Before you finalize your property purchase, use our stamp duty and registration charges calculator to get an idea of the costs involved with buying a new house.

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

From Udaipur to Jodhpur, Credit Dharma brings you the BEST home loan offers! 100% digital process. Transparent rates!

Property Stamp Duty Charges in Rajasthan 2025

Buying a home in Rajasthan? Stamp duty is a key cost to factor in. For 2025, the state has revised rates to ensure fair taxation on property transactions. This one-time tax, calculated as a percentage of the property value, is crucial for legal ownership.

| Category | Rate |

|---|---|

| Male | 6% |

| Male & Female Joint | 6% |

| Legal Entity | 6% |

| Female(Other Than SC/ST/BPL) | 5% |

| Female(SC/ST/BPL) | 4% |

| Between 40% to 80% | 4% |

| Above 80% | 0% |

| Transgender | 0% |

Source of Information: Rajasthan Official Website

Property Registration Charges in Rajasthan 2025

After you pay the stamp duty, you must register your property with the government. In 2025, Rajasthan continues to streamline this process, adding a nominal percentage for registration fees to your total cost. This legal formality recognizes your ownership and safeguards against disputes.

| Document | Value |

|---|---|

| Registration fees (RF) | 1% of the Market Value |

Suggested Read: RERA Charges in Rajasthan 2025

Stamp Duty Charges on Gift Deed and Other Documents in Rajashtan 2025

Gifting property to a loved one? Even gifts attract stamp duty and registration fees in Rajasthan. For 2025, the state mandates these charges to formalize transfers, ensuring the deed holds legal weight. Rates may vary for family members, so check the latest guidelines to make the transfer smooth and valid.

| Document | Stamp Duty | Stamp Duty After Rebate |

|---|---|---|

| Sale Deed | 6% | 6% |

| Sale Deed (Female SC/ST/BPL) | 6% | 4% |

| Sale Deed (Female other than SC/ST/BPL) | 6% | 5% |

| Sale Deed (Disabled 40% to 80%) | 6% | 4% |

| Sale Deed (Disabled above 80%) | 6% | 0% |

| Sale Deed (under CM Jan Awas Yojana/ PM Awas Yojana – EWS) | 6% | 0.5% of consideration |

| Sale Deed (under CM Jan Awas Yojana/ PM Awas Yojana – LIG) | 6% | 1% of consideration |

| Lease Deed between Private Parties (up to 30 years) | On the market value at telescopic rate | On the market value at telescopic rate |

| Lease Deed between Private Parties (more than 30 years) | 6% | 6% |

| Gift Deed (father/mother up to 60 years, brother, sister, husband, son) | 6% | 2.5% |

| Gift Deed (wife, daughter, father/mother above 60 years, etc.) | 6% | 0% |

| Partition Deed (non-ancestral) | 6% | 3% |

| Partition Deed (ancestral property) | 6% of the market value of separated share(s) | 0 |

Suggested Read: Rajasthan Land Records 2025

Stamp Duty on Power of Attorney Deed in Rajasthan 2025

Granting someone authority over your property? A power of attorney (POA) in Rajasthan needs stamp duty and registration to be legally binding.

| Condition | Stamp Duty After Rebate |

|---|---|

| Given for consideration, authorizing the attorney to sell immovable property | 6% |

| Given for consideration, authorizing the attorney to sell immovable property (Female SC/ST/BPL) | 4% |

| Given for consideration, authorizing the attorney to sell immovable property (Female other than SC/ST/BPL) | 5% |

| Given for consideration, authorizing the attorney to sell immovable property (Disability of 40% and above) | 5% |

| Given without consideration to sell immovable property to close family members (father, mother, brother, sister, wife, husband, son, daughter, grandson, granddaughter) | ₹2,000 |

Suggested Read: Rajasthan Housing Board Schemes 2025

Stamp Duty on Agricultural Land and Home Loan Agreement in Rajasthan

| Condition | Stamp Duty |

|---|---|

| Agricultural land transactions | 5% |

| Bank guarantee transactions | 0.5% of the guarantee amount |

| Home loan agreement | 0.1% to 0.5% of the loan amount |

Stamp Duty on Affordable Housing in Rajasthan 2025

In 2025, Rajasthan imposes a stamp duty of 0.5% on lease or sale deeds for projects under the Pradhan Mantri Awas Yojana (PMAY) or the Chief Minister’s Awas Yojana.

For low-income housing, the stamp duty is 1% of the consideration value. Revalidated lease deeds will incur 120% of the stamp duty originally charged.

Lease deeds executed by the state government or public bodies will follow the stamp duty rates specified under Article 33 of the Rajasthan Stamp Act.

Compare Stamp Duty and Registration Charges in All States

| State/UT | Stamp Duty Charges | Registration Fees |

|---|---|---|

| Andhra Pradesh | 5.00% | 1% |

| Arunachal Pradesh | Male: 6% Female: 6% | 1% |

| Assam | Male: 6% Female: 5% | 8.5% |

| Bihar | Male: 6.3% Female: 5.7% | Male: 2.1% Female: 1.9% |

| Chhattisgarh | Male: 5% Female: 4% | 4% |

| Goa | < ₹50 Lakh: 3.5% ₹50 Lakh – ₹75 Lakh: 4.5% ₹75 Lakh – ₹1 Crore: 4.5% > ₹1 Crore: 5% > ₹5 Crore: 6% | < ₹50 Lakh: 3% ₹50 Lakh – ₹75 Lakh: 3% ₹75 Lakh – ₹1 Crore: 3.5% > ₹1 Crore: 3.5% > ₹5 Crore: 3.5% |

| Gujarat | 4.9% | Male: 1% Female: NA |

| Haryana | Urban Area: Male: 7% Female: 5% Joint Ownership: 6% Rural Area: Male: 5% Female: 3% Joint: 4% | Up to ₹50,000: ₹100 ₹50,001 – ₹5 Lakhs: ₹1,000 ₹5 Lakhs – ₹10 Lakhs: ₹5,000 ₹10 Lakhs – ₹20 Lakhs: ₹10,000. |

| Himachal Pradesh | Male: 6%, Female: 4% Male + Female: 5% | Female: <= ₹80 Lakhs: 4% > ₹80 Lakhs: 8% Male/Joint: <= ₹50 Lakhs: 6% > ₹50 Lakhs: 8% |

| Jharkhand | Male: 4% Female: 4% Male + Female: 4% | 3% |

| Karnataka | > ₹45 Lakhs: 5% ₹21 Lakhs – ₹45 Lakhs: 3% < ₹20 Lakhs: 2% | 1% |

| Kerala | 8% | 2% |

| Madhya Pradesh | 7.5% | 3% |

| Maharashtra | Urban areas: Male: 6% Female: 5% Gram Panchayat: Male: 3% Female: 2% MMRDA: Male: 4% Female: 3% | 1% |

| Manipur | 7% | 3% |

| Meghalaya | 9.90% | 1% |

| Mizoram | <= ₹10,000: ₹100 ₹10,000 < Value <= ₹5,00,000: ₹200 > ₹5,00,000: ₹500 | 1% |

| Nagaland | 8.25% | Unspecified |

| Odisha | Male: 5% Female: 4% Joint ownership (Male + Female): 4% Joint (Male + Male): 5% Joint (Female + Female): 4% | 2% |

| Punjab | Female: 5% Male: 7% Joint (Male + Female): 6% Joint (Male + Male): 7% Joint (Female + Female): 5% | 1% |

| Rajasthan | Men: 6% Women: 5% | Men: 1% Women: 1% |

| Sikkim | Sikkimese origin: 5% For others: 10% | Sikkimese origin: ₹50,000 For others: ₹1,00,000 |

| Tamil Nadu | General: 7% Female (For properties valued up to ₹10 Lakhs): 3% | 4% |

| Telangana | 4% | 0.5% |

| Tripura | 5% | 1% |

| Uttar Pradesh | Female/Joint (Female + Female): 6% Male/Joint (Male + Male): 7% Joint (Female + Male): 6.5% | Female/Joint (Female + Female): 1% Male/Joint (Male + Male): 1% Joint (Female + Male): 1% |

| Uttarakhand | Male: 5% Female: 3.75% Joint (Male + Female): 4.37% Joint (Male + Male): 5% Joint (Female + Female): 3.75% | 2% |

| West Bengal | Corporation Area/ Municipal: Below ₹1 Crore: 6% Above ₹1 Crore: 7% Other Areas: Below ₹1 Crore: 5% Above ₹1 Crore: 6% | 1% |

| Andaman and Nicobar Islands | 5% | 2% |

| Chandigarh | 6% | 1% |

| Dadra and Nagar Haveli and Daman and Diu | Female: 4% Male: 6% Joint ownership (Male and Female): 5% | Female: Nil Male: 0.5% Joint (Male and Female): 0.25% |

| Delhi (National Capital Territory of Delhi) | Male: 6% Female: 4% Joint (Male + Female): 5% | 1% |

| Jammu and Kashmir | Female: 3% Male: 7% Joint (Male + Female): 7% Joint (Female + Female): 5% Joint (Male + Male): 7% | 1.20% |

| Ladakh | Female: 3% Male: 7% Joint(Male and Female): 7% Joint (Female and Female): 5% Joint (Male and Male): 7% | 1.20% |

| Lakshadweep | Female: 6% Joint(Female + Male): 7% Others: 8% | Not specified |

| Puducherry | 10% | 0.50% |

How are Stamp Duty and Registration Charges Calculated?

Stamp duty and registration charges depend on the market value of the property or the consideration value (whichever is higher). The stamp duty rate varies by location and property type. Generally, stamp duty is calculated as a percentage of the property value.

- Stamp Duty = Market Value of Property × Stamp Duty Rate

- Registration Charges = Market Value of Property × Registration Rate

Example Calculation

Mr. Sharma plans to buy a residential property. He needs to calculate the total stamp duty and registration charges payable to complete the transaction.

- Stamp Duty for Men : 6% of the Market Value (not the agreement value).

- Registration Charges : 1% of the Market Value.

Calculation Table

| Component | Calculation | Amount (₹) |

|---|---|---|

| Market Value | As per government assessment | 50,00,000 |

| Stamp Duty (6%) | 6% of ₹50,00,000 | 3,00,000 |

| Registration Charges | 1% of ₹50,00,000 | 50,000 |

| Total Cost | Stamp Duty + Registration Charges | 3,50,000 |

Suggested Read: Profitable Cities for Airbnb Investment 2025

How to Pay Stamp Duty in Rajasthan Online?

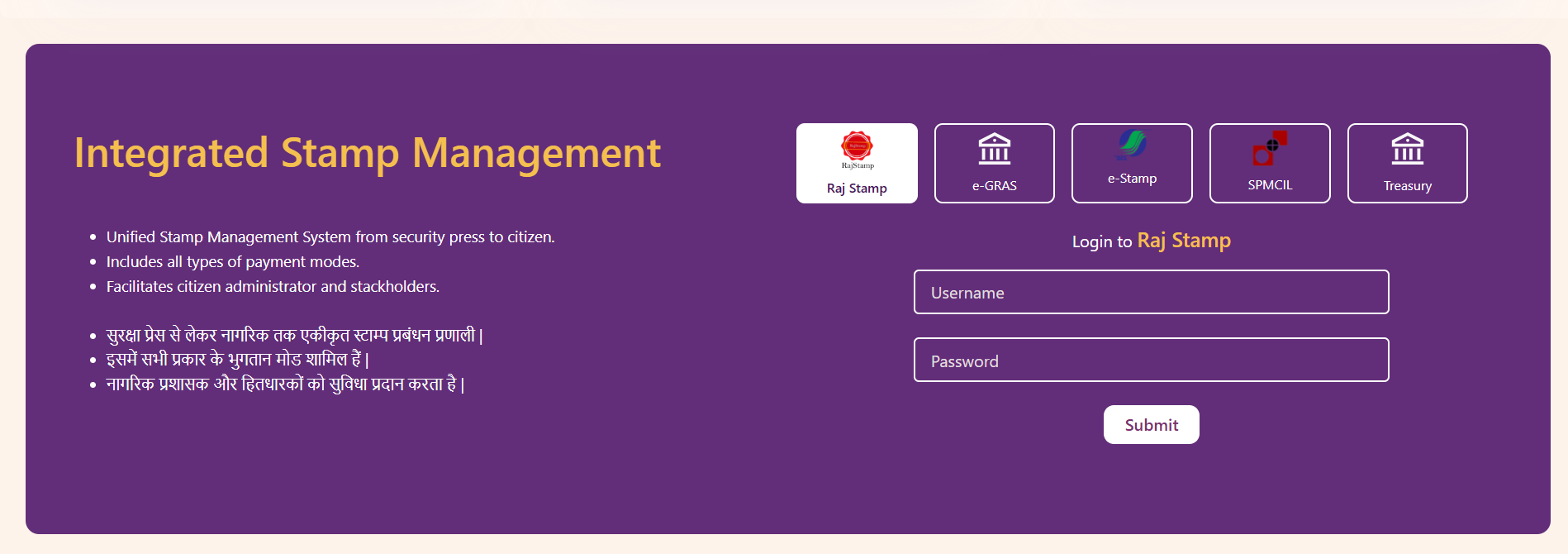

Paying stamp duty online in Rajasthan is quick and secure via the Stamps and Registration portal. Simply upload property details, calculate the duty, and pay via net banking/UPI. A digital stamp certificate is generated instantly for legal validity.

- Visit the official Registration and Stamps Department of Rajasthan website.

- Log in to the Portal

Enter your credentials to log in or create a new account if you don’t have one already.

- Select Payment Gateway

Once logged in, choose the payment gateway of your selected bank from the available options.

- Choose Payment Mode

You can make the payment using net banking or a credit/debit card.

- Complete the Payment and Download the Receipt

After selecting the payment mode, enter the required payment details and complete the transaction. Once the payment is processed successfully, download the receipt for future reference.

Suggested Read: 1 Acre Land Price in India 2025

How to Pay Registration Fees in Rajasthan?

After paying stamp duty, visit the nearest Sub-Registrar Office to register your property.

- Login: Access the e-panjiyan portal using your registered mobile number and verify with OTP.

- Enter Property Details: Fill in the property details for self-valuation, including rebate information (if applicable).

- Witness and CRN: Provide the party witness details and generate the Citizen Reference Number (CRN).

- Payment Details: Enter payment information through available modes (e-Stamp, DD, e-Mitra, e-Gras Challan, etc.), upload required documents.

- Finalize and Submit: Review the document, print the checklist, and forward it to the concerned Sub-Registrar (SR).

- Verification by SR: SR officials will import the document using the CRN and verify details, including the checklist and physical documents.

- Payment Verification: SR verifies the payment details submitted by the citizen.

- Approval and Modifications: SR sends the document for approval, including rebate, payment modifications, court stay (if any), and footnotes.

- Receipt Generation: SR official generates a receipt, captures the parties’ photo and thumbprints, and registers the document.

- Endorsement and Scanning: The document is scanned and handed over to the citizen with the Sub-Registrar’s signature and registration endorsement.

Suggested Read: Transfer Property Act 1882

Required Documents for Stamp Duty Payment in Rajasthan

To pay stamp duty in Rajasthan, you must submit the following documents:

- Mortgaged Property’s Reconveyance

- Transfer Instruments

- Partition Deed

- Gift Deed

- Deed of Exchange

- License Agreement

- Power of Attorney

- Tenancy Agreement

- Lease Deeds

Suggested Read: Inheritance Rights on Ancestral Property

Consequences of Non-Payment of Stamp Duty

- Stamp duty must be paid within 30 days of the property transaction.

- Late payments incur a 2% monthly penalty, which can reach up to 200% of the owed stamp duty.

- Failure to pay stamp duty and registration charges in Rajasthan results in a penalty of 8-20% of the stamp duty amount.

- In some cases, non-payment can lead to imprisonment.

Suggested Read: TDS on Purchase of Property

Rajasthan Stamp Duty and Property Registration: Customer Care

For more details or feedback, you can contact the Registration & Stamps Department at:

- Address: Inspector General, Registration & Stamps, Panjiyan Bhawan, Lohagal-Janana Hospital Road (Sikar Road), Ajmer-305001, Rajasthan

- Phone: +91 – 145 – 2971201

- Fax: +91 – 145 – 2971202

- Email: igrs@rajasthan.gov.in

Suggested Read: What is Undivided Share of Land?

Tax Benefits of Paying Stamp Duty

Paying stamp duty on property transactions in India comes with several tax benefits that can help reduce the overall tax burden. Here are the key advantages:

- Stamp duty and registration charges paid for the purchase of a property are eligible for deductions under Section 80C of the Income Tax Act, 1961.

- You can deduct up to ₹1.5 lakh for stamp duty and registration charges in a financial year if you pay them for purchasing a residential property.

- This deduction applies to both self-occupied and rented properties, as long as you pay the stamp duty during the assessment year.

Suggested Read: Home Loan Insurance Tax Benefits

Factors Affecting Stamp Duty and Registration Charges in Rajasthan

- Property Value: Charges are based on the market or transaction value, whichever is higher.

- Property Type: Residential, commercial, and agricultural properties have different rates.

- Location of the Property: Rates vary between urban and rural areas.

- Gender of the Owner: Female buyers may receive a reduced stamp duty rate.

- Age of the Property: Older properties may have different valuation methods affecting charges.

- Exemption or Concessions: Certain properties may qualify for reduced rates or exemptions.

- Age of the Buyer: Senior citizens may receive concessions for residential properties.

- Transfer Type: Sale, gift, or inheritance transfers attract different rates.

- Government Policies: Changes in policies can impact stamp duty rates and charges.

- Additional Charges: Includes legal documentation, verification, and service fees.

Suggested Read: How to Change Name in Land Registry or Property Documents?

Rajasthan’s recent amendment requiring companies to pay stamp duty on land sale and lease agreements for solar projects will increase project costs by 8%-10%, experts warn. With land expenses accounting for 20% of total costs, this change will significantly impact new renewable energy projects.

The state, a leader in India’s renewable energy capacity with 30 GW installed, may see reduced investment attractiveness due to higher land costs. Existing challenges, such as land aggregation and accessibility issues, could further complicate clean energy deployment in the state. Rising land costs remain a growing concern for the sector.

Secure the Lowest Home Loan Interest Rates with Credit Dharma

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Stamp duty for gift deeds in Rajasthan is 5% of the property value. Exemptions apply for transfers between blood relatives (up to ₹50,000) and female beneficiaries (4% rate if sole owner).

Yes. Women receive a 5%/ 4% stamp duty rate (vs. 6% for men).

Stamp duty is calculated on the property’s circle rate or agreement value (whichever is higher). Registration fees are 1% of the property value.

ID proof, property ownership documents, NOC (if applicable), and payment receipts. For gifts, a signed deed and relationship proof (if exempted) are needed.

No registration is mandatory for rental agreements shorter than 11 months . Longer leases require registration.

Partition deeds incur 3% stamp duty (family partitions) or 5% (non-family). Registration fees apply.

Late payment incurs a 2% monthly penalty (max 200% of the original duty) under the Stamp Act.

No. All gift deeds must be written and registered to be legally enforceable.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan