Before you finalize your property purchase, use our stamp duty and registration charges calculator to get an idea of the costs involved with buying a new house.

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

From Raipur to Bilaspur, Credit Dharma brings you the BEST home loan offers! 100% digital process. Enjoy transparent rates!

Stamp Duty Charges in Chhattisgarh 2025

Buying a home in Chhattisgarh? Stamp duty is a key cost to factor in. For 2025, the state has revised rates to ensure fair taxation on property transactions. This one-time tax, calculated as a percentage of the property value, is crucial for legal ownership.

| Property Owner | Stamp Duty in Chhattisgarh |

|---|---|

| Man | 5% |

| Woman | 4% |

| Joint (Man & Woman) | 4% |

Suggested Read: Bhuiyan Chhattisgarh Land Records

Property Registration Fees in Chhattisgarh 2025

After you pay the stamp duty, you must register your property with the government. In 2025, Chhattisgarh continues to streamline this process, adding a nominal percentage for registration fees to your total cost. This legal formality recognizes your ownership and safeguards against disputes.

| Property Owner | Registration Charges in Chhattisgarh |

|---|---|

| Man | 4% |

| Woman | 4% |

| Joint (Man & Woman) | 4% |

The registration charge is the same for men, women, or joint buyers. For property transactions where the value is less than ₹50,000, a flat fee of ₹500 is charged as a registration fee instead of the percentage rate. The percentage rate applies only to values over ₹50,000.

Calculation Examples

| Buyer Type | Stamp Duty | Registration Charge | Example: Property Value ₹50 Lakhs | Total Outgo |

|---|---|---|---|---|

| Man | 5% | 4% | Stamp Duty: ₹2.5 lakh; Registration: ₹2 lakh | ₹4.5 lakh |

| Woman | 4% | 4% | Stamp Duty: ₹2 lakh; Registration: ₹2 lakh | ₹4 lakh |

| Man + Woman (Joint) | 4% | 4% | Stamp Duty: ₹2 lakh; Registration: ₹2 lakh | ₹4 lakh |

Suggested Read: RERA Charges in Chhattisgarh 2025

Compare Stamp Duty and Registration Charges in All States

| State/UT | Stamp Duty Charges | Registration Fees |

|---|---|---|

| Andhra Pradesh | 5.00% | 1% |

| Arunachal Pradesh | Male: 6% Female: 6% | 1% |

| Assam | Male: 6% Female: 5% | 8.5% |

| Bihar | Male: 6.3% Female: 5.7% | Male: 2.1% Female: 1.9% |

| Chhattisgarh | Male: 5% Female: 4% | 4% |

| Goa | < ₹50 Lakh: 3.5% ₹50 Lakh – ₹75 Lakh: 4.5% ₹75 Lakh – ₹1 Crore: 4.5% > ₹1 Crore: 5% > ₹5 Crore: 6% | < ₹50 Lakh: 3% ₹50 Lakh – ₹75 Lakh: 3% ₹75 Lakh – ₹1 Crore: 3.5% > ₹1 Crore: 3.5% > ₹5 Crore: 3.5% |

| Gujarat | 4.9% | Male: 1% Female: NA |

| Haryana | Urban Area: Male: 7% Female: 5% Joint Ownership: 6% Rural Area: Male: 5% Female: 3% Joint: 4% | Up to ₹50,000: ₹100 ₹50,001 – ₹5 Lakhs: ₹1,000 ₹5 Lakhs – ₹10 Lakhs: ₹5,000 ₹10 Lakhs – ₹20 Lakhs: ₹10,000. |

| Himachal Pradesh | Male: 6%, Female: 4% Male + Female: 5% | Female: <= ₹80 Lakhs: 4% > ₹80 Lakhs: 8% Male/Joint: <= ₹50 Lakhs: 6% > ₹50 Lakhs: 8% |

| Jharkhand | Male: 4% Female: 4% Male + Female: 4% | 3% |

| Karnataka | > ₹45 Lakhs: 5% ₹21 Lakhs – ₹45 Lakhs: 3% < ₹20 Lakhs: 2% | 1% |

| Kerala | 8% | 2% |

| Madhya Pradesh | 7.5% | 3% |

| Maharashtra | Urban areas: Male: 6% Female: 5% Gram Panchayat: Male: 3% Female: 2% MMRDA: Male: 4% Female: 3% | 1% |

| Manipur | 7% | 3% |

| Meghalaya | 9.90% | 1% |

| Mizoram | <= ₹10,000: ₹100 ₹10,000 < Value <= ₹5,00,000: ₹200 > ₹5,00,000: ₹500 | 1% |

| Nagaland | 8.25% | Unspecified |

| Odisha | Male: 5% Female: 4% Joint ownership (Male + Female): 4% Joint (Male + Male): 5% Joint (Female + Female): 4% | 2% |

| Punjab | Female: 5% Male: 7% Joint (Male + Female): 6% Joint (Male + Male): 7% Joint (Female + Female): 5% | 1% |

| Rajasthan | Men: 6% Women: 5% | Men: 1% Women: 1% |

| Sikkim | Sikkimese origin: 5% For others: 10% | Sikkimese origin: ₹50,000 For others: ₹1,00,000 |

| Tamil Nadu | General: 7% Female (For properties valued up to ₹10 Lakhs): 3% | 4% |

| Telangana | 4% | 0.5% |

| Tripura | 5% | 1% |

| Uttar Pradesh | Female/Joint (Female + Female): 6% Male/Joint (Male + Male): 7% Joint (Female + Male): 6.5% | Female/Joint (Female + Female): 1% Male/Joint (Male + Male): 1% Joint (Female + Male): 1% |

| Uttarakhand | Male: 5% Female: 3.75% Joint (Male + Female): 4.37% Joint (Male + Male): 5% Joint (Female + Female): 3.75% | 2% |

| West Bengal | Corporation Area/ Municipal: Below ₹1 Crore: 6% Above ₹1 Crore: 7% Other Areas: Below ₹1 Crore: 5% Above ₹1 Crore: 6% | 1% |

| Andaman and Nicobar Islands | 5% | 2% |

| Chandigarh | 6% | 1% |

| Dadra and Nagar Haveli and Daman and Diu | Female: 4% Male: 6% Joint ownership (Male and Female): 5% | Female: Nil Male: 0.5% Joint (Male and Female): 0.25% |

| Delhi (National Capital Territory of Delhi) | Male: 6% Female: 4% Joint (Male + Female): 5% | 1% |

| Jammu and Kashmir | Female: 3% Male: 7% Joint (Male + Female): 7% Joint (Female + Female): 5% Joint (Male + Male): 7% | 1.20% |

| Ladakh | Female: 3% Male: 7% Joint(Male and Female): 7% Joint (Female and Female): 5% Joint (Male and Male): 7% | 1.20% |

| Lakshadweep | Female: 6% Joint(Female + Male): 7% Others: 8% | Not specified |

| Puducherry | 10% | 0.50% |

How are Stamp Duty and Registration Charges Calculated?

Stamp duty and registration charges depend on the market value of the property or the consideration value (whichever is higher). The stamp duty rate varies by location and property type. Generally, stamp duty is calculated as a percentage of the property value.

- Stamp Duty = Market Value of Property × Stamp Duty Rate

- Registration Charges = Market Value of Property × Registration Rate

Example Calculation

Mr. Sharma plans to buy a residential property. He needs to calculate the total stamp duty and registration charges payable to complete the transaction.

- Stamp Duty for Men : 5% of the Market Value (not the agreement value).

- Registration Charges : 4% of the Market Value.

Calculation Table

| Component | Calculation | Amount (₹) |

|---|---|---|

| Market Value | As per government assessment | 50,00,000 |

| Stamp Duty (6%) | 5% of ₹50,00,000 | 2,50,000 |

| Registration Charges | 4% of ₹50,00,000 | 2,00,000 |

| Total Cost | Stamp Duty + Registration Charges | 4,50,000 |

Suggested Read: Profitable Cities for Airbnb Investment 2025

Documents Required for Stamp Duty and Property Registration in Chhattisgarh 2025

| S.No | Documents Needed for Property Registration in Chhattisgarh |

|---|---|

| 1 | Registry copy of the land or structure |

| 2 | Copy of the lease |

| 3 | Hrin Pustika / Khasra clone |

| 4 | Copy of any government department’s allotment/registry relating to the land/building |

| 5 | Cost of electricity (in case of encroachment) |

| 6 | Agreement to sale |

| 7 | Sale deed |

| 8 | Encumbrance certificate |

| 9 | Property tax receipts |

| 10 | No-objection certificate |

| 11 | Power of Attorney, if applicable |

| 12 | Stamp duty and registration fees payment proof |

| 13 | Occupancy certificate for new buildings |

| 14 | Completion certificate for under-construction buildings |

| 15 | TDS deduction certificate (applicable on properties worth over Rs 50 lakh) |

| 16 | PAN Card of buyer |

| 17 | PAN Card of seller |

| 18 | Aadhaar card of seller |

| 19 | Aadhaar card of buyer |

| 20 | Passport size photos of buyer and seller |

| 21 | ID proof of buyer |

| 22 | ID proof of seller |

| 23 | ID proof of witnesses |

| 24 | Address proof of buyer |

| 25 | Address proof of seller |

| 26 | Address proof of witnesses |

Suggested Read: 1 Acre Land Price in India 2025

How to Pay Stamp Duty Online in Chhattisgarh?

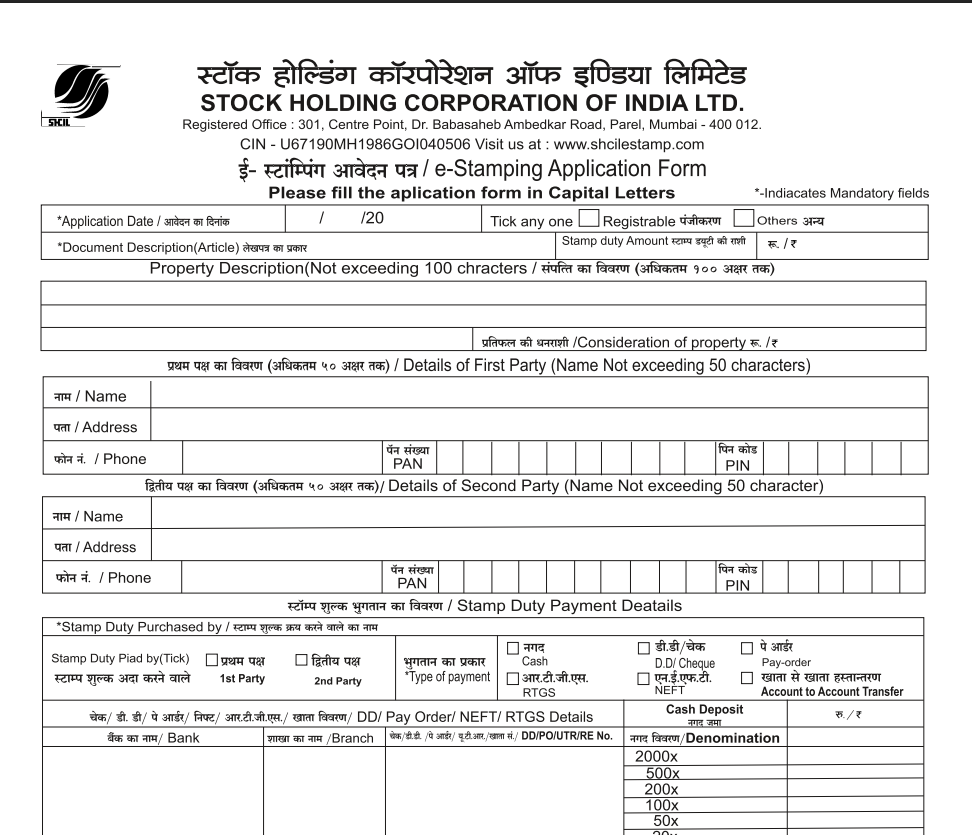

- Visit the official Stock Holding Corporation of India Limited (SHCIL) website.

- Go to “Products and Services,” select “e-Stamp Services,” and then click on “e-Stamping.”

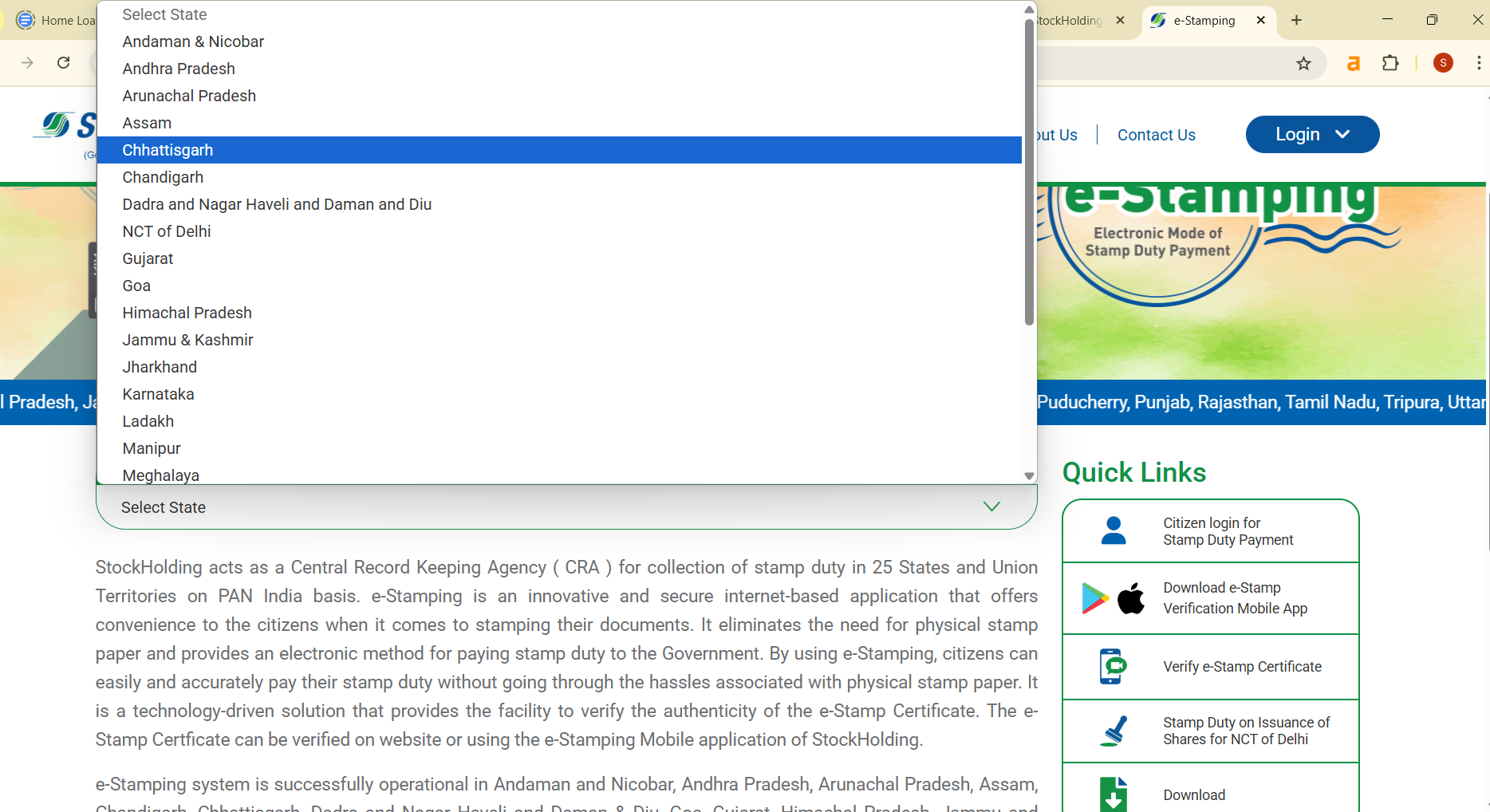

- Choose Chhattisgarh from the dropdown list.

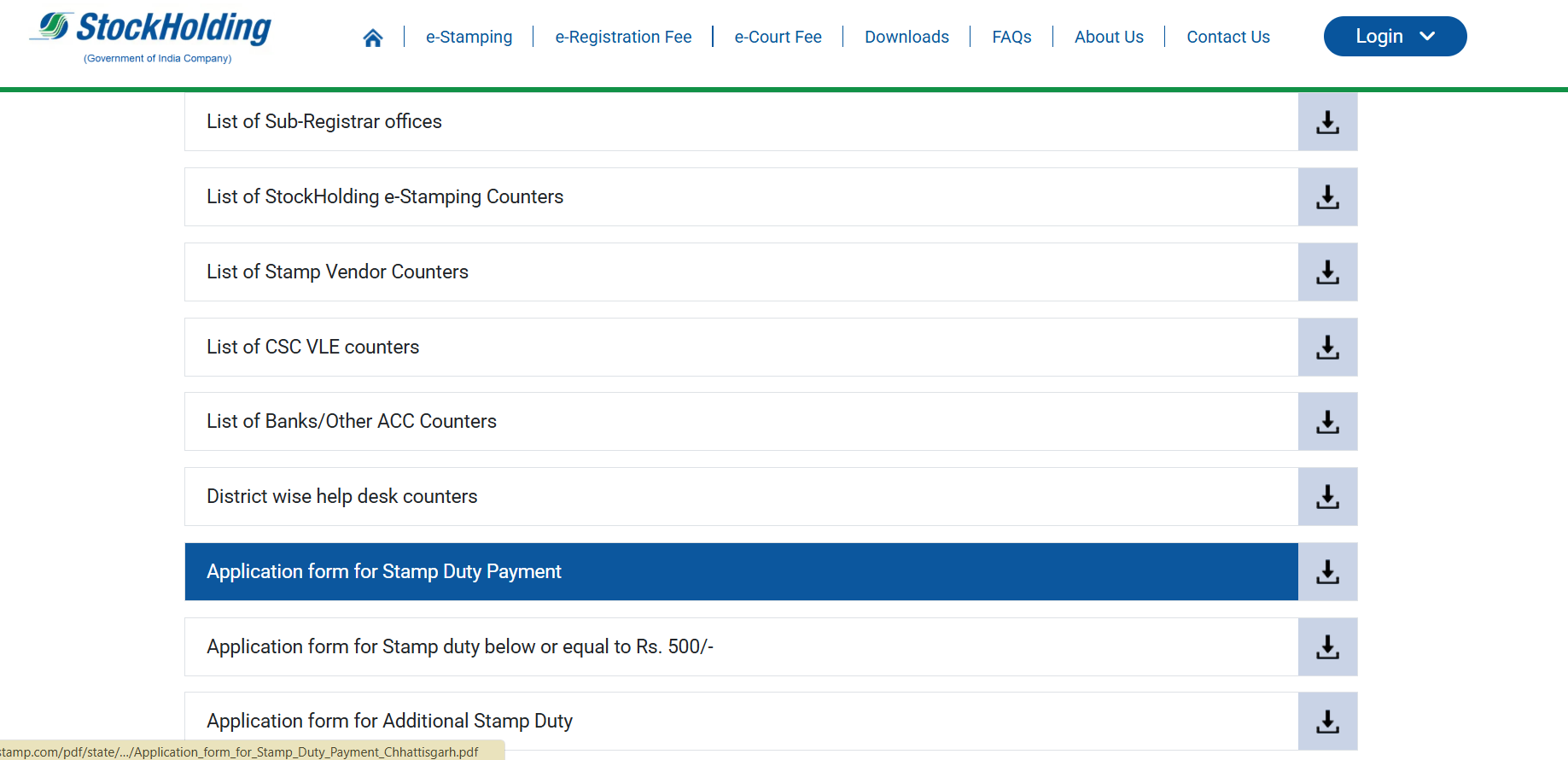

- Download the relevant application form from the “Downloads” section. Fill it out according to your stamp duty payment amount (for payments under Rs. 501).

- Submit the completed form along with your payment for the stamp certificate.

- Print the Online Reference Acknowledgment Number and visit the nearest Stock Holding Branch to get the final printout of the e-stamp certificate.

Suggested Read: Inheritance Rights on Ancestral Property

How to Register Your Property in Chhattisgarh 2025?

- Visit Chhattisgarh’s e-panjeeyan website and click on Pre-Registration.

- Choose Pre-Registration Login or check the online payment process.

- Log in with your existing credentials or create a new account by selecting New User.

- After logging in, fill out the e-panjeeyan form.

- Save the form, click on Bhugtan, and proceed to payment. Verify the final receipt and click Confirm.

- Choose a payment method and complete the payment.

- After payment, select a token date for your appointment at the Sub-Registrar’s Office.

- On the appointment date, visit the SRO office with all relevant documents. Ensure that both parties (buyer/seller) and witnesses are present.

Note: If you prefer not to make the payment online, you can complete the payment at the Sub-Registrar’s Office.

Suggested Read: TDS on Purchase of Property

Chhattisgarh Property Registration Act – Section 25

- Under Section 25 of the Registration Act, 1908, property documents must be submitted to the registrar within four months of execution.

- Failure to meet this deadline results in a penalty of up to 10 times the property registration fee.

The Chhattisgarh Registration Rules, 1939 (Rule 16) mandate that if documents are submitted after the prescribed period, the registering officer must advise the applicant to seek an extension. If the document is presented after the eight-month limit, registration is refused.

Suggested Read: How to Transfer an Unregistered Property?

Stamp Duty Refund in Chhattisgarh

Refunds are applicable for e-stamps only. To claim a refund:

- Submit a form to the Collector, including details from the e-stamp certificate (name, certificate number, ID, etc.).

- After review, the Collector will arrange the refund, minus a 10% service charge.

Suggested Read: How to Identitfy Illegally Constructed Buildings?

Registration Fee Refund in Chhattisgarh

Rule 120 of the Chhattisgarh Registration Rules, 1939 allows refunds if:

- The registration fee paid exceeds the authorized scale.

- Refund claims must be submitted within three months from when the applicant realizes a refund is due.

Suggested Read: Home Loans in Raipur

Indian Stamps (Chhattisgarh Amendment) Bill, 2023

In July 2023, the Indian Stamps (Chhattisgarh Amendment) Bill introduced key changes:

- Clause (11-A): Defines e-stamps for digital transactions.

- Clause (12-A): Elaborates the process of impounding instruments by public officers.

This amendment modernizes the stamp duty system, promoting e-stamping and reducing reliance on physical stamp papers. The shift to electronic stamps enhances transparency and streamlines property transactions.

Suggested Read: How to Calculate Agricultural Land Area?

Tax Benefits of Paying Stamp Duty

Paying stamp duty on property transactions in India comes with several tax benefits that can help reduce the overall tax burden. Here are the key advantages:

- Stamp duty and registration charges paid for the purchase of a property are eligible for deductions under Section 80C of the Income Tax Act, 1961.

- You can deduct up to ₹1.5 lakh for stamp duty and registration charges in a financial year if you pay them for purchasing a residential property.

- This deduction applies to both self-occupied and rented properties, as long as you pay the stamp duty during the assessment year.

Suggested Read: Home Loan Insurance Tax Benefits

Factors Affecting Stamp Duty and Registration Charges in Chhattisgarh

- Property Value: Charges are based on the market or transaction value, whichever is higher.

- Property Type: Residential, commercial, and agricultural properties have different rates.

- Location of the Property: Rates vary between urban and rural areas.

- Gender of the Owner: Female buyers may receive a reduced stamp duty rate.

- Age of the Property: Older properties may have different valuation methods affecting charges.

- Exemption or Concessions: Certain properties may qualify for reduced rates or exemptions.

- Age of the Buyer: Senior citizens may receive concessions for residential properties.

- Transfer Type: Sale, gift, or inheritance transfers attract different rates.

- Government Policies: Changes in policies can impact stamp duty rates and charges.

- Additional Charges: Includes legal documentation, verification, and service fees.

Suggested Read: How to Change Name in Land Registry or Property Documents?

“While stamp duty and registration charges in Chhattisgarh provide cost incentives for women and joint buyers, savvy purchasers can save even more by choosing property locations where urban surcharges are lower and guideline values are realistic. I always advise clients to compare the stamp duty burden in multiple localities, check for recent government notifications, and negotiate based on actual payable costs. This proactive approach ensures buyers aren’t blindsided by unexpected fees and can maximize ownership value.”

-Sanjay B, Home Financing Expert, Credit Dharma

Secure the Lowest Home Loan Interest Rates with Credit Dharma

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

In Chhattisgarh, the stamp duty is 5% for male buyers and 4% for female buyers. For joint ownership between a man and a woman, the rate is 4%.

The registration charge is 4% of the property’s market value, applicable to all buyers regardless of gender.

Yes, women buyers receive a 1% concession on stamp duty, paying 4% instead of the standard 5% applicable to men.

Stamp duty can be paid online through the Stock Holding Corporation of India Limited (SHCIL) website by selecting ‘e-Stamp services’ and choosing Chhattisgarh. Alternatively, physical stamp papers can be purchased from authorized vendors.

Required documents include:

Sale deed

Identity proofs (Aadhaar, PAN) of buyer and seller

Property tax receipts

Encumbrance certificate

No-objection certificate (if applicable)

Proof of stamp duty and registration fee payment

Yes, stamp duty paid via e-stamping is refundable. To initiate a refund, submit a form to the Collector with details from the e-stamp certificate. A 10% service charge will be deducted from the refund amount.

The buyer is typically responsible for paying both stamp duty and registration charges unless otherwise agreed upon by the parties involved.

Generally, lenders do not include stamp duty and registration charges in the home loan amount. These expenses are to be borne by the buyer separately.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan