Estimated reading time: 10 minutes

Securing a home is an exciting journey, and receiving the home loan sanction letter marks an important milestone along the way. It represents a step closer to turning your dream of homeownership into reality. For many, this moment brings a mix of anticipation and relief, knowing that the process is moving forward.

With the home loan sanction letter in hand, you can begin to plan your next steps more confidently, feeling assured that your goal of owning a home is within reach.

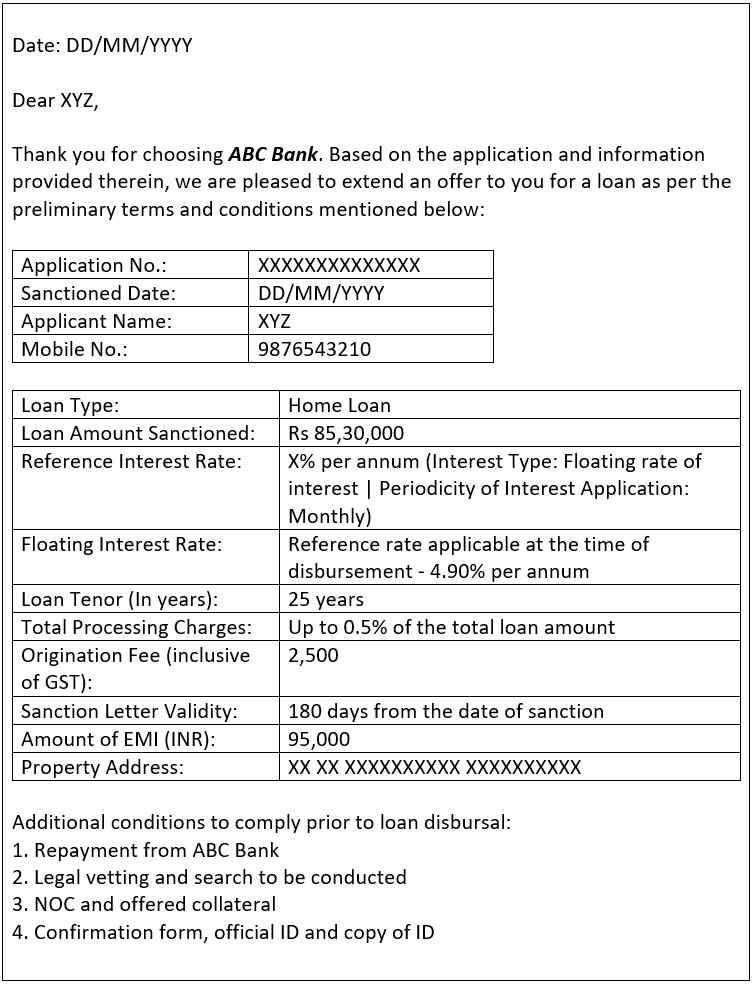

Home Loan Sanction Letter Format

What is a Home Loan Sanction Letter?

A home loan sanction letter is a formal document issued by a lender that confirms the approval of your loan application after a detailed evaluation of your financial standing. The lender reviews aspects such as your credit history, income, and repayment ability before issuing the letter.

It specifies the loan amount, interest rate, tenure, and the terms and conditions under which the loan is sanctioned. Though it does not guarantee disbursement, the sanction letter is a crucial document that signifies the lender’s agreement to proceed with the loan.

What Does the Home Loan Sanction Letter Include?

| Component | Description |

|---|---|

| Total Loan Amount | The maximum loan amount approved by the lender for your home purchase. |

| Interest Rate | The rate at which interest will be charged on the loan amount. |

| Type of Interest Rate | Specifies whether the interest rate is fixed or floating. |

| Base Rate Considerations | The base rate used by the lender as a reference for calculating the interest rate. |

| Tenure of Repayment | The duration over which you will repay the loan (loan term). |

| EMI Payment Details | Information about your Equated Monthly Installments, including amount and payment schedule. |

| Validity Period of the Sanction Letter | The time frame within which the loan offer remains valid, typically 3 to 6 months. |

| Tax Benefits | Details on any applicable tax benefits under current laws. |

| Special Schemes or Offers | Information on any special schemes or offers applicable to your loan. |

How to Request a Home Loan Sanction Letter

Obtaining a home loan sanction letter is a structured process that involves several essential steps. Understanding each phase can help you prepare adequately and increase your chances of approval. Here’s how you can secure a home loan sanction letter from your lender:

1. Home Loan Application

Start by completing the home loan application form provided by your chosen lender. Ensure that all the information is accurate and complete to avoid any processing delays. Along with the application, you’ll need to submit necessary documents, which typically include:

- Identity Proof: Passport, driver’s license, or national ID card.

- Address Proof: Utility bills, rental agreements, or property tax receipts.

- Income Proof: Salary slips, bank statements, or income tax returns.

- Property Documents: Details and legal papers of the property you wish to purchase.

Many lenders now offer end-to-end digital processes, allowing you to apply for a loan online from the comfort of your home.

Also Read: How to Track Your Home Loan Application

2. Verification by the Lender

Once your application and documents are submitted, the lender will initiate a thorough verification process. This involves:

- Assessing Credit History: Reviewing your credit score and past repayment behavior.

- Verifying Income and Employment: Confirming your employment status and income stability.

- Evaluating Financial Obligations: Checking existing loans or liabilities that may impact your repayment capacity.

The lender may contact you for additional information or clarification during this stage. Prompt and accurate responses can expedite the verification process.

Check Out: Impact of DTI on Home Loan Approval

3. Home Loan Approval and Sanction Letter Issuance

After successful verification, the lender will approve your loan application and issue a home loan sanction letter. This letter includes key details such as:

- Approved Loan Amount: The maximum amount you are eligible to borrow.

- Interest Rate and Type: The applicable interest rate and whether it’s fixed or floating.

- Loan Tenure: The period over which you will repay the loan.

- Terms and Conditions: Any special clauses, fees, or requirements you need to fulfill.

Note: The sanction letter signifies a conditional approval of your loan—it is not the final loan agreement. To proceed to loan disbursement, you must:

- Provide Acceptance: Sign and return a copy of the sanction letter to the lender.

- Comply with Conditions: Fulfill any conditions mentioned, such as purchasing insurance or providing additional documentation.

- Property Verification: Allow the lender to conduct legal and technical evaluations of the property.

What is the Home Loan Sanction Process?

Obtaining a home loan involves several critical steps to ensure a smooth and successful approval:

- Application Submission

Complete and submit your loan application along with essential documents such as identity proof, income proof, and property details.

- Payment of Processing Fees

Pay a non-refundable processing fee that covers administrative costs associated with your loan application.

- Credit and Income Assessment

The lender assesses your creditworthiness by examining your credit score, employment history, income stability, and existing debts to determine your loan eligibility.

- Document Verification

The submitted documents, including personal identification, financial statements, and property paperwork, undergo thorough verification by the lender.

- Issuance of Sanction Letter

Upon successful verification, the lender issues a sanction letter specifying the loan amount approved, interest rate, tenure, EMI details, and other relevant conditions.

- Legal and Technical Evaluation

Legal experts review property documents to ensure compliance with legal norms, while a technical assessment confirms the property’s market value and structural soundness.

- Acceptance of Sanction Letter

Review, sign, and return the sanction letter to indicate your acceptance of the specified loan terms.

- Execution of Loan Agreement

Both the borrower and lender sign the formal loan agreement, legally binding them to the agreed terms.

- Loan Disbursement

After finalizing all paperwork and formalities, the lender disburses the approved loan amount, either fully or in stages, depending on the property’s construction status.

Check Out: Credit Score Checker

Get a Home Loan

with Highest Eligibility

& Best Rates

Digital Home Loan Sanction Letter

A Digital Sanction Letter is an electronically issued version of the traditional Home Loan Sanction Letter, typically delivered via email or through the lender’s online portal.

Benefits of a Digital Sanction Letter:

- Instant Availability: Quickly accessible once approved.

- Convenience: Easily downloadable and shareable.

- Secure: Digitally signed and authenticated by the lender.

- Paperless: Environmentally friendly and reduces paperwork.

- Easy storage: Can be safely stored electronically for future reference.

How to Get a Digital Sanction Letter:

- Apply Online:

Submit your home loan application through your lender’s online platform or app. - Upload Documents Digitally:

Provide necessary documents electronically through the lender’s portal. - Online Verification:

The lender verifies your details digitally and evaluates your eligibility. - Receive Digital Sanction Letter:

Once approved, the lender sends you a notification and provides access to the digital sanction letter via email or your online account. - Download & Accept:

Review terms, digitally acknowledge, and proceed with the loan process.

Most leading banks and housing finance companies now offer digital sanction letters to streamline and speed up the loan approval process.

Home Loan Sanction Letter Validity

The validity of a home loan sanction letter varies by lender but typically ranges from 3 to 6 months. For instance:

| Bank | Sanction Letter Validity |

|---|---|

| Axis Bank | Valid for up to 6 months from the date of issuance. |

| Kotak Mahindra Bank | Valid for 6 months. |

| ICICI Bank | Valid for 6 months from the date of issuance. |

What to Do After Recieving the Home Loan Sanction Letter?

- Review the Terms: Carefully read through the sanction letter to understand all terms and conditions.

- Acceptance: Sign and return the acceptance copy to the lender within the validity period to proceed with the loan process.

- Fulfill Conditions: Complete any stipulated conditions, such as providing additional documentation or complying with specific requirements outlined in the sanction letter.

- Initiate Disbursement: Once all conditions are met and the acceptance is acknowledged, coordinate with your lender to schedule the disbursement of the loan amount.

Adhering to these steps within the specified validity period ensures a smooth transition from loan approval to disbursement.

Home Loan Processing Fees by Top Banks

| Bank | Home Loan Processing Fee |

|---|---|

| SBI (State Bank of India) | 0.35% of the loan amount (min ₹2,000, max ₹10,000) + GST |

| HDFC Bank | Upto 0.50% of the loan amount or Rs. 3300/- whichever is higher |

| ICICI Bank | 0.50% of the loan amount (min ₹3,000, max ₹5,000) + GST |

| Axis Bank | 1% of the loan amount or ₹10,000 (whichever is lower) |

| Kotak Mahindra Bank | Upto 2% of loan amount (plus taxes and any other applicable statutory dues) |

| Bajaj Housing Finance | Up to 4% of the loan amount |

Difference Between Home Loan Sanction Letter and Final Loan Agreement

| Aspect | Home Loan Sanction Letter | Final Loan Agreement |

|---|---|---|

| Purpose | Notification of loan approval based on initial application. | Formal contract outlining all terms and conditions of the loan. |

| Content | Approved loan amount, interest rate, tenure, and preliminary terms. | Detailed terms, repayment schedule, legal obligations, and clauses. |

| Binding Nature | Non-binding; subject to further documentation and verification. | Legally binding agreement enforceable by law. |

| Validity Period | Limited timeframe to accept the offer before it lapses. | Remains in effect for the entire loan tenure unless amended. |

| Conditions | May include provisional conditions to be met for final approval. | Comprehensive conditions and obligations for both lender and borrower. |

| Disbursement Details | Basic information on loan disbursement process. | Detailed disbursement schedule and procedures. |

| Documentation Required | Initial documents reviewed for approval. | Final set of documents required for loan processing and disbursement. |

| Amendments | Limited ability to negotiate terms. | Terms can be modified only through mutual agreement and legal procedures. |

| Acceptance | Requires borrower’s acceptance to proceed to next steps. | Signed by both parties to finalize the loan agreement. |

| Insurance Requirements | May mention the need for loan or property insurance. | Detailed insurance obligations and coverage specifics. |

Conclusion

A home loan sanction letter is a crucial step in your home loan journey, marking the lender’s initial approval of your loan application. It outlines the loan amount, interest rate, tenure, and basic terms. However, this letter is not the final agreement but an offer you must accept within a specific timeframe.

By thoroughly reviewing the terms, promptly submitting the necessary documents, and ensuring clear communication with your lender, you can smoothly progress to the final loan agreement and disbursement.

Ready to take the next step in your home loan journey? Contact Credit Dharma today for expert guidance and personalized support to secure the best home loan tailored to your needs. Let us help you achieve your homeownership goals with ease and confidence.

Frequently Asked Questions

No, the sanction letter is a provisional approval. The final loan agreement, signed after fulfilling all conditions, is legally binding and details the final terms of the loan.

It typically includes the approved loan amount, interest rate, loan tenure, EMI amount, validity period, and any special conditions for loan disbursement.

A sanction letter is generally valid for 3 to 6 months, depending on the lender. You must accept the offer within this period for the loan to proceed.

After receiving the sanction letter, you need to accept the terms, submit any remaining documents, and sign the loan agreement to move forward with the disbursement process.

Yes, if you fail to meet any of the conditions specified in the letter or provide inaccurate information, the lender may revoke the sanction.

You should verify the loan amount, interest rate, tenure, fees, penalties, and special conditions. Make sure all details are accurate before accepting the offer.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan