The down payment wiped out your savings, yet bare walls stare back? Rather than swipe a card for every sofa and appliance, top up your existing loan in minutes.

With ICICI Bank’s home renovation loan, it disburses funds exclusively for interiors at housing‑loan rates. All expenses merge under one schedule, so budgeting stays simple and transparent.

Quick digital processing means no fresh property valuation or lengthy paperwork. Decorate now, pay gradually, and keep your cash cushion intact.

ICICI Bank Home Renovation Loan Overdraft Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 10.85% p.a. onwards |

| Maximum Loan Amount | Contact the Bank |

| Maximum Tenure | 1 – 6 Years |

| Processing Fees | 2% of the Loan Amount |

Suggested Read: Top Banks Offering Home Renovation Loans

ICICI Bank Home Renovation Loan Interest Rates

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

| Category | Interest Rates |

|---|---|

| Home Renovation Loan | 10.85% p.a. – 16.65% p.a. |

Suggested Read: ICICI Bank Home Loan Top Up

ICICI Bank Home Renovation Loan Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a home loan.

| Aspects | Details |

|---|---|

| Citizenship | You must be a citizen of India |

| Age Requirement | 20 – 58 years |

| Minimum Income | You must have a stable income of at least ₹30,000 per month |

| Credit History | A healthy credit history and score can help speed up approval process |

| Ownership or Co-ownership Requirement | Provide ownership or co-ownership details of the property undergoing renovation |

Suggested Read: ICICI Bank Loan Against Property

ICICI Bank Home Renovation Loan Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan.

| Category | Processing Fees |

|---|---|

| Home Renovation Loan | 2% of the loan amount |

Suggested Read: ICICI Bank Home Loan Customer Care

ICICI Bank Home Renovation Loan Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan.

| Aspect | Details |

|---|---|

| Penal Charges | |

| Cheque/Auto Debit/ECS bounce charges | ₹500 |

| Late payment charges | 5% per annum on overdue EMI until repaid |

| Non-maintenance of payment mode charges | ₹800 |

| Service Charges | |

| Loan processing fee | Up to 2% of loan amount (non-refundable) |

| Repayment mode change charges | ₹500 |

| Loan cancellation charges | Nil if cancelled within 15 days (processing fee non-refundable). After 15 days: ₹2,500. |

| Prepayment/Foreclosure charges | 3% of outstanding principal Nil after 12 EMIs Nil for BIL ≤ ₹50 lakh for micro/small enterprises with URC. |

| Part payment charges | 3% + GST for loans ≤ 24 months Nil for loans > 24 months. |

| Salary Overdraft processing fee | 0.99% of limit (₹1,999 min, ₹2,999 max) |

| Salary Overdraft annual renewal fee | ₹1,999 |

| Cash transaction at branch | ₹100 |

| Duplicate NOC/NDC | ₹250 (physical copy at branch) |

| Information utility fee (corporate) | ₹300 |

| Prepayment statement | ₹200 (physical copy at branch) |

| Amortisation schedule | ₹200 (physical copy at branch) |

| Loan recovery charges (if applicable) | At actual cost |

Suggested Read: Kitchen Directions According to Vastu

ICICI Bank Home Renovation Loan Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the home loan application process smooth.

For Salaried Individuals

| Document Type | Details |

|---|---|

| Proof of Identity/Residence | Any one of the following OVDs (accepted as current/communication address proof): • Passport • Driving License (issued by Regional Transport Authority) • Voter ID (issued by Election Commission) • Letter from National Population Register (with name and address) • Complete Aadhar Card • NREGA Card |

| Latest Bank Statement | • Latest 3 months bank statement (where salary/income is credited) |

| Salary Slips | • Last 3 months salary slips |

For Self-Employed Individuals

| Document Type | Details |

|---|---|

| Proof of Identity/Residence | Any one of the following OVDs (accepted as current/communication address proof): • Passport • Driving License (issued by Regional Transport Authority) • Voter ID (issued by Election Commission) • Letter from National Population Register (with name and address) • Complete Aadhar Card • NREGA Card |

| Income Proof | • Audited financials for the last 2 years • Latest 6 months bank statement |

| Other Documents | • Office Address Proof • Proof of Residence/Office Ownership • Proof of Business Continuity |

Suggested Read: Best House Facing Directions

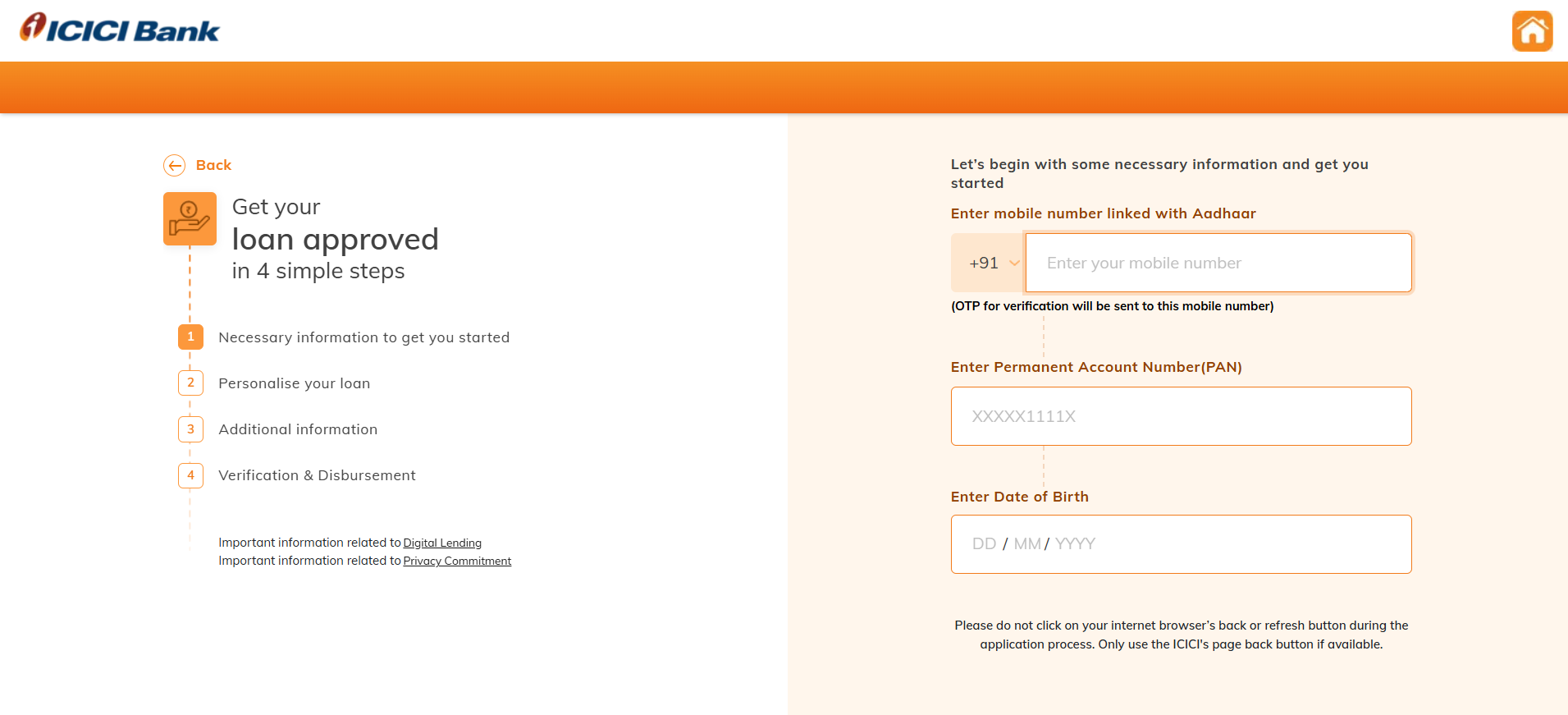

How to Apply for ICICI Bank Home Renovation Loan?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan.

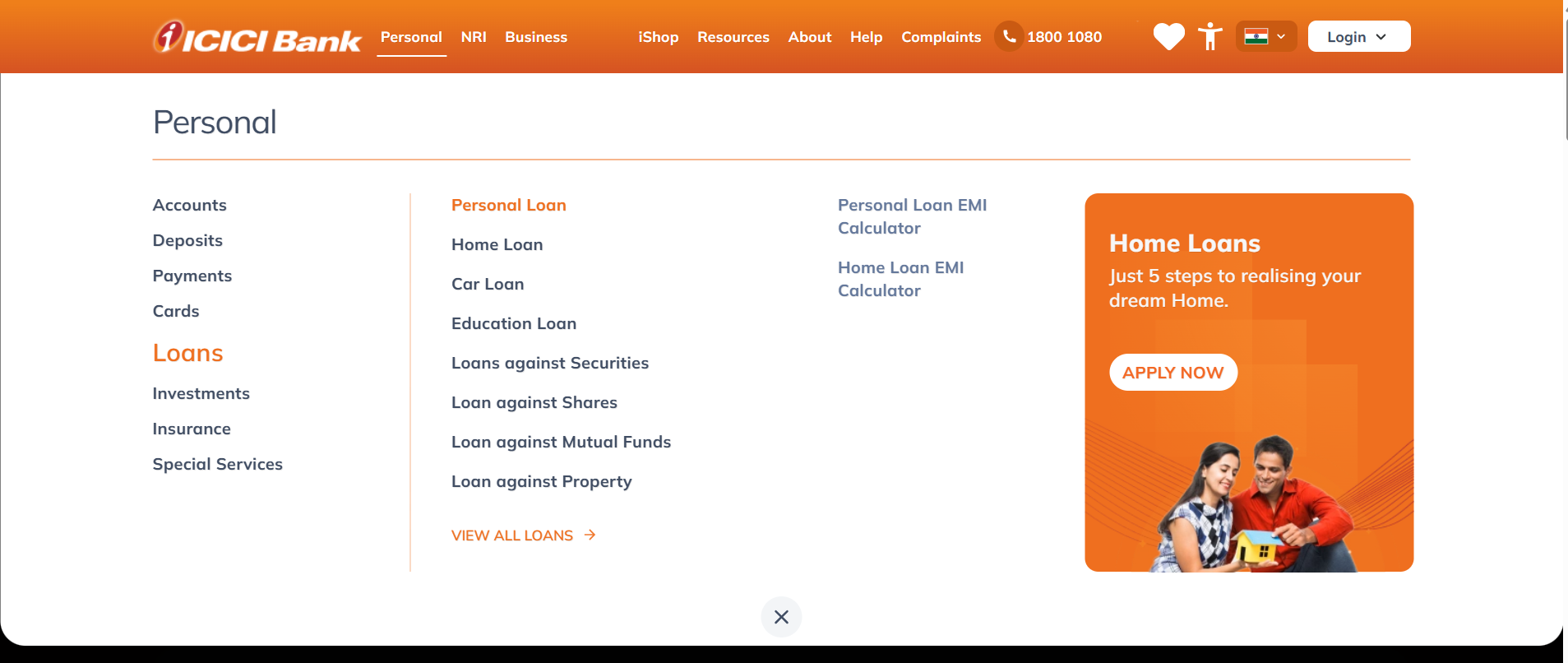

- Visit the official ICICI Bank website.

- From the top dashboard, click on Personal. Select Loans > Personal Loan.

- Scroll down and click Apply Now under Personal Loan for Renovation.

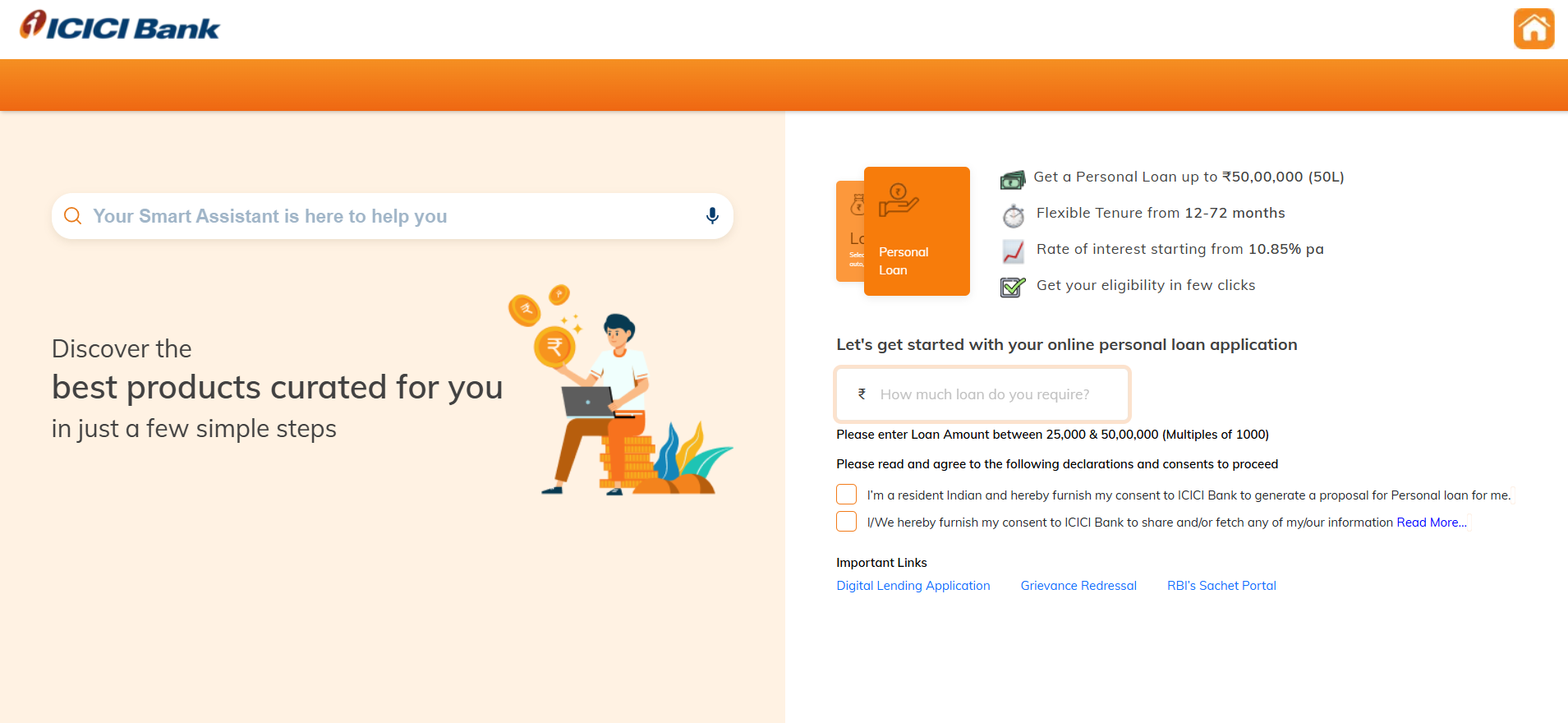

- Enter the required loan amount and accept the Terms and Conditions.

- Enter your mobile number, PAN, and date of birth.

- Enter your Aadhaar Card details. Complete the OTP verification by entering the OTP sent to your registered mobile number.

- Enter your official name as per records. Provide your employment details, including:

Type of work (Salaried/Self-employed)

Organization name

Official email ID - Enter your place of birth, purpose of the loan, religion, and category (General/SC/ST/OBC/Other).

- Complete the eNACH process and verify with OTP.

- A video KYC will be scheduled as part of the verification process.

- Once all the steps are completed, the provisionally approved loan amount will be displayed on the screen.

Suggested Read: Home Automation Ideas

Compare Top Banks Home Loan Interest Rates

Explore home loan offers from different banks to find the best deal that fits your needs.

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer

Frequently Asked Questions

Personal‑loan APRs often cross 14‑18 % and credit cards 36 %+, while furnishing loans start in the single digits—saving serious interest over 3‑5 years.

Yes. Under Section 24(b) you can claim up to ₹30,000 a year on interest paid toward a renovation/furnishing loan, within the overall ₹2 lakh home‑interest cap.

If you already have a mortgage, the furnishing loan is usually secured by the same property (BOI even waives fresh mortgage up to ₹5 lakh). A few NBFCs offer totally unsecured renovation loans—but they price higher.

Functionally they’re similar—both give you extra funds. A top-up loan rides on your existing mortgage (often at the same tenor), whereas a stand-alone renovation loan can be taken even if you have no current home loan. Choose whichever has the lower effective rate + simpler paperwork for you.

Typically lenders fund 70–90 % of the renovation estimate (max ₹20–30 lakh in most retail products). The exact cap depends on your income, existing EMIs, property value, and bank policy. You’ll need to arrange the rest as margin money.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan