When it comes to financing your home, finding ways to save on interest and reduce overall loan commitments is key. With the LIC Housing Finance home loan prepayment calculator, you can instantly calculate how partial or full prepayments can significantly lower your debt burden.

Save Lakhs on Your LIC Home Loan with Prepayments!

LIC Housing Finance Home Loan Prepayment Charges

| Service | Charges |

|---|---|

| Prepayment Charges | Floating and fixed rates: NIL if paid through own funds 2% on prepaid loan amount if paid through other sources |

Suggested Read: LIC Housing Finance Home Loan Interest Rates 2025

LIC Housing Finance Home Loan Prepayment Rules and Conditions

When it comes to prepaying your LIC Housing Finance home loan, there are specific rules and conditions you should be aware of to ensure a smooth process.

Prepayment Minimum and Maximum Limits

- The minimum prepayment amount must be at least 5 times the prevailing EMI.

- The maximum prepayment should not exceed 25% of the principal outstanding in a financial year.

- For prepayments exceeding 5 lakhs, you need to inform the LIC Housing Finance branch 30 days in advance.

Prepayment Timing and Process

- Prepayment requests can only be accepted from Monday to Friday between the 6th and 22nd of the month.

- The effect of prepayment, including changes to the loan account or rate of interest, will be applied in the next installment cycle as per mutually agreed terms.

Notice Period

- If you wish to prepay part or the full loan, you must provide a 30 days clear written notice to LIC Housing Finance.

- This period is counted from the date the notice is received by the lender.

Note:

- Prepayment charges will be levied based on the guidelines of the National Housing Bank (NHB) and LIC Housing Finance’s policies.

- These charges are subject to the terms mentioned in your loan documents.

Suggested Read: Should You Prepay Your Home Loan?

Who is Eligibile to Make LIC Housing Finance Home Loan Prepayment?

If you’re a LIC Housing Finance home loan borrower, here’s what you need to know about eligibility for prepayment:

- The primary borrower of the LIC Housing Finance home loan is eligible to make the prepayment.

- In case of a joint home loan, co-applicants can also make the prepayment, provided the loan is in their name as well.

- Your account should be free of defaults or overdue payments. Prepayment is typically allowed only if your repayment track record is consistent.

- Some lenders require borrowers to complete a minimum number of EMIs (e.g., 6–12 months) before allowing prepayment. Check your loan agreement for specific terms.

Read More: LIC Home Loan Statement Download

How Does LIC Housing Finance Home Loan Prepayment Calculator Work?

To calculate the impact of prepayment on your home loan, the formula involves adjusting the remaining principal and recalculating either the loan tenure or the EMI. The formula is:

Remaining Principal = (Remaining Principal – Prepayment Amount) × (1 + i/n)^(n × t)

Where:

- Remaining Principal: The remaining loan amount after accounting for the prepayment.

- Prepayment Amount: The extra payment made towards the loan over and above the regular EMI.

- i: The annual interest rate on the home loan.

- n: The number of times the interest is compounded per year (usually 12 for monthly compounding).

- t: The remaining term of the loan in years.

Check Out: LIC Housing Finance Home Loan EMI Calculator

Home Loan Prepayment Case Study

Mr. Ram, a resident of Mumbai, took a home loan from LIC Housing Finance to purchase a property. He opted for a loan amount of ₹50,00,000 at an interest rate of 9.75% p.a., with a loan tenure of 30 years.

His monthly EMI was ₹42,958. Over the years, Mr. Ram diligently paid his monthly installments. After 15 years of repayment, he decided to make a prepayment of ₹5,00,000 to reduce his loan burden and save on interest payments. Below is an analysis of how this prepayment impacted his loan status.

| Category | Details |

|---|---|

| Loan Amount | ₹50,00,000 |

| Rate of Interest | 9.75% p.a. |

| Tenure | 30 years |

| EMI | ₹42,958 |

| Total Interest to be Paid in 30 Years | ₹1,04,64,779 |

| Total Amount to be Paid in 30 years | ₹ 1,54,64,779 |

Prepayment Details

Mr. Ram decides to make a prepayment of ₹5,00,000 at the 15-year mark. Let’s analyze the impact of this prepayment.

| Prepayment Amount | ₹5,00,000 |

|---|---|

| New Principal After Prepayment | ₹41,69,068 – ₹5,00,000 = ₹36,69,068 |

Loan Status at Year 15

At the 15-year mark, Mr. Ram has already made 180 EMIs and has 180 EMIs remaining. Here’s the status of the loan at that point:

| Category | Amount |

|---|---|

| Opening Balance (Year 15) | ₹41,69,068 |

| EMIs Paid | 180 months (15 years) |

| EMIs Remaining | 180 months |

| Interest Already Paid | ₹1,04,64,779 – Remaining Interest ≈ ₹36,08,226 |

Impact of Prepayment

Below is the detailed impact of the prepayment on Mr. Ram’s home loan:

| Category | Before Prepayment | After Prepayment | Savings |

|---|---|---|---|

| Remaining Principal | ₹41,69,068 | ₹36,69,068 | ₹5,00,000 |

| Remaining Tenure | 15 years (180 months) | 11.5 years (138 months) | 3.5 years (42 months) |

| Monthly EMI | ₹42,958 | ₹42,958 | – |

| Total Future Payments | ₹77,32,440 | ₹59,28,204 | ₹18,04,236 |

| Interest Component | ₹35,63,372 | ₹22,59,136 | ₹13,04,236 |

Financial Benefits:

- Reduction in Loan Tenure: The prepayment of ₹5,00,000 reduces Mr. Ram’s loan tenure by 3.5 years (from 15 years to 11.5 years).

- Interest Savings: Mr. Ram will save approximately ₹13,04,236 in interest payments.

- Total Cash Flow Savings: The total amount of money saved in future payments, including the reduction in principal and interest, is ₹18,04,236.

Suggested Read: Why LIC Insurance is Important for Home Loan Protection?

Documents Required for LIC Housing Finance Home Loan Prepayment

- Prepayment Request Form (duly filled and signed).

- Identity & Address Proof : PAN card, Aadhaar, passport, etc.

- Loan Account Details : Loan account number and original loan agreement.

- Payment Instrument : Cheque/DD/online payment proof for prepayment amount.

Also Read: How to Check LIC Home Loan Status Online?

How to Make LIC Housing Finance Home Loan Prepayment Online?

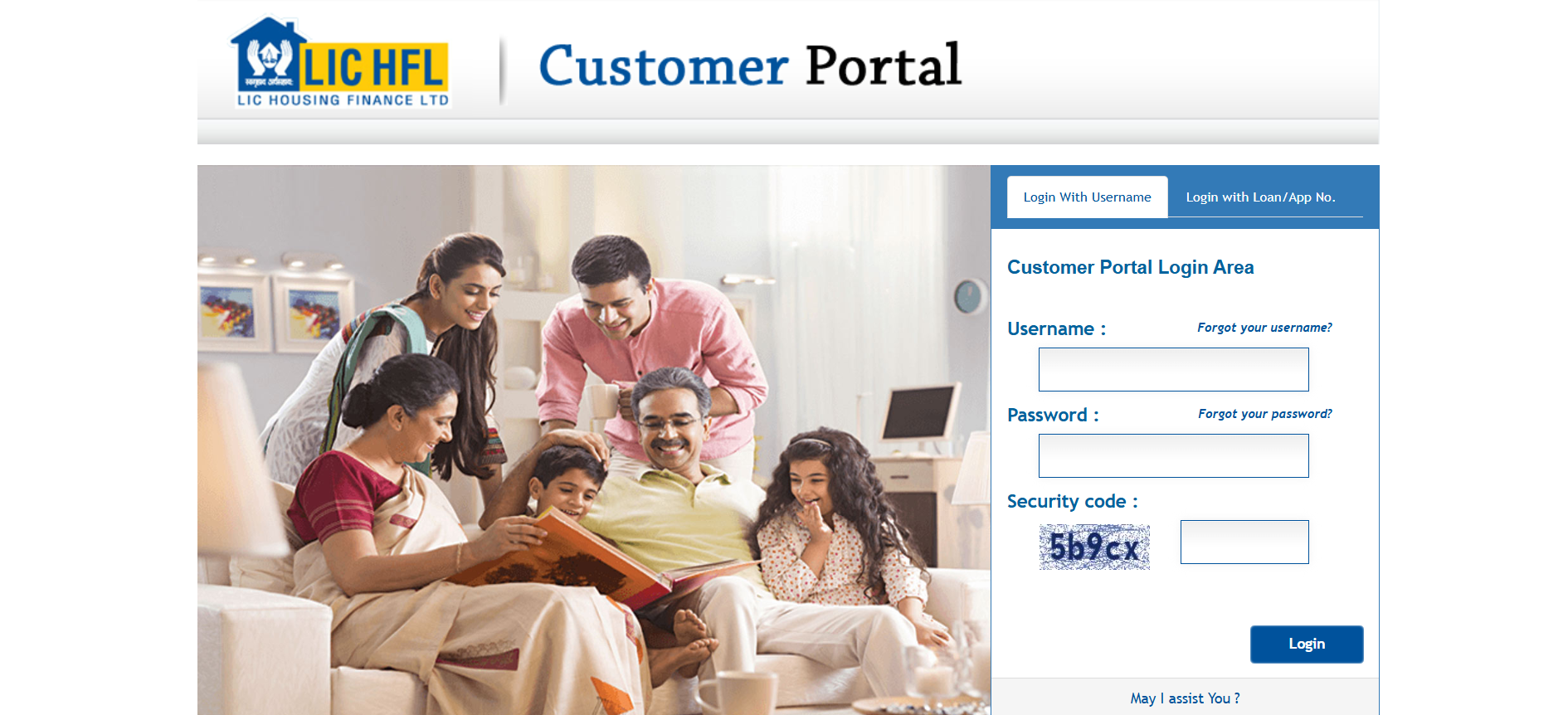

- Access the Customer Portal

Visit the LIC HFL Customer Portal and log in using your credentials.

- Navigate to ‘Pay Online’

After logging in, click on the ‘Pay Online’ option.

- Select Loan Account and View Dues

Choose your loan account and click on “Get Dues” to view the outstanding amount.

- Enter Prepayment Amount

Input the amount you wish to prepay. Note that the minimum prepayment amount is ₹10,001, with a maximum of 10% of the outstanding principal per transaction and up to 25% annually.

- Confirm and Make Payment

Select your preferred payment mode (Net Banking or UPI) and complete the transaction.

- Download Receipt

Upon successful payment, a confirmation message will appear. You can download the payment acknowledgment receipt, and the actual receipt will be sent to your registered email ID.

Suggested Read: Home Loan Closure

How to Make LIC Housing Finance Home Loan Prepayment Offline?

| Step | Description |

|---|---|

| 1. Visit a LIC Housing Branch | Locate and visit the nearest LIC Housing Finance branch during working hours. |

| 2. Prepare the Payment | – Cheque Payment: Issue a cheque in favor of “LIC Housing Finance Limited”. – Cash Payment: Ensure the exact amount as change may not be available. |

| 3. Submit the Payment | Submit the cheque or cash along with a written application specifying your loan account number, amount being prepaid, and whether it’s a partial or full prepayment. |

| 4. Pay Applicable Charges | – Partial prepayments and full prepayments have charges. Refer to the Schedule of Charges under the “Fair Practice Code” on the LIC Housing website. |

| 5. Obtain Acknowledgment | Request an acknowledgment receipt for the payment. |

| Important Notes | – Prepayments are accepted between the 6th and 24th of each month. – It may take up to 7 working days for the prepayment to reflect in your loan account. |

Suggested Read: Impact on Home Loan Insurance During Home Loan Balance Transfer?

Why Does LIC Housing Finance Charge You on Making Home Loan Prepayment?

LIC Housing Finance, like other housing finance companies (HFCs), charges prepayment fees on home loans primarily for the following reasons:

| Reason | Explanation | Key Points |

|---|---|---|

| Compensation for Lost Interest | Lenders lose future interest income when loans are prepaid. | – Fee offsets financial loss from foregone interest. – Ensures recovery of anticipated revenue. |

| Administrative Costs | Prepayment involves documentation, verification, and record updates. | – Covers operational expenses. – Secondary reason compared to lost interest. |

| Regulatory Framework | HFCs (like LIC Housing) are regulated by NHB, not RBI. | – NHB permits prepayment fees forboth fixed and floating-rate loans. – RBI bans fees for banks’ floating-rate loans. – Borrowers must verify updated regulations. |

| Market Practices & Profit | Prepayment fees act as a revenue stream in competitive markets. | – HFCs may prioritize profitability. – Borrowers can negotiate terms or switch lenders. |

Suggested Read: Top 5 Banks for Home Loan Balance Transfer

When are Banks Not Allowed to Charge Prepayment Fees?

- Floating-Rate Home Loans (Individuals): RBI prohibits prepayment charges on floating-rate loans for individuals, allowing flexibility for partial and full prepayments.

- Government Scheme Loans: Loans under schemes like PMAY cannot have prepayment charges to promote affordable housing.

- Refinancing/Balance Transfer: Banks can’t charge prepayment fees when a loan is refinanced or transferred to another lender, except for standard processing fees.

Suggested Read: Home Loan Prepayment vs Investment

Things to Consider While Making LIC Housing Finance Home Loan Prepayment

- Loan Type: Check if you have a fixed or floating rate loan to determine if prepayment charges apply.

- Prepayment Charges: Fixed-rate loans may attract a 2% charge on the outstanding principal for loan transfer.

- Partial vs. Full Prepayment: Partial prepayment reduces EMI or tenure, full prepayment eliminates the loan entirely.

- Loan Tenure Impact: Prepayment can shorten your tenure or reduce your EMI.

- Prepayment vs. Investing: Consider if investing the prepayment amount gives higher returns than saving on interest.

- Tax Implications: Prepayment may reduce home loan interest deductions under Sections 80C and 24(b).

- CIBIL Score Impact: Prepayment might temporarily affect your credit score.

- Emergency Fund: Ensure sufficient funds remain after prepayment for unforeseen expenses.

- Loan Agreement Terms: Review your agreement for any specific prepayment penalties or conditions.

- Long-Term Financial Goals: Align prepayment with your broader financial strategy and goals.

- EMI and Interest Reduction: Prepayment reduces both your EMI and total interest payable.

- Loan Balance: Ensure the prepayment amount is sufficient to meet your financial objectives.

Suggested Read: Can Home Loan Balance Transfer Backfire?

When is it the Right Time to Make Home Loan Prepayment?

- When interest rates on your loan exceed potential returns from investments (e.g., stock markets, FDs).

- After building an emergency fund (3–6 months of expenses) and clearing high-interest debts.

- When prepayment penalties are low or waived (e.g., RBI prohibits banks from charging fees on floating-rate home loans for individuals).

- To shorten loan tenure significantly (prioritize prepayment if reducing tenure aligns with financial goals like retirement).

- If tax benefits (e.g., Section 24 deductions) are no longer a priority (prepayment reduces interest, lowering tax savings).

Suggested Read: Mutual Funds vs. Rental Income

Home Loan Part Pre Payment vs. Full Pre Payment

Here’s a concise comparison of Home Loan Part Prepayment vs. Home Loan Full Prepayment in a tabular format:

| Criteria | Part Prepayment | Full Prepayment |

|---|---|---|

| Definition | Paying a portion of the outstanding loan amount before tenure ends. | Paying the entireremaining loan balance to close the loan immediately. |

| Impact on Loan | Reduces tenure(if EMI unchanged) or lowers EMI(if tenure unchanged). | Loan is closed permanently; no further EMIs or interest. |

| Key Benefit | Saves interest over the loan term; retains liquidity for other needs. | Eliminates debt entirely; improves cash flow post-closure. |

| Processing Fees | Lower or nil fees (varies by lender). May have annual prepayment limits. | Higher fees (e.g., 1–3% of outstanding amount). Some lenders waive fees. |

| Tax Implications | Tax benefits on interest (if applicable) continue for the reduced tenure. | Tax benefits (e.g., Section 24/80C in India) cease post-closure. |

| Eligibility | Allowed multiple times (subject to lender terms). No lock-in period in most cases. | One-time closure. Requires sufficient funds to settle the entire balance. |

| Example | Loan: ₹50L @ 8% for 20 years. Part-prepay ₹10L → Tenure reduces to ~15 years. | Loan: ₹50L outstanding. Full prepayment closes the loan, saving ₹XXL in future intere |

Suggested Read: Can You Pay Rent to Your Parents and Claim HRA?

Advantages and Disadvantages of Home Loan Prepayment

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Interest Savings | Reduces overall interest paid over the loan tenure. | May not be ideal if the prepayment does not significantly reduce interest. |

| Loan Tenure | Shortens the loan tenure, allowing you to repay the loan faster. | Could lead to a higher monthly EMI if the loan tenure is reduced. |

| Financial Freedom | Provides peace of mind and reduces debt burden. | Might strain finances if the prepayment amount is large. |

| Credit Score Improvement | Can boost credit score by reducing outstanding debt. | Prepayment might temporarily lower liquidity. |

| Flexibility in Loan Terms | Offers the option to re-adjust loan tenure or EMI based on new principal. | Could incur prepayment penalties, especially in fixed-rate loans. |

| Opportunity for Investment | Frees up funds for other investments once the loan is repaid earlier. | Potential opportunity loss if funds used for prepayment could have been invested elsewhere for better returns. |

Suggested Read: Cities for Profitable Airbnb Investment in India

Get a Home Loan

with Highest Eligibility

& Best Rates

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Becoming a homeowner is a dream—but paying for that home shouldn’t feel like a financial marathon. With the LIC Home Loan Prepayment Calculator at your disposal, you can make well-informed payment decisions that keep your finances healthy and your dreams well within reach.

Frequently Asked Questions

LIC Housing Finance generally allows any amount of prepayment without charges on floating rate home loans. For fixed rate loans, conditions may apply, so it’s best to refer to your loan agreement or contact LIC directly.

The reduction in EMI after a prepayment depends on whether you choose to lower the EMI or shorten the loan tenure. If you opt to decrease the EMI, the amount of reduction will depend on the remaining tenure and the prepayment amount.

Most lenders allow significant prepayments for floating rate home loans without any charges. However, fixed rate loans might have restrictions or penalties. The exact terms can vary, so checking your specific loan agreement is advisable.

To close a home loan early with LIC, you can make a full prepayment of the outstanding balance. It’s recommended to notify LIC in advance, prepare the necessary funds, and follow up with them to complete any required formalities to ensure the loan is closed properly.

Deciding between prepayment or continuing with a home loan depends on your financial situation. Prepayment can save on interest costs but may deplete your cash reserves. Consider your financial goals and consult with a financial advisor to make an informed decision.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan