Estimated reading time: 6 minutes

Imagine finally finding the perfect home in Madhya Pradesh—a cozy house in the heart of Indore or a serene bungalow amidst the greenery of Bhopal. But before you can move in, there are essential financial steps to take care of, namely stamp duty and registration charges.

If these terms sound daunting, don’t worry! We will break them down in a way that doesn’t feel like a legal lecture.

Looking for low interest rate home loans in Madhya Pradesh?

What Exactly is Stamp Duty?

Think of stamp duty as a fee you pay to make your property transaction official and ensures that it is recognised by the government. It’s like a ticket that legitimizes your purchase.

In Madhya Pradesh, this fee is calculated based on the property’s market value or the transaction amount, whichever is higher.

Stamp Duty Charges in Madhya Pradesh 2024

Understanding stamp duty charges is essential for anyone looking to buy a home or invest in property. Here’s the stamp duty and registration charges in Madhya Pradesh:

| Gender | Stamp Duty Charges |

|---|---|

| Female | 7.50% |

| Male | 7.50% |

| Joint | 7.50% |

Document Wise Stamp Duty in Madhya Pradesh

| Document | Stamp Duty Charges |

|---|---|

| Lease Deed | 8% of the total rent including the deposit |

| Gift Deed to Family | 1% of the market value of the property |

| Gift Deed to Others | 5% of the market value of the property |

What About Registration Charges?

Once stamp duty is sorted, there’s another fee called registration charges. This is a smaller percentage of the property’s value and covers the cost of officially recording the property in your name at the local sub-registrar’s office.

Registration Charges in Madhya Pradesh 2024

| Location | Charges |

|---|---|

| Madhya Pradesh | 3% |

Documents Required For Paying Stamp Duty in Madhya Pradesh

Prepare all necessary paperwork in order simplifies the transaction and avoids delays in the property buying journey:

| Category | Documents Required |

|---|---|

| Property Ownership Transfers | Deed of Partition Reconveyance of Mortgaged Property Gift Deed Exchange deed |

| Financial and Security Instruments | Mortgage Deed Certificates of Sale |

| Occupancy and Use Agreements | Tenancy Agreement Lease Deeds |

| Legal and Authority Delegations | Power of Attorneys Licence Agreement |

How to Pay Stamp Duty in Madhya Pradesh Online?

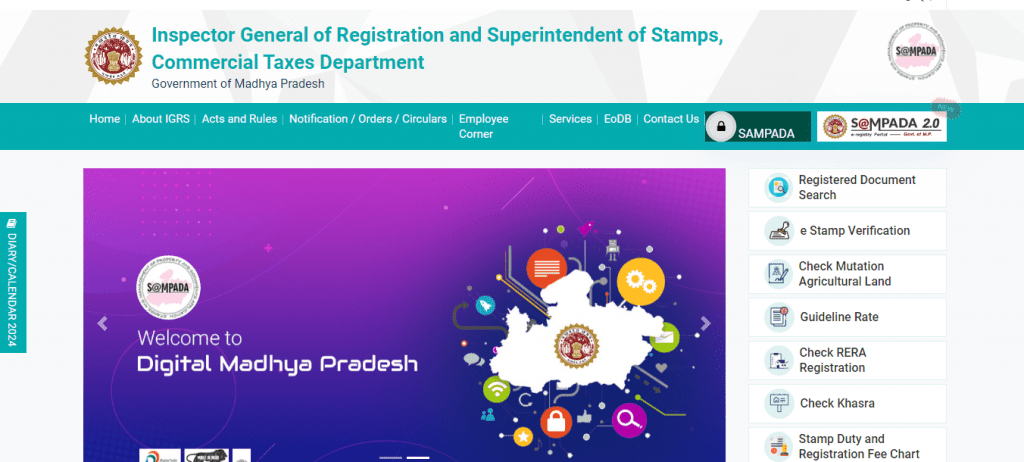

Step 1: Visit the official website of the Registration and Stamps Department, Madhya Pradesh.

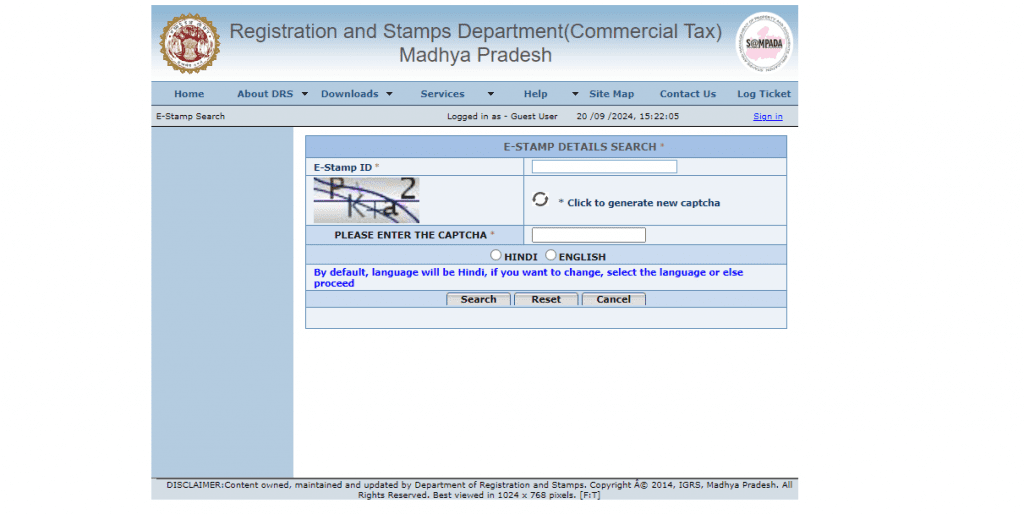

Step 2: Click on “E-Stamp Verification.”

Step 3: On the next screen, enter the E-Stamp ID and the captcha to pay the stamp duty.

Step 4: Pay the charges using a credit card, debit card, or net banking.

Note: If you haven’t registered, you’ll need to sign up before proceeding.

How to Pay Stamp Duty in Madhya Pradesh Offline?

Stamp Duty Concessions

Governments use stamp duty concessions as a strategic tool to promote homeownership by making it more financially accessible. These benefits and reductions lower entry barriers for buyers, encouraging more individuals and families to invest in their own homes.

Reduced Stamp Duty Rates for Women:

- Women may pay a lower rate of stamp duty compared to men.

- This differential rate aims to promote property ownership among women, contributing to their financial independence and empowerment.

- The exact discount can vary by region, but it’s typically around 1-2% lower than the rate for men.

Stamp Duty Concessions:

- Many states offer reduced stamp duty rates for first-time homeowners to make property ownership more accessible and affordable.

- First-time buyers might also qualify for additional tax benefits on the stamp duty paid, under certain conditions.

Joint Ownership Incentives:

- Some jurisdictions offer a reduction in stamp duty rates, further encouraging joint ownership.

- This is applicable only on properties registered under joint names with a woman as one of the owners.

Factors Influencing Stamp Duty and Registration Charges in Madhya Pradesh

- Property Location: Stamp duty rates can vary depending on whether the property is located in an urban or rural area.

- Property Type: Residential and commercial properties may have different stamp duty and registration charges.

- Property Value: The higher the market value or consideration value of the property, the more stamp duty and registration fees you may have to pay.

- Owner’s Gender: In some cases, women are eligible for a lower stamp duty rate compared to men.

- Age of the Owner: Some states provide concessions on stamp duty for senior citizens, which may also apply in Madhya Pradesh.

- Property Usage: If the property is for agricultural use, industrial purposes, or personal residential use, different charges may apply.

- Transfer Type: Stamp duty can vary depending on whether the transfer is a sale, gift, inheritance, or mortgage.

- Government Policies: Changes in state government policies or any new laws introduced may affect stamp duty and registration charges.

Stamp Duty and Registration Charges For All States

| State | Stamp Duty -Male | Stamp Duty -Female | Registration Charges |

|---|---|---|---|

| Andhra Pradesh | 5% | 5% | 1% |

| Arunachal Pradesh | 6% | 6% | 1% |

| Assam | 6% | 5% | 8.50% |

| Bihar | 6.30% | 5.70% | 1% |

| Chhattisgarh | 5% | 4% | 1% |

| Goa | 3.5% – 5% | 3.5% – 5% | 1% |

| Gujarat | 4.90% | 4.90% | 1% |

| Haryana | 7% | 5% | 1% |

| Himachal Pradesh | 5% | 5% | 1% |

| Jharkhand | 4% | 4% | 1% |

| Karnataka | 2% – 5% | 2% – 5 | 1% |

| Kerala | 8% | 8% | 2% |

| Madhya Pradesh | 7.50% | 7.50% | 1% |

| Maharashtra | 6% | 5% | 1% |

| Manipur | 7% | 7% | 3% |

| Meghalaya | 9.90% | 9.90% | 1% |

| Mizoram | 9% | 9% | 1% |

| Nagaland | 8.25% | 8.25% | 1% |

| Odisha | 5% | 4% | 1% |

| Punjab | 4.75% | 2.75% | 1% |

| Rajasthan | 6% | 5% | 1% |

| Sikkim | 5% | 5% | 1% |

| Tamil Nadu | 4% | 4% | 2% |

| Telangana | 5% | 5% | 1% |

| Tripura | 5% | 5% | 1% |

| Uttarakhand | 5% | 3.75% | 1% |

| Uttar Pradesh | 7% | 5% | 1% |

| West Bengal | 6% – 7% | 6% – 7% | 1% |

| Delhi | 6% | 4% | 1% |

| Daman & Diu | 6% | 4% | 0.50% |

| Jammu and Kashmir | 7% | 3% | 1.20% |

Get a Home Loan

with Highest Eligibility

& Best Rates

Secure Your Home Purchase with Credit Dharma

Buying a home involves more than just choosing the right place. Understanding stamp duty and registration charges ensures you are financially prepared and legally protected.

Ready to take the next step in your home buying journey? Credit Dharma is here to help you beyond just calculating stamp duty. Our expert team can guide you through the entire home loan process, offering competitive rates and personalised solutions to match your unique financial situation.

Frequently Asked Questions

The buyer of the property is typically responsible for paying stamp duty, although specifics can vary based on local laws and agreements.

The government usually calculates stamp duty as a percentage of the property’s purchase price or market value, whichever is higher.

If you don’t pay stamp duty on documents that need it, you could face serious issues. Courts won’t allow these documents as evidence, making disputes hard to resolve. Plus, authorities might hold them until you pay the duty and any extra fines, which can be quite hefty.

Stamp duty is required for all real estate transactions, except when transferring properties through a Will.

Yes, stamp duty rates and regulations vary significantly across different states and territories, reflecting local real estate market conditions and government policies.

The current stamp duty rates in Madhya Pradesh are 7.50% for female owners and 7.50% for male owners.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan