Purchasing property in Jharkhand involves understanding two critical costs: stamp duty and registration charges. These fees are mandatory for legally transferring property ownership. In this blog, we break down the latest updates, rates, and processes for 2025 to help you plan your investment wisely.

Looking for low interest rate home loans in Jharkhand?

What Are Stamp Duty and Registration Charges?

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

Stamp Duty Charges in Jharkhand

| Gender | Stamp Duty Charges |

|---|---|

| Female | 4% |

| Male | 4% |

| Male + Female | 4% |

| Female + Female | 4% |

These rates apply uniformly across genders and ownership types for property transactions in Jharkhand in 2025.

For example, on a property valued at ₹50 lakhs:

- Stamp Duty would be ₹2 lakh

- Registration Charges would be ₹1.5 lakh

- Total statutory charges would be ₹3.5 lakh

Read More: RERA Charges in Jharkhand

Registration Charges in Jharkhand 2025

Alongside stamp duty, registration charges are an additional cost that property buyers must pay to register the property under their name.

| Gender | Registration Charges |

|---|---|

| Male | 3% |

| Female | 3% |

| Male + Female | 3% |

Stamp Duty and Registration Charges on Various Intruments

Certainly, here is a simple and crisp table outlining the stamp duty and registration charges for different instruments in Jharkhand for 2025:

| Description of Instrument | Stamp Duty in Jharkhand | Registration Fee in Jharkhand |

|---|---|---|

| Adoption Deed | ₹42 | ₹1,000 |

| Agreement | ₹3.50 | ₹1,000 |

| Bond | (i) Exceeds ₹1,000 but ≤ ₹5,000: ₹25 (ii) Exceeds ₹5,000 but ≤ ₹50,000: 5.25% of Bond Value (iii) Exceeds ₹50,000: 6.3% of Bond Value | 3% of the value of the bond |

| Conveyance (Sale Deed) | 4% of the document value | 3% of the value of the document |

| Gift Deed | (i) ≤ ₹1,000: ₹31.50 (ii) > ₹1,000 but ≤ ₹10,000: ₹31.50 for the first ₹1,000 + ₹21 per ₹500 or part thereof exceeding ₹1,000 (iii) > ₹10,000: ₹31.50 per ₹500 | 3% of the value of the deed |

| Mortgage | 4.2% of the value of the deed | 2% of the value of the deed |

| Partition | Same as Bond | 3% of the value of the deed |

| Partnership Deed | ₹42 | ₹2,000 |

| Power of Attorney (PoA) | ₹31.50 | Applicable for values from ₹2,000 to ₹10,000 |

| Trust (Declaration of) | ₹47.25 | ₹2,000 |

| Will | Nil | ₹2,000 |

| Society Registration | Nil | ₹50 |

| Firm Registration | Nil | ₹3 |

Read More: PAN Details of All Top Banks

Stamp Duty in Jharkhand for Gift Deed

As per Section 122 of the Transfer of Property Act, 1882, a gift deed involves the voluntary transfer of existing real estate property or assets, whether movable or immovable, from the giver to the recipient without any consideration.

The stamp duty for a gift deed in Jharkhand is calculated based on the value of the gift. The table below outlines the stamp duty charges applicable under different circumstances:

| Gift Value Range | Stamp Duty Calculation | Total Stamp Duty |

|---|---|---|

| Up to ₹1,000 | Flat rate | ₹31.50 |

| ₹1,001 to ₹10,000 | ₹31.50 for the first ₹1,000 + ₹21 for every ₹500 or part thereof exceeding ₹1,000 | ₹31.50 + ₹21 × (Amount > ₹1,000) |

| Above ₹10,000 | ₹31.50 for every ₹500 | ₹31.50 × (Total Gift Value ÷ ₹500) |

Documents Required For Paying Stamp Duty in Jharkhand

Prepare all necessary paperwork in order simplifies the transaction and avoids delays in the property buying journey:

| Category | Documents Required |

|---|---|

| Property Ownership Transfers | Deed of Partition Reconveyance of Mortgaged Property Gift Deed Exchange deed |

| Financial and Security Instruments | Mortgage Deed Certificates of Sale |

| Occupancy and Use Agreements | Tenancy Agreement Lease Deeds |

| Legal and Authority Delegations | Power of Attorneys Licence Agreement |

Read More: Jharbhoomi | Jharkhand Land Records

How to Pay Stamp Duty in Jharkhand?

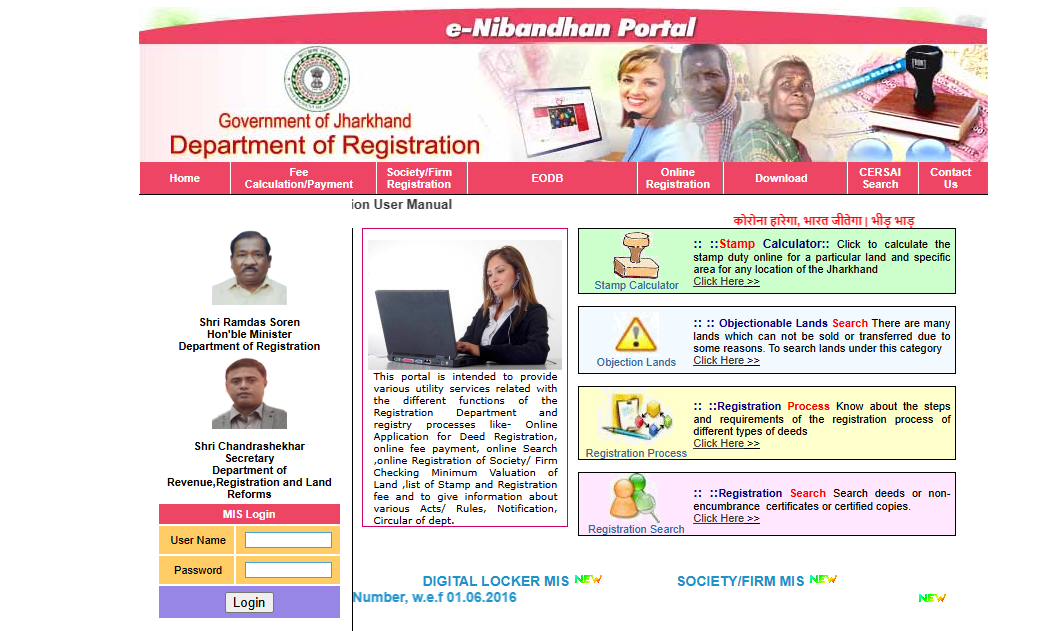

- Go to the Jharkhand Registration Department’s website or the E-Nibandhan portal.

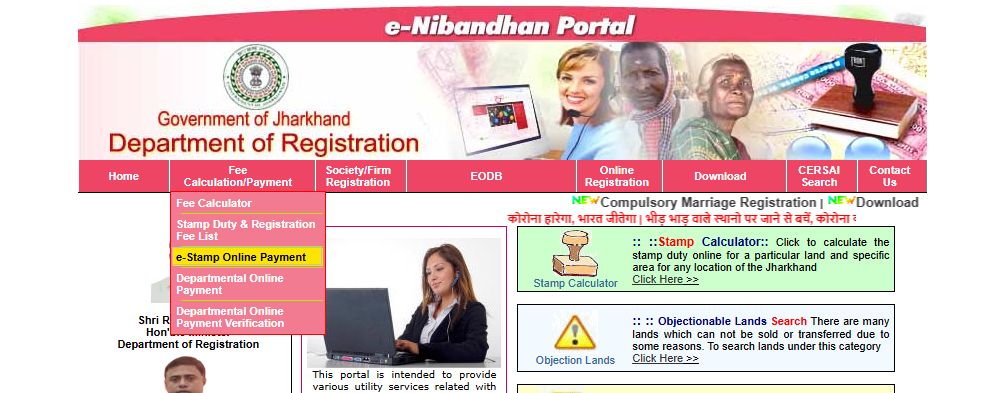

- Under ‘Fee Calculation/Payment’ tab, click on ‘E-Stamp Online Payment’ option.

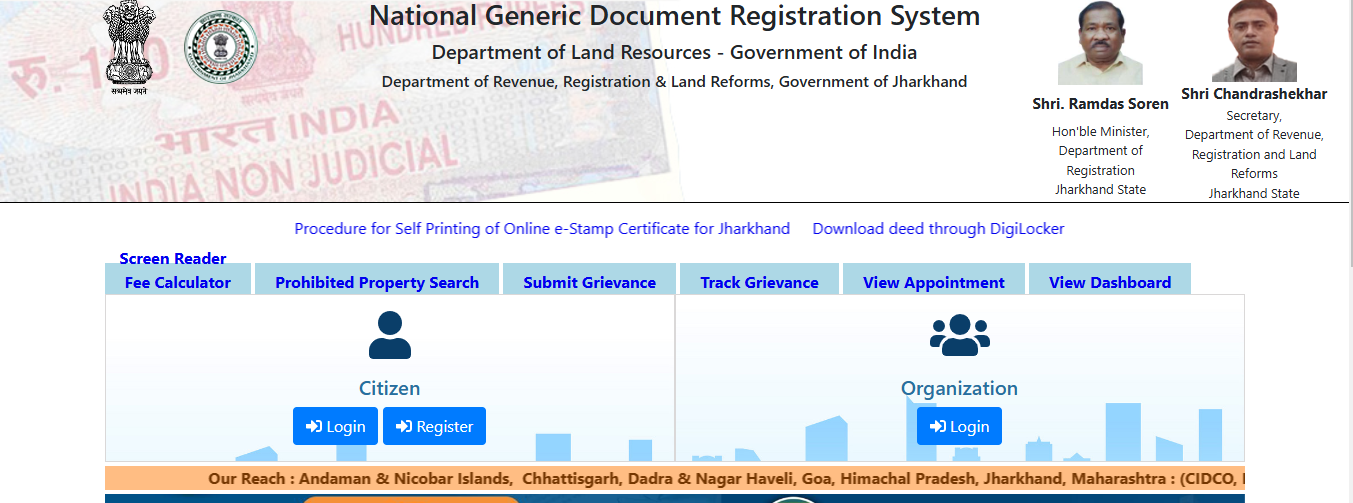

- You will be redirected to the Jharbandhan website, which utilizes the National Generic Documents Registration System for a unified property registration process.

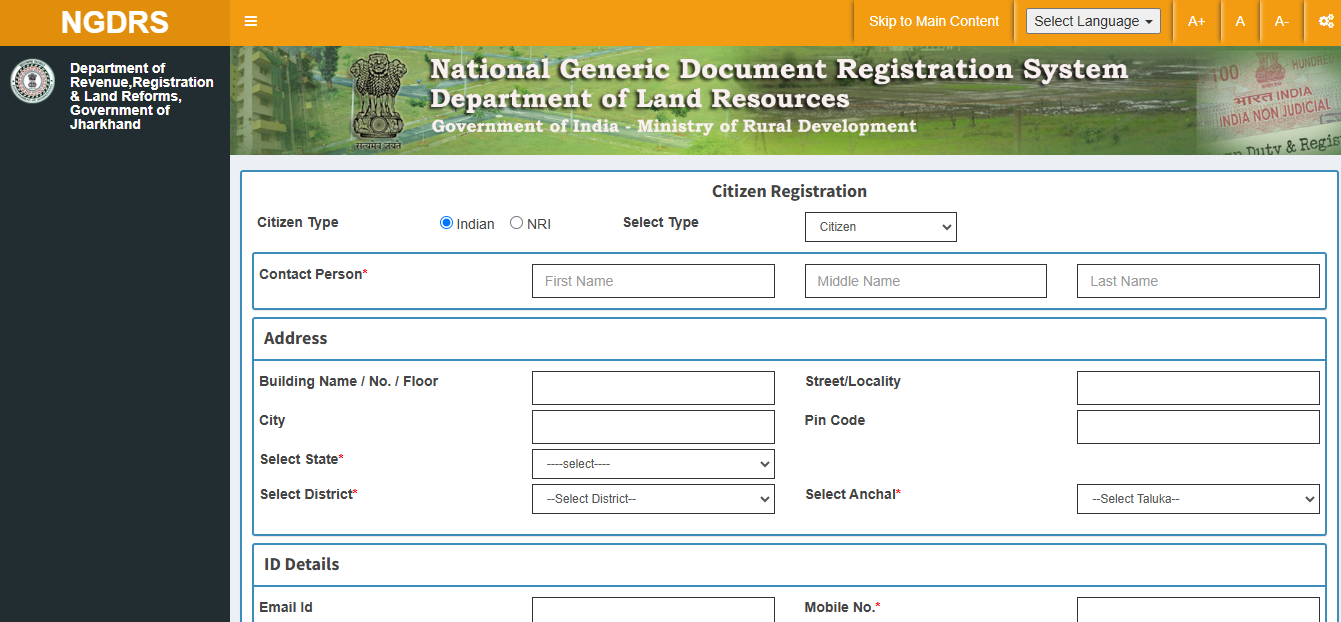

- New Users: Click ‘Register’ and complete the registration form.

Existing Users: Log in with your username and ID.

- Upload Required Documents

After logging in, upload the necessary documents for your transaction.

- Make the Payment

Proceed to pay the stamp duty online through the portal.

- Book an Appointment

After payment, schedule an appointment with the relevant Sub-Registrar’s Office (SRO).

Visit the SRO to verify your uploaded documents, completing the registration process.

How to Pay Stamp Duty in Jharkhand Offline?

How to Pay Registration Charges in Jharkhand?

- Visit the SHCIL website.

- Choose Your Payment Option

- Online Payment: Click on ‘Online Payment’ to pay your stamp duty directly.

- Verify e-Stamp Certificate: Select ‘Verify e-Stamp Certificate’ to check your payment status.

- Statewise Contact Details: If you need assistance, click on ‘Statewise Contact Details for e-Stamping’ to get in touch with an SHCIL officer in your state.

How to Check Slot Availability for Property Registration in Jharkhand?

- Complete Payment: Ensure registration charges and stamp duty are paid.

- Visit SRO Office: Both parties must go to the nearest Sub-Registrar Office (SRO) with the necessary documents.

- Submit Documents: Provide all required paperwork for verification by the SRO.

- Book Appointment Online: Access the e-Nibandhan portal and enter your application details to select an available appointment slot.

- Book Appointment Offline: Alternatively, visit the SRO office in person to check and schedule an appointment.

- Attend Appointment: Go to the SRO office on the scheduled date to complete the registration process.

How to Avail Stamp Duty Refund in Jharkhand?

According to the Revenue Audit Manual of Stamp Duty and Registration Charges by the Accountant General (Audit), stamp and registration fees paid in Jharkhand can be refunded under the following conditions:

- Overpayment: If the stamp duty paid exceeds the statutory requirement.

- Debenture Renewal: When a stamped debenture is renewed.

- Rejected or Postponed Application: If the registration application is either rejected or postponed.

Time Limitations: Refund applications must be submitted within three months of the overpayment, renewal, or rejection/postponement of the registration application. To initiate a refund, applicants need to send their request to the Chief Controlling Revenue Authority for Stamp Duty within this period.

How To Use Credit Dharma’s Stamp Duty Calculator?

- Choose the state where you intend to purchase your property from a drop-down menu.

- Type in the total value of the property you’re planning to buy.

- Specify the gender of the buyer.

- The calculator will display the calculated stamp duty and registration charges

Stamp Duty and Registration Charges Concession in Jharkhand

There is no stamp duty or registration fees rebate for women in Gujarat; both men and women pay the same stamp duty.

Get a Home Loan

with Highest Eligibility

& Best Rates

Stamp Duty and Registration Charges For All States

| State | Stamp Duty -Male | Stamp Duty -Female | Registration Charges |

|---|---|---|---|

| Andhra Pradesh | 5% | 5% | 1% |

| Arunachal Pradesh | 6% | 6% | 1% |

| Assam | 6% | 5% | 8.50% |

| Bihar | 6.30% | 5.70% | 1% |

| Chhattisgarh | 5% | 4% | 1% |

| Goa | 3.5% – 5% | 3.5% – 5% | 1% |

| Gujarat | 4.90% | 4.90% | 1% |

| Haryana | 7% | 5% | 1% |

| Himachal Pradesh | 5% | 5% | 1% |

| Jharkhand | 4% | 4% | 1% |

| Karnataka | 2% – 5% | 2% – 5 | 1% |

| Kerala | 8% | 8% | 2% |

| Madhya Pradesh | 7.50% | 7.50% | 1% |

| Maharashtra | 6% | 5% | 1% |

| Manipur | 7% | 7% | 3% |

| Meghalaya | 9.90% | 9.90% | 1% |

| Mizoram | 9% | 9% | 1% |

| Nagaland | 8.25% | 8.25% | 1% |

| Odisha | 5% | 4% | 1% |

| Punjab | 4.75% | 2.75% | 1% |

| Rajasthan | 6% | 5% | 1% |

| Sikkim | 5% | 5% | 1% |

| Tamil Nadu | 4% | 4% | 2% |

| Telangana | 5% | 5% | 1% |

| Tripura | 5% | 5% | 1% |

| Uttarakhand | 5% | 3.75% | 1% |

| Uttar Pradesh | 7% | 5% | 1% |

| West Bengal | 6% – 7% | 6% – 7% | 1% |

| Delhi | 6% | 4% | 1% |

| Daman & Diu | 6% | 4% | 0.50% |

| Jammu and Kashmir | 7% | 3% | 1.20% |

Data Source: Check stamp duty and registration charge details on the official government website for the Indian Stamp Act.

“In Jharkhand, knowing the exact stamp duty slabs—especially for gift deeds—helps avoid surprises and optimize costs. Always check the latest government notifications and possible family exemptions to ensure a smooth, cost‑efficient property transfer.”

-Anand Chaubey, Credit Dharma

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Frequently Asked Questions

The buyer of the property is typically responsible for paying stamp duty, although specifics can vary based on local laws and agreements.

Stamp duty is usually calculated as a percentage of the property’s purchase price or the market value, whichever is higher.

If you don’t pay stamp duty on documents that need it, you could face serious issues. Courts won’t allow these documents as evidence, making disputes hard to resolve. Plus, authorities might hold them until you pay the duty and any extra fines, which can be quite hefty.

All real estate transactions require stamp duty, except when properties are transferred through a Will.

Yes, stamp duty rates and regulations vary significantly across different states and territories, reflecting local real estate market conditions and government policies.

The current stamp duty rates in Jharkhand are 4% for female owners and 4% for male owners.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan