For many NRIs, the idea of “home” is split between two time zones: weekday routines abroad and memories of festivals back in India. Buying property becomes a way to stitch those worlds together, yet coordinating paperwork, local regulations, and large remittances can feel daunting from thousands of miles away.

PNB Housing Finance’s NRI Home Loan is structured to work with digital submissions and abroad-based income proofs, keeping you from chasing stamps at a local branch during precious vacation days.

PNB Housing Finance NRI Home Loan Highlights

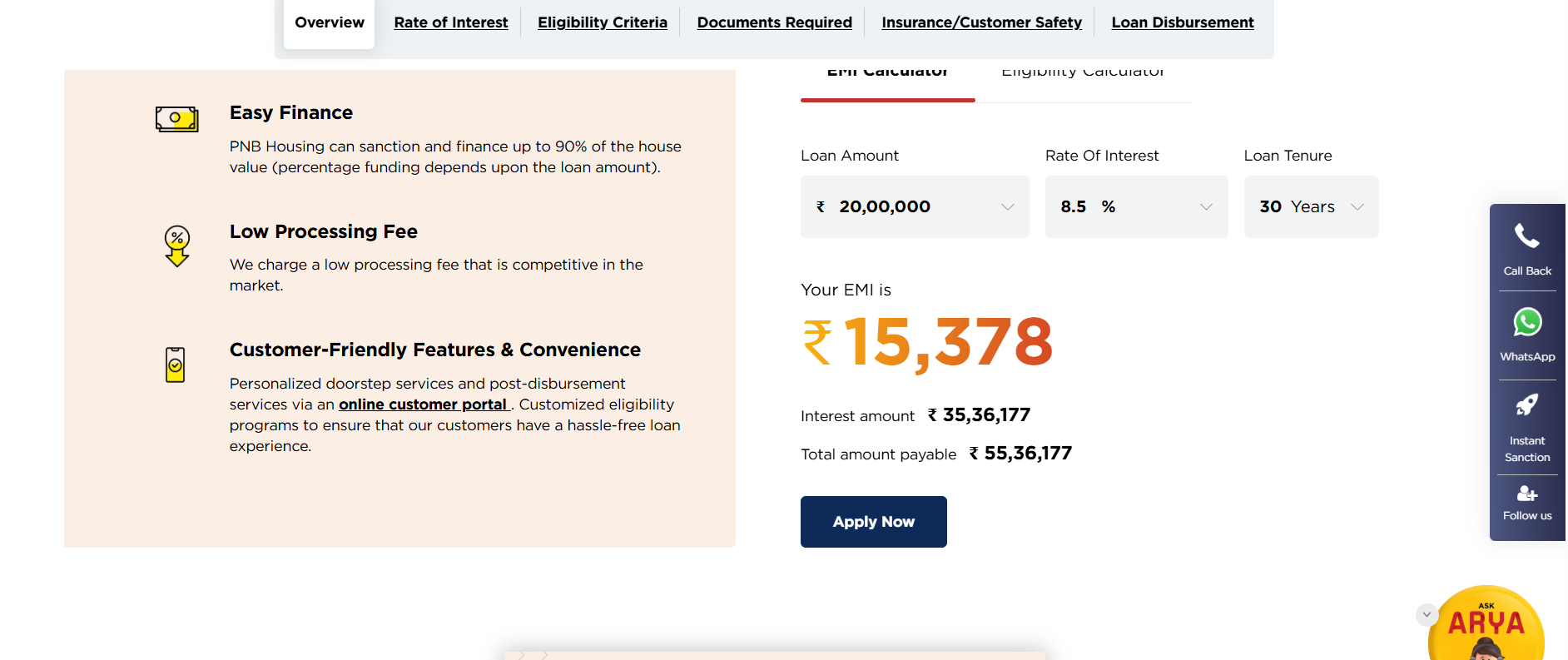

This quick snapshot shows the core numbers—rate, loan share, and tenure—so you can gauge affordability at a glance.

| Aspects | Highlights |

|---|---|

| Interest Rates | 8.50% p.a. onwards |

| Maximum Loan Amount | 75% – 90% of the Value of the Property |

| Maximum Tenure | 30 Years |

Suggested Read: Can NRIs Buy Agricultural Land in India?

PNB Housing Finance NRI Home Loan Interest Rates

Knowing the starting rate lets you estimate your EMI and decide whether the loan matches your cash-flow comfort.

| Applicant Type | Interest Rate |

|---|---|

| NRIs/PIOs | 8.50% p.a. onwards |

Suggested Read: Rules for NRI Real Estate Investment in India

PNB Housing Finance NRI Home Loan Eligibility Criteria

Check these basic conditions first; meeting them is the key to unlocking your NRI borrowing power.

| Eligibility Criterion | Details |

|---|---|

| Citizenship / Status | Indian citizen or Person of Indian Origin (PIO) holding an Indian passport and classified as NRI (deputation / employment / assignment) |

| Overseas Track Record | Minimum 1 year of continuous service / stay abroad before applying (waived for applicants posted overseas on deputation) |

| Age Limit at Loan Maturity | Not more than 70 years |

Suggested Read: NRI CIBIL Score Requirement for Home Loans

PNB Housing Finance NRI Home Loan Processing Fees

Understanding the one-time processing fee helps you budget for the costs that appear before the loan even starts.

| Fee Type | Amount |

|---|---|

| Processing Fees | 1% of the loan applied for + GST |

Suggested Read: PNB Housing Finance Home Loan Customer Care

PNB Housing Finance NRI Home Loan Other Charges

Review the penalty and service fees now, so no surprise bills pop up later in your repayment journey.

| Charge Type | Description |

|---|---|

| Late Payment Charges | 24% p.a on unpaid EMI for the delayed period |

| Repayment Schedule Fee | ₹500/- + GST will be charged |

| Documents Fee | ₹750/- + GST will be charged (After 6 months from 1st disbursement) |

| Loan Pre-closure Fee | ₹750/- + GST |

| Provisional Interest and Final Interest Paid Certificate Fee | ₹500/- + GST (On request made per instance otherwise 1 Final Interest and 2 Provisional sent through e-mail every year free of cost and no cost on self-download) |

| Copy of Property Documents Fee | ₹500/- + GST (If received through e-mail) ₹1000/- + GST (If printed copies < 50 pages) ₹1500/- + GST (If printed copies > 50 pages) |

| ROI Change Fee (Fixed to Floating) | 3% of POS + GST |

| ROI Change Fee (Floating to Floating with reduction in rate) | 0.5% of POS + GST |

| Fee for EMI payment in cash | ₹1000/- + GST |

| Custody Charges (For property documents not taken back after maturity) | ₹1000/- + GST p.m (after 1 month of Loan closure/maturity) |

| Document Retrieval Charges | ₹1000/- + GST |

| CERSAI Fees | ₹100/- + GST (If loans disbursed after January 31, 2016) ₹500/- + GST (If loans disbursed before January 31, 2016) |

| CERSAI Validation Fees | ₹50/- + GST |

| MODT/Registration of Charge | ₹500/- + GST |

Suggested Read: How to Check PNB Home Loan Application Status?

PNB Housing Finance NRI Home Loan: Documents Required

Keep these IDs, income proofs, and visa papers handy; complete paperwork speeds up approval and disbursement.

| Document Category | Accepted Proofs / Details |

|---|---|

| Photo ID | Passport, Driving License, PAN Card, Voter ID (any one) |

| Residence Address (India) | Electricity, Water, Telephone Bill, Passport, Driving License, Aadhaar (any one) |

| Passport & Visa | Copy of valid Indian passport and current visa |

| Current Overseas Address | Any proof showing present foreign address |

| PIO Status | PIO Card issued by Govt. of India (for PIO applicants) |

| Employment Evidence | Employer ID card, valid work permit, employment contract |

| Business Address (Self-employed) | Proof of overseas business address |

| Income Proof – Salaried | • Latest 12-month salary certificates • 12-month salary-account statement |

| Income Proof – Self-employed / Others | • Last 2 years audited / CA-certified balance sheet & P&L with computation sheets • 12-month bank statement |

Suggested Read: What to Do If You Lose Your Property Documents?

How to Apply to PNB Housing Finance NRI Home Loan?

The online application is simple—fill in your details, upload the documents, and track your loan with the reference number you receive.

- Visit the PNB Housing Finance official website.

- Navigate to the “Loans Products” tab. From the dropdown menu, select “NRI Home Loan” to begin your application.

- Scroll down to find the “Apply Now” button.

- Fill in your personal details, including your PAN ID, mobile number, and email address to create an account.

- After registration, you will be redirected to an online application form. Complete all the required fields, including details about your property, income, and employment.

- Submit the necessary documents such as identity proof, address proof, income proof, and property documents, as requested by PNB Housing Finance.

- Review all the entered information and documents. Once everything is correct, click on the “Submit” button to send your application.

- Upon successful submission, you will receive an application reference number for tracking your home loan application.

Suggested Read: PNB Home Loan Repayment Options

Compare Top Banks NRI Home Loan Interest Rates

Placing different lenders’ rates side by side helps you pick the option that keeps your EMIs light and manageable.

| Banks/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| HDFC Bank | 10.10% p.a. onwards |

| ICICI Bank | 8.75% p.a. onwards |

| LIC Housing Finance | 8.25% p.a. onwards |

| Bajaj Housing Finance | 8.25% p.a. onwards |

| Axis Bank | 10.50% p.a. onwards |

| Tata Capital | 8.75% p.a. onwards |

| Bank of India | 8.25% p.a. onwards |

| Kotak Mahindra Bank | 8.65% p.a. onwards |

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Frequently Asked Questions

Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) holding an Indian passport with at least one year of employment abroad are eligible to apply.

The loan can be utilized for the acquisition, construction, repair, renovation, or improvement of a flat or house in India, as well as for purchasing a plot.

The repayment period can extend up to 30 years, including any moratorium period.

PNB Housing can sanction and finance up to 90% of the property’s value, depending on the loan amount.

Interest rates start at 8.50% per annum for NRIs and PIOs.

Applicants need to submit a duly filled application form with a photograph, proof of age and residence, income proof, bank statements, property documents, and a processing fee cheque, among others.

No, there are no prepayment charges for PNB NRI Home Loans.

Repayments can be made through remittances from abroad via normal banking channels or from funds in NRE/NRO accounts in India.

Yes, adding a co-applicant, such as an immediate family member, can enhance loan eligibility by considering the combined income.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan