Before you finalize your property purchase, use our stamp duty and registration charges calculator to get an idea of the costs involved with buying a new house.

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

From Patna to Muzaffarpur, Credit Dharma brings you the BEST home loan offers! 100% digital process. Enjoy transparent rates!

Property Registration Charges in Bihar

After you pay the stamp duty, you must register your property with the government. In 2025, Bihar continues to streamline this process, adding a nominal percentage for registration fees to your total cost. This legal formality recognizes your ownership and safeguards against disputes.

| Gender | Charges |

|---|---|

| Female | 1.9% |

| Male | 2.1% |

| Joint Ownership | 2% |

| Transfer From Female to Male | 2.1% |

| Transfer From Male to Female | 1.9% |

| Others | 2% |

Stamp Duty Charges in Bihar

Buying a home in Bihar? Stamp duty is a key cost to factor in. For 2025, the state has revised rates to ensure fair taxation on property transactions. This one-time tax, calculated as a percentage of the property value, is crucial for legal ownership.

| Gender | Stamp Duty Charges |

|---|---|

| Female | 5.7% |

| Male | 6.3% |

| Female + Female | 5.7% |

| Male + Male | 6.3% |

| Transfer From Female to Male | 6.3% |

| Transfer From Male to Female | 5.7% |

| Others | 6% |

Suggested Read: RERA Charges in Bihar 2025

Stamp Duty and Registration Charges on Gift Deed and Other Documents in Bihar

Gifting property to a loved one? Even gifts attract stamp duty and registration fees in Bihar. The state mandates these charges to formalize transfers, ensuring the deed holds legal weight. Rates may vary for family members, so check the latest guidelines to make the transfer smooth and valid.

| S.No | Document/Instrument | Stamp Duty Charges | Registration Fee |

|---|---|---|---|

| 1 | Acknowledgement of a debt | Rs.100 | Rs.1000 |

| 2 | Administration Bond | Rs.100 | Rs.1000 |

| 3 | Adoption Deed | Rs.100 | Rs.1000 |

| 4 | Affidavit | Rs.100 | Rs.1000 |

| 5 | Agreement | Rs.10 for every Rs.15,000 or part thereof | Rs.1000 |

| 6 | Agreement Deed Executed by members of SELF HELP GROUP | Fully Exempted | Rs.50 |

| 7 | Agreement relating to deposit of Title deeds, Pawn, or Pledge | Rs.85 | Rs.1000 |

| 8 | Appointment for the purpose of execution of any power | Rs.250 | Rs.1000 |

| 9 | Appraisement or Valuation | Rs.100 | Rs.1000 |

| 10 | Apprenticeship Deed | Rs.100 | Rs.1000 |

| 11 | Article of Association of a Company | Rs.1500 | Rs.1000 |

| 12 | Award | Rs.500 | Rs.1000 |

| 13 | Bond | Rs.3 for every Rs.100 of the value of the bond | Rs.1000 |

| 14 | Cancellation Instrument | Rs.1000 | Rs.1000 |

| 15 | Certificate of Sale | Rs.100 | Rs.1000 |

| 16 | Charter Party | Rs.100 | Rs.1000 |

| 17 | Composition Deed | Rs.250 | Rs.1000 |

| 18 | Co-Partnership Deed | Same as Partnership (No.46) | Rs.1000 |

| 19 | Conveyance (sales) | 5.7% for transfer from male to female | Rs.1000 |

| 20 | Copy or extract | Rs.100 | Rs.1000 |

| 21 | Counterpart | Rs.100 | Rs.1000 |

| 22 | Custom Bond | Rs.100 | Rs.1000 |

| 23 | Debentures | Rs.1000 | Rs.1000 |

| 24 | Divorce | Rs.250 | Rs.1000 |

| 25 | Entry as an advocate | Rs.1000 | Rs.1000 |

| 26 | Exchange of Property | Fully Exempted | Rs.1000 |

| 27 | Further charge on mortgage property | Rs.100 | Rs.1000 |

| 28 | Gift Deed | Fully Exempted | Rs.1000 |

| 29 | Indemnity Bond | Rs.100 | Rs.1000 |

| 30 | Lease Deed | Based on MVR | Rs.1000 |

| 31 | Letting on Rent | 0.5% on total amount to be paid in the shape of rent | Rs.1000 |

| 32 | Letter of License | Rs.300 | Rs.1000 |

| 33 | Memorandum of Association | Rs.500 | Rs.1000 |

| 34 | Mortgage Deed | Rs.100 | Rs.1000 |

| 35 | Mortgage of Crop | Rs.200 | Rs.1000 |

| 36 | Notarial Act | Rs.10 | Rs.1000 |

| 37 | Note or Memorandum | Rs.15 | Rs.1000 |

| 38 | Note of protest by the Master of Ship | Rs.50 | Rs.1000 |

| 39 | Partition Deed | Rs.50 | Rs.1000 |

| 40 | Partnership Deed | 2.5% of the capital of partnership deed | Rs.1000 |

| 41 | Reconstitution of Partnership | 6% on value of immovable property | Rs.1000 |

| 42 | Dissolution of Partnership | 6% on value of immovable property | Rs.1000 |

| 43 | Power of Attorney | Rs.1000 | Rs.1000 |

| 44 | Protest of Bill or Note | Rs.50 | Rs.1000 |

| 45 | Protest by the Master of a Ship | Rs.50 | Rs.1000 |

| 46 | Re-conveyance of Mortgage Property | 1% [Same as mortgage No.40(b)] max. Rs.1000 | Rs.1000 |

| 47(A)(a) | Release (Ancestral Property to Relatives) | 3% same duty as Bond (No.15) | Rs.1000 |

| 47(A)(b) | Release (Other Cases) | 6% same as conveyance (No.23) | Rs.1000 |

| 47(B) | Release of BENAMI Right | 6% as conveyance (No.23) | Rs.1000 |

| 47(C) | Release of Mortgage Redemption | 6% as conveyance (No.23) on consideration | Rs.1000 |

| 48 | Respondentia Bond | Same as Bond (No.15) for loan amount | – |

| 49 | Security Bond | 3% as Bond (No.15) max. Rs.1000 | Rs.1000 |

| 50(A) | Settlement (Family Members) | 3% same as Bond (No.15) | 2% |

| 50(B) | Settlement (Others) | 6% | 2% |

| 51 | Revocation of Settlement | 3% same as Bond (No.15) max. Rs.1000 | E(iii) if original registered / A(1) if not |

| 52 | Share Warrants | 1.5x duty on Conveyance (No.23) for share value | – |

| 53(A) | Surrender of Lease Exemption (Lease ≤ Rs.1000) | Duty of lease | Rs.1000 |

| 53(B) | Surrender of Lease Exemption (Others) | Rs.1000 | Rs.1000 |

| 54(A) | Transfer (Shares) | 0.5x Conveyance (No.23) duty | – |

| 54(B) | Transfer (Debentures) | 0.5x Conveyance (No.23) duty | – |

| 54(C) | Transfer (Bond/Mortgage Interest) | Same as Bond (No.15) max. Rs.1000 | – |

| 54(D) | Transfer (Property under Administrator General Act) | Rs.1000 | – |

| 54(E) | Transfer (Trust Property) | Same as Conveyance (No.23) for market value | – |

| 55 | Transfer of Lease | 6% same as Conveyance (No.23) | 2% |

| 56(A) | Trust (Declaration of Trust) | Rs.5000 | 2% |

| 56(B) | Trust (Revocation of Trust) | Rs.1000 | A(1) if not registered / 2% |

| 57 | Warrants for Goods | Rs.15 | – |

| 58 | Fee for Acknowledging Money Receipt | N/A | Rs.2000 |

| 59 | Will/Adoption Registration | N/A | Rs.2000 |

| 60 | Searching/Inspection | N/A | Rs.40, Rs.20, Rs.30, Rs.40 per entry |

| 61 | Copy/Entry Before Registration | N/A | Rs.3 per 100 words |

| 62 | Special Power of Attorney Authentication | N/A | Rs.100 |

| 63 | General Power of Attorney | N/A | Rs.250 |

| 64 | Authenticated Power of Attorney | N/A | Rs.100 |

| 65 | Registry by DSR | N/A | Rs.5000 |

| 66 | Officer Attendance at Private Residence | N/A | Rs.5000 |

| 67(A) | PARDANASHI Lady Exemption | N/A | Rs.200 |

| 67(B) | Bodily Infirmity/Jail Exemption | N/A | Rs.400 |

| 68 | Fines (Section 25/34) | N/A | Varies (Fine = 1x, 3x, 9x registration fee) |

| 69 | Sending Memorandum to Other Office | N/A | Rs.25 |

| 70 | Return of Registered Document | N/A | Rs.100 per month (max. Rs.1000) |

| 71 | Return of Refused Document | N/A | Rs.100 per month (max. Rs.1000) |

Suggested Read: Bihar Bhumi – Land Records

Compare Stamp Duty and Registration Charges in All States

| State/UT | Stamp Duty Charges | Registration Fees |

|---|---|---|

| Andhra Pradesh | 5.00% | 1% |

| Arunachal Pradesh | Male: 6% Female: 6% | 1% |

| Assam | Male: 6% Female: 5% | 8.5% |

| Bihar | Male: 6.3% Female: 5.7% | Male: 2.1% Female: 1.9% |

| Chhattisgarh | Male: 5% Female: 4% | 4% |

| Goa | < ₹50 Lakh: 3.5% ₹50 Lakh – ₹75 Lakh: 4.5% ₹75 Lakh – ₹1 Crore: 4.5% > ₹1 Crore: 5% > ₹5 Crore: 6% | < ₹50 Lakh: 3% ₹50 Lakh – ₹75 Lakh: 3% ₹75 Lakh – ₹1 Crore: 3.5% > ₹1 Crore: 3.5% > ₹5 Crore: 3.5% |

| Gujarat | 4.9% | Male: 1% Female: NA |

| Haryana | Urban Area: Male: 7% Female: 5% Joint Ownership: 6% Rural Area: Male: 5% Female: 3% Joint: 4% | Up to ₹50,000: ₹100 ₹50,001 – ₹5 Lakhs: ₹1,000 ₹5 Lakhs – ₹10 Lakhs: ₹5,000 ₹10 Lakhs – ₹20 Lakhs: ₹10,000. |

| Himachal Pradesh | Male: 6%, Female: 4% Male + Female: 5% | Female: <= ₹80 Lakhs: 4% > ₹80 Lakhs: 8% Male/Joint: <= ₹50 Lakhs: 6% > ₹50 Lakhs: 8% |

| Jharkhand | Male: 4% Female: 4% Male + Female: 4% | 3% |

| Karnataka | > ₹45 Lakhs: 5% ₹21 Lakhs – ₹45 Lakhs: 3% < ₹20 Lakhs: 2% | 1% |

| Kerala | 8% | 2% |

| Madhya Pradesh | 7.5% | 3% |

| Maharashtra | Urban areas: Male: 6% Female: 5% Gram Panchayat: Male: 3% Female: 2% MMRDA: Male: 4% Female: 3% | 1% |

| Manipur | 7% | 3% |

| Meghalaya | 9.90% | 1% |

| Mizoram | <= ₹10,000: ₹100 ₹10,000 < Value <= ₹5,00,000: ₹200 > ₹5,00,000: ₹500 | 1% |

| Nagaland | 8.25% | Unspecified |

| Odisha | Male: 5% Female: 4% Joint ownership (Male + Female): 4% Joint (Male + Male): 5% Joint (Female + Female): 4% | 2% |

| Punjab | Female: 5% Male: 7% Joint (Male + Female): 6% Joint (Male + Male): 7% Joint (Female + Female): 5% | 1% |

| Rajasthan | Men: 6% Women: 5% | Men: 1% Women: 1% |

| Sikkim | Sikkimese origin: 5% For others: 10% | Sikkimese origin: ₹50,000 For others: ₹1,00,000 |

| Tamil Nadu | General: 7% Female (For properties valued up to ₹10 Lakhs): 3% | 4% |

| Telangana | 4% | 0.5% |

| Tripura | 5% | 1% |

| Uttar Pradesh | Female/Joint (Female + Female): 6% Male/Joint (Male + Male): 7% Joint (Female + Male): 6.5% | Female/Joint (Female + Female): 1% Male/Joint (Male + Male): 1% Joint (Female + Male): 1% |

| Uttarakhand | Male: 5% Female: 3.75% Joint (Male + Female): 4.37% Joint (Male + Male): 5% Joint (Female + Female): 3.75% | 2% |

| West Bengal | Corporation Area/ Municipal: Below ₹1 Crore: 6% Above ₹1 Crore: 7% Other Areas: Below ₹1 Crore: 5% Above ₹1 Crore: 6% | 1% |

| Andaman and Nicobar Islands | 5% | 2% |

| Chandigarh | 6% | 1% |

| Dadra and Nagar Haveli and Daman and Diu | Female: 4% Male: 6% Joint ownership (Male and Female): 5% | Female: Nil Male: 0.5% Joint (Male and Female): 0.25% |

| Delhi (National Capital Territory of Delhi) | Male: 6% Female: 4% Joint (Male + Female): 5% | 1% |

| Jammu and Kashmir | Female: 3% Male: 7% Joint (Male + Female): 7% Joint (Female + Female): 5% Joint (Male + Male): 7% | 1.20% |

| Ladakh | Female: 3% Male: 7% Joint(Male and Female): 7% Joint (Female and Female): 5% Joint (Male and Male): 7% | 1.20% |

| Lakshadweep | Female: 6% Joint(Female + Male): 7% Others: 8% | Not specified |

| Puducherry | 10% | 0.50% |

Stamp Duty on Rental Agreements in Bihar

- 1% stamp duty is levied on rental agreements, based on the total yearly rent and security deposit.

- If the total rent and security deposit are less than ₹500, the duty will be calculated on ₹500.

- The party responsible for preparing and stamping the rental agreement usually covers the registration charge, unless otherwise specified in the agreement.

Note: Rental agreements are used to grant property use for a specific time without ownership. The agreement outlines terms and conditions between the landlord and tenant.

Suggested Read: How to Include Rental Income in IT Returns?

How are Stamp Duty and Registration Charges Calculated?

Stamp duty and registration charges depend on the market value of the property or the consideration value (whichever is higher). The stamp duty rate varies by location and property type. Generally, stamp duty is calculated as a percentage of the property value.

- Stamp Duty = Market Value of Property × Stamp Duty Rate

- Registration Charges = Market Value of Property × Registration Rate

Example Calculation

Mr. Sharma plans to buy a residential property. He needs to calculate the total stamp duty and registration charges payable to complete the transaction.

- Stamp Duty for Men : 6.3% of the Market Value (not the agreement value).

- Registration Charges : 2.1% of the Market Value.

Calculation Table

| Component | Calculation | Amount (₹) |

|---|---|---|

| Market Value | As per government assessment | 50,00,000 |

| Stamp Duty | 6.3% of ₹50,00,000 | 3,15,000 |

| Registration Charges | 2.1% of ₹50,00,000 | 1,05,000 |

| Total Cost | Stamp Duty + Registration Charges | 4,20,000 |

Suggested Read: Profitable Cities for Airbnb Investment 2025

How to Register Your Property in Bihar Online?

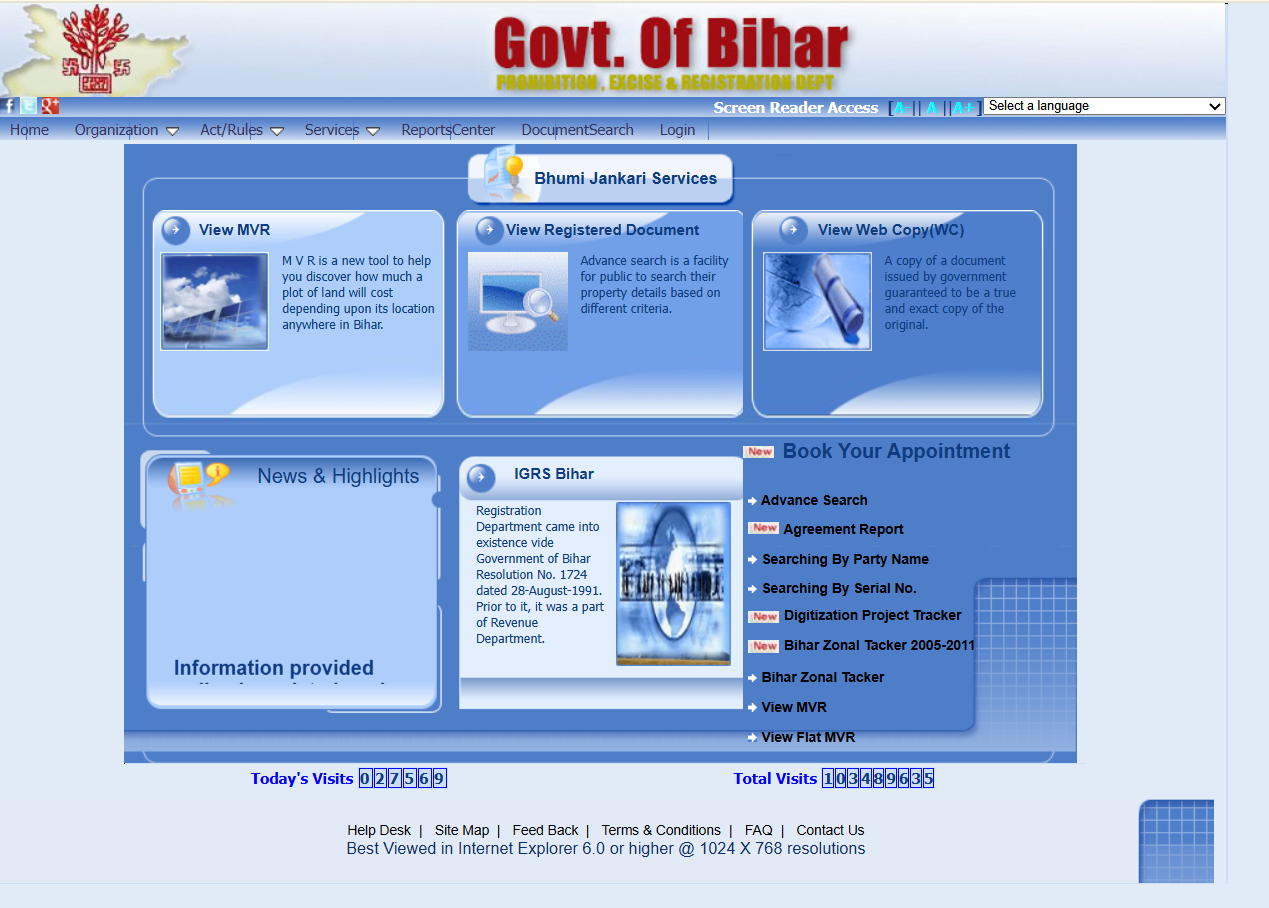

- CliVisit the official Bihar Bhumi website.

- First you have to register your self on the Bhumi Jankari Portal, to carry on the registration process.

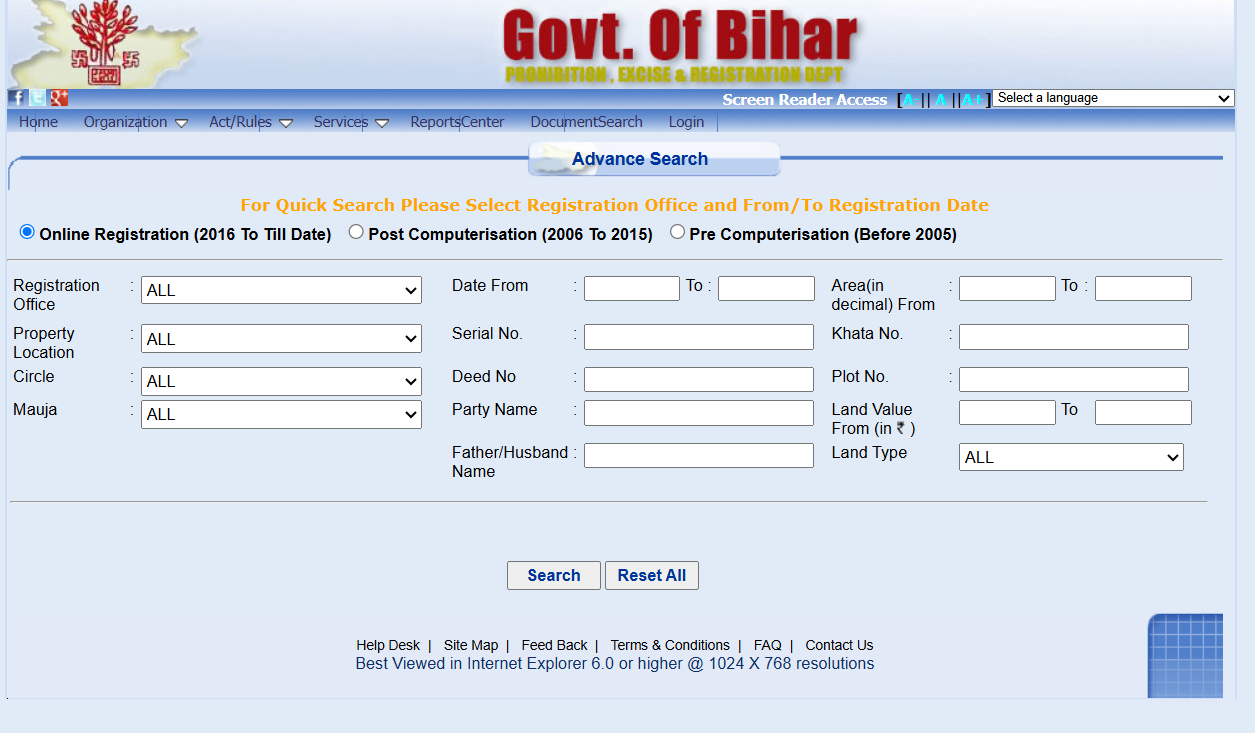

Click on “View Registered Document”

- Fill in the application form. Enter the OTP sent to your registered contact number.

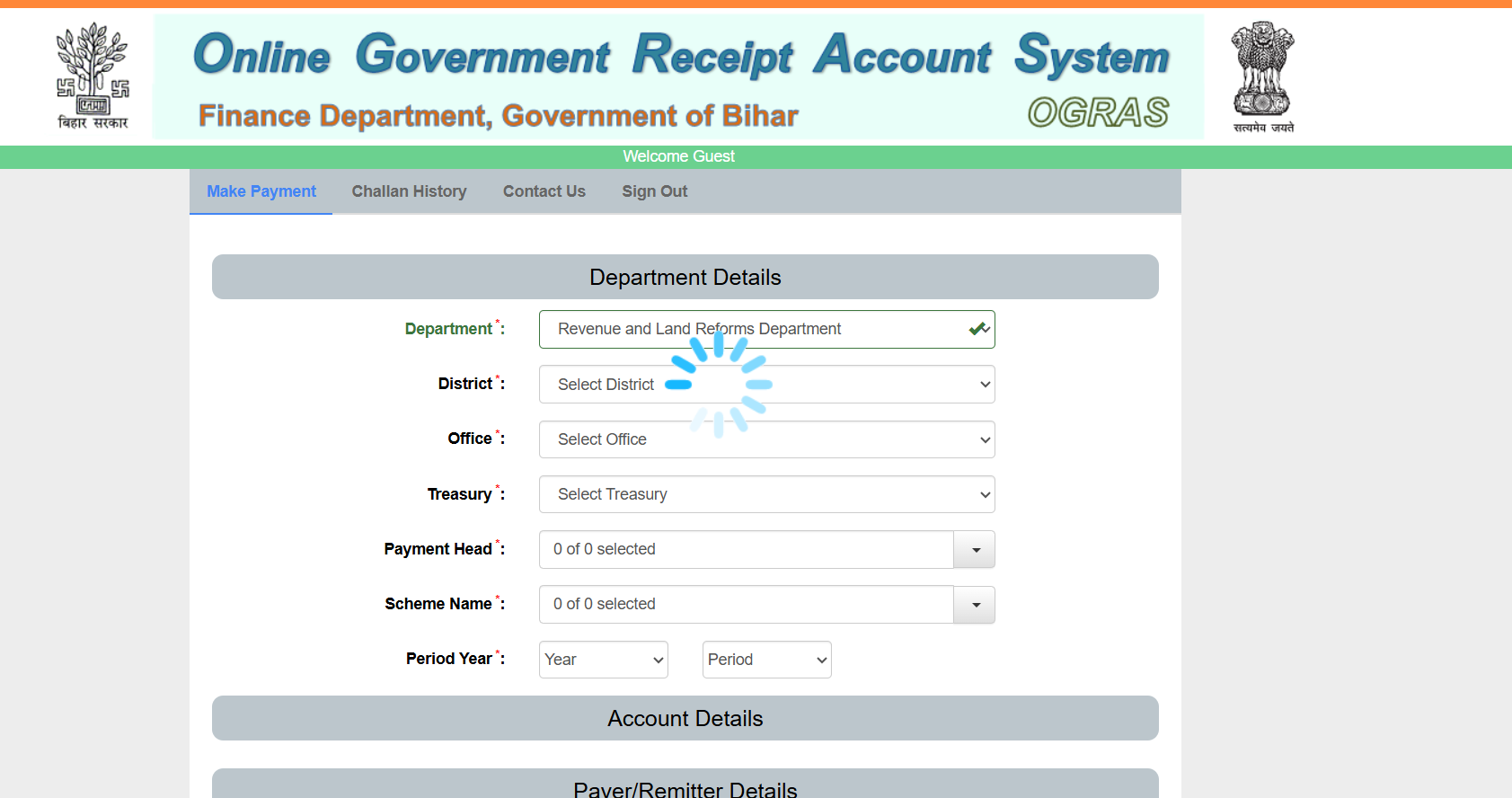

- Visit the OGRAS web portal to complete the payment.

Suggested Read: 1 Acre Land Price in India 2025

Who is Eligible to Register a Preoperty in Bihar?

To successfully register a property in Bihar, the following conditions must be met:

- The individual must have the property in their name.

- The individual must be the legal heir to the deceased’s estate (if applicable).

- The individual must be the authorized signatory with a valid power of attorney.

Suggested Read: Transfer Property Act 1882

How to Calculate Market Value Realization (MVR) Rate in Bihar?

- Visit the Portal: Go to Bhumijankari Portal and click “View MVR” on the homepage.

- Enter Details: Fill in required information such as registration office, circle name, thana code, land type, transaction type, total cost, and area.

- View Calculation: Click “View Calculation” to check the MVR details.

- Search Property Info: Alternatively, enter details like area, location, deed number, plot number, etc., to find property information.

Suggested Read: Inheritance Rights on Ancestral Property

Submission Deadline for Property Registration Documents

- Under Section 25 of the Bihar Registration Act, property registration documents must be submitted to the Registrar’s office within four months from the registration date.

- Failure to meet this deadline results in a fine of up to 10 times the registration charges.

Suggested Read: TDS on Purchase of Property

Paper Specifications for Property Registration

- All property registration documents in Bihar, including stamp duty, must be printed on A-4 size plain white paper (Executive Bond paper).

- Maps and property plans must be printed on A-4 size bond paper.

- Both parties must submit equal copies of all documents during the registration process.

Suggested Read: What is Undivided Share of Land?

Stamp Duty Rebate and Increment Guidelines

- Man buying from a woman: An additional 0.40% stamp duty applies to the property value.

- Woman buying from a man: A 0.40% rebate on stamp duty is provided.

- Woman buying from a woman: No rebate is given for stamp duty.

Exemption for Industrial Land Transactions

- Full exemption: Stamp duty and property registration charges are 100% exempt for industrial land transactions.

- This applies to leased, transferred, or sold land used for industrial purposes, whether located inside or outside an industrial zone.

Suggested Read: How to Calculate Agricultural Land Area?

Penalty for Late Payment of Stamp Duty and Registration Charges

- Stamp duty should be paid immediately after the property transaction is completed or by the next working day.

- Late payments incur a penalty, with fines increasing over time.

Suggested Read: Plot vs. Apartment vs. Villa

Tax Benefits of Paying Stamp Duty

Paying stamp duty on property transactions in India comes with several tax benefits that can help reduce the overall tax burden. Here are the key advantages:

- Stamp duty and registration charges paid for the purchase of a property are eligible for deductions under Section 80C of the Income Tax Act, 1961.

- You can deduct up to ₹1.5 lakh for stamp duty and registration charges in a financial year if you pay them for purchasing a residential property.

- This deduction applies to both self-occupied and rented properties, as long as you pay the stamp duty during the assessment year.

Suggested Read: Home Loan Insurance Tax Benefits

Factors Affecting Stamp Duty and Registration Charges in Bihar

- Property Value: Charges are based on the market or transaction value, whichever is higher.

- Property Type: Residential, commercial, and agricultural properties have different rates.

- Location of the Property: Rates vary between urban and rural areas.

- Gender of the Owner: Female buyers may receive a reduced stamp duty rate.

- Age of the Property: Older properties may have different valuation methods affecting charges.

- Exemption or Concessions: Certain properties may qualify for reduced rates or exemptions.

- Age of the Buyer: Senior citizens may receive concessions for residential properties.

- Transfer Type: Sale, gift, or inheritance transfers attract different rates.

- Government Policies: Changes in policies can impact stamp duty rates and charges.

- Additional Charges: Includes legal documentation, verification, and service fees.

Suggested Read: How to Change Name in Land Registry or Property Documents?

Secure the Lowest Home Loan Interest Rates with Credit Dharma

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

The buyer of the property is typically responsible for paying stamp duty, although specifics can vary based on local laws and agreements.

Stamp duty is usually calculated as a percentage of the property’s purchase price or the market value, whichever is higher.

If you don’t pay stamp duty on documents that need it, you could face serious issues. Courts won’t allow these documents as evidence, making disputes hard to resolve. Plus, authorities might hold them until you pay the duty and any extra fines, which can be quite hefty.

All real estate transactions require stamp duty, except when properties are transferred through a Will.

Yes, stamp duty rates and regulations vary significantly across different states and territories, reflecting local real estate market conditions and government policies.

The current stamp duty rates in Bihar are 6.30% for female owners and 5.70% for male owners.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan