Building a home piece by piece is exciting until the bills arrive brick by brick. Cash flow rarely follows the neat schedule you planned; masons may need payments weeks before your next milestone bonus hits the bank.

A Home Construction Loan from PNB Housing Finance provides headroom precisely for these in-between moments. Funds are disbursed in phases—foundation, superstructure, finishing—only when you need them, which keeps carrying costs sensible. It’s a quiet safety net that allows you to upgrade where it matters (better wiring, stronger waterproofing) without resorting to high-interest stopgap options or stalling the build.

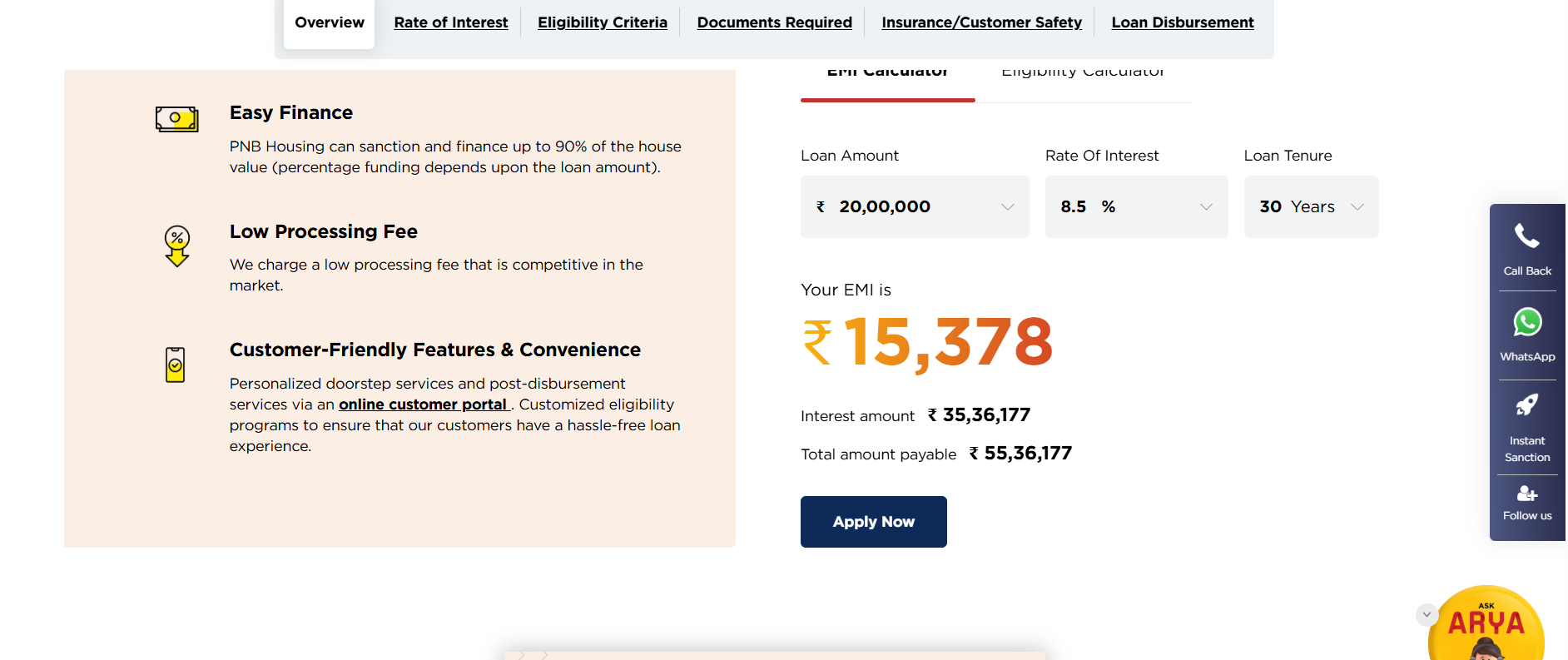

PNB Housing Finance Home Construction Loan Highlights

| Category | Highlights |

|---|---|

| Interest Rates | 8.50% p.a. onwards |

| Maximum Tenure | 30 Years |

| Maximum Loan Amount | Contact the Bank |

| Processing Fees | 1% of the Loan Amount + GST |

PNB Housing Finance Home Construction Loan Interest Rates 2025

PNB adjusts home loan interest rates based on whether you’re salaried, self-employed, or have a professional practice. Below is a quick look at how your employment type can influence your rate.

PNB Housing Finance Home Construction Loan Interest Rates for Salaried Employees

| Credit Score | Home Loan Below 35 Lakhs (p.a.) | Home Loan Above 35 Lakhs (p.a.) |

|---|---|---|

| >= 825 | 8.5% to 9% | 8.5% to 9% |

| > 800 to 825 | 8.8% to 9.3% | 8.8% to 9.3% |

| > 775 to 799 | 9.1% to 9.6% | 9.2% to 9.7% |

| > 750 to <= 775 | 9.25% to 9.75% | 9.35% to 9.85% |

| > 725 to <= 750 | 9.55% to 10.05% | 9.7% to 10.2% |

| > 700 to <= 725 | 9.85% to 10.35% | 10.05% to 10.55% |

| > 650 to <= 700 | 10.25% to 10.75% | 10.45% to 10.95% |

| upto 650 | 10.25% to 10.75% | 10.45% to 10.95% |

| NTC Cibil >=170 | 10.25% to 10.75% | 10.45% to 10.95% |

| NTC Cibil <170 | 10.15% to 10.65% | 10.35% to 10.85% |

PNB Housing Finance Home Construction Loan Interest Rates for Self Employed Individuals

| Credit Score | Home Loan Below 35 Lakhs (p.a.) | Home Loan Above 35 Lakhs (p.a.) |

|---|---|---|

| >= 825 | 8.8% to 9.3% | 8.8% to 9.3% |

| > 800 to 825 | 8.95% to 9.45% | 8.95% to 9.45% |

| > 775 to 799 | 9.65% to 10.15% | 9.8% to 10.3% |

| > 750 to <= 775 | 9.8% to 10.3% | 10.15% to 10.65% |

| > 725 to <= 750 | 10.25% to 10.75% | 10.3% to 10.8% |

| > 700 to <= 725 | 10.55% to 11.05% | 10.75% to 11.25% |

| > 650 to <= 700 | 10.75% to 11.25% | 10.95% to 11.45% |

| upto 650 | 10.75% to 11.25% | 10.95% to 11.45% |

| NTC Cibil >=170 | 10.65% to 11.15% | 10.85% to 11.35% |

| NTC Cibil <170 | 10.55% to 11.05% | 10.75% to 11.25% |

Suggested Read: Fixed vs. Floating Interest Rates

PNB Housing Finance Home Construction Loan Eligibility Criteria

Before applying for a home construction loan, it’s essential to understand the eligibility criteria. Here’s the essential eligibility checklist set by Punjab National Bank:

| Eligibility Criteria | Details |

|---|---|

| Citizenship | Indian |

| Work Experience | Minimum 3 years for salaried applicants Minimum 5 years business continuity for self-employed |

| Minimum CIBIL Score | 650 |

PNB Housing Finance Home Construction Loan Processing Fees

| Category | Charges |

|---|---|

| Processing Fees | 1% + GST |

PNB Housing Finance Home Construction Loan Other Charges

PNB applies various fees and charges on its home loans. Besides processing fees, borrowers may also have to pay administrative costs, legal fees, and prepayment charges.

| Charge Type | Amount |

|---|---|

| Legal Fee/ Legal Recovery Charges | As Per Actuals |

| Prepayment on Floating Rate (Part/Full) | a. Individual Property: NIL b. Non-Individual Identity: 2% of the Principal Amount Paid + GST |

| Prepayment on Fixed Rate (Part/Full) | a. Paid through Own Sources: NIL b. Payment made by Third Party: 3% of the Principal Amount Paid + GST c. Non-Individual Identity: 3% of the Principal Amount Paid + GST |

| Cheque/NACH Mandate Form Return (Bounce) | a. 1st Bouce: ₹750 + GST b. 2nd Bouce: ₹1000 + GST |

| Overdue Charges | 24% p.a on Unpaid EMI for Delayed Period |

| Statement of Account | Free from web/mobile portal ₹500/- + GST for branch request |

| Repayment Schedule Fee | Free from web portal ₹500/- + GST for branch request |

| Copy of Property Documents | ₹500/- + GST (E-mail) ₹1000/- + GST (Printed copies, max 50 pages) |

| Swap of Repayment Instructions | Free (NACH mode) ₹750/- + GST (Physical mode) |

| Loan Preclosure Statement | ₹750 + GST |

| ROI Change (Fixed to Floating) | 3% of POS + GST |

| Fee for EMI Payment in Cash/Single Cheque | ₹1000/- + GST |

| Custody Charges for Property Documents | ₹1000/- + GST p.m. after loan closure |

| CERSAI Fees | ₹100/- + GST (Loans after Jan 31, 2016) |

| MDT/Registration of Charge | ₹500/- + GST |

| Non Submission of Documents Related to Loan Condition/Security | ₹1,000 per month |

Suggested Read: PNB Housing Finance PMAY 2.0 Scheme

PNB Housing Finance Home Construction Loan Documents Required

When applying for a Plot Loan from PNB Housing Finance, it is essential to provide the necessary documentation to ensure a smooth and efficient loan processing experience. The documents required may vary depending on whether you are a salaried employee or a self-employed individual.

General Identity Documents

| Category | Documents Required |

|---|---|

| Age Proof | PAN Card, Passport, or Any other Certificate from Statutory Authority |

| Residence Proof | Passport, Driving License, Telephone Bill, Ration Card, Election Card, Any other Certificate from Statutory Authority |

Income Proof Documents

| Salaried Employees | Self Employed |

|---|---|

| Latest Salary Slips for 3 months | Certificate & Proof of business existence along with Business Profile |

| Form 16 for last 2 years | Last 3 years Income Tax returns (self and business) with Profit & Loss Account |

| Last 6 months Bank Statements (salary account) | Balance Sheets duly certified/audited by a Chartered Accountant |

| Last 12 months Bank Account Statements (self & business) |

Construction Documents

| Documents Required |

|---|

| Approved Plan |

Suggested Read: Plot vs. Flat vs. Bunglow

How to Apply to PNB Housing Finance Home Construction Loan?

- Visit the PNB Housing Finance official website.

- Navigate to the “Loans Products” tab. From the dropdown menu, select “Home Construction Loan” to begin your application.

- Scroll down to find the “Apply Now” button.

- Fill in your personal details, including your PAN ID, mobile number, and email address to create an account.

- After registration, you will be redirected to an online application form. Complete all the required fields, including details about your property, income, and employment.

- Submit the necessary documents such as identity proof, address proof, income proof, and property documents, as requested by PNB Housing Finance.

- Review all the entered information and documents. Once everything is correct, click on the “Submit” button to send your application.

- Upon successful submission, you will receive an application reference number for tracking your home loan application.

Suggested Read: PNB Housing Finance Home Loan Interest Rates 2025

Compare Top Banks Home Loan Interest Rates

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Land often appreciates over time, which means a plot + construction loan through PNB Housing Finance plot loan can be a prudent long-term investment. At Credit Dharma, we make this possible by offering lowest guaranteed Loan Against Property interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

A PNB Home Construction Loan is a financial product offered by Punjab National Bank (PNB) to individuals seeking funds for constructing a residential property on a plot of land.

The loan amount is need-based, determined by the project’s cost and the borrower’s repaying capacity.

Margin requirements vary based on the loan amount:

– Up to ₹30 lakh: 15%

– Above ₹30 lakh to ₹75 lakh: 20%

– Above ₹75 lakh: 25%

The loan can be repaid over a maximum tenure of 30 years or up to the borrower’s age of 70 years, whichever is later.

The loan is secured by an equitable or registered lien on the property being financed.

Yes, processing fees and documentation charges apply. For detailed information, refer to PNB’s official website or contact the nearest branch.

PNB allows prepayment of home loans. It’s advisable to check the specific terms and any associated charges with the bank.

Applications can be submitted online through PNB’s official website or by visiting the nearest PNB branch with the required documents.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan