For many NRIs, the idea of “home” is split between two time zones: weekday routines abroad and memories of festivals back in India. Buying property becomes a way to stitch those worlds together, yet coordinating paperwork, local regulations, and large remittances can feel daunting from thousands of miles away.

LIC Housing Finance’s NRI Home Loan is structured to work with digital submissions and abroad-based income proofs, keeping you from chasing stamps at a local branch during precious vacation days.

LIC Housing Finance Home Loan for NRIs Highlights

This quick snapshot shows the core numbers—rate, loan share, and tenure—so you can gauge affordability at a glance.

| Aspects | Highlights |

|---|---|

| Interest Rates | 8.65% p.a. onwards |

| Loan Amount | 90% of the property value |

| Maximum Tenure | Salaried: 30 years Self Employed: 25 years |

Suggested Read: Can NRIs Buy Agricultural Land in India?

LIC Housing Finance Home Loan for NRIs Interest Rates 2025

Knowing the starting rate lets you estimate your EMI and decide whether the loan matches your cash-flow comfort.

Salaried Employees

| CIBIL Score | Home Loan for NRI |

|---|---|

| >= 800 | – |

| 775 – 799 | – |

| 750 – 774 | 8.65% p.a. – 8.80% p.a. |

| 725 – 749 | – |

| 700 – 724 | 8.90% p.a. – 9.05% p.a. |

| 600 – 699 | 9.55% p.a. – 9.90% p.a. |

| < 600 | 10.00% p.a. – 10.40% p.a. |

| 150 <= CIBIL <= 200 | 8.75% p.a. onwards |

| 100 <= CIBIL <= 150 | 9.25% p.a. onwards |

| Sure Fixed Scheme | 10.00% p.a. – 10.25% p.a. |

Self Employed Individuals

| CIBIL Score | Home Loan for NRI |

|---|---|

| >= 800 | – |

| 775 – 799 | – |

| 750 – 774 | 8.90% p.a. – 9.05% p.a. |

| 725 – 749 | – |

| 700 – 724 | 9.15% p.a. – 9.30% p.a. |

| 600 – 699 | 9.65% p.a. – 10.00% p.a. |

| < 600 | 10.10% p.a. – 10.50% p.a. |

| 150 <= CIBIL <= 200 | 8.85% p.a. |

| 100 <= CIBIL <= 150 | 9.35% p.a. |

Suggested Read: Rules for NRI Real Estate Investment in India

LIC Housing Finance Home Loan for NRIs Eligibility Criteria

Check these basic conditions first; meeting them is the key to unlocking your NRI borrowing power.

| Eligibility Criteria | Details |

|---|---|

| Applicant Age | Minimum: 21 years Maximum: 70 years |

| Income Requirements | Stable income (salary, business, or rental income) with proof of regularity |

| Power of Attorney (PoA) | Required for property transactions in India |

| Credit Score | Minimum CIBIL score of 700+ (preferably higher for better terms) |

Suggested Read: NRI CIBIL Score Requirement for Home Loans

LIC Housing Finance Home Loan for NRIs Processing Fees

Understanding the one-time processing fee helps you budget for the costs that appear before the loan even starts.

| Loan Slab | Processing Fee |

|---|---|

| Up to ₹ 1 Crore | 0.25% of loan amount Maximum: ₹ 15,000 + GST |

| ₹1 crore – ₹2 crore | Rs 20,000 + GST |

| ₹2 crore- ₹5 crore | Rs 25,000 + GST |

| ₹5 crore – ₹15 crore | Rs 50,000 + GST |

Suggested Read: Loan Against LIC Policy

LIC Housing Finance Home Loan for NRIs Other Fees and Charges

Review the penalty and service fees now, so no surprise bills pop up later in your repayment journey.

| Service | Charges |

|---|---|

| Prepayment Charges | Floating and fixed rates: NIL if paid through own funds 2% on prepaid loan amount if paid through other sources |

| Penal Charges | Up to 12 months: 1.50% per month Beyond 12 months: 1.75% per month |

| Document retrieval charges | Rs 2,500 |

| Providing document list | Rs 500 |

| Photocopies of title documents | Rs 1,000 |

| Cheque bounce charges | Rs 350 |

| ECS/NACH dishonor charges | Rs 200 |

Suggested Read: LIC Housing Finance Home Loan Login

LIC Housing Finance Home Loan for NRIs Documents Required

Keep these IDs, income proofs, and visa papers handy; complete paperwork speeds up approval and disbursement.

General Documents

| Category | Details |

|---|---|

| Identity Proof | Proof of Identity (PAN, Passport, Driver’s License, Voter ID card) |

| Employment Proof | Employer Identity Card Attested copy of valid Passport and visa |

| Address Proof | Address proof mentioning the current overseas address Proof of Residence/Address (e.g., Telephone Bill, Electricity Bill, Water Bill, Piped Gas Bill, Passport, Driving License, Aadhaar Card) |

| Specialized Documents for Specific Applicants | Copy of Continuous Discharge Certificate (CDC) for merchant navy employees PIO Card issued by the Government of India (for Persons of Indian Origin) |

| Attestation of Documents | Can be done by: – FOs/Representative Offices – Indian Embassy/Consulate – Overseas Notary Public – Officials of Branch/Sourcing outfits in India |

| Loan Application Form | Loan application form duly filled 3 passport-size photographs |

Income Proof Documents

| Salaried Applicant/Co-applicant/Guarantor | Self-Employed Applicant/Co-applicant/Guarantor |

|---|---|

| Valid work permit | Business address proof |

| Employment contract (English translation duly attested by employer/consulate/foreign office/Embassy if in another language) | Proof of income in case of self-employed professionals/businessmen |

| Last three months’ salary certificate/slip | Last 2 years Audited/C.A. certified Balance Sheet and P&L accounts |

| Last six months’ Bank Statement showing salary credit | Last 2 years Individual Tax Return except for NRI/PIO located in Middle East countries |

| Latest salary certificate/slip in original and copy of identity card issued by the current employer | Last six months’ Bank Statement of overseas account in the name of individual as well as company/unit |

| Duly acknowledged copy of last year Individual Tax Return (except for NRIs/PIOs located in Middle East or Merchant Navy employees) |

NRI Account Statement Documents

| Account Statement |

|---|

| Bank account details for the previous 6 months overseas account showing salary and savings and Indian account if any. |

| If any previous loan from other Banks/Lenders, then Loan A/C statement for last 1 year. |

Suggested Read: What to Do If You Lose Your Property Documents?

How to Apply for LIC Housing Finance Home Loan for NRIs?

The online application is simple—fill in your details, upload the documents, and track your loan with the reference number you receive.

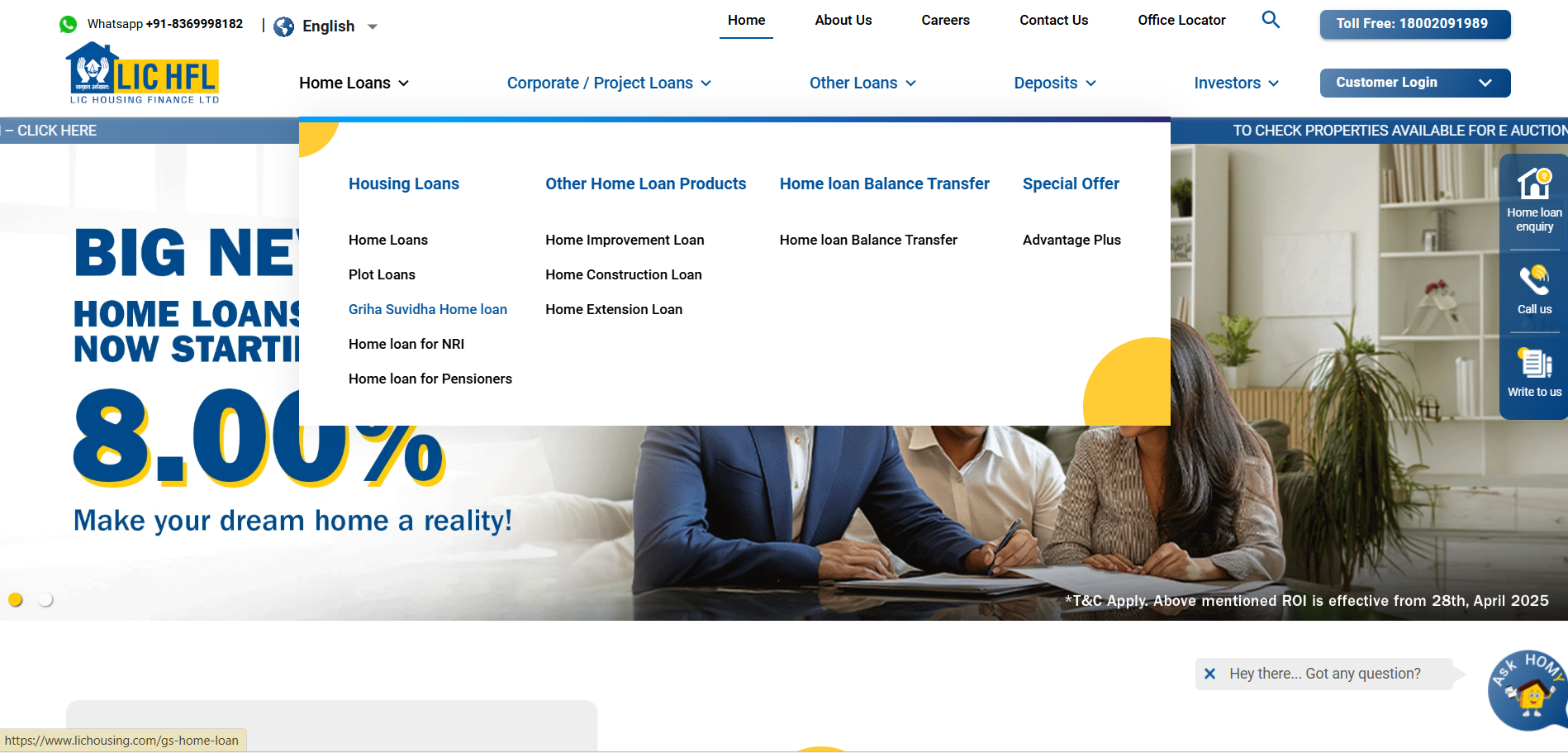

- Go to the official LIC Housing Finance website.

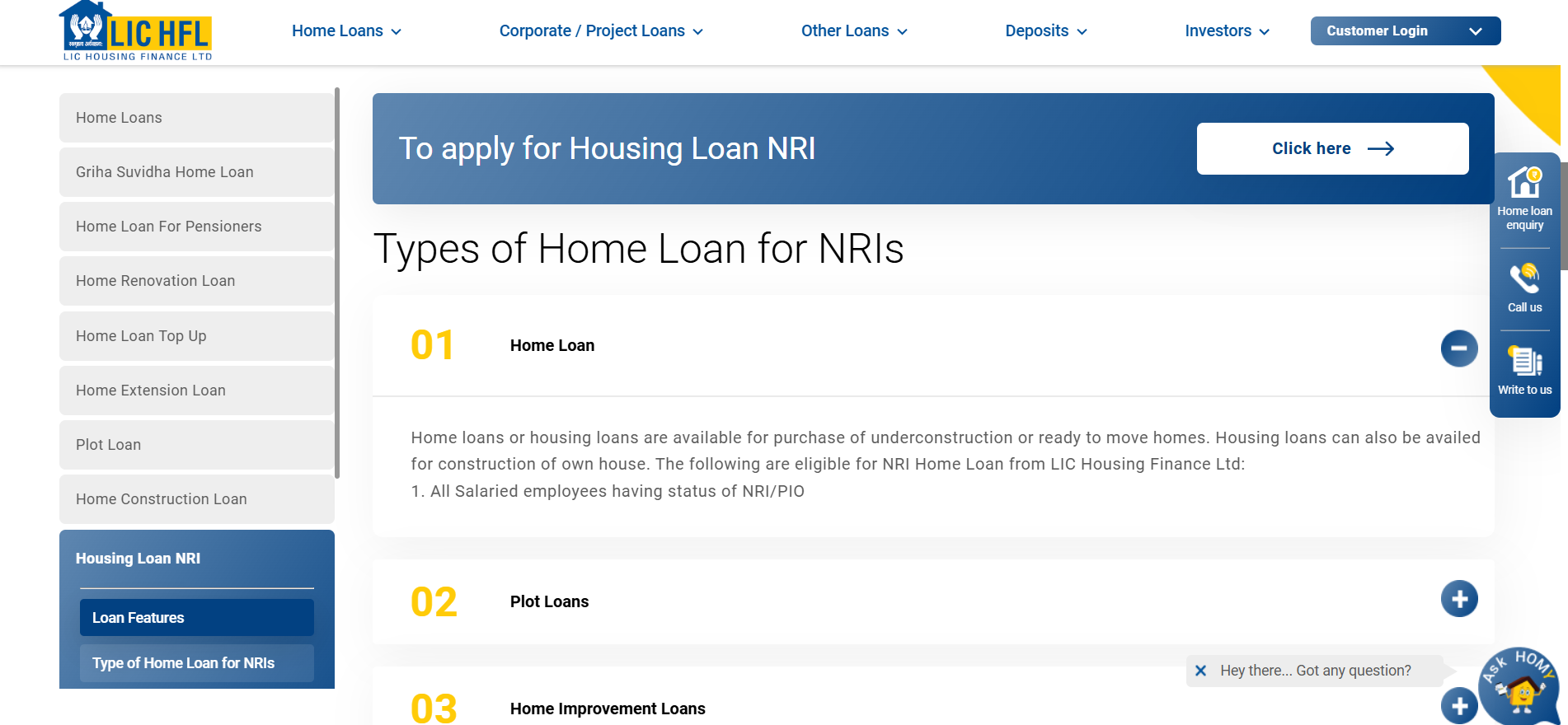

- Navigate to Home Loans > Home Loan for NRIs .

- Click Apply Now.

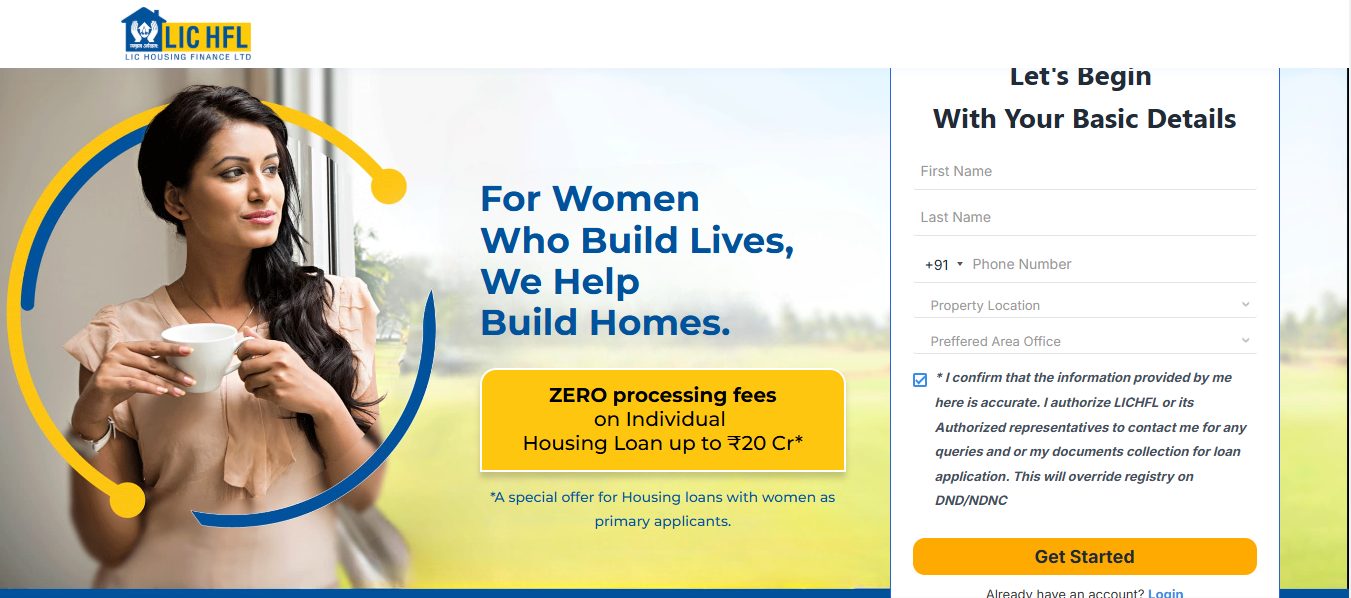

- Enter your name, mobile number, property location, and preferred office area, then click on “Get Started.”

- Complete the application form with accurate personal, financial, and property details .

- Upload all required supporting documents .

- Review all information and documents carefully, then submit the application.

- Upon successful submission, you will receive an acknowledgment or reference number .

Suggested Read: Home Loan Prepayment vs. Investment

Compare Top Banks NRI Home Loan Interest Rates

Placing different lenders’ rates side by side helps you pick the option that keeps your EMIs light and manageable.

| Banks/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| HDFC Bank | 10.10% p.a. onwards |

| ICICI Bank | 8.75% p.a. onwards |

| LIC Housing Finance | 8.25% p.a. onwards |

| Bajaj Housing Finance | 8.25% p.a. onwards |

| Axis Bank | 10.50% p.a. onwards |

| Tata Capital | 8.75% p.a. onwards |

| Bank of India | 8.25% p.a. onwards |

| Kotak Mahindra Bank | 8.65% p.a. onwards |

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

Yes, NRIs are eligible for home loans from most Indian banks and financial institutions. Eligibility criteria typically include stable income, creditworthiness, and proof of NRI status. Age limits and loan terms may vary by lender.

Some banks allow NRIs to apply independently, while others may require a resident Indian co-applicant or guarantor. Policies vary, so check with your lender.

Typically, NRIs can borrow up to 80–90% of the property value (Loan-to-Value ratio). The exact amount depends on income, repayment capacity, and bank policies.

Interest rates are competitive and often similar to those for resident Indians. Rates may vary based on the bank’s policies, loan type (fixed or floating), and the borrower’s profile.

Yes, but disbursements are made in stages linked to construction milestones. The loan agreement will outline payment terms tied to project progress.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan