Before you finalize your property purchase, use our stamp duty and registration charges calculator to get an idea of the costs involved with buying a new house.

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

Blog Summary

Stamp duty and registration charges in Goa are key property costs, ranging between 3% and 6% depending on property value. The Credit Dharma guide outlines exact slabs—for instance, stamp duty is 3.5% up to ₹50 lakh and 6% above ₹5 crore, while registration fees range from 3% to 3.5%. It also details document-specific charges like agreements and rectifications, plus a state-wise comparison to help buyers understand how Goa’s rates compare across India. This ensures homebuyers can plan finances better and complete property registration smoothly.

Stamp Duty Charges in Goa 2025

| Market Value | Stamp Duty |

|---|---|

| Upto Rs 50 Lakhs | 3.5% |

| Above Rs 50 Lakhs upto Rs 75 Lakhs | 4.5% |

| Above Rs 75 Lakhs upto Rs 1 Crore | 4.5% |

| Above Rs 1 Crore | 5% |

| Above Rs 5 Crore | 6% |

| Agreement for Sale | 2.9% |

| Deed of Rectification | Rs 500 |

| Deed of Conveyance in Favour of Housing Co. Op. Societies | 3% |

Suggested Read: RERA Charges in Goa

Property Registration Charges in Goa 2025

| Market Value | Registration Charges |

|---|---|

| Upto Rs 50 Lakhs | 3% |

| Above Rs 50 Lakhs upto Rs 75 Lakhs | 3% |

| Above Rs 75 Lakhs upto Rs 1 Crore | 3.5% |

| Above Rs 1 Crore | 3.5% |

| Above Rs 5 Crore | 3.5% |

| Agreement for Sale | 3% |

| Deed of Rectification | Rs 500 |

| Deed of Conveyance in Favour of Housing Co. Op. Societies | 1.5% |

Suggested Read: Goa Land Records

Compare Stamp Duty and Registration Charges in All States

| State/UT | Stamp Duty Charges | Registration Fees |

|---|---|---|

| Andhra Pradesh | 5.00% | 1% |

| Arunachal Pradesh | Male: 6% Female: 6% | 1% |

| Assam | Male: 6% Female: 5% | 8.5% |

| Bihar | Male: 6.3% Female: 5.7% | Male: 2.1% Female: 1.9% |

| Chhattisgarh | Male: 5% Female: 4% | 4% |

| Goa | < ₹50 Lakh: 3.5% ₹50 Lakh – ₹75 Lakh: 4.5% ₹75 Lakh – ₹1 Crore: 4.5% > ₹1 Crore: 5% > ₹5 Crore: 6% | < ₹50 Lakh: 3% ₹50 Lakh – ₹75 Lakh: 3% ₹75 Lakh – ₹1 Crore: 3.5% > ₹1 Crore: 3.5% > ₹5 Crore: 3.5% |

| Gujarat | 4.9% | Male: 1% Female: NA |

| Haryana | Urban Area: Male: 7% Female: 5% Joint Ownership: 6% Rural Area: Male: 5% Female: 3% Joint: 4% | Up to ₹50,000: ₹100 ₹50,001 – ₹5 Lakhs: ₹1,000 ₹5 Lakhs – ₹10 Lakhs: ₹5,000 ₹10 Lakhs – ₹20 Lakhs: ₹10,000. |

| Himachal Pradesh | Male: 6%, Female: 4% Male + Female: 5% | Female: <= ₹80 Lakhs: 4% > ₹80 Lakhs: 8% Male/Joint: <= ₹50 Lakhs: 6% > ₹50 Lakhs: 8% |

| Jharkhand | Male: 4% Female: 4% Male + Female: 4% | 3% |

| Karnataka | > ₹45 Lakhs: 5% ₹21 Lakhs – ₹45 Lakhs: 3% < ₹20 Lakhs: 2% | 1% |

| Kerala | 8% | 2% |

| Madhya Pradesh | 7.5% | 3% |

| Maharashtra | Urban areas: Male: 6% Female: 5% Gram Panchayat: Male: 3% Female: 2% MMRDA: Male: 4% Female: 3% | 1% |

| Manipur | 7% | 3% |

| Meghalaya | 9.90% | 1% |

| Mizoram | <= ₹10,000: ₹100 ₹10,000 < Value <= ₹5,00,000: ₹200 > ₹5,00,000: ₹500 | 1% |

| Nagaland | 8.25% | Unspecified |

| Odisha | Male: 5% Female: 4% Joint ownership (Male + Female): 4% Joint (Male + Male): 5% Joint (Female + Female): 4% | 2% |

| Punjab | Female: 5% Male: 7% Joint (Male + Female): 6% Joint (Male + Male): 7% Joint (Female + Female): 5% | 1% |

| Rajasthan | Men: 6% Women: 5% | Men: 1% Women: 1% |

| Sikkim | Sikkimese origin: 5% For others: 10% | Sikkimese origin: ₹50,000 For others: ₹1,00,000 |

| Tamil Nadu | General: 7% Female (For properties valued up to ₹10 Lakhs): 3% | 4% |

| Telangana | 4% | 0.5% |

| Tripura | 5% | 1% |

| Uttar Pradesh | Female/Joint (Female + Female): 6% Male/Joint (Male + Male): 7% Joint (Female + Male): 6.5% | Female/Joint (Female + Female): 1% Male/Joint (Male + Male): 1% Joint (Female + Male): 1% |

| Uttarakhand | Male: 5% Female: 3.75% Joint (Male + Female): 4.37% Joint (Male + Male): 5% Joint (Female + Female): 3.75% | 2% |

| West Bengal | Corporation Area/ Municipal: Below ₹1 Crore: 6% Above ₹1 Crore: 7% Other Areas: Below ₹1 Crore: 5% Above ₹1 Crore: 6% | 1% |

| Andaman and Nicobar Islands | 5% | 2% |

| Chandigarh | 6% | 1% |

| Dadra and Nagar Haveli and Daman and Diu | Female: 4% Male: 6% Joint ownership (Male and Female): 5% | Female: Nil Male: 0.5% Joint (Male and Female): 0.25% |

| Delhi (National Capital Territory of Delhi) | Male: 6% Female: 4% Joint (Male + Female): 5% | 1% |

| Jammu and Kashmir | Female: 3% Male: 7% Joint (Male + Female): 7% Joint (Female + Female): 5% Joint (Male + Male): 7% | 1.20% |

| Ladakh | Female: 3% Male: 7% Joint(Male and Female): 7% Joint (Female and Female): 5% Joint (Male and Male): 7% | 1.20% |

| Lakshadweep | Female: 6% Joint(Female + Male): 7% Others: 8% | Not specified |

| Puducherry | 10% | 0.50% |

How to Calculate Stamp Duty and Registration Charges in Goa?

Calculating stamp duty and registration charges in Goa involves a clear process based on property value and fixed rates.

How to?

- Determine the Property Value: You need to first determine the market value or the government-assessed rate of the property. Use the higher value between the two to calculate the stamp duty and registration charges.

- Apply Stamp Duty Rates: In Goa, the stamp duty rate for a sale deed is 5.50% of the property’s market value or the agreed sale value (whichever is higher).

- Apply Registration Charges: The registration charges are 0.50% of the property’s value. This charge is applicable to most property transactions in the state.

Example Calculation

Let’s take a property worth ₹60,00,000 as an example to illustrate the calculation process.

| Component | Calculation | Amount (₹) |

|---|---|---|

| Stamp Duty | 60,00,000 × 4.5% | 2,70,000 |

| Registration Charges | 60,00,000 × 3% | 1,80,000 |

| Total | 2,70,000 + 1,80,000 | 4,50,000 |

Suggested Read: How to Identitfy Illegally Constructed Buildings?

How to Pay Stamp Duty in Goa?

Stamp duty payment is essential to complete the registration process of property transactions in Goa. It legally validates ownership documents, ensuring they are recognized under the law. Here are the ways you can pay stamp duty in Goa:

1. Purchasing Stamp Paper

- Stamp paper can be purchased from an authorized vendor.

- It contains all the relevant details of the property transaction.

- The stamp paper must be submitted to the sub-registrar’s office within four months of issuance.

- Both the buyer and seller must sign the stamp paper.

2. Using Franking

- The property agreement is printed on a plain sheet and signed by both parties.

- The signed agreement is then submitted to an authorized bank.

- The bank uses a franking machine to process the payment of stamp duty.

- The stamp duty charges are paid directly to the bank, which may also charge franking fees.

- Franking charges generally amount to 0.1% of the property value.

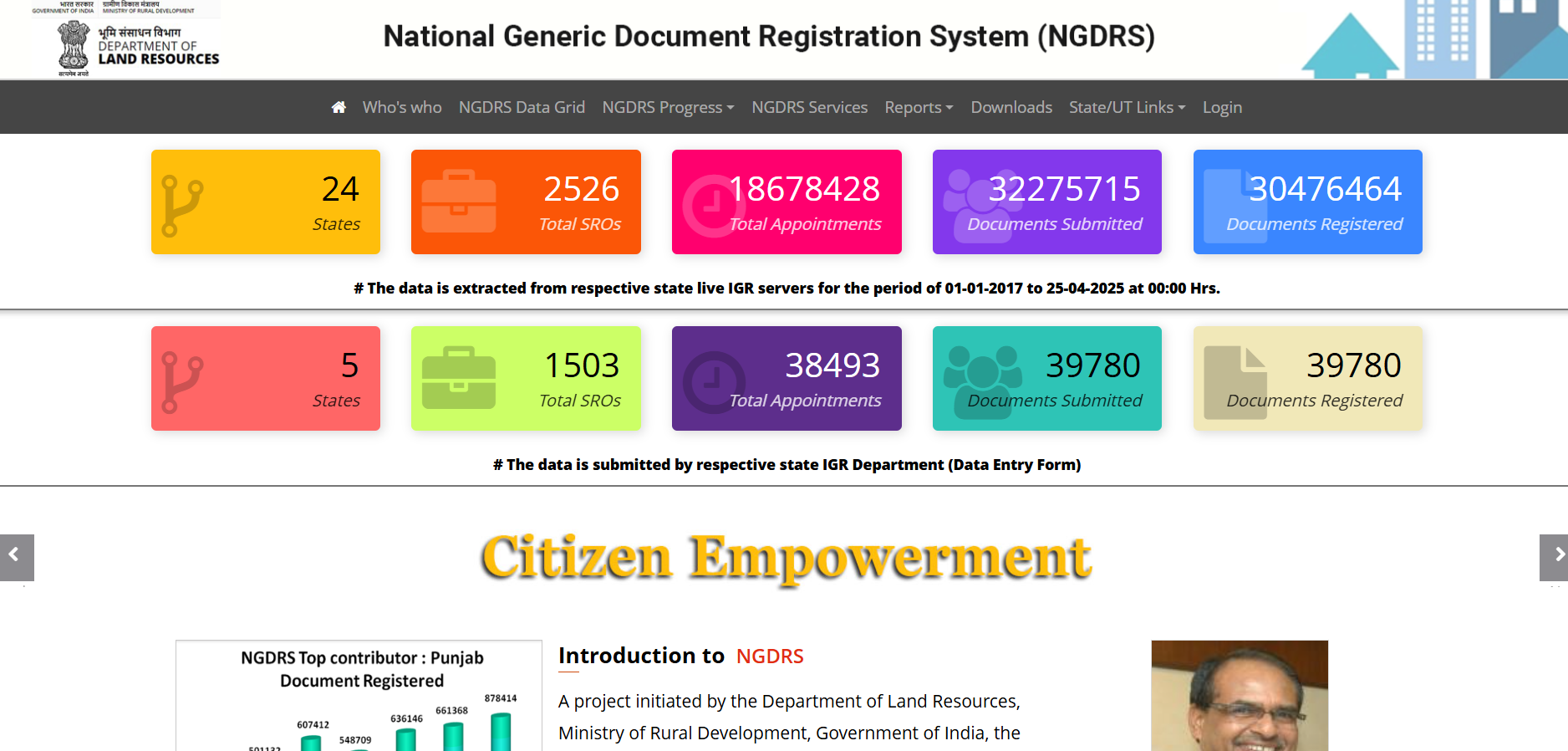

3. E-Stamping

- E-Stamping allows online payment of stamp duty.

- Visit the Document Registration website for Goa to calculate the stamp duty.

- The payment can be made through net banking, debit cards, or credit cards.

Suggested Read: Cost of Living in Goa

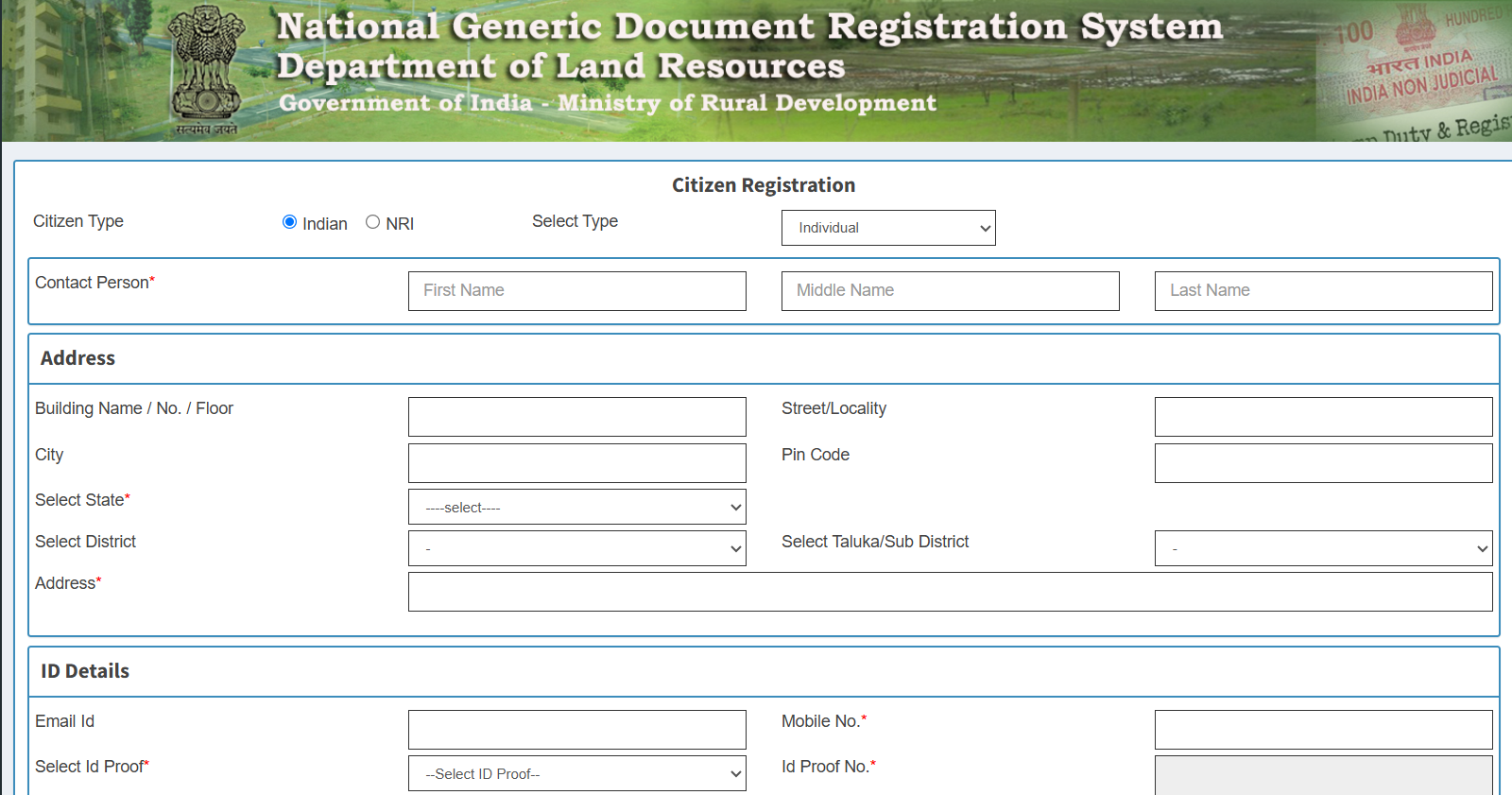

How to Pay Property Registration Fees in Goa?

- Visit the official Goa Registration Department portal.

- Register as a citizen by filling in your personal and address details, then create a username and password.

- Log in using your credentials, OTP, and captcha, then click on Document Entry and select New Document Entry.

- Provide all necessary property and seller-purchaser details; the system will calculate the property valuation.

- Enter the party details, including purchaser and witness information, then save the details.

- Enter the consideration amount for stamp duty calculation, which will show the applicable charges.

- Generate an E-Challan for payment and complete the payment via net banking, debit, or credit card.

- Select the appointment date, time, and office shift, and appear physically at the Sub-Registrar’s Office with your documents for final registration.

Suggested Read: Why Should You Buy a Property in Goa?

How to Pay Stamp Duty and Registration Charges Offline in Goa?

You can pay the stamp duty directly at the Sub-Registrar’s office when you register the property document.

- Prepare Documents: Ensure all required documents are ready for registration.

- Visit the Sub-Registrar’s Office: Go to the office with the documents and two witnesses.

- Fill Payment Form: Complete the payment form with transaction details.

- Make Payment: Pay the stamp duty and registration charges using cash, demand draft, or cheque.

- Obtain Receipt: Collect the receipt as proof of payment.

Suggested Read: Plot vs. Apartment vs. Villa

Documents Required for Stamp Duty and Registration Charges in Goa

- Deed registration document (Dalil)

- Relevant land documents

- No Objection Certificate (NOC)

- Digital layout or photograph of the property

- Proof of ownership (e.g., lease deed, utility bills)

- Identity proof (Aadhar card, PAN card, Driver’s license, Voter ID card, Passport)

- Proof of stamp duty payment

- Identity proof of two legal witnesses

- Property map

- Power of attorney (if applicable)

Tax Benefits of Paying Stamp Duty

Paying stamp duty on property transactions in India comes with several tax benefits that can help reduce the overall tax burden. Here are the key advantages:

- Stamp duty and registration charges paid for the purchase of a property are eligible for deductions under Section 80C of the Income Tax Act, 1961.

- You can deduct up to ₹1.5 lakh for stamp duty and registration charges in a financial year if you pay them for purchasing a residential property.

- This deduction applies to both self-occupied and rented properties, as long as you pay the stamp duty during the assessment year.

Suggested Read: Home Loan Insurance Tax Benefits

In the home loan process, stamp duty often becomes the silent budget-breaker. Unlike the EMI, which is spread over years, this payment is immediate and non-negotiable. Buyers who understand the exact percentage applicable in their state, and plan their down payment accordingly, are the ones who experience a smooth and stress-free registration process.

– Akul Aggarwal, Home Loan Expert

Factors Affecting Stamp Duty and Registration Charges in Goa

- Property Value: Charges are based on the market or transaction value, whichever is higher.

- Property Type: Residential, commercial, and agricultural properties have different rates.

- Location of the Property: Rates vary between urban and rural areas.

- Gender of the Owner: Female buyers may receive a reduced stamp duty rate.

- Age of the Property: Older properties may have different valuation methods affecting charges.

- Exemption or Concessions: Certain properties may qualify for reduced rates or exemptions.

- Age of the Buyer: Senior citizens may receive concessions for residential properties.

- Transfer Type: Sale, gift, or inheritance transfers attract different rates.

- Government Policies: Changes in policies can impact stamp duty rates and charges.

- Additional Charges: Includes legal documentation, verification, and service fees.

Suggested Read: How to Change Name in Land Registry or Property Documents?

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

Stamp duty in Goa and registration charges in Goa form an essential part of property acquisition costs, generally ranging from 3% to 6% of the property value. For anyone planning to buy property in Goa, it is crucial to budget for these property registration charges in advance to avoid last-minute surprises during the registration process.

Understanding the Goa stamp duty rates and registration fees not only ensures a smooth and legally valid property registration in Goa but also helps buyers make informed investment decisions. Whether it’s a holiday home in Goa, a beachfront villa, or a real estate investment property, being aware of these charges guarantees a transparent, hassle-free transaction in one of India’s most attractive real estate markets.

Get Expert Advice on Goa Real Estate!

Frequently Asked Questions

Stamp duty is collected by state governments in India. Each state has its laws and rates regarding stamp duty.

When there is no consideration (i.e., no money or value exchanged), authorities usually levy stamp duty based on the market value of the property or asset being transferred. The specific rates and rules may vary by jurisdiction.

The effects of non-payment of stamp duty can vary, but typically include:

Authorities may not consider the document legally valid or admissible as evidence in court.

They may deem the transaction void or unenforceable.

Some may impose legal penalties, fines, or interest for non-payment or late payment of stamp duty.

Sometimes, the authorities may take legal action to recover the unpaid stamp duty.

The limitation of stamp duty refund depends on the laws and regulations of the specific jurisdiction. However, some common limitations may include:

The tax office may only offer refunds within a specific time after you pay the stamp duty.

Refunds may only be granted under certain circumstances, such as if the transaction is canceled or the stamp duty was overpaid.

Administrative fees or other conditions may be associated with processing stamp duty refunds.

Refunds may not be available for certain types of transactions or documents.

Failure to pay property stamp duty promptly incurs a penalty of 2% per month on the outstanding amount, with a maximum penalty capped at 200% of the deficit stamp duty amount.

In Goa, the stamp duty for gift deeds executed in favor of immediate family members—such as father, mother, brother, sister, spouse, children, grandchildren, nephew, niece, son-in-law, daughter-in-law, brother-in-law, and sister-in-law—is a flat fee of ₹5,000, regardless of the property’s market value.

For gift deeds involving non-family members, the stamp duty rates align with standard property conveyance charges, ranging from 3% to 6% based on the property’s value. Additionally, a registration fee of 1% of the property’s value is applicable to all gift deeds.

In Goa, stamp duty is calculated based on the property’s market value, determined by the higher of the declared transaction value or the government’s prescribed circle rate (ready reckoner rate) for the specific area. The applicable stamp duty rates are structured into slabs:

Up to ₹50 lakh: 3.5%

₹50 lakh up to ₹75 lakh: 4%

₹75 lakh up to ₹1 crore: 4.5%

₹1 crore up to ₹5 crore: 5%

₹5 crore and above: 6%

For example, if a property’s market value is ₹80 lakh, it falls into the ₹75 lakh to ₹1 crore slab, attracting a stamp duty of 4.5%, resulting in a payment of ₹3.6 lakh. Additionally, registration charges apply, typically ranging from 3% to 3.5% of the property’s value, depending on the specific slab.

In Goa, stamp papers do not have a specific expiration date for their use. According to the Indian Stamp Act of 1899, there is no prescribed time limit within which a purchased stamp paper must be utilized.

However, Section 54 of the Act allows for a refund if the stamp paper is returned unused to the Collector within six months of purchase, subject to a deduction.

This six-month period pertains solely to the eligibility for refunds and does not affect the validity of the stamp paper for future use. Therefore, a stamp paper purchased in Goa remains valid indefinitely for executing documents, regardless of the time elapsed since its purchase.

In Goa, stamp duty rates are based on the property’s market value:

– Up to ₹50 lakh: 3.5%

– ₹50 lakh to ₹75 lakh: 4%

– ₹75 lakh to ₹1 crore: 4.5%

– ₹1 crore to ₹5 crore: 5%

– Above ₹5 crore: 6%

In Goa, the authorities calculate stamp duty for rent agreements as follows:

– Less than 1 year: 0.8% of the total rent.

– Between 1 and 5 years: 0.8% of the average annual rent.

– Exceeding 5 years and up to 10 years: 2.67% of the average annual rent.

– More than 10 years and up to 20 years: 5.33% of the average annual rent.

– Exceeding 20 years and up to 30 years: 8% of the average annual rent.

– Exceeding 30 years and up to 100 years: 10.67% of the average annual rent.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan