Paying property tax in Ludhiana and taxes in other cities like Navi Mumbai is an important responsibility for property owners. Property tax is a yearly charge collected by the municipal corporation to fund essential city services. This tax supports infrastructure development, maintenance of roads, water supply, and waste management systems. It ensures the city remains functional and improves living conditions for residents.

By staying updated on tax payments, property owners can fulfil their civic duties and support their community.

How to Pay Property Tax in Ludhiana

There are two ways to pay property tax in Ludhiana: online and offline. You can choose the method that is most convenient for you.

Online Payment Method

To pay your property tax online, follow these steps:

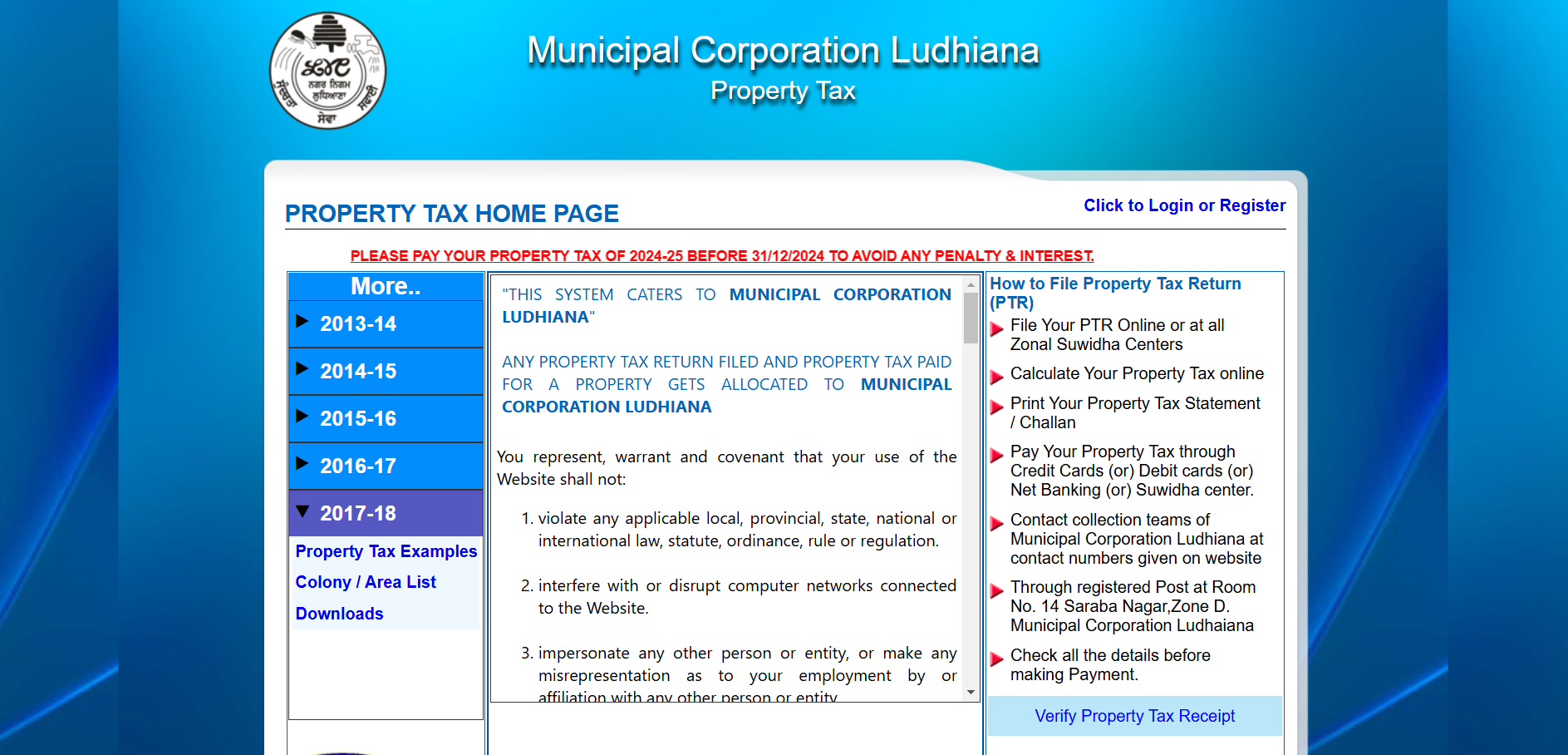

- Visit the official website of the Ludhiana Municipal Corporation.

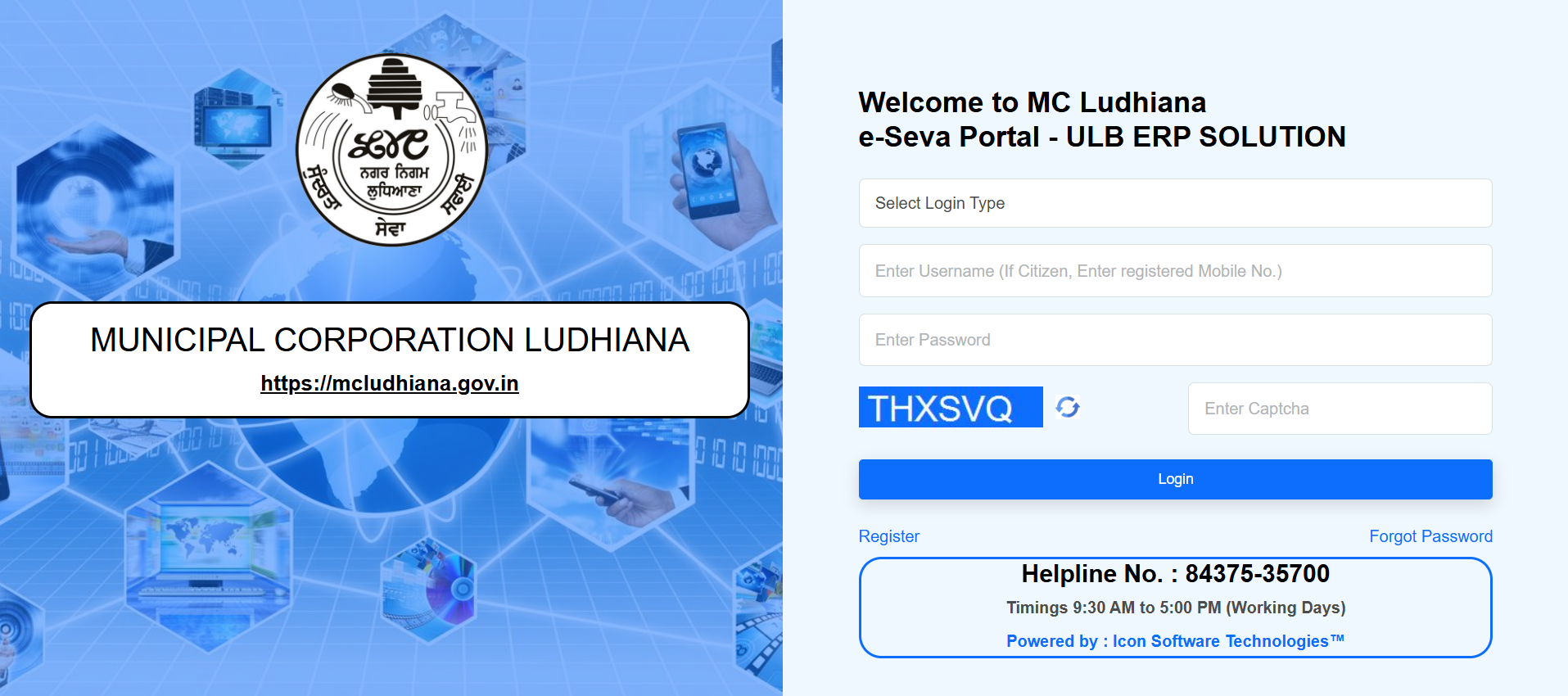

- Log in with your username and password. If you don’t have an account, you can register by providing your details.

- After logging in, enter your property details, such as the assessment code and area.

- Review your property tax dues and confirm the amount.

- Choose your payment method (debit card, credit card, or net banking).

- Complete the payment. After the transaction is successful, a receipt will be generated.

- Save the receipt for your records.

Check Out: How To Pay Property Taxes Online?

Offline Payment Method

To pay your property tax offline, you can visit the Ludhiana Municipal Corporation office. Here’s how:

- Go to the Municipal Corporation office in Ludhiana.

- Collect a property tax payment form from the counter.

- Fill in the required details, such as your property ID and the amount due.

- Submit the form at the payment counter.

- Pay the tax amount in cash or by cheque.

- After payment, you will receive a receipt. Keep it for future reference.

Also Read : How to Pay Navi Mumbai Property Tax

What is Property Tax in Ludhiana?

Property tax is an amount that property owners in Ludhiana pay to the local government, specifically the Ludhiana Municipal Corporation. This tax is charged annually and helps the government maintain and improve public services in the city.

The money collected through property taxes is mainly used for the upkeep of city infrastructure like roads, water supply, and waste management. It is an important source of revenue for the city, ensuring that basic services are provided to all residents.

If you own property in Ludhiana, you are required to pay this tax based on the value of your property. The tax helps the local government to fund the development and maintenance of the city. Without property taxes, it would be difficult for the government to provide these essential services.

Who Needs to Pay Property Tax in Ludhiana?

Property tax in Ludhiana applies to all property owners, but not all types of properties are taxed the same way.

Taxable Properties

If you own residential, commercial, or vacant land in Ludhiana, you need to pay property tax. This includes both developed properties like houses or shops and empty plots of land. The tax is calculated based on the size, type, and value of the property.

Exemptions

However, not all properties are subject to tax. Some properties are exempt, including:

- Religious buildings, such as temples, mosques, and churches

- Agricultural land used for farming

- Properties owned by freedom fighters or certain government bodies

- Properties used for charitable purposes or educational institutions that are exempt from income tax

How to Calculate Property Tax in Ludhiana?

Property tax in Ludhiana depends on the type of property you own. The calculation method varies for residential, commercial, and vacant properties.

Residential Property Tax Calculation

- Tax Basis: Calculated based on the construction cost and area of the residential property.

- Components:

- Construction Cost per Square Foot: Added to the collector rate (government-set land rate).

- Depreciation: Subtracted from the total; typically 10% of the construction cost.

- Annual Cost: 5% of the total calculated cost after depreciation.

- Tax Rate: 0.5% levied on the annual cost.

Commercial Property Tax Calculation

- Calculation Basis:

Similar to residential properties, based on area and construction cost. - Tax Rate: Generally higher than residential properties.

- Additional Factors:

- Location: The area where the commercial property is situated.

- Usage: The purpose for which the commercial space is used.

- Key Differences: Higher tax rate and specific considerations for location and usage compared to residential property taxes.

Vacant Land Tax Calculation

- Property Type: Vacant plots in Ludhiana.

- Calculation Basis:

- Based on the collector rate for the land.

- 5% of the collector rate is considered the annual cost.

- A 0.5% tax is applied to the annual cost.

- Applicable Range: Valid for vacant plots between 100 and 500 square yards.

Rented Property Tax Calculation

- Property Type: Rented properties.

- Tax Basis:

- Residential Rentals: 7.5% of the annual rental income is taxable.

- Commercial/Industrial Rentals: 10% of the annual rental income is taxable.

- Key Requirement: Landlords must calculate property tax based on the rental income received annually.

Last Date of Property Tax Payment in Ludhiana

- In Ludhiana, property tax payments are due every year on March 31st. This is the last day to pay without facing any penalties.

- If you miss the deadline, you will be charged a 20% penalty on the amount due. Additionally, an 18% interest will be added to the outstanding amount.

- To avoid extra costs, make sure to pay your property tax before the due date.

Rebates and Exemptions

Ludhiana offers a rebate to property owners who pay their property tax early. This helps reduce the tax burden for those who settle their dues before the due date.

Some properties are exempt from property tax.

These include:

- Religious buildings are used for religious activities.

- Educational institutions that are not government-owned or aided.

- Government properties like hospitals and schools.

Conclusion

Paying your property tax in Ludhiana on time is crucial. It helps maintain local services and infrastructure. By paying early, you can also benefit from rebates and avoid penalties. Remember, the due date is March 31st, so make sure to complete the payment before then. This will save you from additional charges like interest or penalties. Paying property tax in Ludhiana on time ensures you meet your civic duty without facing any extra costs.

Reach out to Credit Dharma for more property and home loan related queries.

Frequently Asked Questions

Property tax in Ludhiana is a charge levied by the Municipal Corporation on properties to fund city services like roads, drainage, and health.

All property owners, including residential, commercial, and vacant land owners, need to pay property tax in Ludhiana.

Religious buildings, educational institutions, and government properties are exempt from property tax in Ludhiana.

You can pay property tax online through the official portal or offline at the Municipal Corporation office.

The due date for property tax payment in Ludhiana is March 31st each year.

If you miss the due date, you will incur a 20% penalty and an 18% interest charge on the due amount.

Yes, Ludhiana offers rebates for early property tax payments.

For residential properties, property tax is calculated based on factors like construction cost, area, and depreciation.

Yes, you can get a rebate on property tax if you pay it before the due date.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan