Buying a plot is the foundation of your forever home – and PNB Housing Finance makes it effortless. With transparent pricing, quick loan disbursal, and flexible repayment plans starting at just 9.50% p.a. for up to 30 years, you can secure up to 75% of the plot’s market value – bringing your vision closer to reality.

PNB Housing Finance Plot Loan Highlights

| Categories | Details |

|---|---|

| Interest Rates | 9.50% p.a. onwards |

| Tenure | 30 Years |

| Maximum Loan Amount | 70% – 75% of the plot’s market value |

| Processing Fees | 1% of the Loan Amount + GST |

PNB Housing Finance Plot Loan Interest Rates 2025

Timing is everything when it comes to plot loans. Your credit score can make a difference in your PNB Housing Finance Plot Loan interest rate. Take a look at the table below to see how your credit rating can help you secure the best possible rate for your plot loan.

| Credit Score | Salaried / Self-employed professional (SEP) | Self-employed non-professional (SENP) |

|---|---|---|

| >=825 | 9.50% to 10% | 9.80% to 10.30% |

| >800 to 825 | 9.50% to 10% | 9.90% to 10.40% |

| >775 to 799 | 10.10% to 10.60% | 10.65% to 11.15% |

| >750 to <=775 | 10.25% to 10.75% | 10.80% to 11.30% |

| >725 to <=750 | 10.55% to 11.05% | 11.25% to 11.75% |

| >700 to <=725 | 10.85% to 11.35% | 11.55% to 12.05% |

| >650 to <=700 | 11.25% to 11.75% | 11.75% to 12.25% |

| upto 650 | 11.25% to 11.75% | 11.75% to 12.25% |

| NTC Cibil >=170 | 11.25% to 11.75% | 11.65% to 12.15% |

| NTC Cibil <170 | 11.15% to 11.65% | 11.55% to 12.05% |

Suggested Read: YEIDA Plot Loan Scheme 2025

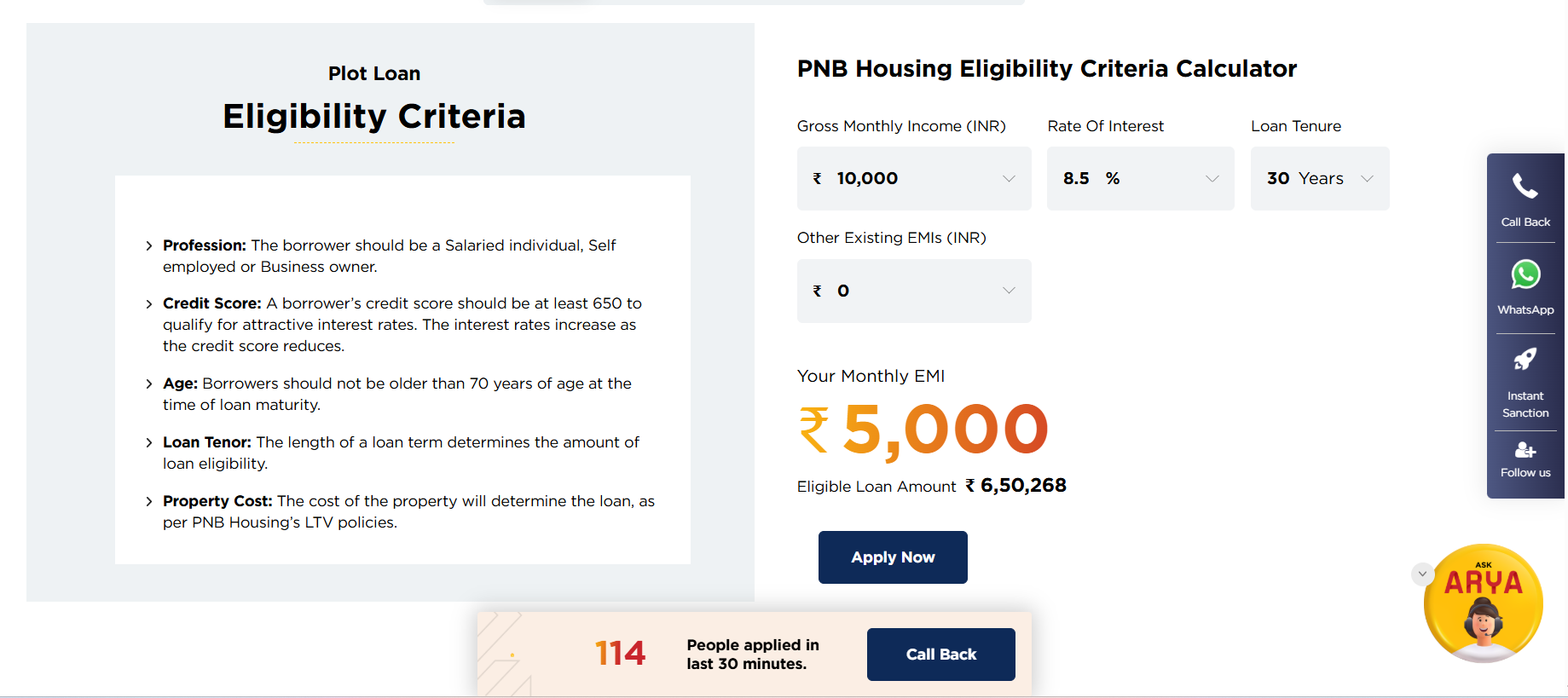

PNB Housing Finance Plot Loan Eligibility Criteria

When considering a plot loan from PNB Housing Finance, it’s essential to understand the eligibility criteria. Below is a breakdown of the key requirements to help you assess whether you qualify for this loan.

| Eligibility Criteria | Details |

|---|---|

| Profession | Salaried individual/ self-employed/ business owner. |

| Credit Score | 650+ (Interest rates increase as the credit score reduces.) |

| Age | Should not be older than 70 years of age at the time of loan maturity. |

| Loan Tenure | 30 Years |

| Loan Amount | The cost of the property will determine the loan. The length of a loan term determines the amount of loan eligibility. |

Suggested Read: Plot Loan vs. Home Loan

PNB Housing Finance Plot Loan Processing Fees

PNB Housing Finance takes processing fees to cover the cost of reviewing your documents and assessing your loan application.

| Fees Category | Charges Applicable |

|---|---|

| Processing Fees | 1% of the loan amount + GST |

PNB Housing Finance Plot Loan Other Fees and Charges

PNB applies various fees and charges on its home loans. Besides processing fees, borrowers may also have to pay administrative costs, legal fees, and prepayment charges.

| Charge Type | Amount |

|---|---|

| Legal Fee/ Legal Recovery Charges | As Per Actuals |

| Prepayment on Floating Rate (Part/Full) | a. Individual Property: NIL b. Non-Individual Identity: 2% of the Principal Amount Paid + GST |

| Prepayment on Fixed Rate (Part/Full) | a. Paid through Own Sources: NIL b. Payment made by Third Party: 3% of the Principal Amount Paid + GST c. Non-Individual Identity: 3% of the Principal Amount Paid + GST |

| Cheque/NACH Mandate Form Return (Bounce) | a. 1st Bouce: ₹750 + GST b. 2nd Bouce: ₹1000 + GST |

| Overdue Charges | 24% p.a on Unpaid EMI for Delayed Period |

| Statement of Account | Free from web/mobile portal ₹500/- + GST for branch request |

| Repayment Schedule Fee | Free from web portal ₹500/- + GST for branch request |

| Copy of Property Documents | ₹500/- + GST (E-mail) ₹1000/- + GST (Printed copies, max 50 pages) |

| Swap of Repayment Instructions | Free (NACH mode) ₹750/- + GST (Physical mode) |

| Loan Preclosure Statement | ₹750 + GST |

| ROI Change (Fixed to Floating) | 3% of POS + GST |

| Fee for EMI Payment in Cash/Single Cheque | ₹1000/- + GST |

| Custody Charges for Property Documents | ₹1000/- + GST p.m. after loan closure |

| CERSAI Fees | ₹100/- + GST (Loans after Jan 31, 2016) |

| MDT/Registration of Charge | ₹500/- + GST |

| Non Submission of Documents Related to Loan Condition/Security | ₹1,000 per month |

Suggested Read: PNB Housing Finance PMAY 2.0 Scheme

PNB Housing Finance Plot Loan Documents Required

When applying for a Plot Loan from PNB Housing Finance, it is essential to provide the necessary documentation to ensure a smooth and efficient loan processing experience. The documents required may vary depending on whether you are a salaried employee or a self-employed individual.

General Identity Documents

| Category | Documents Required |

|---|---|

| Age Proof | PAN Card, Passport, or Any other Certificate from Statutory Authority |

| Residence Proof | Passport, Driving License, Telephone Bill, Ration Card, Election Card, Any other Certificate from Statutory Authority |

Income Proof Documents

| Salaried Employees | Self Employed |

|---|---|

| Latest Salary Slips for 3 months | Certificate & Proof of business existence along with Business Profile |

| Form 16 for last 2 years | Last 3 years Income Tax returns (self and business) with Profit & Loss Account |

| Last 6 months Bank Statements (salary account) | Balance Sheets duly certified/audited by a Chartered Accountant |

| Last 12 months Bank Account Statements (self & business) |

Property Documents

| Documents Required |

|---|

| Photocopy of Title Documents of the Property |

| Approved Plan |

Suggested Read: Plot vs. Flat vs. Bunglow

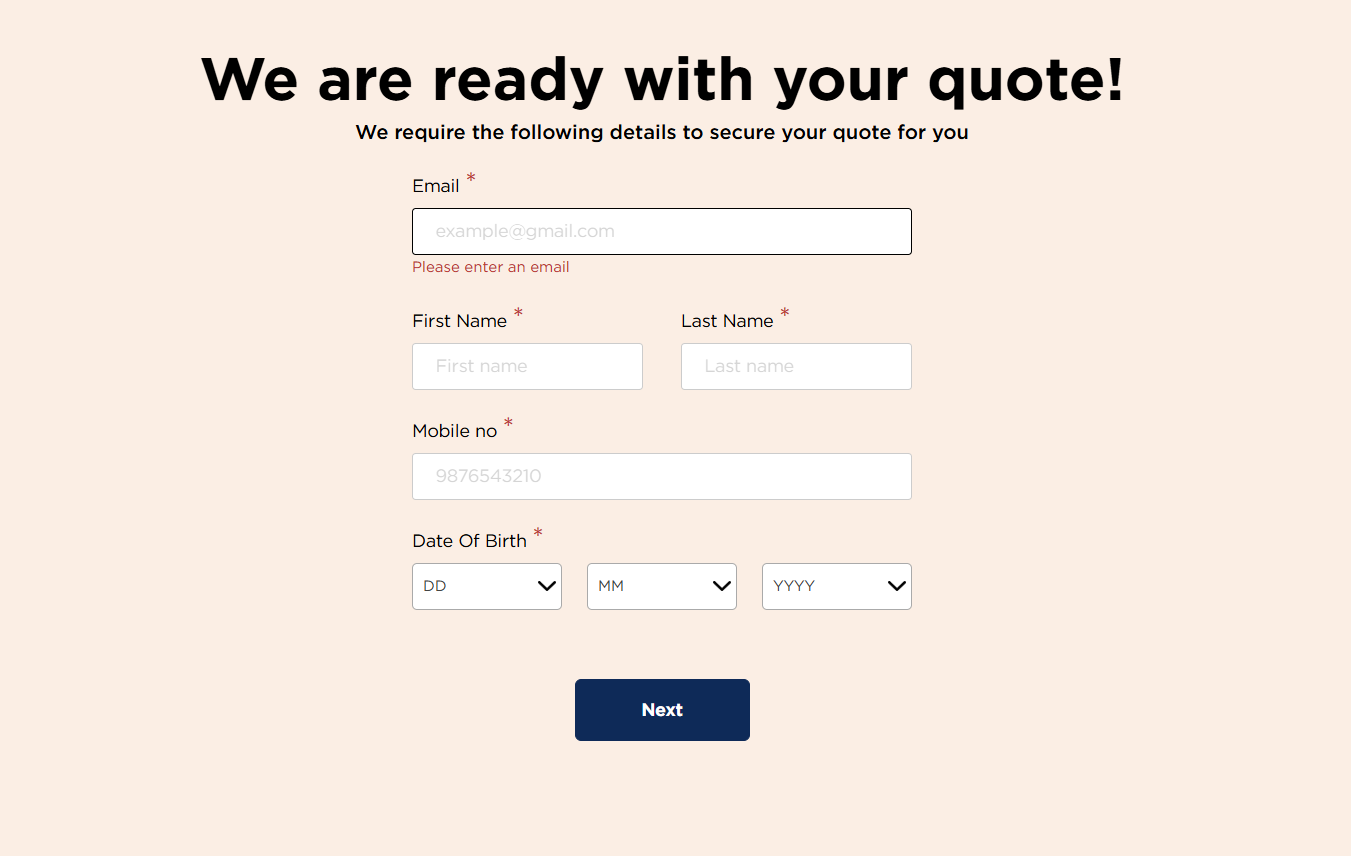

How to Apply to PNB Housing Finance Plot Loan?

- Visit the PNB Housing Finance official website.

- Scroll down and click on “Apply Now”

- Choose whether you’re applying for a new home loan or a balance transfer.

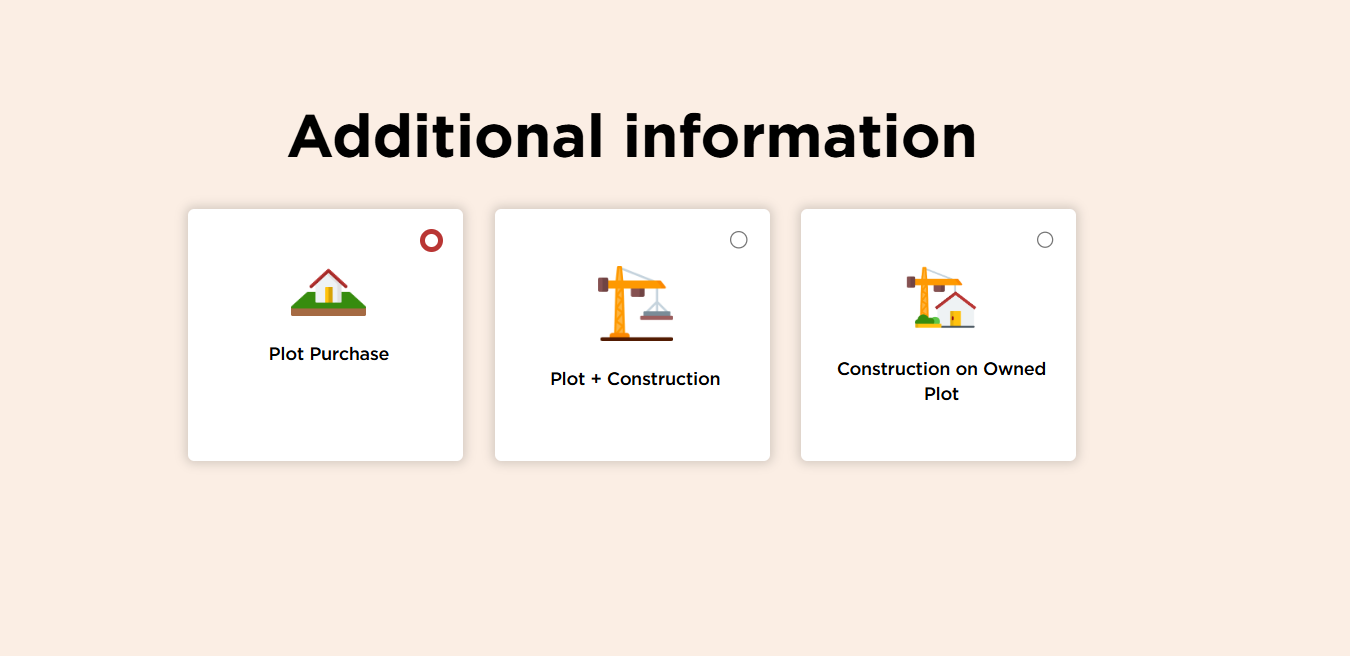

- Select the broad loan category that best suits your needs.

- Pick the specific type of plot loan you’re interested in.

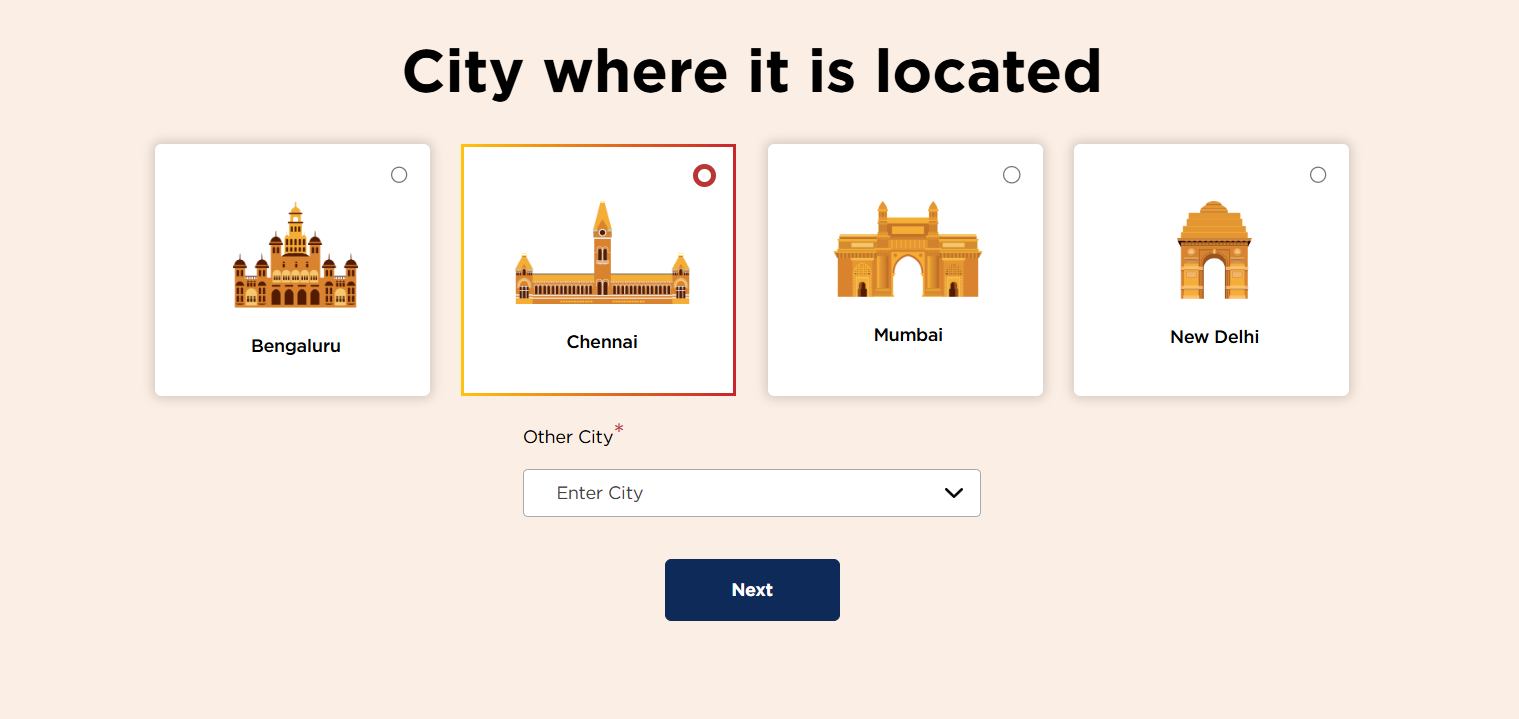

- Select your city of residence.

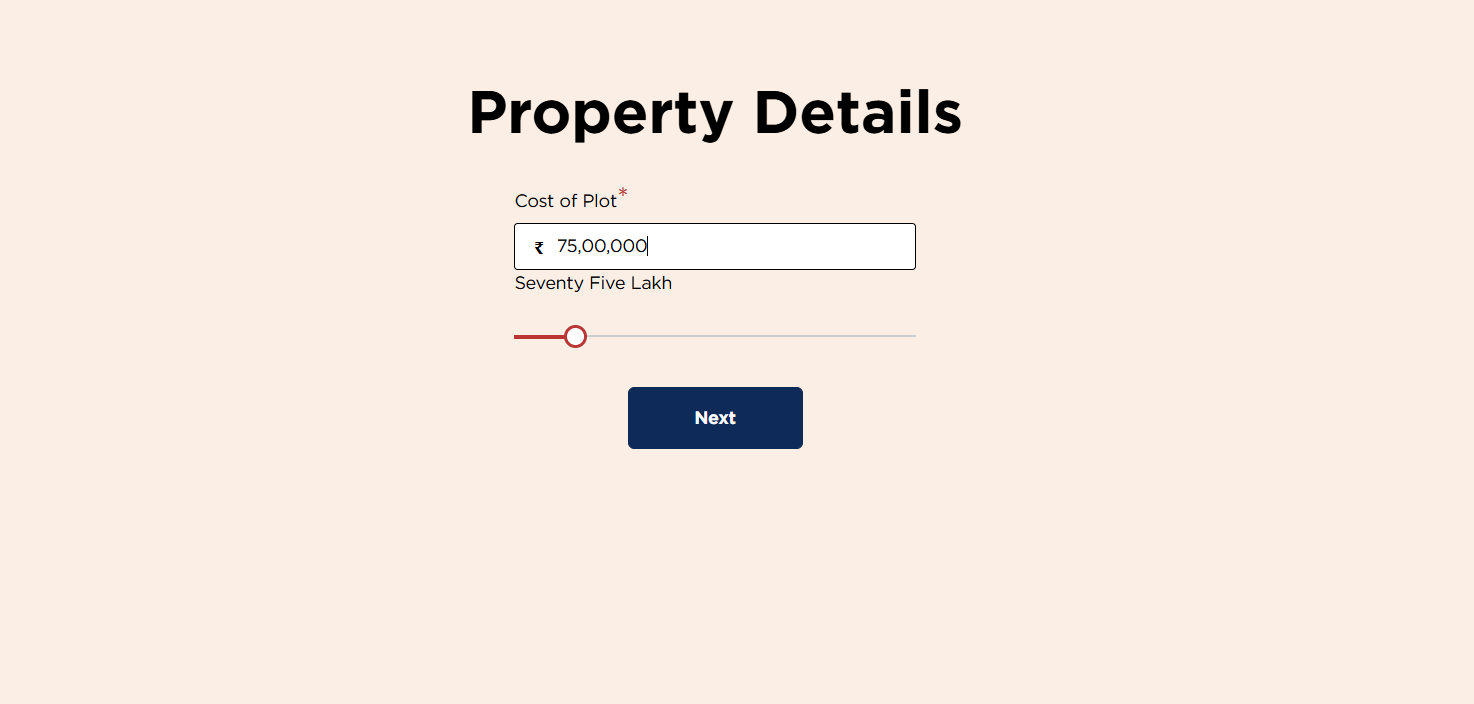

- Enter the cost of the plot you want to purchase.

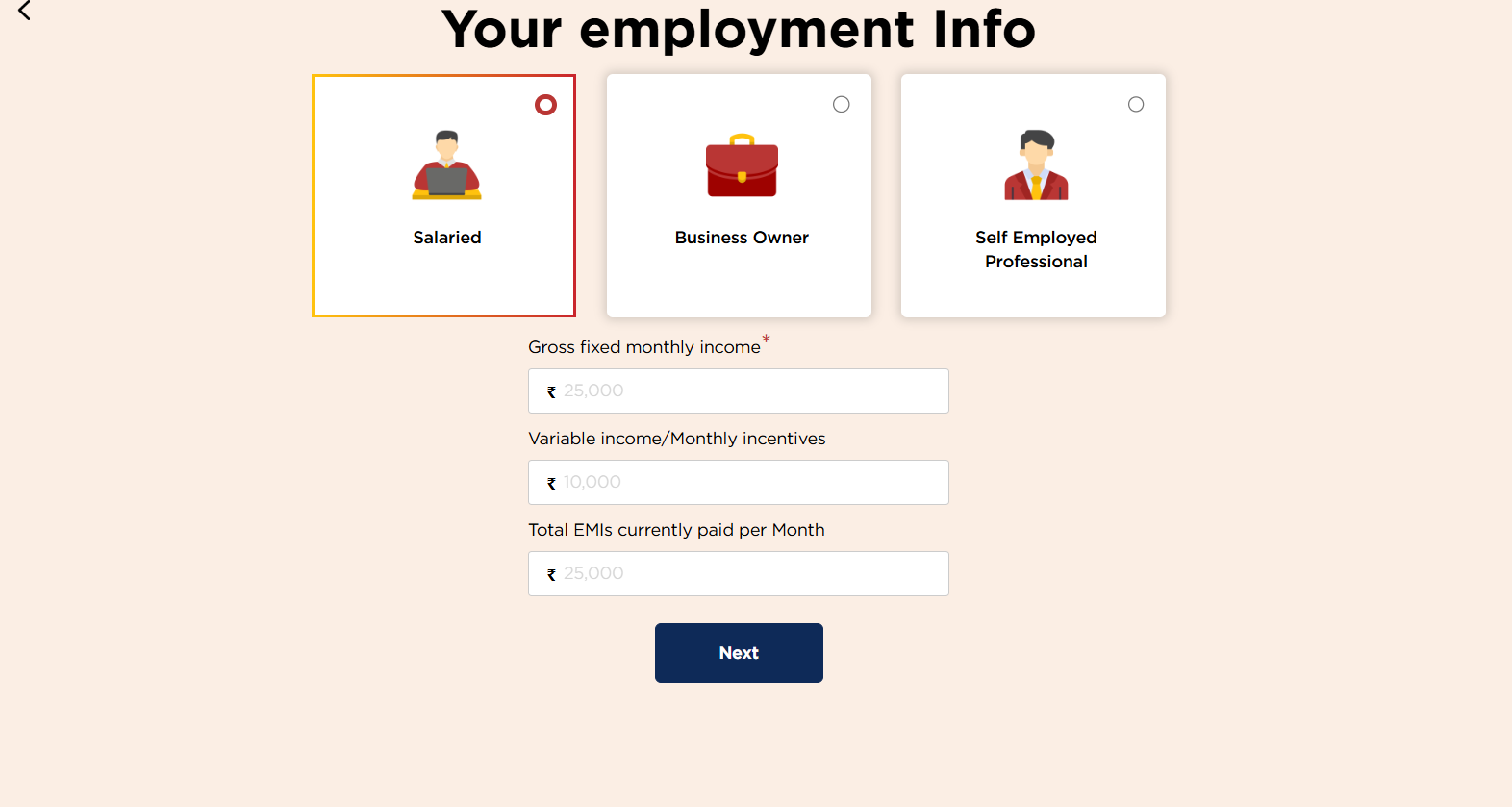

- Provide your employment and income details.

- If you have a co-applicant, include their income and financial details as well.

- Lastly, enter your contact information, including your name and age, to receive a loan quote.

Suggested Read: 1 Acre Land Price in Ayodhya

Plot Loan Tax Benefits

- If you purchase a plot without intending to construct a home (e.g., holding it as a long-term investment), no tax deductions apply under Sections 80C or 24B of the Income Tax Act.

- If you buy a plot with plans to build a house, villa, or bungalow , both your plot loan (for land purchase) and home loan (for construction) qualify for tax deductions.

Tax Benefits Under Section 80C

- Up to ₹1.5 lakh annually can be claimed as a deduction for the principal portion of your plot loan repayments.

- This applies only if the plot is used for constructing a self-occupied or rented-out property.

Tax Benefits Under Section 24B

- Interest paid on both your plot loan and home loan qualifies for deduction under Section 24B.

- For self-occupied properties, the annual limit is ₹2 lakh (or ₹3.5 lakh if the loan was sanctioned before April 1, 2019).

- For rented properties, there’s no cap on interest deductions.

Additional Exemptions

- Title transfer fees and enrollment fees paid in the same year the home’s construction is completed are also included in the exempted amount under Section 80C.

Suggested Read: How to Calculate Agricultural Land Area?

Compare Top Banks Plot Loan Interest Rates

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Suggested Read: Land Prices in India 2025

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

Land often appreciates over time, which means a plot purchased through PNB Housing Finance plot loan can be a prudent long-term investment. At Credit Dharma, we make this possible by offering lowest guaranteed Loan Against Property interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

PNB Housing provides financing for up to 70-75% of the plot’s market value, based on the cost of the property and eligibility.

Yes, tax benefits can be availed if you begin construction on the purchased land within the stipulated time frame, as per Section 24(b) of the Income Tax Act.

The interest rates for PNB Housing Plot Loans start from 9.50% and vary based on your credit score and financial profile. Rates are floating and can change according to market trends.

PNB Housing offers flexible repayment tenure based on your loan amount, profile, and financial requirements. The exact tenure will be provided during loan approval.

Salaried individuals, self-employed professionals, and self-employed non-professionals with a minimum credit score of 650 are eligible. The borrower should also be less than 70 years old at the time of loan maturity.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan