Gujarat’s property market continues to flourish, backed by robust industrial growth and strategic infrastructure developments. Property transactions, whether residential or commercial, involve a host of legal and financial considerations. This blog will walk you through the updated stamp duty and registration charges in Gujarat for 2025.

Looking for low interest rate home loans in Gujarat?

What Are Stamp Duty and Registration Charges?

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

Stamp Duty Charges in Gujarat

| Aspect | Stamp Duty Charges in Gujarat |

|---|---|

| Basic Rate | 3.50% |

| Surcharge @40% on Basic Rate | 1.4% |

| Total Stamp Duty Charges | 4.90% |

Registration Charges in Gujarat

| Gender | Registration Charges |

|---|---|

| Male | 1% |

| Female | No Charges |

| Male + Female | 1% |

| Female + Female | No Charges |

Waiver for Women: The Gujarat government offers a registration fee waiver for women, aiming to empower them and encourage registering properties under a female family member’s name.

Additional Charges: Apart from the waiver, homebuyers are required to pay certain ancillary fees during property registration, such as:

- Folio Fee: INR 10 or a revised rate as determined by the government.

- Index Fee: INR 50 per copy.

- Advocate Fee: Varies based on professional consultation.

Stamp Duty on Various Properties in Gujarat

Below is a quick reference table illustrating the stamp duty rates on different property types in Gujarat:

| Property Type | Stamp Duty Rate |

|---|---|

| Residential | 4.9% of the market value |

| Commercial | Around 5% of the market value |

| Agricultural Land | Approximately 3% of the market value |

Read More: RERA Charges in Gujarat

Stamp Duty on Various Deeds in Gujarat

| Property Deed/Document | Stamp Duty |

|---|---|

| Sale Deed / Gift Deed | 6% of the property value |

| Transfer of Lease Right Deed | 3% of the property value |

| Deed of Exchange (on property value) | 3% of the property value |

| Lease Deed (1–5 years) | 1.5% of the property value |

| Lease Deed (1–10 years) | 3% of the property value |

| Lease Deed (1–15 years) | 6% of the property value |

| Lease Deed (1–20 years) | 6% of the property value |

| Lease Deed (above 20 years) | 6% of the property value |

| Mortgage Deed (with possession) — Maximum Stamp Duty | 3% of the property value |

| Mortgage Deed (without possession) — Maximum Stamp Duty | 1.5% of the property value |

| Amendment Deed | ₹5 |

| General Power of Attorney (GPA) | ₹15 |

| Special Power of Attorney (SPA) | ₹5 |

Read More: Gujarat Housing Board Schemes 2025

Property Registration Documents in Gujarat

- Proof of Ownership (e.g., Title Deed)

- Input Sheet containing details of both parties (with signatures)

- Identity Proofs of buyer and seller

- Address Proofs

- Application Form No. 1, if applicable under Section 32 A of the Gujarat Stamps Act, 1958

- Original Power of Attorney, if registering on behalf of another person

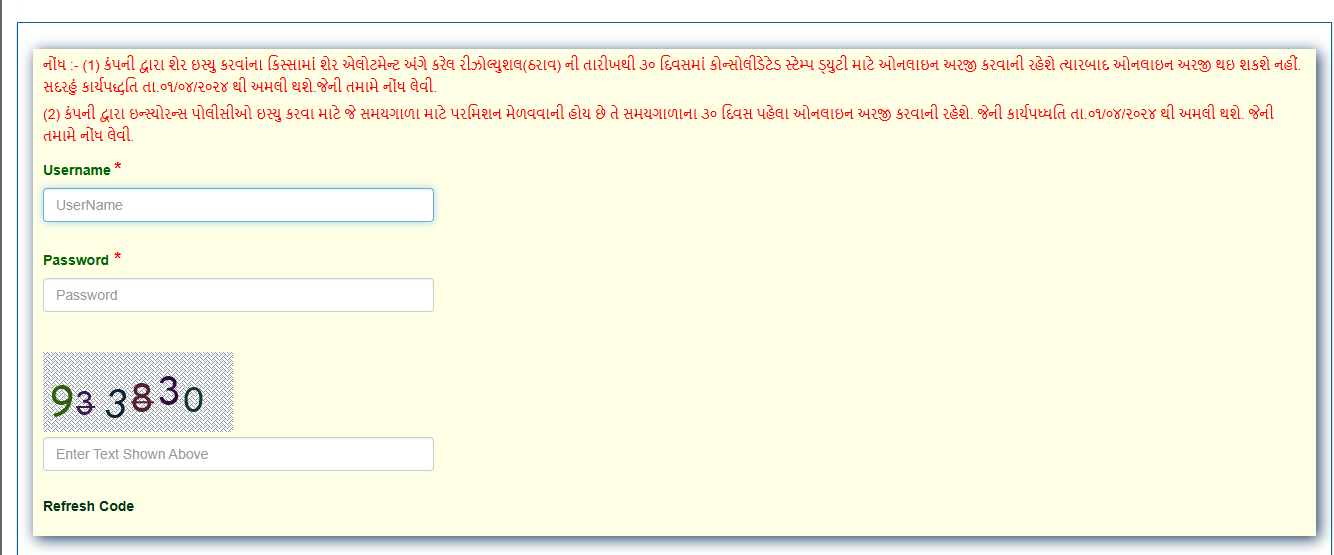

How to Pay Stamp Duty and Registration Charges in Gujarat 2025?

- Visit the Gujarat Revenue Department’s official website.

- Under the Online Services, click on “Payment of Consolidated Stamp Duty.”

- Create a new account or log in with existing credentials.

- Select Payment Option

Choose the relevant stamp duty and registration charges section.

- Provide Property Details

Fill in the required information, including property specifics and transaction value.

- Attach Supporting Documents

Upload any required documents to complete the submission.

- Make the Payment

Use net banking, debit/credit card, or UPI for payment.

- Download Receipt

Once the transaction is successful, save or print the payment receipt and acknowledgment for your records.

Read More: How to Download Gujarat Land Records?

Stamp Duty and Registration Charges Concession in Gujarat

- There is no stamp duty rebate for women in Gujarat; both men and women pay the same stamp duty.

- Women are, however, exempt from paying registration charges.

Time Taken for Stamp Duty & Registration Charges in Gujarat

Below is the typical timeline for completing stamp duty and registration payments:

| Time | Process Stage |

|---|---|

| 1 | Submit the sale deed for property registration |

| 2–3 | Verification of documents and payment processing |

| 4–5 | Issuance of payment receipt |

| 6–7 | Return of the registered sale deed to the property owner |

Read More: Home Loans in Ahmedabad

Consequences of Skipping Stamp Duty and Registration in Gujarat

- Mandatory Under Law: The Indian Stamp Act of 1899 and the Registration Act of 1908 make stamp duty payments compulsory across India, including Gujarat.

- Invalid Registration: Failing to pay stamp duty and registration charges renders the property registration legally void.

- Monthly Penalty: Authorities can impose a 2% penalty every month on any unpaid stamp duty amount.

- Additional Fine: An extra charge of up to 200% of the unpaid duty can be levied as a penalty.

Read More: Cost of Living in Ahmedabad

Stamp Duty and Registration Charges For All States

| State | Stamp Duty -Male | Stamp Duty -Female | Registration Charges |

|---|---|---|---|

| Andhra Pradesh | 5% | 5% | 1% |

| Arunachal Pradesh | 6% | 6% | 1% |

| Assam | 6% | 5% | 8.50% |

| Bihar | 6.30% | 5.70% | 1% |

| Chhattisgarh | 5% | 4% | 1% |

| Goa | 3.5% – 5% | 3.5% – 5% | 1% |

| Gujarat | 4.90% | 4.90% | 1% |

| Haryana | 7% | 5% | 1% |

| Himachal Pradesh | 5% | 5% | 1% |

| Jharkhand | 4% | 4% | 1% |

| Karnataka | 2% – 5% | 2% – 5 | 1% |

| Kerala | 8% | 8% | 2% |

| Madhya Pradesh | 7.50% | 7.50% | 1% |

| Maharashtra | 6% | 5% | 1% |

| Manipur | 7% | 7% | 3% |

| Meghalaya | 9.90% | 9.90% | 1% |

| Mizoram | 9% | 9% | 1% |

| Nagaland | 8.25% | 8.25% | 1% |

| Odisha | 5% | 4% | 1% |

| Punjab | 4.75% | 2.75% | 1% |

| Rajasthan | 6% | 5% | 1% |

| Sikkim | 5% | 5% | 1% |

| Tamil Nadu | 4% | 4% | 2% |

| Telangana | 5% | 5% | 1% |

| Tripura | 5% | 5% | 1% |

| Uttarakhand | 5% | 3.75% | 1% |

| Uttar Pradesh | 7% | 5% | 1% |

| West Bengal | 6% – 7% | 6% – 7% | 1% |

| Delhi | 6% | 4% | 1% |

| Daman & Diu | 6% | 4% | 0.50% |

| Jammu and Kashmir | 7% | 3% | 1.20% |

Read More: How to Pay Ahmedabad Property Tax?

Get a Home Loan

with Highest Eligibility

& Best Rates

Gujarat Stamp Duty and Registration Charges: Feedback and Queries

| Contact Method | Details |

|---|---|

| Phone Numbers | 07923256342, 07923256343, 07929688960 |

| Email Addresses | edpcell-dat@gujarat.gov.in, helpdesk-igr@gujarat.gov.in |

Secure Your Home Purchase with Credit Dharma

Understanding stamp duty and registration charges is crucial when buying property in Gujarat, as they add to your overall costs. Being aware of these expenses helps you plan your finances more effectively.

Ensure you have all the necessary documents and stay informed about the latest rates to avoid any unexpected costs. For additional guidance, don’t hesitate to contact Credit Dharma’s team of experts

Frequently Asked Questions

The buyer of the property is typically responsible for paying stamp duty, although specifics can vary based on local laws and agreements.

Stamp duty is usually calculated as a percentage of the property’s purchase price or the market value, whichever is higher.

If you don’t pay stamp duty on documents that need it, you could face serious issues. Courts won’t allow these documents as evidence, making disputes hard to resolve. Plus, authorities might hold them until you pay the duty and any extra fines, which can be quite hefty.

All real estate transactions require stamp duty, except when properties are transferred through a Will.

Yes, stamp duty rates and regulations vary significantly across different states and territories, reflecting local real estate market conditions and government policies.

The current stamp duty rates in Gujarat are 4.90% for female owners and 4.90% for male owners.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan