Himachal Pradesh’s real estate sector is evolving rapidly. Every property purchase in UP comes with the additional expense of stamp duty and registration charges. These charges not only give legal recognition to the transaction but also provide security and clarity for all parties involved.

This blog will walk you through the updated stamp duty and registration charges in Himachal Pradesh for 2025.

Are you looking for lower interest rate home loans in Himachal Pradesh?

What Are Stamp Duty and Registration Charges?

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

Stamp Duty Charges in Himachal Pradesh 2025

| Buyer Category | Stamp Duty |

|---|---|

| Female | 4% |

| Male | 6% |

| Joint (Male + Female) | 5% |

Property/ Land Registration Charges in Himachal Property 2025

| Buyer Category | Registration Charges Details |

|---|---|

| Female | 4% for properties worth Rs 80 Lakhs; 8% for properties above Rs 80 Lakhs |

| Male | 6% for properties worth Rs 50 Lakhs |

| Joint | 8% for properties above Rs 50 Lakhs |

Suggested Read: RERA Fees and Charges in Himachal Pradesh

Stamp Duty on Gift Deed and Other Documents in Himachal Pradesh

Apart from the Sale Deed, the Himachal Pradesh Department of Revenue levies stamp duty on other legal instruments. The applicable charges for these instruments are as follows:

| Instrument | Stamp Duty Charges |

|---|---|

| Gift Deed | 4-6% |

| Will Deed | Rs 200 |

| Lease Deed | Rs 200 |

| General Power of Attorney (GPA) | Rs 100-200 |

| Conveyance Deed | 4-6% of the Deed value |

| Special Power of Attorney | Rs 100 |

| Mortgage Deed | Rs 15 |

| Adoption Deed | Rs 37.50 |

Suggested Read: How to Convert Your Home into an AirBnB?

Stamp Duty for Non-Residents in Himachal Pradesh

Himachal Pradesh has updated Schedule 1 of the Indian Stamp Act, 1899. Under the new order, all non-residents are now required to pay a uniform stamp duty:

| Transaction Type | Previous Stamp Duty Rate | New Stamp Duty Rate |

|---|---|---|

| Purchase/Lease by Non-Residents | 6% – 8% | 12% |

Suggested Read: RBI Repo Rate Cut 2025

How to Pay Stamp Duty and Registration Charges in Himachal Pradesh Online?

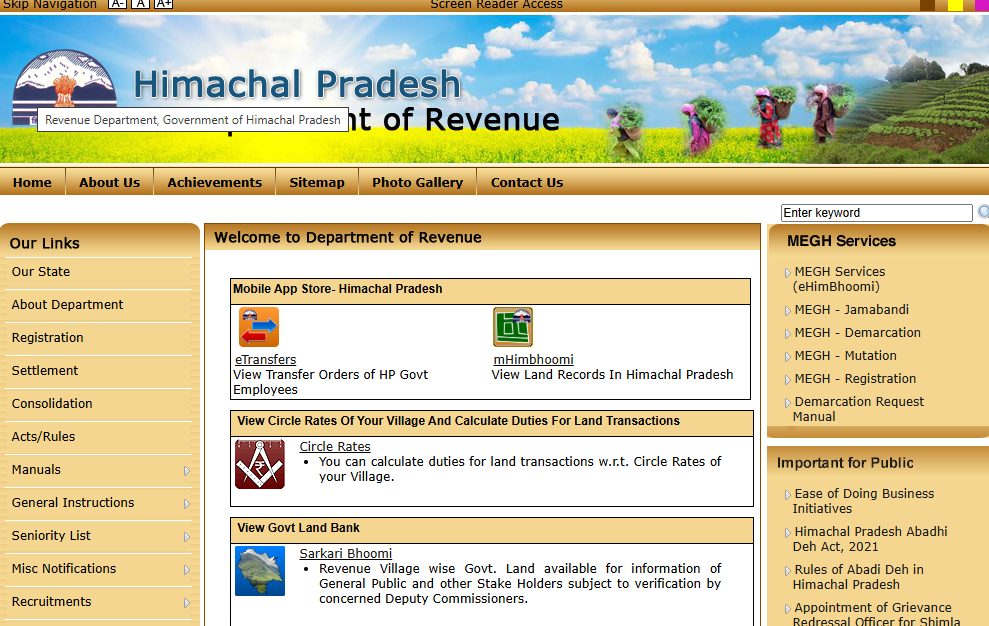

- Visit the official website of “Himachal Pradesh Department of Revenue.”

- On the homepage, click the link labeled “View Circle Rates Of Your Village And Calculate Duties For Land Transactions.”

- You will be redirected to the customized NGDRS portal. Select the “Citizen Registration” option from the left pane.

- Complete the form by providing your name, address, email ID, phone number, and property details. Click “Submit” to register as a user.

- Return to the homepage and log in using your User ID and password.

- After logging in, upload the required documents. Proceed to pay the stamp duty and registration charges online using one of the following payment methods: debit card/ credit card/ NEFT/ RTGS/ UPI/ Wallet

- Once the payment is completed and the documents are uploaded, an appointment will be scheduled with the concerned Sub-Registrar Office (SRO). On the designated date, visit the SRO office to complete the verification process.

Alternative Payment Option via SHCIL

Property buyers may also pay stamp duty online through the Stock Holding Corporation of India Ltd (SHCIL) website.

- Visit the SHCIL website.

- Select Himachal Pradesh from the drop-down list and follow the instructions to complete your payment.

Suggested Read: Top 5 HFCs Offering Home Loans

How to Pay Stamp Duty and Registration Charges in Himachal Pradesh Offline?

Property buyers can pay stamp duty and registration charges offline using the following methods:

Suggested Read: 15 vs 30 Year Home Loan Tenure

Property Registration in Himachal Pradesh: Documents Required

- Jamabandi or Bhu Naksha (HP Nasal)

- Circle Rate Document

- Agriculturist Certificate/Permission (as per Section 118 of HP TRA)

- Self-declaration or affidavit from both Buyer and Seller stating the land’s distance from the road

- Identity proofs for both Buyer and Seller

- PAN cards for both Buyer and Seller

- Valuation certificate for built-up area (if the sale includes built-up property)

- Copy of an approved map (if the built-up area is within municipal limits)

- Copy of the Tatima Document (for Tatima Registry transactions)

Suggested Read: Home Loan Tax Benefits

Stamp Duty and Registration Charges in Himachal Pradesh: Customer Care

| Method | Information |

|---|---|

| Email Address | dlr-hp@nic.in |

| Contact Number | +91-177-2623678 |

| Postal Address | Directorate Of Land Records, Block No 28, SDA Complex, Kasumpati, Shimla, Himachal Pradesh |

Suggested Read: 12 Month Road Map to a Perfect Credit Score

Stamp Duty and Registration Charges For All States

| State | Stamp Duty -Male | Stamp Duty -Female | Registration Charges |

|---|---|---|---|

| Andhra Pradesh | 5% | 5% | 1% |

| Arunachal Pradesh | 6% | 6% | 1% |

| Assam | 6% | 5% | 8.50% |

| Bihar | 6.30% | 5.70% | 1% |

| Chhattisgarh | 5% | 4% | 1% |

| Goa | 3.5% – 5% | 3.5% – 5% | 1% |

| Gujarat | 4.90% | 4.90% | 1% |

| Haryana | 7% | 5% | 1% |

| Himachal Pradesh | 5% | 5% | 1% |

| Jharkhand | 4% | 4% | 1% |

| Karnataka | 2% – 5% | 2% – 5 | 1% |

| Kerala | 8% | 8% | 2% |

| Madhya Pradesh | 7.50% | 7.50% | 1% |

| Maharashtra | 6% | 5% | 1% |

| Manipur | 7% | 7% | 3% |

| Meghalaya | 9.90% | 9.90% | 1% |

| Mizoram | 9% | 9% | 1% |

| Nagaland | 8.25% | 8.25% | 1% |

| Odisha | 5% | 4% | 1% |

| Punjab | 4.75% | 2.75% | 1% |

| Rajasthan | 6% | 5% | 1% |

| Sikkim | 5% | 5% | 1% |

| Tamil Nadu | 4% | 4% | 2% |

| Telangana | 5% | 5% | 1% |

| Tripura | 5% | 5% | 1% |

| Uttarakhand | 5% | 3.75% | 1% |

| Uttar Pradesh | 7% | 5% | 1% |

| West Bengal | 6% – 7% | 6% – 7% | 1% |

| Delhi | 6% | 4% | 1% |

| Daman & Diu | 6% | 4% | 0.50% |

| Jammu and Kashmir | 7% | 3% | 1.20% |

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

In Himachal Pradesh, understanding and complying with stamp duty and registration charges is vital to ensure a smooth property transaction. If you’re looking for a home loan in Himachal Pradesh, Credit Dharma is here to help. With expert guidance and competitive financing options, we can simplify your journey to home ownership.

Frequently Asked Questions

In Himachal Pradesh, stamp duty is a tax levied on property transactions to validate legal ownership. As of 2025, the rates are 6% for male buyers, 4% for female buyers, and a uniform 12% for non-residents purchasing or leasing land with government approval.

Property registration charges in the state are set at 2% of the property’s value. These charges apply uniformly, regardless of the buyer’s gender or residency status.

Non-residents can purchase property in Himachal Pradesh, but acquiring agricultural land requires prior permission under Section 118 of the Himachal Pradesh Tenancy and Land Reforms Act, 1972. However, non-agricultural properties like flats or houses can be bought without such permissions.

Stamp duty charges are calculated as a percentage of the property’s registered value: 6% for male buyers, 4% for female buyers, and 12% for non-residents. For example, a male resident purchasing a property valued at ₹50 lakh would pay ₹3 lakh as stamp duty.

Stamp duty for the sale of property is determined by applying the respective rate—6% for male buyers, 4% for female buyers, and 12% for non-residents—to the property’s registered value. Ensuring accurate valuation is crucial for correct stamp duty assessment.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan