In today’s ever-changing financial world, managing your home loan efficiently is more important than ever. ICICI Bank Home Loan with Overdraft offers a fresh, practical approach that combines the benefits of a home loan with the flexibility of an overdraft. It’s designed to help homeowners not only save on interest but also gain easy access to funds when needed—without the hassle of additional paperwork.

By making extra deposits into your loan account, you can reduce the outstanding balance and lower your interest payments, giving you more financial freedom. Here’s how this unique offering can empower you to take control of your home loan and make the most of your money.

ICICI Bank Home Loan Overdraft Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 9.25% p.a. onwards |

| Maximum Loan Amount | Up to ₹5 Crore |

| Maximum Tenure | 20 Years |

| Processing Fees | Up to 2% of the loan amount |

Suggested Read: ICICI Bank Home Loan Interest Rates 2025

ICICI Bank Home Loan Overdraft Interest Rates

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

| Loan Amount | Salaried Customers | Self-Employed Customers |

|---|---|---|

| Up to ₹35 lakhs | 9.25% – 9.65% | 9.40% – 9.80% |

| ₹35 lakhs to ₹75 lakhs | 9.50% – 9.80% | 9.65% – 9.95% |

| Above ₹75 lakhs | 9.60% – 9.90% | 9.75% – 10.05% |

Suggested Read: ICICI Bank Home Loan Customer Care

ICICI Bank Home Loan Overdraft Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a home loan.

| Parameter | Details |

|---|---|

| Loan Type | – Loan Against Property (LAP) – Top-Up Loan (including Top-Up on Balance Transfer of Loan) – Lease Rental Discounting – Loan Against Land – Loan Against Specialized Property/Collateral Plus/ERTF |

| Eligible Profiles | All |

| Eligible Entities | – Proprietorship – Partnership – LLPs – Private Limited Companies – Listed Public Limited Companies – Closely Held Limited Companies – Trusts and Societies |

| End Use | Business and Personal Utility |

| Loan Amount (Note) | May vary depending on the profile (Salaried / Self-Employed) of the customer |

Suggested Read: ICICI Bank Home Loan Balance Transfer

ICICI Bank Home Loan Overdraft Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan.

| Product | Processing Fees |

|---|---|

| Home Loan Overdraft | 2% of the loan |

ICICI Bank Home Loan Overdraft Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan.

| Charge Type | Details |

|---|---|

| Loan Processing Charges | Up to 2% of loan amount (non-refundable) |

| Administrative Charges | 0.25% of loan amount or ₹5,000 (whichever is lower, non-refundable) |

| Commitment Charges (Overdraft) | 0.5% on shortfall if <30% utilization (quarterly avg.) – Not for salaried customers |

| Part Prepayment Fees | Nil |

| Prepayment Charges (Fixed Rate) | 2% on home loans, 4% on non-home loans (exceptions: PSL, small/micro, loans ≤ ₹50L) |

| Prepayment Charges (Floating Rate) | Nil for home loans, 2%-4% for others (based on purpose/borrower type) |

| Conversion Charges | ₹3,000 for floating-to-fixed 2% for fixed-to-floating 0.5% for overdraft |

| Cheque/ECS Dishonor Charges | ₹500 per instance |

| Cheque/Repayment Swap Charges | ₹500 |

| Penal Charges (Delay/Default) | 5% p.a. on overdue sum + taxes |

| Amortisation Schedule | ₹200 (physical copy) |

| Statement of Account | ₹200 (physical copy) |

| Prepayment Statement | ₹200 (physical copy) |

| Duplicate NOC/No Dues | ₹250 |

| Revalidation of NOC | ₹250 |

| Non-submission of Documents | ₹5,000 per month (from due date till submission) |

| Non-collection of Property Docs (post 60 days) | ₹1,000 per month |

| Construction Delay (Land Loan) | 1% p.a. on principal or ₹50,000 (whichever is lower) after 4 years from 1st disbursal |

| Overdraft Renewal Fees | ₹5,000 (not applicable for Money Saver & Insta OD) |

| Loan/Property Document Retrieval | ₹500 |

| Cash EMI Payment at Branch | ₹100 |

| Information Utility (Corporate Cases) | ₹300 |

| CERSAI Charges | ₹50 (loan ≤₹5L) ₹100 (loan >₹5L) |

| Auction, Legal, SARFAESI, Enforcement, Ads, Professional, Repossession, Security | At actuals |

| Non-maintenance of Payment Mode | ₹800 |

Suggested Read: ICICI Bank Home Loan Prepayment Calculator

ICICI Bank Home Loan Overdraft Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the home loan application process smooth.

Identity Proof

| Criterion | Details |

|---|---|

| Identity & Address Proof | Aadhaar/Passport/Driving License/Voter ID/NREGA Card/Letter from NPR containing name & address |

| Date of Birth Proof | Passport/Driving License/Voter ID/NREGA Card/Letter from NPR containing name & address |

Income Proof

| Category | Documents Required |

|---|---|

| Salaried Individuals | Latest Form 16 Latest 1-month Salary Slip Last 6 months’ Bank Statements |

| Self-Employed Individuals | Last 6 months’ Bank Statements (all operative accounts) Last 2 years CA Certified/Audited ITRs with Computation of Income P&L Statement Balance Sheet GST Returns for the last 1 year |

For Non-Individuals (Entities)

| Criterion | Details |

|---|---|

| Identity Proof (Any 2) | Registration Certificate (incl. Udyam), Shop & Establishment License, Sales/Income Tax Returns, CST/VAT/GST Certificate, Importer Exporter Code (IEC), License/Practice Certificate from professional body, Complete ITR (authenticated), Utility Bills (Electricity, Water, Landline) |

| Address Proof (Any 1) | GST Certificate, Business Registration Certificate, Gumasta License, Udhyam Registration, Bank Statement (not entity proof), Utility Bill, ITR, Rent Agreement + Utility Bill (within 2 months) |

| Note | If registered & permanent addresses differ, proof required for both. |

Additional Documents Based on Entity Type

| Entity Type | Documents Required |

|---|---|

| Partnership Firm | Partnership Deed |

| LLP (Limited Liability Partnership) | LLP Agreement, Certificate of Incorporation, CA/CS-certified Designated Partners List, Profit Sharing Ratio |

| Public/Private Ltd. Co. | Certificate of Incorporation, MOA & AOA, CA/CS-certified list of Directors & Shareholders with Name, DOB, Nationality, Address |

| Trust | Trust Deed with Registration Certificate, List of all Beneficiaries, Trustees, Settlors, Protectors, Authors (with Name & DOB) |

| Society | By-laws/Memorandum + Registration Certificate, List of Members (Name, Address, DOB) |

| HUF | List of Adult Coparceners (attested by Karta) |

| Others | Authorised Signatory KYC & Relationship Details (Private/Public Ltd., LLP, Partnership, Trust, Society), List of Directors & Senior Management (Private/Public Ltd.), LEI Certificate (₹5 crore+ exposure) |

Suggested Read: ICICI Bank Home Loan Moratorium

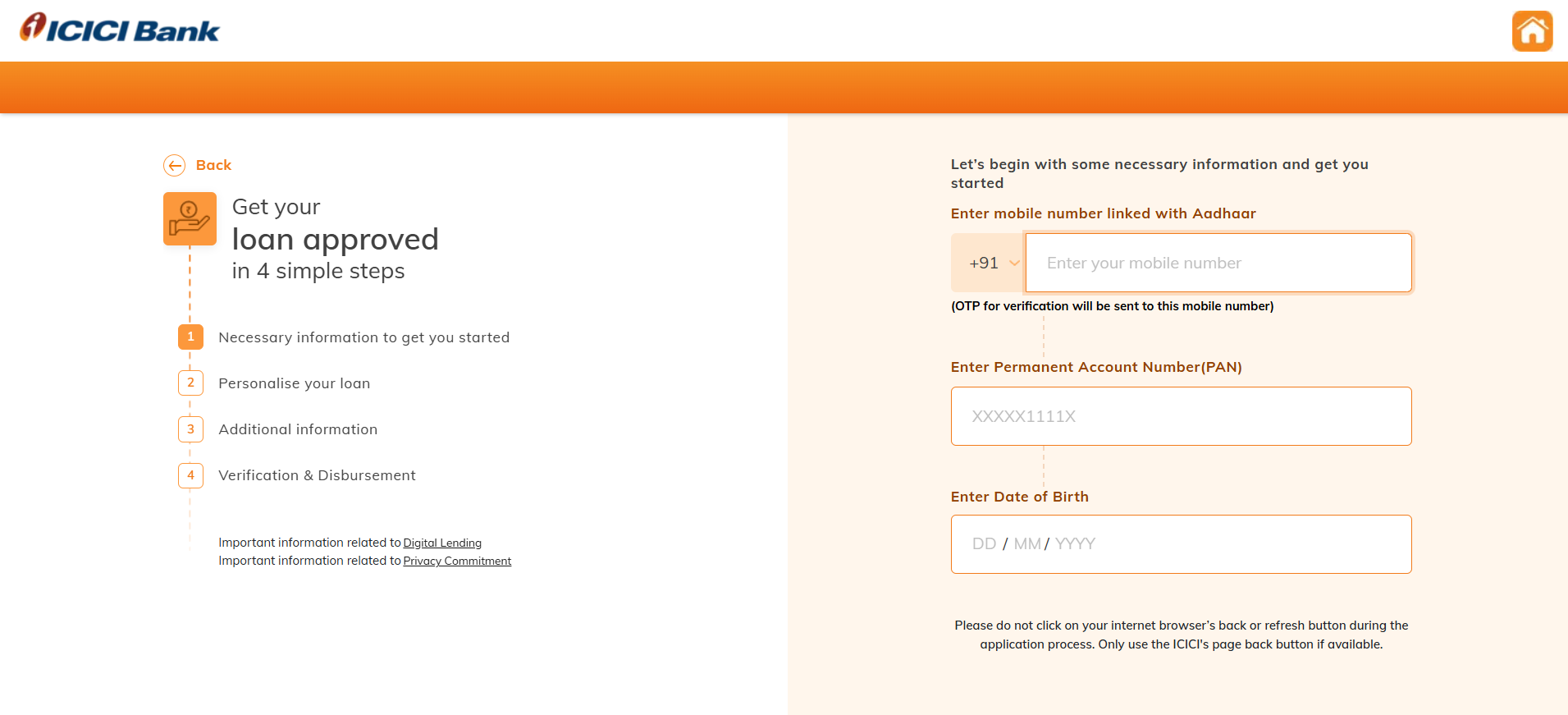

How to Apply for ICICI Bank Home Loan Overdraft?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan.

- Visit the official ICICI Bank website.

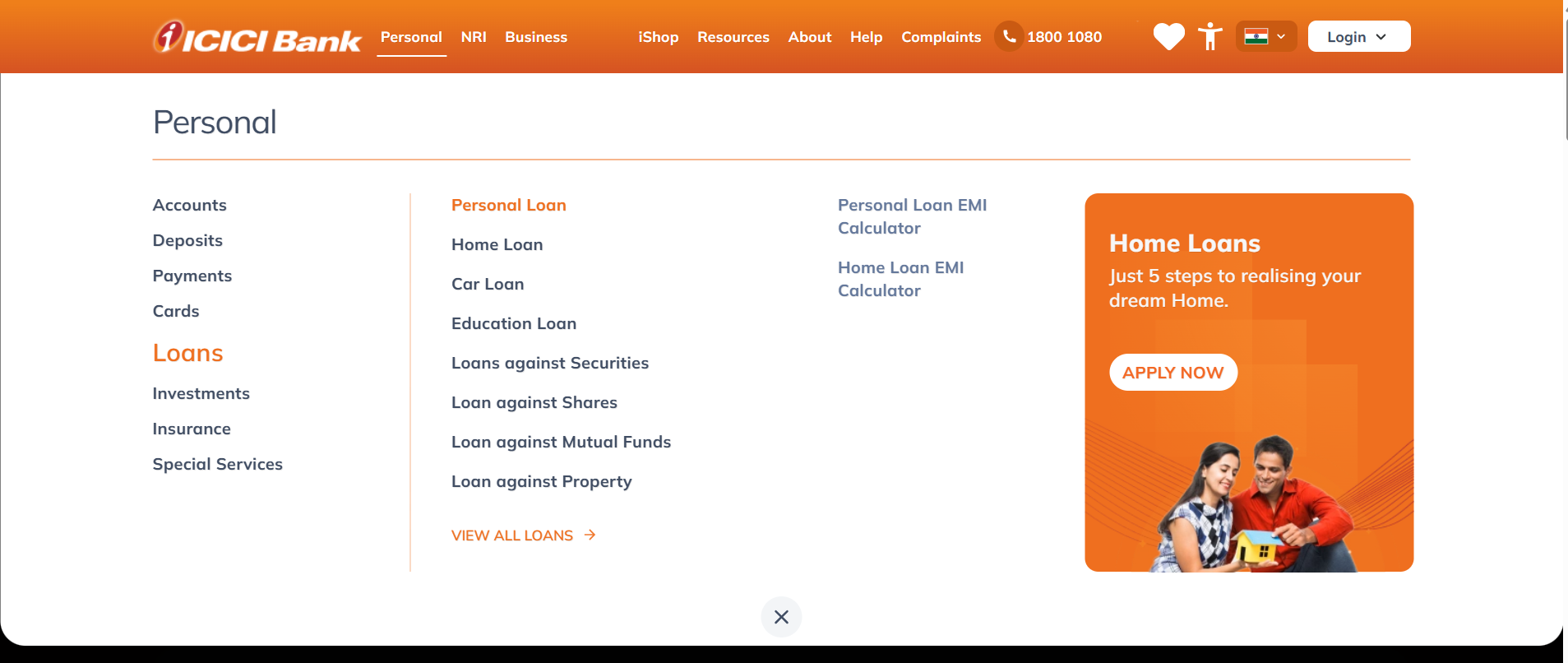

- From the top dashboard, click on Personal. Select Loans > Home Loan.

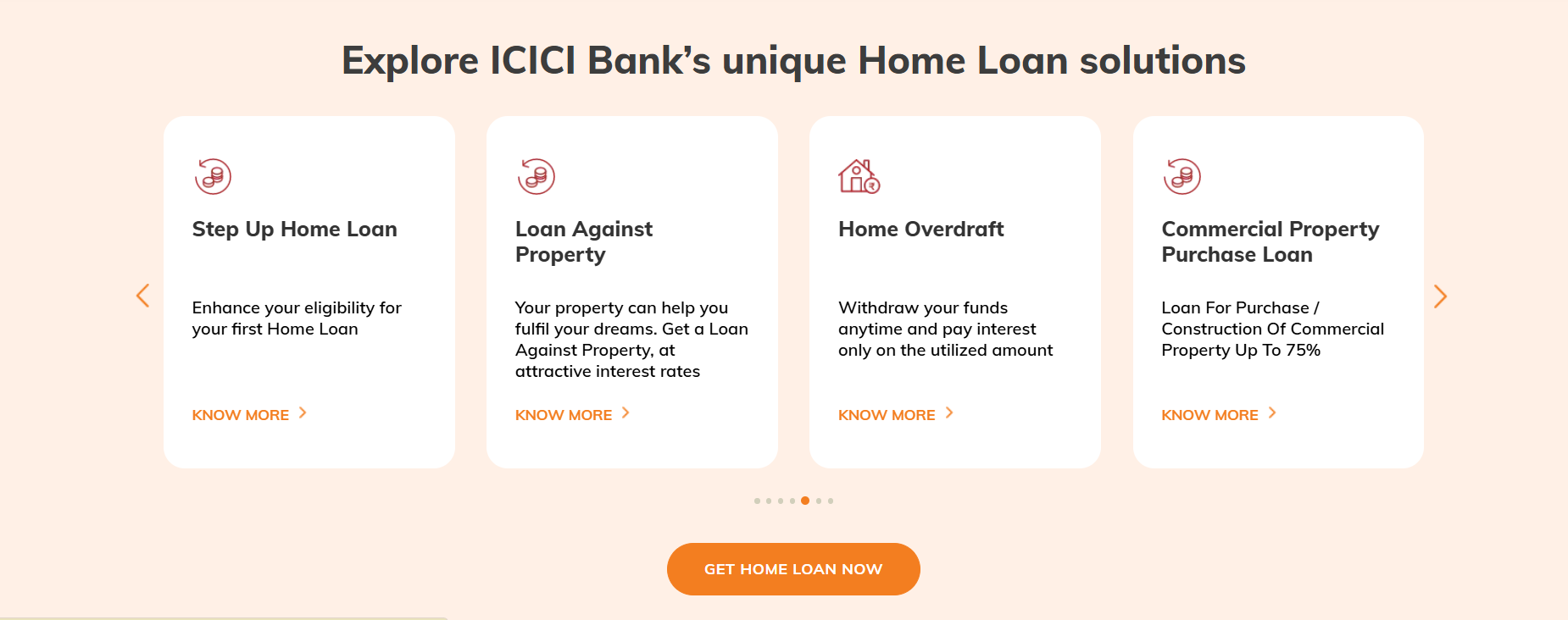

- Scroll down and click Apply Now under Home Loan Overdraft.

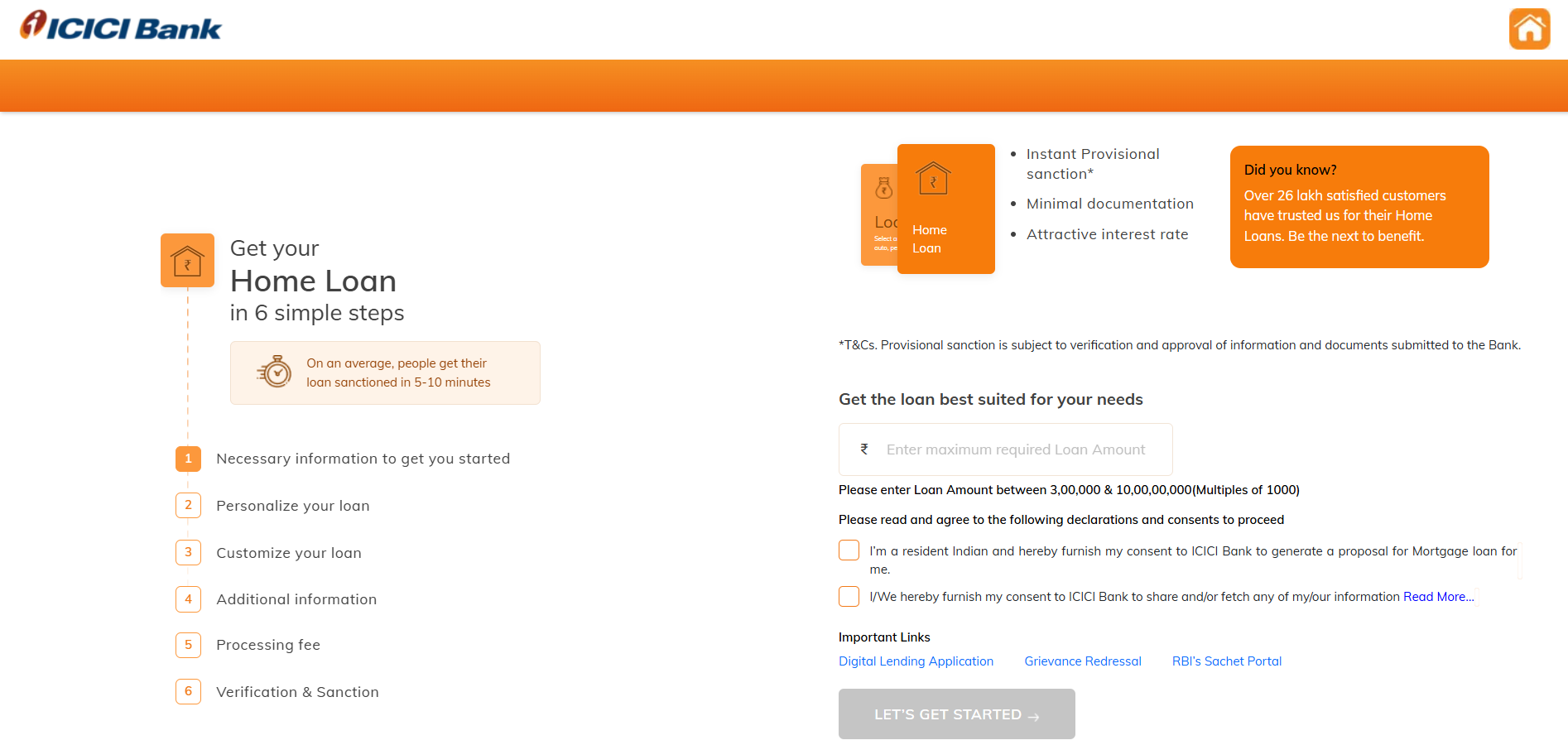

- Enter the required loan amount and accept the Terms and Conditions.

- Enter your mobile number, PAN, and date of birth.

- Enter your Aadhaar Card details. Complete the OTP verification by entering the OTP sent to your registered mobile number.

- Enter your official name as per records. Provide your employment details, including:

Type of work (Salaried/Self-employed)

Organization name

Official email ID - Enter your place of birth, purpose of the loan, religion, and category (General/SC/ST/OBC/Other).

- Complete the eNACH process and verify with OTP.

- A video KYC will be scheduled as part of the verification process.

- Once all the steps are completed, the provisionally approved loan amount will be displayed on the screen.

Suggested Read: ICICI Bank Home Loan Statement Download

Compare Top Banks Home Loan Overdraft Interest Rates

Explore home loan offers from different banks to find the best deal that fits your needs.

| Bank/NBFC | Interest Rates |

|---|---|

| SBI Maxgain | 8.50% p.a. – 9.45% p.a. |

| Axis Bank | 10.50% p.a. onwards |

| ICICI Bank | 9.00% p.a. onwards |

| Bank of India | 8.25% p.a. onwards |

| Bank of Baroda | 8.00% p.a. onwards |

| Central Bank of India | 8.15% p.a. onwards |

Conclusion

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Frequently Asked Questions

Yes, there’s a renewal fee that applies every year for the Home Overdraft facility. The renewal charges will be debited directly from your overdraft account.

Not quite. While you have flexibility in using the funds, there are restrictions—you can’t use the amount for speculative or restricted purposes.

Yes! You can transfer your salary account to ICICI Bank and then apply for the Home Overdraft facility.

Absolutely! If you’re a salaried customer (meaning you have an ICICI Bank salary account or work with select corporates), you can take the Home Overdraft facility along with your Home Loan.

No, you’ll need to have a Home Loan or take a Loan Against Property to be eligible for the Home Overdraft facility. Just having a salary account alone isn’t enough.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan