides home loans with interest rates that reflect current market conditions and are influenced by factors like your CIBIL score. You can choose a fixed rate or a floating rate, according to your financial situation.

Bank of India Fixed Interest Rate Home Loans Based on CIBIL Score

Bank of India offers fixed interest rate home loans where the interest rate remains constant for the first 5 years. Upon completion of this period, the then-current fixed rate will be applied.

If you choose to switch to a floating rate after this term, you will be charged the current floating rate at that time.

| CIBIL Score | Salaried | Self Employed |

|---|---|---|

| 825 and Above | 10.60% p.a. onwards | |

| 800 – 824 | 10.60% p.a. onwards | |

| 740 – 799 | 10.60% p.a. onwards | |

| 725 – 759 | 10.70% p.a. onwards | |

| 675 – 724 | 10.80% p.a. onwards | |

| Below 624 (For Women Beneficiary) | 11.90% p.a. onwards | 12.05% p.a. onwards |

| Below 624 (For Others) | 11.95% p.a. onwards | 12.10% p.a. onwards |

| -1/ 0 | 10.90% p.a. onwards | |

Bank of India Floating Interest Rate Home Loans Based on CIBIL Score

At Bank of India, floating interest rates for home loans are determined by your CIBIL score and are calculated annually, unless stated otherwise.

These variable rates apply both to new home loans and to customers opting to switch their existing loan to a floating rate structure.

| CIBIL Score | Salaried | Self Employed |

|---|---|---|

| 825 and Above | 8.40% p.a. onwards | |

| 800 – 824 | 8.50% p.a. onwards | |

| 740 – 799 | 8.70% p.a. onwards | |

| 725 – 759 | 8.80% p.a. onwards | |

| 675 – 724 | 9.55% p.a. onwards | |

| Below 624 (For Women Beneficiary) | 10.65% p.a. onwards | 10.80% p.a. onwards |

| Below 624 (For Others) | 10.70% p.a. onwards | 10.85% p.a. onwards |

| -1/ 0 | 8.80% p.a. onwards | |

Bank of India Star Home Loan – Furnishing Eligibility Criteria

| Category | Requirements |

|---|---|

| Age | 18 years – 70 years |

| Nationality | Indian/ NRI/ PIO |

| Profession | Individuals: Salaried/ Self Employed Non Individuals: Association of Individuals/ HUF/ Corporates |

Check Out: Bank of India Home Loan Eligibility Calculator

Bank of India Star Home Loan – Furnishing Documents Required

When applying for a home loan with the Bank of India, you will need to provide specific documents that verify your identity, income, and property details. Below is a detailed list:

General Documents

| Category | Documents Required |

|---|---|

| Proof of Identity | PAN Card/ Driver’s License / Voter ID / Passport / Aadhar Card |

| Proof of Address | Driver’s License / Ration Card / Voter ID / Passport / Aadhar Card / Registered Rent Agreement |

Proof of Income

| Salaried | Self Employed |

|---|---|

| Last 6 months’ Salary Slips | Last 3 Years ITR with Computation of Income |

| 1 Year ITR/Form 16 | Profit & Loss Account |

| 6 months bank account statement (salary account or individual account). | Balance Sheet |

| Capital Account Statement | |

| Bank account statement for the last 12 months (for individual or business). | |

| Business proof |

NRI/ PIO

| Category | Documents |

|---|---|

| Passport & Visa | Passport with VISA printed on it |

| Work Authorization | Work Permit |

| Identity Proof | Copy of PAN, ID card issued by employer |

| Proof of Address | Proof of address in India Proof of address in the foreign country Proof of address from employer with contact details |

| Income Proof | Latest salary slip in original Annual income tax return filed as per applicable rules for the last 2 years |

Check Out: Bank of India Home Loan Insurance

Bank of India Star Home Loan – Furnishing Processing Fees

Bank of India takes processing fees to cover the cost of reviewing your documents and assessing your loan application.

| Category | Processing Fees |

|---|---|

| For Individuals | 0.25% of Loan amount Min. ₹1,500 to Max. ₹20,000 |

Suggested Read: Bank of India Home Loan Customer Care

Bank of India Star Home Loan – Furnishing Other Fees and Charges

Bank of India’s Star Home Loan – Furnishing isn’t just about borrowing for sofas and wardrobes; a handful of extra fees tag along. Below is a quick snapshot of those charges so you can budget accurately from day one.

Charges for Registration / Satisfaction of Security Interest & Related Transactions

| Transaction (Form) | Loan ≤ ₹5 lakh | Loan > ₹5 lakh |

|---|---|---|

| Mortgage by deposit of title deeds (Form I) | ₹ 50 | ₹ 100 |

| Mortgage of immovable property other than deposit of title deeds (Form I) | ₹ 50 | ₹ 100 |

| Hypothecation of plant & machinery / stocks / receivables (Form I) | ₹ 50 | ₹ 100 |

| Charge on intangible assets (patent, trademark, licence etc.) (Form I) | ₹ 50 | ₹ 100 |

| Charge on under‑construction property by instrument other than mortgage (Form I) | ₹ 50 | ₹ 100 |

| Satisfaction of any charge filed under Sl 1‑5 (Form II) | NIL | NIL |

| Securitisation / reconstruction of financial assets (Form III) | – | ₹ 500 |

| Satisfaction of securitisation / reconstruction (Form IV) | – | ₹ 50 |

Miscellaneous Applications

| Purpose | Fee |

|---|---|

| Copy / information from Register | ₹ 10 |

| Condonation of delay (≤ 30 days) | Up to 10 × basic fee |

Additional Fee for Late Filing of Chargeable Transactions

| Delay (from due date) | Additional Fee | Illustration* |

|---|---|---|

| 31 – 40 days | 2 × applicable fee | Base fee ₹ 100 → extra ₹ 200 |

| 41 – 50 days | 5 × applicable fee | Base fee ₹ 100 → extra ₹ 500 |

| 51 – 60 days | 10 × applicable fee | Base fee ₹ 100 → extra ₹ 1,000 |

Read More: Home Loans in Bangalore

How to Apply for Bank of India Star Home Loan – Furnishing?

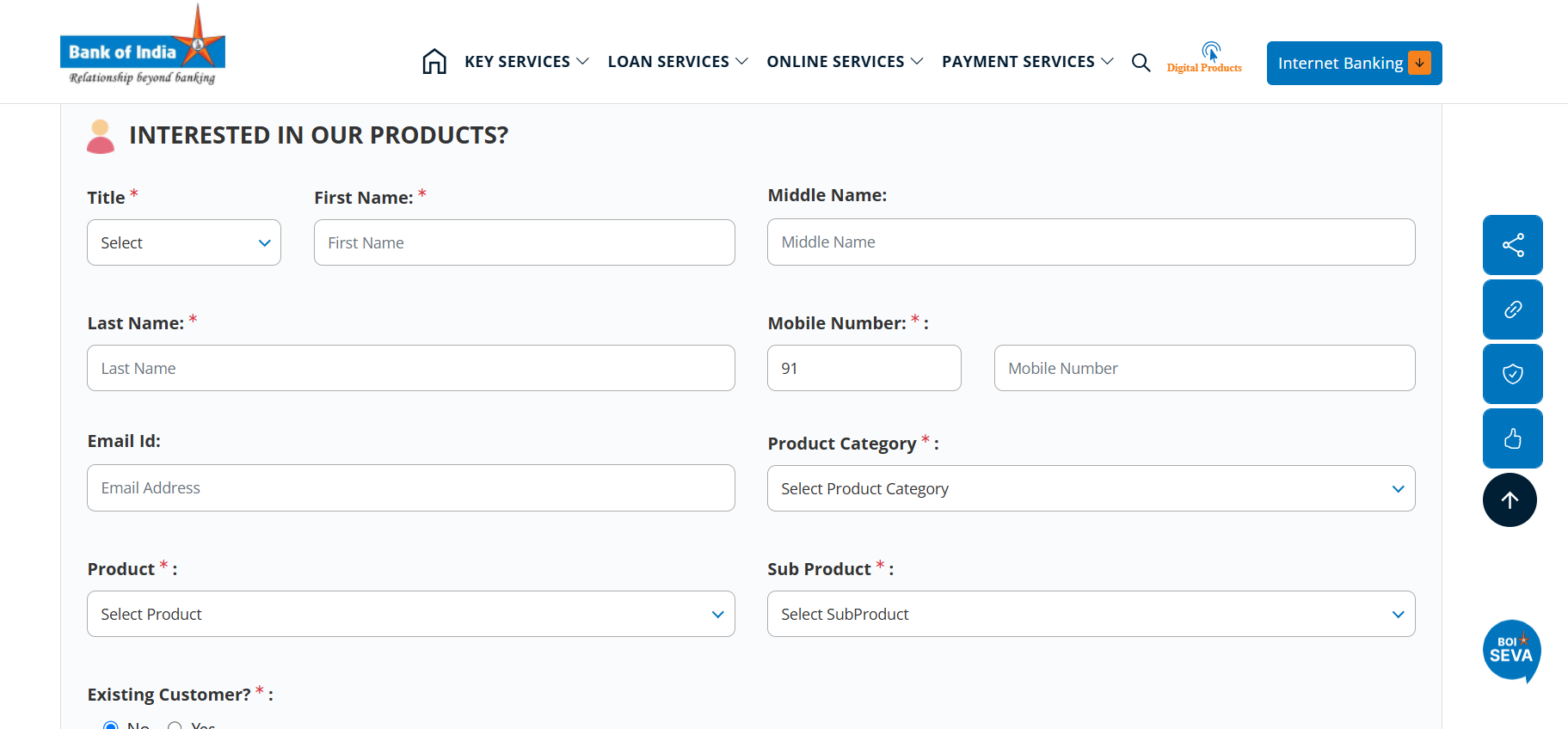

To apply for a Bank of India home loan online, follow these steps for a smooth and hassle-free process.

- Visit the official Bank of India website and choose the loan type.

- Click on “Apply Now”

- Enter your personal details, desired loan amount, and preferred branch in the online form.

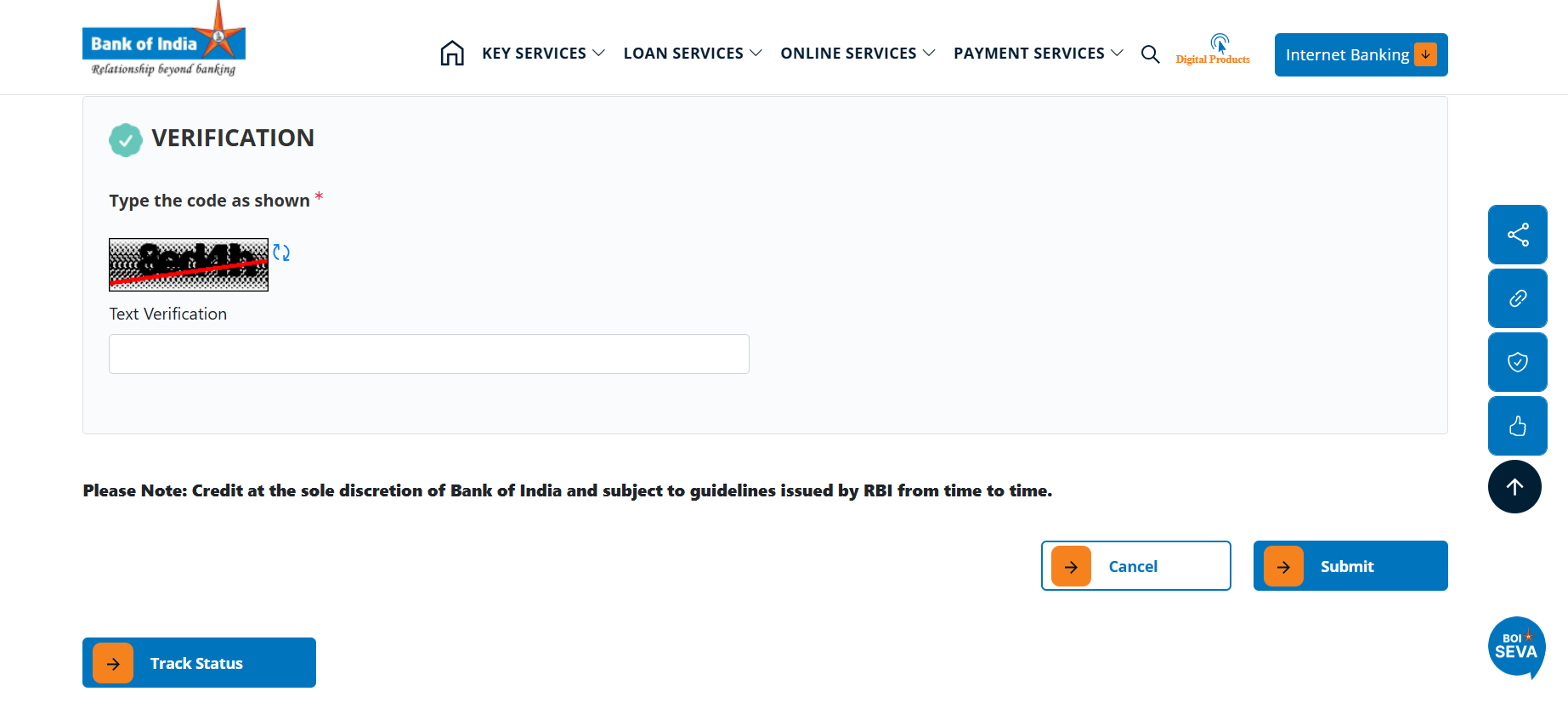

- Complete the CAPTCHA verification, then click Submit to send your application.

Read More: How to Reduce Your Home Loan Tenure?

Compare Top Banks Home Loan Interest Rates 2025

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

Personal‑loan APRs often cross 14‑18 % and credit cards 36 %+, while furnishing loans start in the single digits—saving serious interest over 3‑5 years.

Typical caps are 15 % of your sanctioned home loan (Bank of India) or up to 100 % of the renovation estimate so long as the overall loan‑to‑value stays within 75‑90 %.

Yes. Under Section 24(b) you can claim up to ₹30,000 a year on interest paid toward a renovation/furnishing loan, within the overall ₹2 lakh home‑interest cap.

If you already have a mortgage, the furnishing loan is usually secured by the same property (BOI even waives fresh mortgage up to ₹5 lakh). A few NBFCs offer totally unsecured renovation loans—but they price higher.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan