5 minutes

Looking to download your Kotak Mahindra Home Loan statement? It’s a handy document that gives you a clear picture of your loan repayment history, showing the principal and interest paid, outstanding balance, and any charges applied.

Whether you’re tracking your EMIs or preparing for tax season, this statement makes managing your loan simple and hassle-free. Let us help you with this guide to understand how to download it easily!

Kotak Mahindra home loan EMIs weighing you down?

Get a Home Loan Balance Transfer with Credit Dharma!

How to Download Kotak Mahindra Home Loan Statement Online

You can easily access and download your Kotak Mahindra home loan statement using various methods. Below are the steps for each option.

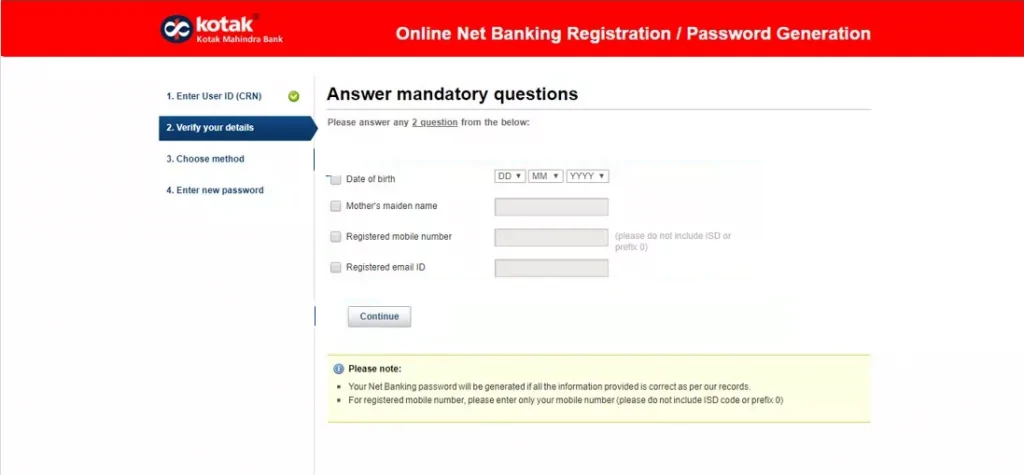

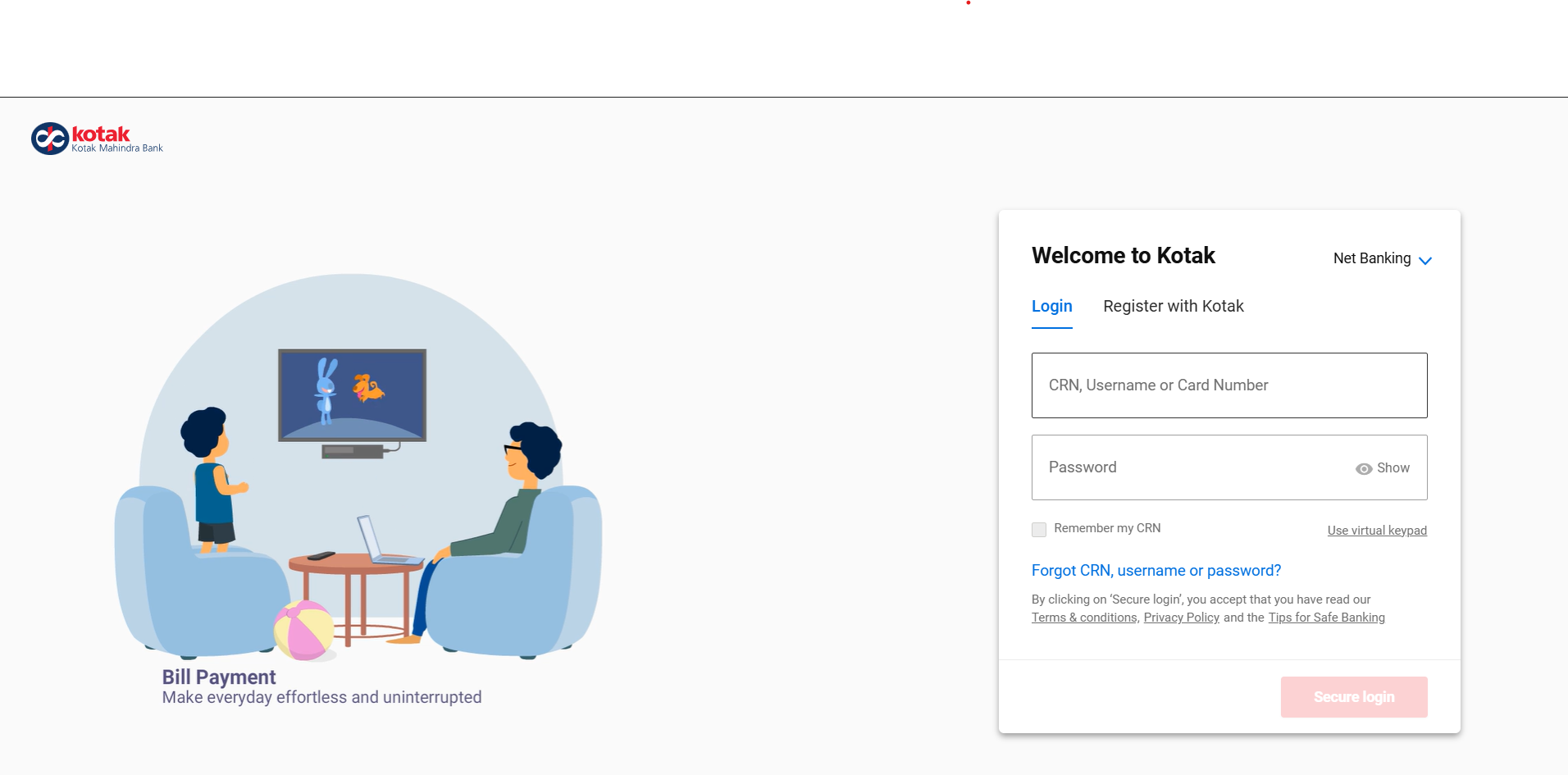

- Through Net Banking:

Log in to Kotak Mahindra’s Net Banking portal.

a. Select the “Installment Loans” tab.

b. Choose “Personal Loans.”

c. Click on “Overview.”

d. Download or view your home loan statement.

- Through Mobile Banking:

a. Open the Kotak Mahindra Mobile Banking app.

b. Navigate to the “Loans” section.

c. Select “Personal Loan.”

d. Download or view the statement from there.

- Via WhatsApp Banking:

a. Add ‘022 6600 6022’ to your WhatsApp contacts.

b. Send the word “Help” to this number.

c. Follow the instructions by typing the appropriate number for loan requests.

d. Verify using the OTP sent to your registered mobile number.

e. Download or view your home loan statement as prompted.

Offline Methods to Obtain the Statement

If you prefer offline methods, you can still easily get your Kotak Mahindra home loan statement. Here are the ways to do so:

1. Visit a Branch:

You can visit your nearest Kotak Mahindra Bank branch to request the home loan statement. Locate the closest branch through the bank’s official website.

2. Contact Customer Service:

Alternatively, you can call Kotak Mahindra’s customer service at 1860 266 2666 (available Monday to Saturday, 9 AM to 7 PM). They will assist you in obtaining the statement.

3. Charges and Conditions:

The first statement request per year is free. If you need an additional statement within the same year, a fee of ₹250 + GST applies. You can pay the charges through NEFT, and the statement will be issued within 3 working days once the payment is received.

Check Out: IFCS Code Finder

Get a Home Loan

with Highest Eligibility

& Best Rates

Home Loan Statement

A housing loan statement offers a comprehensive overview of your loan details, helping you keep track of your repayment status. You can download your Kotak Mahindra home loan statement online via the Kotak Mahindra net banking portal or request it from a physical branch. This statement is also useful for tax filing purposes serving as your Kotak Mahindra home loan interest certificate. A typical loan statement includes:

- Loan start date and projected end date

- The total amount repaid

- Original loan amount, applicable interest rate, and loan tenure

- Outstanding loan amount, remaining term, and interest

- Details of paid and pending EMIs

Check Out: Kotak Mahindra Customer Care

Why do you need Kotak Mahindra Home Loan Statement?

| Benefits of Tracking Loan Statements | Details |

|---|---|

| Track Repayments | Regularly reviewing your loan statement keeps you informed about the total amount paid towards your loan. |

| Monitor Outstanding Balance | Stay updated on the remaining loan amount, which helps in planning future finances. |

| Plan Future Repayments | Use the statement to strategize your SBI repayment schedule and ensure timely payments. |

| Strategic Prepayments | Identify opportunities to make prepayments and reduce your overall debt burden. |

| Efficient Financial Management | Regular monitoring of your loan statement supports better financial planning and management. |

| Accessibility | You can access your loan statement anytime during the year, either online or by visiting a physical SBI branch. |

Stuck with high Kotak Mahindra home loan interest?

Save lakhs on your home loan with a balance transfer!

Conclusion

Regularly checking your Kotak Mahindra home loan statement is essential for keeping your loan on track. It helps you monitor your payments, understand your outstanding balance, and avoid any late fees. By staying updated, you can manage your finances more effectively. Kotak Mahindra Bank offers multiple digital options to access your statement quickly.

Credit Dharma offers home loans at competitive interest rates and provides expert financial advice. Helping you make informed decisions for a better financial future.

Frequently Asked Questions

You can view it online through net banking, mobile banking, or WhatsApp banking.

The statement is free once a year. Additional requests will cost ₹250 + GST.

Yes, you can visit a branch or contact customer service for an offline statement.

The statement shows your total loan amount, EMIs, outstanding balance, and interest rate.

It takes up to 3 working days once the request and payment are processed.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan