Time is precious, especially in the real estate market. Buying a home is exciting, but home loans can feel overwhelming. Credit Dharma is here to change that.

From your first click to final approval, our straightforward online process and dedicated support team make applying for a HDFC Bank home loan smooth, transparent, and stress-free.

Start your application online anytime, anywhere—no more waiting in long queues.

HDFC Bank Home Loan: Online Application Process

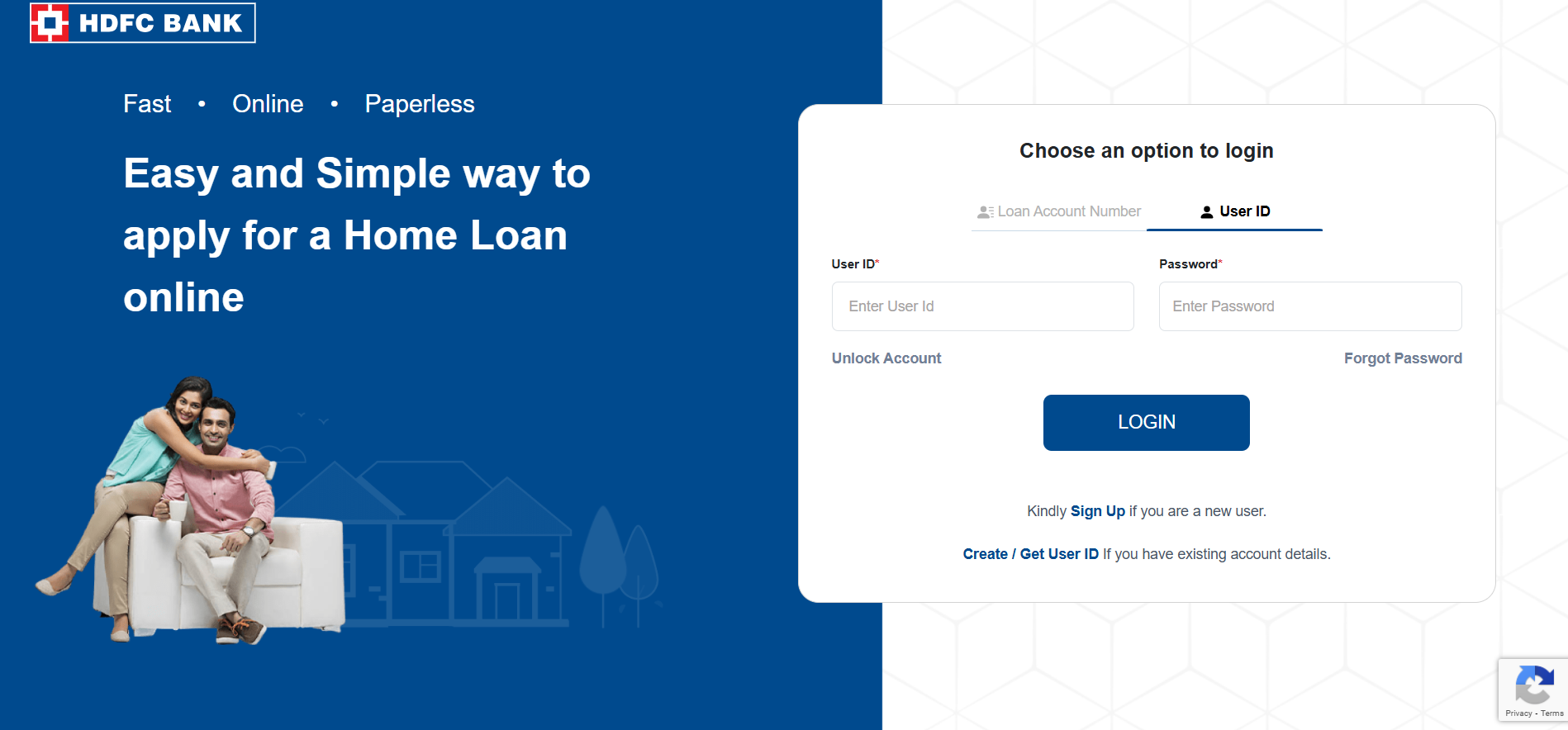

- Visit the official HDFC Bank website and navigate to the loan application section.

- Complete the application form by providing the required basic details.

- Upload the necessary documents as requested in the form.

- Pay the applicable processing fees securely through the online payment gateway.

- Submit your completed application for review.

- Wait for a representative from HDFC Bank to contact you for further assistance and next steps.

Check Out: HDFC Bank Home Loan Eligibility Calculator

HDFC Bank Home Loan: Offline Application Process

- Locate Nearest Branch: Visit your nearest HDFC Bank branch or authorized representative office.

- Consult Loan Advisor: Discuss loan requirements, eligibility, and interest rates with the loan advisor at the branch.

- Obtain Application Form: Collect the home loan application form from the branch office.

- Fill Application Form: Complete the application form carefully with accurate personal, employment, and property details.

- Gather Required Documents: Attach necessary documents like ID proof, address proof, income proof, bank statements, and property documents.

- Submit Application Form: Hand over the filled application form along with documents at the branch.

Check Out: HDFC Home Loan EMI Calculator

HDFC Bank Home Loan Application Process with Credit Dharma

- Visit Credit Dharma’s official website.

- Enter your name, city of residence, and mobile number.

- Choose your preferred loan type, for example, “home loan”.

- Enter the OTP and click on “verify.”

- Enter your property details, employment type, income, and CIBIL score.

- Now sit back and relax. Home Loan Experts from Credit Dharma will call you within the next 24 Hours.

Suggested Read: HDFC Home Loan Login

HDFC Bank Home Loan Application Approval to Disbursement Stages

| Stage | Description |

|---|---|

| Loan Approval Notification | Receive loan approval notification via email/SMS, including approved loan details. |

| Loan Agreement Signing | Receive a formal sanction letter with final loan amount, interest rate, EMI, and loan tenure. |

| Submission of Original Documents | Submit all required original property documents and sale agreements. |

| Verification of Documents | HDFC Bank conducts legal and technical verification of submitted documents. |

| Final Sanction Letter Issuance | Receive a formal sanction letter with the final loan amount, interest rate, EMI, and loan tenure. |

| Payment of Processing Fees | Submit a formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Request for Loan Disbursement | Submit formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Loan Amount Disbursal | Begin regular EMI payments as per the repayment schedule in your loan agreement. |

| Loan Repayment Commencement | Begin regular EMI payments as per repayment schedule in your loan agreement. |

Also Read: How to Track Your Application Status?

How Long Does it Take to Process a Home Loan Application?

| Stage | Key Activities | Estimated Time | Factors Affecting Time |

|---|---|---|---|

| 1. Application Submission | Submit application (online/offline) with documents. | Online: Instant Offline: 1–2 days | Document completeness, submission mode (online vs. offline). |

| 2. Eligibility Check | Credit profile, income stability, and existing debts. | 3–5 business days | Credit profile, income stability, existing debts. |

| 3. Property Valuation | Credit score assessment, income verification, and debt analysis. | 3–7 days | Property type (under-construction/ready), legal clarity. |

| 4. Loan Sanction | Approval of loan amount, interest rate, and terms. | 2–3 days post-valuation | Compliance with LTV ratio, valuation report. |

| 5. Legal & Technical Check | Verify property title, ownership, structural safety, and regulatory approvals. | 5–10 days | Property disputes, regulatory compliance, builder delays. |

| 6. Documentation | Loan agreement signing, mortgage registration, EMI setup. | 1–3 days | Applicant responsiveness, document accuracy. |

| 7. Disbursement | Funds transferred to seller/builder. | 1–3 days (ready property) | Builder coordination, escrow formalities. |

Total Processing Time

- Best Case: 2–3 weeks (ready property, no delays).

- Typical Case: 4–6 weeks (standard processing).

- Under-Construction: 6–8 weeks (phased disbursement).

Also Read: What to Do Once Your Home Loan Gets Rejected?

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Applicants need to provide KYC documents (like Aadhaar Card, Voter ID), PAN Card or Form 60, proof of income (salary slips or P&L statements), bank statements for the last 6 months, and property-related documents.

You can apply online by visiting the official website, filling out the application form with personal and financial details, uploading the required documents, and submitting the form. A representative will then contact you for further steps.

HDFC Bank aims to approve and disburse Home Loans within 48 hours of receiving the complete application and necessary documents.

A sanction letter is an official document issued by HDFC Bank after evaluating your application. It outlines the approved loan amount, interest rate, tenure, and other terms and conditions.

A credit score of 750 or above is generally considered ideal for securing a Home Loan from HDFC Bank, as it reflects good creditworthiness.

No, HDFC Bank typically offers financing up to 75-90% of the property’s value. The exact percentage depends on various factors, including the property’s price and the applicant’s profile.

HDFC Bank offers various Home Loan options, including loans for property purchase, home renovation, home construction, and balance transfer with top-up facilities.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan