Retirement should be a time to enjoy the fruits of your hard work, not worry about finances. With SBI’s Reverse Mortgage Loan, senior citizens can unlock the value of their self-owned home to create a steady income stream. This loan helps those without enough savings to live comfortably by providing monthly payments, all while they continue to stay in their home. There’s no need to worry about repaying the loan during your lifetime—SBI has got you covered.

SBI Reverse Mortgage Loan Highlights

Looking for a way to unlock the value of your home in retirement? SBI Reverse Mortgage Loan lets you convert your home equity into a regular income stream. Let’s take a look at the highlights of this option.

| Category | Highlights |

|---|---|

| Interest Rate | 11.50% p.a. onwards |

| Loan Amount | NCR/ Pune/ Mumbai/ Ahmedabad/ Bangalore/ Hyderabad/ Chennai: ₹2 Crore Other Cities: ₹1.50 Crore |

| Tenure | 10 – 15 Years (Depends on the Age of the Borrower) |

| Processing Fees | 0.50% of the Loan Amount (₹2,000 – ₹10,000) |

Suggested Read: Impact of Repo Rate Cut on SBI Home Loan

SBI Reverse Mortgage Loan Interest Rates 2025

Here’s everything you need to know about the competitive interest rates for SBI Reverse Mortgage Loans in 2025. It’s the perfect option for senior citizens looking for extra financial stability.

| Category | Interest Rates |

|---|---|

| SBI Reverse Mortgage Loan | 11.50% p.a. onwards |

SBI Reverse Mortgage Loan Eligibility Criteria

Let’s see if you meet the basic eligibility criteria, so you can get started on your journey to financial freedom in your golden years.

| Category | Requirements |

|---|---|

| Minimum Age | 60 Years |

| Nationality | Indian Resident |

| Minimum Age for Joint Borrowers | 58 Years |

Suggested Read: Home Loan Prepayment vs. Retirement Investment

SBI Reverse Mortgage Loan Processing Fees

Fees shouldn’t be a barrier to your financial security. Check out the straightforward processing fees for SBI’s Reverse Mortgage Loan, and see how affordable it can be to unlock the equity in your home.

| Processing Fees |

|---|

| 0.50% of the loan amount + GST |

| Minimum: ₹2,000 | Maximum: ₹10,000 |

SBI Reverse Mortgage Loan Other Fees and Charges

A small fine print goes a long way in helping you avoid any surprises. Get to know the additional fees and charges associated with SBI’s Reverse Mortgage Loan to ensure smooth sailing through the process.

| Charges/Reason | Details |

|---|---|

| CERSAI Registration Charges | ₹50+ GST (Onwards) |

| Fee for Switching to Current Card Rate | ₹5,000 + GST |

| Safe Custody Charges | ₹1,000 + GST per quarter or part thereof for delayed collection of original title deeds (beyond 60 days). |

| Conversion Charges for Switching Loan | Switching loan from MCLR/Base Rate/SBAR to EBLR is allowed at ₹1,000 per account + GST. |

| Penalty for Failed/Non-Payment of EMI | ₹250 + GST per EMI missed |

| Penalty for Cheque Returned (Insufficient Funds) | ₹500 + GST |

| Penalty for Failed SI/NACH | ₹250 + GST per failed SI/NACH transaction |

Suggested Read: Home Loans Available for Retired Persons

SBI Reverse Mortgage Loan Documents Required

Paperwork made easy! Here’s the list of documents you’ll need to apply for SBI’s Reverse Mortgage Loan, so you can get started with minimal hassle and maximum peace of mind.

General Applicant Documents

| Document | Details |

|---|---|

| Loan Application | Completed loan application form 3 Passport size photographs |

| Proof of Identity | Any one of the following: PAN/ Passport/ Driver’s License/ Voter ID card |

| Proof of Residence/ Address | Any one of the following: Recent copy of Telephone Bill/ Electricity Bill/ Water Bill/ Piped Gas Bill/ Passport/ Driving License |

Must Read: Best Property Valuation Practices

Property-related Documents

| Document | Details |

|---|---|

| Registered Sale Deed | Sale deed and link documents for tracing the title |

| Occupancy Certificate | Optional document |

| Share Certificate | Only for Maharashtra, along with Maintenance Bill Electricity Bill Property Tax Receipt |

| Approved Plan Copy | Xerox Blueprint & Registered Development Agreement of the builder Conveyance Deed |

Must Read: How to Get a Home Loan With Out Income Proof?

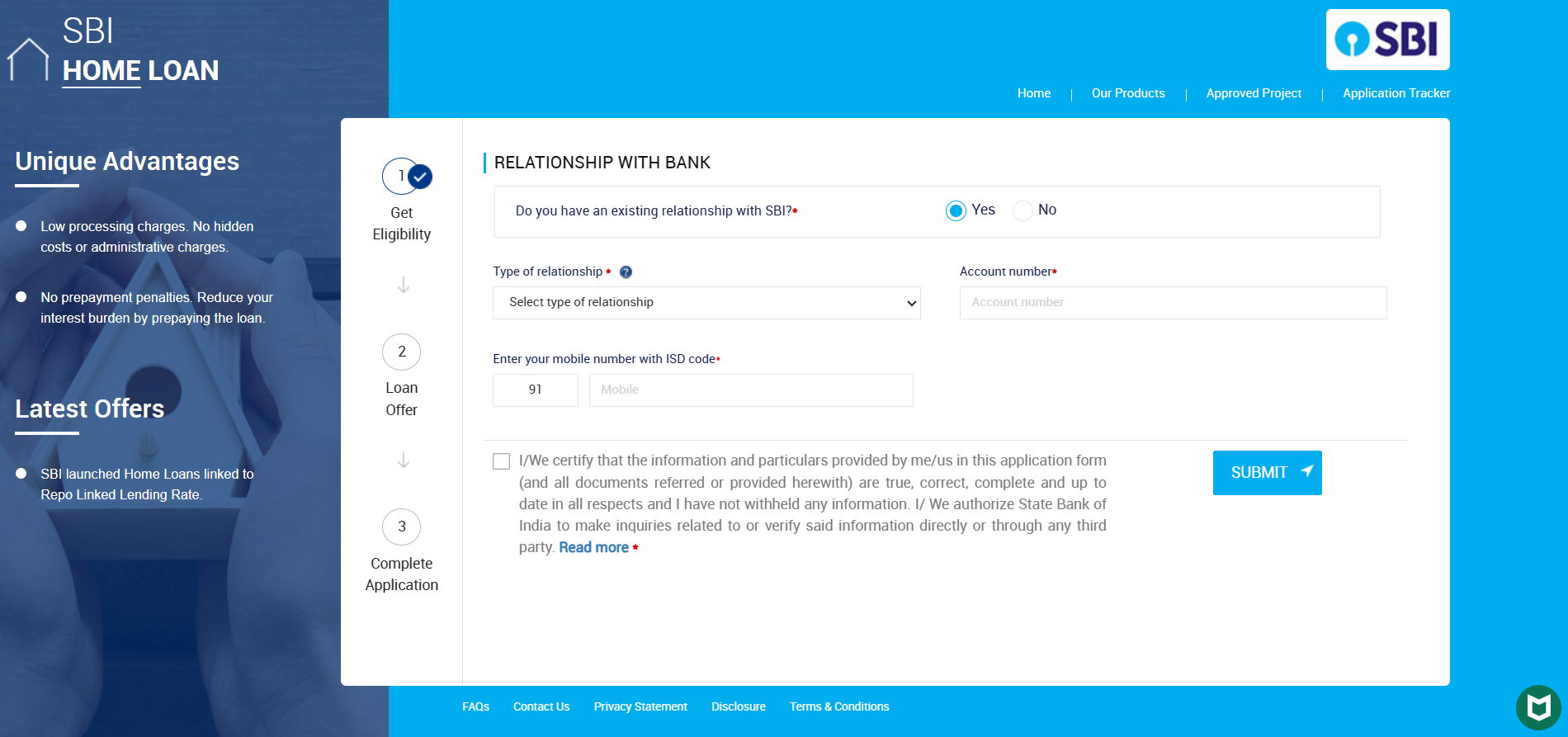

How to Apply for SBI Reverse Mortgage Loan?

Ready to apply? Here’s a step-by-step guide to help you navigate the SBI Reverse Mortgage Loan application process. It’s simpler than you think, and we’re here to guide you through it.

- Visit the official SBI Home Loan Application Form.

Form A – Personal Details: Fill in your personal details such as name, date of birth, PAN, contact information, KYC, and marital status.

Form B – Employment & Income: Provide your employment status and income details to assess your loan repayment ability.

Form C – Property & Loan Details: Enter specifics about the property and the loan amount, tenure, and other details.

Form D – Declaration: Read and sign the declaration to confirm your agreement.

- Submit Required Documents

After completing the application, gather the necessary documents. SBI offers a doorstep document collection service for your convenience.

- Application Processing

Once you submit all the required documents, SBI will process your application. Upon successful application approval, you will receive a loan sanction letter.

Suggested Read: SBI Home Loan Customer Care

Compare Reverse Mortgage Loan Interest Rates 2025

Shopping for the best reverse mortgage deal? Compare the interest rates from top banks and NBFCs to find the option that best suits your needs and offers you the best deal in 2025.

| Bank/ NBFCs | Interest Rates |

|---|---|

| Bank of Baroda | 11.25% p.a. onwards |

| Bank of India | 10.85% p.a. onwards |

| Union Bank of India | 11.30% p.a. onwards |

| Indian Bank | 9.40% p.a. onwards |

| Indian Overseas Bank | Fixed Rate of Interest at MCLR +1.00% |

| Punjab National Bank | 12.60% p.a. onwards |

| Axis Bank | 11% p.a. onwards |

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

A reverse mortgage allows senior citizens to convert the equity in their self-owned home into a regular income stream, without the need to sell the property or make monthly repayments during their lifetime.

Yes, you retain ownership of your home. The reverse mortgage is a lien against the property, not a transfer of ownership.

Absolutely. You can live in your home for as long as you wish, provided you maintain the property, pay property taxes, and keep up with insurance.

Repayment is due when you sell the property, move out permanently, or pass away. Until then, no monthly repayments are required.

No, the income received through a reverse mortgage is not considered taxable income under Section 10(43) of the Income Tax Act, 1961.

Yes, your heirs can inherit the property. However, they will need to repay the loan, which can be done by selling the property or through other means.

Most reverse mortgages come with a “no negative equity” guarantee, meaning you or your heirs won’t owe more than the home’s value.

Yes, reverse mortgages in India are regulated by the National Housing Bank (NHB) under the guidelines issued for reverse mortgage products.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan